Schedule P 540NR Alternative Minimum Tax and Credit LimitationsNonresidents or Part Year Residents Instructions Schedule P 540NR Form

Understanding the Schedule P 540NR Alternative Minimum Tax and Credit Limitations

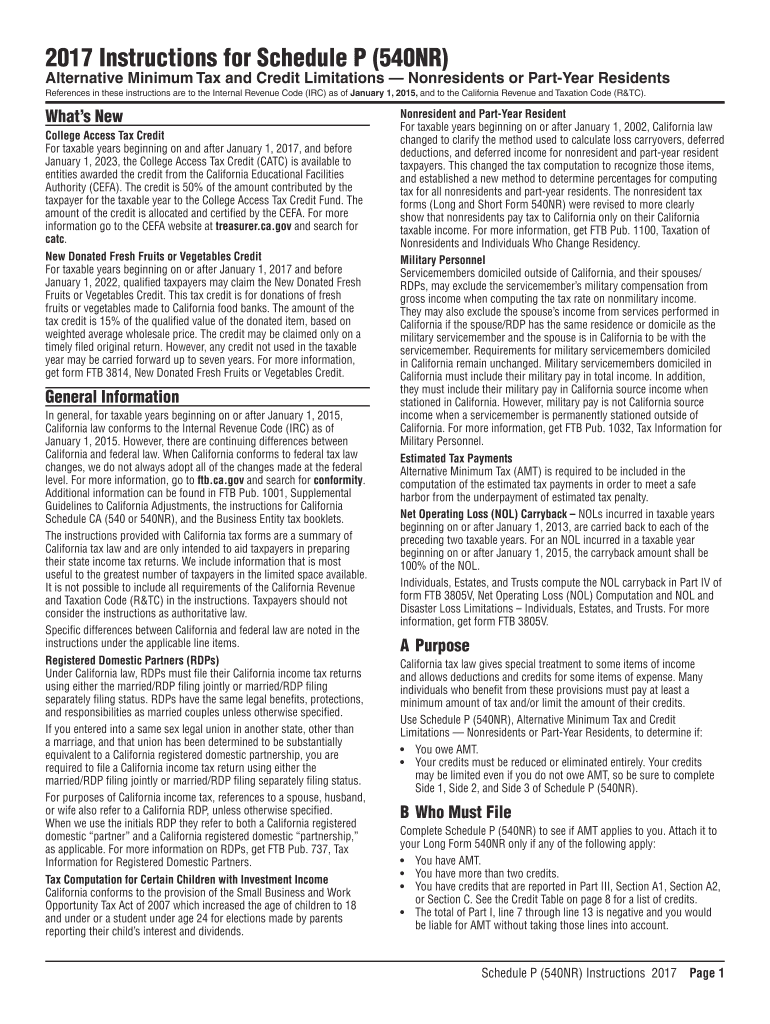

The Schedule P 540NR is a crucial form for nonresidents or part-year residents in the United States, specifically designed to address alternative minimum tax (AMT) and credit limitations. This form helps taxpayers calculate their AMT liability and determine any applicable credits. Understanding its purpose is essential for accurate tax reporting and compliance.

This form is particularly relevant for individuals who may not be fully aware of their tax obligations while living or working in multiple states. It ensures that nonresidents are taxed fairly based on their income earned within the state, while also providing guidance on available credits that can reduce their overall tax liability.

Steps to Complete the Schedule P 540NR

Completing the Schedule P 540NR involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary financial documents, including income statements and records of any tax credits. Next, follow these steps:

- Fill out your personal information, including your name, address, and Social Security number.

- Report your total income earned in the state for the tax year.

- Calculate your alternative minimum taxable income (AMTI) using the provided instructions.

- Determine your AMT liability based on the AMTI and applicable rates.

- Identify any credits you may qualify for and apply them to reduce your AMT liability.

- Review your completed form for accuracy before submission.

Following these steps will help ensure that your Schedule P 540NR is completed correctly and submitted on time.

Legal Use of the Schedule P 540NR

The Schedule P 540NR is legally binding when completed and submitted according to state regulations. To ensure its legal standing, it is important to adhere to the guidelines set forth by the IRS and state tax authorities. This includes providing accurate information and ensuring that all calculations are correct.

Using a reliable eSignature tool can further enhance the legal validity of your completed form. eSignatures are recognized under the ESIGN Act and UETA, making them a secure option for signing tax documents electronically.

State-Specific Rules for the Schedule P 540NR

Each state may have specific rules and requirements regarding the Schedule P 540NR. It is essential to be aware of these regulations, as they can affect how you complete the form and the credits available to you. For example, some states may have additional forms or documentation requirements for nonresidents.

Consulting the state tax authority's website or a tax professional can provide clarity on any state-specific rules that may apply to your situation.

Filing Deadlines and Important Dates

Filing deadlines for the Schedule P 540NR typically align with the general tax filing deadlines. It is crucial to be aware of these dates to avoid penalties. Generally, the deadline for filing your tax return, including the Schedule P 540NR, is April fifteenth of the following year.

Extensions may be available, but it is important to check with the state tax authority for specific guidelines and any associated deadlines for submitting the form.

Required Documents for the Schedule P 540NR

To complete the Schedule P 540NR accurately, you will need several documents, including:

- W-2 forms or other income statements

- Records of any tax credits you plan to claim

- Previous tax returns, if applicable

- Documentation of any deductions or adjustments

Having these documents ready will streamline the completion process and ensure that you provide all necessary information.

