Sole Proprietorship Forms

What is the Sole Proprietorship Form?

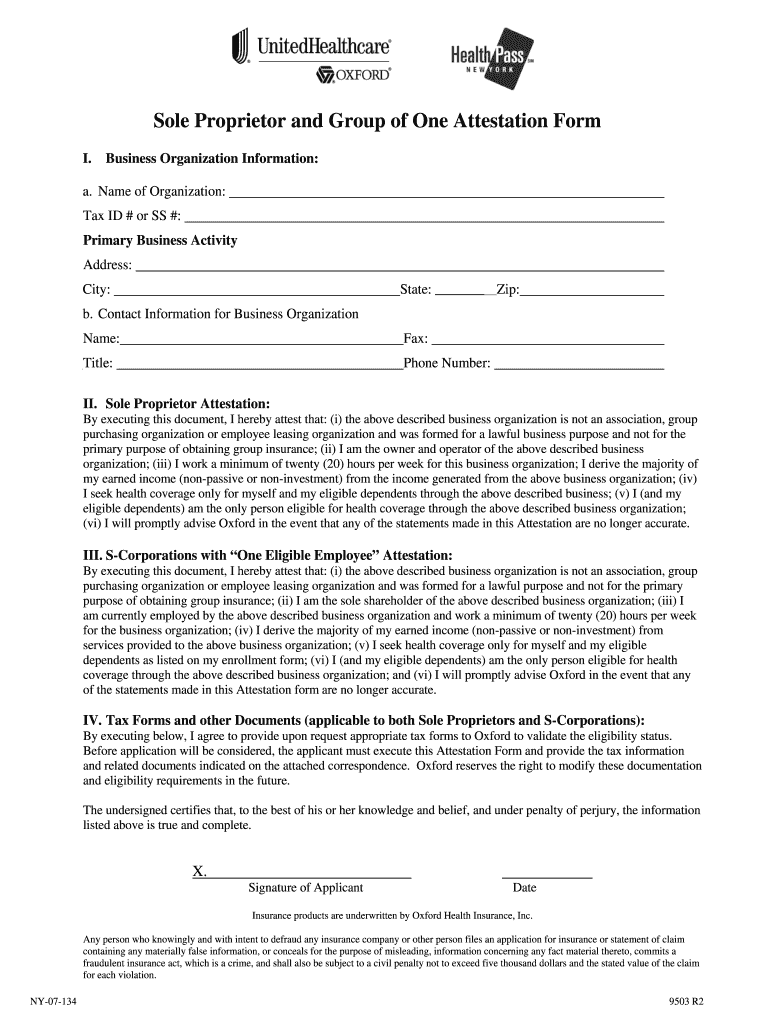

The sole proprietorship form is a legal document that establishes an individual as the sole owner of a business. This form is essential for anyone looking to operate a business independently, as it outlines the owner’s responsibilities and rights. In the United States, this form is often required for tax purposes and to ensure compliance with local regulations. By completing this form, the owner can also open a business bank account, apply for permits, and file taxes under the business name.

Steps to Complete the Sole Proprietorship Form

Completing the sole proprietorship form involves several key steps. First, gather all necessary information, including your name, business name, and contact details. Next, accurately fill out the form, ensuring that all sections are completed. It is important to review the form for any errors or omissions before submission. Once completed, you may need to sign the form and submit it to the appropriate local or state authority. This process may vary slightly depending on your location, so checking local requirements is advisable.

Legal Use of the Sole Proprietorship Form

The legal use of the sole proprietorship form is crucial for establishing your business as a legitimate entity. This form not only serves as proof of ownership but also helps protect your personal assets by clearly delineating business operations. When properly filed, it allows you to operate under a business name, collect revenue, and fulfill tax obligations. Compliance with local laws regarding sole proprietorships is essential to avoid penalties or legal issues that may arise from improper use of the form.

