Sa400 2013

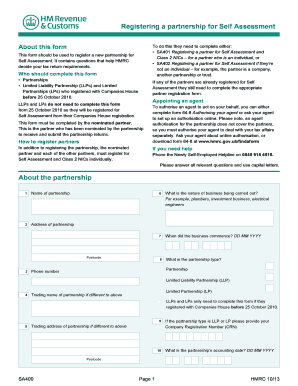

What is the SA400?

The SA400 is a specific form used in the United Kingdom for self-assessment tax purposes, particularly for self-employed individuals or those with other sources of income. This form is essential for reporting income and calculating the amount of tax owed. It is issued by HM Revenue and Customs (HMRC) and plays a crucial role in ensuring compliance with tax regulations. Completing the SA400 accurately is vital for maintaining good standing with tax authorities.

How to use the SA400

Using the SA400 involves several steps to ensure that all necessary information is accurately reported. Begin by gathering all relevant financial records, including income statements, expenses, and any other documentation that supports your claims. Next, fill out the form with your personal information, income details, and any allowable deductions. Once completed, review the form for accuracy before submitting it to HMRC. Utilizing electronic means for submission can streamline the process and enhance security.

Steps to complete the SA400

Completing the SA400 requires careful attention to detail. Follow these steps:

- Gather all necessary financial documents, including income sources and expenses.

- Fill out your personal information, including your National Insurance number.

- Report your income accurately, detailing all sources of earnings.

- Include any allowable expenses that can reduce your taxable income.

- Review the completed form for any errors or omissions.

- Submit the form electronically or via mail, ensuring it is sent before the deadline.

Legal use of the SA400

The legal use of the SA400 is governed by tax laws in the UK. When completed correctly, the form serves as a legally binding document that outlines an individual's income and tax obligations. It is essential to comply with all relevant regulations, including the use of e-signatures if submitting electronically. Ensuring that the form is filled out truthfully and accurately is crucial, as any discrepancies can lead to penalties or legal issues.

Filing Deadlines / Important Dates

Filing deadlines for the SA400 are critical for compliance. Typically, the deadline for submitting the form is January 31st following the end of the tax year. For example, for the tax year ending April 5, the form must be submitted by January 31 of the following year. It is advisable to mark these dates on your calendar to avoid late submissions, which can incur penalties.

Required Documents

To successfully complete the SA400, certain documents are required. These include:

- Income statements from all sources, such as self-employment income, rental income, or dividends.

- Records of allowable expenses, including receipts and invoices.

- Your National Insurance number and personal identification details.

- Any previous tax returns or correspondence from HMRC.

Form Submission Methods

The SA400 can be submitted through various methods. The most common ways include:

- Online submission via the HMRC website, which is the preferred method for many due to its convenience and efficiency.

- Mailing a paper version of the form to HMRC, which may take longer to process.

- In-person submission at designated HMRC offices, although this option is less common.

Quick guide on how to complete sa400

Complete Sa400 effortlessly on any device

Digital document management has gained traction among businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed paperwork, as you can obtain the necessary form and safely store it online. airSlate SignNow provides you with all the tools required to create, edit, and electronically sign your documents swiftly without delays. Handle Sa400 on any device using airSlate SignNow's Android or iOS applications and enhance any document-based process today.

The easiest way to edit and electronically sign Sa400 with ease

- Find Sa400 and click on Get Form to begin.

- Use the tools we provide to complete your document.

- Emphasize pertinent sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your eSignature using the Sign tool, which takes moments and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your updates.

- Choose how you wish to send your form: via email, text message (SMS), an invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or errors that necessitate the printing of new document copies. airSlate SignNow fulfills your document management requirements in just a few clicks from any device you prefer. Edit and electronically sign Sa400 to ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct sa400

Create this form in 5 minutes!

How to create an eSignature for the sa400

How to create an eSignature for your PDF online

How to create an eSignature for your PDF in Google Chrome

The best way to generate an electronic signature for signing PDFs in Gmail

How to generate an eSignature right from your smartphone

How to generate an electronic signature for a PDF on iOS

How to generate an eSignature for a PDF on Android

People also ask

-

What is the sa400 and how does it benefit my business?

The sa400 is a powerful tool within airSlate SignNow that enables businesses to streamline their document signing process. By utilizing sa400, users can reduce turnaround times, enhance collaboration, and ensure secure document management, leading to increased efficiency in business operations.

-

How does the pricing structure for sa400 work?

The sa400 offers a competitive pricing structure that is designed to fit various business needs. AirSlate SignNow provides multiple subscription plans, ensuring that whether you are a small business or a large enterprise, there is an option that includes access to the features of sa400 at an affordable rate.

-

Can I integrate sa400 with other software applications?

Yes, the sa400 is designed with compatibility in mind, offering various integrations with popular software applications. This allows you to streamline workflows by connecting your existing tools with airSlate SignNow’s features, enhancing your overall productivity.

-

What key features are included with the sa400?

The sa400 includes a range of features such as customizable templates, advanced security measures, and real-time tracking of document status. These features are tailored to improve your signing experience and make managing documents more efficient.

-

Is the sa400 secure for sensitive documents?

Absolutely, the sa400 incorporates state-of-the-art security protocols to ensure your documents are protected. It includes features like encryption and multi-factor authentication, making it a reliable choice for handling sensitive business information.

-

How does sa400 enhance the eSigning experience for users?

The sa400 enhances the eSigning experience by providing an intuitive interface that simplifies the document signing process. Users can quickly upload, send, and sign documents, ensuring a seamless experience that reduces the hassle often associated with traditional signing methods.

-

What types of documents can I manage with the sa400?

With the sa400, you can manage a variety of document types, including contracts, agreements, and forms. This versatility allows businesses to utilize airSlate SignNow across different departments, making it an essential tool for any organization.

Get more for Sa400

- Httpsapi17ilovepdfcomv1download pinterest form

- Httpsapi19ilovepdfcomv1download pinterest form

- Va form 22 5490 veterans benefits administration

- Saskatchewan assistance move form 1006

- Notice of appealincome security pdf 739 kb canadaca form

- Registered education savings plan resp transfer form bmo

- Application for cpp survivors pension and childrens benefits form

- Enf 6enf06 engpdf form

Find out other Sa400

- eSign Oregon Car Dealer Job Description Template Online

- Sign Ohio Courts LLC Operating Agreement Secure

- Can I eSign Michigan Business Operations POA

- eSign Car Dealer PDF South Dakota Computer

- eSign Car Dealer PDF South Dakota Later

- eSign Rhode Island Car Dealer Moving Checklist Simple

- eSign Tennessee Car Dealer Lease Agreement Form Now

- Sign Pennsylvania Courts Quitclaim Deed Mobile

- eSign Washington Car Dealer Bill Of Lading Mobile

- eSign Wisconsin Car Dealer Resignation Letter Myself

- eSign Wisconsin Car Dealer Warranty Deed Safe

- eSign Business Operations PPT New Hampshire Safe

- Sign Rhode Island Courts Warranty Deed Online

- Sign Tennessee Courts Residential Lease Agreement Online

- How Do I eSign Arkansas Charity LLC Operating Agreement

- eSign Colorado Charity LLC Operating Agreement Fast

- eSign Connecticut Charity Living Will Later

- How Can I Sign West Virginia Courts Quitclaim Deed

- Sign Courts Form Wisconsin Easy

- Sign Wyoming Courts LLC Operating Agreement Online