Quick guide on how to complete 2017 schedule p 540nr alternative minimum tax and credit limitationsnonresidents or part year residents instructions 2017

Prepare Schedule P 540NR Alternative Minimum Tax And Credit LimitationsNonresidents Or Part Year Residents Instructions Schedule P 540NR effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal environmentally-friendly alternative to traditional printed and signed papers, as you can obtain the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and electronically sign your documents quickly without delays. Manage Schedule P 540NR Alternative Minimum Tax And Credit LimitationsNonresidents Or Part Year Residents Instructions Schedule P 540NR on any device using the airSlate SignNow Android or iOS applications and enhance any document-focused process today.

How to edit and electronically sign Schedule P 540NR Alternative Minimum Tax And Credit LimitationsNonresidents Or Part Year Residents Instructions Schedule P 540NR with ease

- Find Schedule P 540NR Alternative Minimum Tax And Credit LimitationsNonresidents Or Part Year Residents Instructions Schedule P 540NR and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight pertinent sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes moments and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Select how you would like to share your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searching, or mistakes that require reprinting new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choice. Edit and electronically sign Schedule P 540NR Alternative Minimum Tax And Credit LimitationsNonresidents Or Part Year Residents Instructions Schedule P 540NR and ensure exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 2017 schedule p 540nr alternative minimum tax and credit limitationsnonresidents or part year residents instructions 2017

The best way to generate an eSignature for your PDF file in the online mode

The best way to generate an eSignature for your PDF file in Chrome

How to make an eSignature for putting it on PDFs in Gmail

The best way to create an electronic signature right from your smartphone

How to create an electronic signature for a PDF file on iOS devices

The best way to create an electronic signature for a PDF on Android

People also ask

-

What is Schedule P 540NR in relation to airSlate SignNow?

Schedule P 540NR is a form used for individuals who need to report income and deductions in California as non-residents. With airSlate SignNow, you can easily eSign and send your Schedule P 540NR quickly and securely. Our platform streamlines the process, ensuring compliance and ease of submission.

-

How can airSlate SignNow help me with my Schedule P 540NR filing?

By using airSlate SignNow, you can prepare and manage your Schedule P 540NR documents efficiently. Our eSigning features allow you to gather required signatures digitally, which speeds up the filing process. Moreover, you have access to templates that simplify your documentation efforts.

-

Is there a cost associated with using airSlate SignNow for Schedule P 540NR?

Yes, airSlate SignNow offers various pricing plans that are cost-effective for individuals and businesses. These plans typically include unlimited document signing, storage, and easy access to forms like Schedule P 540NR. Check our pricing page for more details on subscription options.

-

Are there any features specifically designed for Schedule P 540NR users in airSlate SignNow?

Absolutely! airSlate SignNow provides customizable templates, which can be tailored for Schedule P 540NR submissions. You can easily add fields for signatures and dates, making it convenient for non-residents to complete and eSign their documents.

-

Can I integrate airSlate SignNow with other software for Schedule P 540NR?

Yes, airSlate SignNow seamlessly integrates with various software solutions, which can enhance your experience while filing your Schedule P 540NR. Whether you use accounting software or tax preparation tools, our integrations allow for a smoother workflow.

-

What are the benefits of eSigning my Schedule P 540NR with airSlate SignNow?

eSigning your Schedule P 540NR with airSlate SignNow offers several benefits, including speed, security, and convenience. It eliminates the need for printing, scanning, or mailing documents, allowing for instant submission and tracking of your tax forms.

-

Is airSlate SignNow secure for handling sensitive Schedule P 540NR documents?

Yes, airSlate SignNow prioritizes security, employing the latest encryption technologies to protect your sensitive Schedule P 540NR documents. You can trust that your information is safe, ensuring privacy and confidentiality throughout the signing process.

Get more for Schedule P 540NR Alternative Minimum Tax And Credit LimitationsNonresidents Or Part Year Residents Instructions Schedule P 540NR

- Advance care planning acp facilitator traininghonoring form

- Pathology consultation request form

- Mfis form

- Pre clinical health requirements pchr duquesne university school of pharmacy form

- Application process respiratory therapy foothill college form

- Return this cover sheet with your medical history form

- Ca withdrawal medical form

- Pdf los angeles pierce college online request for nursing program form

Find out other Schedule P 540NR Alternative Minimum Tax And Credit LimitationsNonresidents Or Part Year Residents Instructions Schedule P 540NR

- Electronic signature Montana Stock Transfer Form Template Computer

- Help Me With Electronic signature Texas Debt Settlement Agreement Template

- How Do I Electronic signature Nevada Stock Transfer Form Template

- Electronic signature Virginia Stock Transfer Form Template Secure

- How Do I Electronic signature Colorado Promissory Note Template

- Can I Electronic signature Florida Promissory Note Template

- How To Electronic signature Hawaii Promissory Note Template

- Electronic signature Indiana Promissory Note Template Now

- Electronic signature Kansas Promissory Note Template Online

- Can I Electronic signature Louisiana Promissory Note Template

- Electronic signature Rhode Island Promissory Note Template Safe

- How To Electronic signature Texas Promissory Note Template

- Electronic signature Wyoming Indemnity Agreement Template Free

- Electronic signature Iowa Bookkeeping Contract Safe

- Electronic signature New York Bookkeeping Contract Myself

- Electronic signature South Carolina Bookkeeping Contract Computer

- Electronic signature South Carolina Bookkeeping Contract Myself

- Electronic signature South Carolina Bookkeeping Contract Easy

- How To Electronic signature South Carolina Bookkeeping Contract

- How Do I eSignature Arkansas Medical Records Release