Required Documents

When filling out the sole proprietorship form, several documents may be required. Typically, you will need to provide identification, such as a driver’s license or Social Security number. Additionally, if you are operating under a business name different from your own, a fictitious name registration may be necessary. Some jurisdictions may also require proof of business licenses or permits, depending on the nature of your business. Ensuring that you have all required documents ready can streamline the filing process.

Form Submission Methods

Submitting the sole proprietorship form can be done through various methods, depending on local regulations. Common submission methods include online filing, mailing the completed form, or delivering it in person to the appropriate office. Online submission is often the most efficient option, allowing for quicker processing times. If mailing the form, be sure to use a reliable service and keep a copy for your records. In-person submissions may provide immediate confirmation of receipt, which can be beneficial for tracking purposes.

Eligibility Criteria

Eligibility to file a sole proprietorship form typically requires that the individual be at least eighteen years old and a legal resident of the United States. There are generally no restrictions on the type of business you can operate as a sole proprietor, but certain professions may require additional licensing or permits. It is important to check with local authorities to ensure compliance with any specific eligibility requirements that may apply to your business type.

IRS Guidelines

The Internal Revenue Service (IRS) provides specific guidelines for sole proprietorships, particularly regarding tax obligations. As a sole proprietor, you report your business income and expenses on your personal tax return using Schedule C. It is essential to maintain accurate financial records throughout the year to facilitate this reporting. Additionally, understanding the tax implications of your business operations can help you make informed decisions and ensure compliance with federal tax laws.

Quick guide on how to complete sole proprietor fill in the blanks form

Utilize the simpler approach to handle your Sole Proprietorship Forms

The traditional techniques for finalizing and approving documents consume an excessively long duration in comparison to contemporary paperwork management systems. Previously, you needed to seek out relevant social forms, print them, fill in all the details, and mail them. Now, you can obtain, complete, and sign your Sole Proprietorship Forms in a single web browser tab with airSlate SignNow. Preparing your Sole Proprietorship Forms has never been more straightforward.

Steps to finalize your Sole Proprietorship Forms with airSlate SignNow

- Access the category page you need and locate your state-specific Sole Proprietorship Forms. Alternatively, utilize the search bar.

- Verify that the version of the form is accurate by reviewing it.

- Select Get form and enter editing mode.

- Fill out your document with the necessary details using the editing tools.

- Review the added information and click the Sign tool to validate your form.

- Select the most convenient way to create your signature: generate it, draw your signature, or upload an image of it.

- Select DONE to save the modifications.

- Download the document onto your device or proceed to Sharing settings to send it electronically.

Effective online tools like airSlate SignNow make it easier to complete and submit your forms. Give it a try to discover how much time document management and approval processes are genuinely meant to take. You'll save a signNow amount of time.

Create this form in 5 minutes or less

FAQs

-

The IRS sent me a form 1065, but I am a sole proprietor. Do I ignore this form and fill out a schedule C?

I would assume that you applied for an employer identification number and checked the partnership box by mistake instead of sole proprietor. If this is the case, this requires you to obtain a new EIN.If you properly filled out the application for an EIN, you can ignore the 1065 notice.Your EIN acknowledgement letter from the IRS will state what type of return they expect you to file under the EIN.

-

Which forms do I fill out for taxes in California? I have a DBA/sole proprietorship company with less than $1000 in profit. How many forms do I fill out? This is really overwhelming. Do I need to fill the Form 1040-ES? Did the deadline pass?

You need to file two tax returns- one Federal Tax Form and another California State income law.My answer to your questions are for Tax Year 2018The limitation date for tax year 15.04.2018Federal Tax return for Individual is Form 1040 . Since you are carrying on proprietorship business, you will need to fill the Schedule C in Form 1040Form 1040 -ES , as the name suggests is for paying estimated tax for the current year. This is not the actual tax return form. Please note that while Form 1040, which is the return form for individuals, relates to the previous year, the estimated tax form (Form 1040-EZ ) calculates taxes for the current year.As far as , the tax return under tax laws of Californa State is concerned, the Schedule CA (540) Form is to be used for filing state income tax return . You use your federal information (forms 1040) to fill out your 540 FormPrashanthttp://irstaxapp.com

-

I ran a small sole proprietor business and my income was less, around (1.2 lakh), which ITR form do I need to fill and submit?

The ITR-4 Form is applicable for individuals who generate income from proprietary business or carrying any profession.If the requirements of audit are applicable, the due date of filing of return is 30th September. Otherwise, usually the due date of filing of return for non-audit cases is 31st July.Assesses who are eligible to file using the ITR-4 Form are:Carrying on a business or professionEligible for Presumptive Business Income but where Turnover/Gross Receipts exceeds Rs. 1 croreReturn may include Salary/PensionEarn Income from House PropertyEarn Income from Other Sources**And you have to keep all your bank statements and the balance sheet updated,so that you may not face the difficulties in filling and submitting the ITR-4 form.Now I would like to say one of my experience regarding the ITR-4 form filling. I was just going through the internet and i have seen that one of the site “LEGALRAASTA” provides the ITR-4 filling online.

-

Being in a sole proprietorship business in the Philippines, do I need to fill out any W8/W9 forms in order to be paid by a company that was recently bought by a US corporation?

NOT a W-9 as that is for domestic vendors.You do not even have to fill out a W-8BEN (probably the actual correct form) if you wish to have US taxes taken out of your payments and paid to the IRS. It is only required if you wish to have no US taxes withheld on your payment.

-

Does the sole proprietor firm exporting software, who is not registered with the STPI, have to fill-in SOFTEX forms? Can it get inward foreign remittances settled without SOFTEX?

Yes. you may file your softex with the jurisdictional Director of STPI unit. If you don’t file softex, you may still accept remittances under General Services head. You bank should ask you the purpose of money received in account. If you say software, then you would be required to submit relevant Softex. Otherwise the receipt may be categorized under various General services (management services, technical services etc).As you say that you are exporting software, to be on the right side of law, you should file softex.

-

How does a sole proprietorship firm in India fill the W-8BEN-E?

This form is used by foreign entities to document their status for some code provision in the US. so if you are a registered entity in India then you can fill up the same but there is myth i.e Sole Proprietorship Firm is a registered legal entity.Basically there is no proper legal registration or way to register the sole proprietorship firm. in the solo firm you got only the tax registration or some other local license. so for the filings any above forms you have to register the legal entity like Pvt ltd company or LLP or OPC etc.in the US pvt ltd company is similar to the INC Corporation & LLP is similar to LLC.

-

Do military members have to pay any fee for leave or fiancee forms?

NOOOOOOO. You are talking to a military romance scammer. I received an email from the US Army that directly answers your question that is pasted below please keep reading.I believe you are the victim of a military Romance Scam whereas the person you are talking to is a foreign national posing as an American Soldier claiming to be stationed overseas on a peacekeeping mission. That's the key to the scam they always claim to be on a peacekeeping mission.Part of their scam is saying that they have no access to their money that their mission is highly dangerous.If your boyfriend girlfriend/future husband/wife is asking you to do the following or has exhibited this behavior, it is a most likely a scam:Moves to private messaging site immediately after meeting you on Facebook or SnapChat or Instagram or some dating or social media site. Often times they delete the site you met them on right after they asked you to move to a more private messaging siteProfesses love to you very quickly & seems to quote poems and song lyrics along with using their own sort of broken language, as they profess their love and devotion quickly. They also showed concern for your health and love for your family.Promises marriage as soon as he/she gets to state for leave that they asked you to pay for.They Requests money (wire transfers) and Amazon, iTune ,Verizon, etc gift cards, for medicine, religious practices, and leaves to come home, internet access, complete job assignments, help sick friend, get him out of trouble, or anything that sounds fishy.The military does provide all the soldier needs including food medical Care and transportation for leave. Trust me, I lived it, you are probably being scammed. I am just trying to show you examples that you are most likely being connned.Below is an email response I received after I sent an inquiry to the US government when I discovered I was scammed. I received this wonderful response back with lots of useful links on how to find and report your scammer. And how to learn more about Romance Scams.Right now you can also copy the picture he gave you and do a google image search and you will hopefully see the pictures of the real person he is impersonating. this doesn't always work and take some digging. if you find the real person you can direct message them and alert them that their image is being used for scamming.Good Luck to you and I'm sorry this may be happening to you. please continue reading the government response I received below it's very informative. You have contacted an email that is monitored by the U.S. Army Criminal Investigation Command. Unfortunately, this is a common concern. We assure you there is never any reason to send money to anyone claiming to be a Soldier online. If you have only spoken with this person online, it is likely they are not a U.S. Soldier at all. If this is a suspected imposter social media profile, we urge you to report it to that platform as soon as possible. Please continue reading for more resources and answers to other frequently asked questions: How to report an imposter Facebook profile: Caution-https://www.facebook.com/help/16... < Caution-https://www.facebook.com/help/16... > Answers to frequently asked questions: - Soldiers and their loved ones are not charged money so that the Soldier can go on leave. - Soldiers are not charged money for secure communications or leave. - Soldiers do not need permission to get married. - Soldiers emails are in this format: john.doe.mil@mail.mil < Caution-mailto: john.doe.mil@mail.mil > anything ending in .us or .com is not an official email account. - Soldiers have medical insurance, which pays for their medical costs when treated at civilian health care facilities worldwide – family and friends do not need to pay their medical expenses. - Military aircraft are not used to transport Privately Owned Vehicles. - Army financial offices are not used to help Soldiers buy or sell items of any kind. - Soldiers deployed to Combat Zones do not need to solicit money from the public to feed or house themselves or their troops. - Deployed Soldiers do not find large unclaimed sums of money and need your help to get that money out of the country. Anyone who tells you one of the above-listed conditions/circumstances is true is likely posing as a Soldier and trying to steal money from you. We would urge you to immediately cease all contact with this individual. For more information on avoiding online scams and to report this crime, please see the following sites and articles: This article may help clarify some of the tricks social media scammers try to use to take advantage of people: Caution-https://www.army.mil/article/61432/< Caution-https://www.army.mil/article/61432/> CID advises vigilance against 'romance scams,' scammers impersonating Soldiers Caution-https://www.army.mil/article/180749 < Caution-https://www.army.mil/article/180749 > FBI Internet Crime Complaint Center: Caution-http://www.ic3.gov/default.aspx< Caution-http://www.ic3.gov/default.aspx> U.S. Army investigators warn public against romance scams: Caution-https://www.army.mil/article/130...< Caution-https://www.army.mil/article/130...> DOD warns troops, families to be cybercrime smart -Caution-http://www.army.mil/article/1450...< Caution-http://www.army.mil/article/1450...> Use caution with social networking Caution-https://www.army.mil/article/146...< Caution-https://www.army.mil/article/146...> Please see our frequently asked questions section under scams and legal issues. Caution-http://www.army.mil/faq/ < Caution-http://www.army.mil/faq/ > or visit Caution-http://www.cid.army.mil/ < Caution-http://www.cid.army.mil/ >. The challenge with most scams is determining if an individual is a legitimate member of the US Army. Based on the Privacy Act of 1974, we cannot provide this information. If concerned about a scam you may contact the Better Business Bureau (if it involves a solicitation for money), or local law enforcement. If you're involved in a Facebook or dating site scam, you are free to contact us direct; (571) 305-4056. If you have a social security number, you can find information about Soldiers online at Caution-https://www.dmdc.osd.mil/appj/sc... < Caution-https://www.dmdc.osd.mil/appj/sc... > . While this is a free search, it does not help you locate a retiree, but it can tell you if the Soldier is active duty or not. If more information is needed such as current duty station or location, you can contact the Commander Soldier's Records Data Center (SRDC) by phone or mail and they will help you locate individuals on active duty only, not retirees. There is a fee of $3.50 for businesses to use this service. The check or money order must be made out to the U.S. Treasury. It is not refundable. The address is: Commander Soldier's Records Data Center (SRDC) 8899 East 56th Street Indianapolis, IN 46249-5301 Phone: 1-866-771-6357 In addition, it is not possible to remove social networking site profiles without legitimate proof of identity theft or a scam. If you suspect fraud on this site, take a screenshot of any advances for money or impersonations and report the account on the social networking platform immediately. Please submit all information you have on this incident to Caution-www.ic3.gov < Caution-http://www.ic3.gov > (FBI website, Internet Criminal Complaint Center), immediately stop contact with the scammer (you are potentially providing them more information which can be used to scam you), and learn how to protect yourself against these scams at Caution-http://www.ftc.gov < Caution-http://www.ftc.gov > (Federal Trade Commission's website)

-

Can you add 5 odd numbers to get 30?

It is 7,9 + 9,1 + 1 + 3 + 9 = 30Wish you can find the 7,9 and 9,1 in the list of1,3,5, 7,9 ,11,13,151,3,5,7, 9,1 1,13,15

-

_+_+_+_+_ = 30. How do you fill in the blanks using 1, 3, 5, 7, 9, 11 or 13?

15 + 13 + (11-9) + (7-5) + (1-3) = 30

Create this form in 5 minutes!

How to create an eSignature for the sole proprietor fill in the blanks form

How to create an eSignature for the Sole Proprietor Fill In The Blanks Form online

How to create an eSignature for the Sole Proprietor Fill In The Blanks Form in Google Chrome

How to make an eSignature for putting it on the Sole Proprietor Fill In The Blanks Form in Gmail

How to make an eSignature for the Sole Proprietor Fill In The Blanks Form from your smartphone

How to create an eSignature for the Sole Proprietor Fill In The Blanks Form on iOS

How to make an eSignature for the Sole Proprietor Fill In The Blanks Form on Android OS

People also ask

-

What is the purpose of the I 864A form?

The I 864A form, known as the Contract Between Sponsor and Household Member, is used to document the financial support provided by household members of a sponsor. Understanding the I 864A form instructions is crucial for ensuring that all required information is accurately filled out, which can simplify the immigration process.

-

How do I complete the I 864A form correctly?

To complete the I 864A form correctly, you should follow specific guidelines outlined in the I 864A form instructions. Make sure to gather details about your household income and assets, properly fill in the sponsor's information, and ensure all signatures are in place before submission.

-

Where can I find helpful resources for I 864A form instructions?

Helpful resources for I 864A form instructions can typically be found on the official USCIS website and trusted immigration resources. It’s beneficial to follow these guidelines closely or consult with professionals to ensure compliance with the requirements.

-

What are the potential costs associated with filing the I 864A form?

While filing the I 864A form itself does not have a fee, related processes may incur costs such as legal assistance or document preparation services. Understanding these potential expenses alongside I 864A form instructions is essential for budgeting during the immigration process.

-

Can I sign the I 864A form electronically?

Yes, you can sign the I 864A form electronically using services like airSlate SignNow. This can streamline the signing process while adhering to I 864A form instructions, making it easier to gather signatures from all necessary parties.

-

What should I do if my household member refuses to sign the I 864A form?

If a household member refuses to sign the I 864A form, it's important to communicate the importance of their support in the immigration process. Referencing the I 864A form instructions can help clarify their obligations and encourage participation.

-

Are there any common mistakes to avoid when filling out the I 864A form?

Yes, common mistakes include incorrect income calculations, missing signatures, and failing to provide necessary documentation. To avoid these pitfalls, refer closely to the I 864A form instructions and double-check all entries before submission.

Get more for Sole Proprietorship Forms

Find out other Sole Proprietorship Forms

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors