TX C 240 QTR 2019-2026

What is the TX C 240 QTR

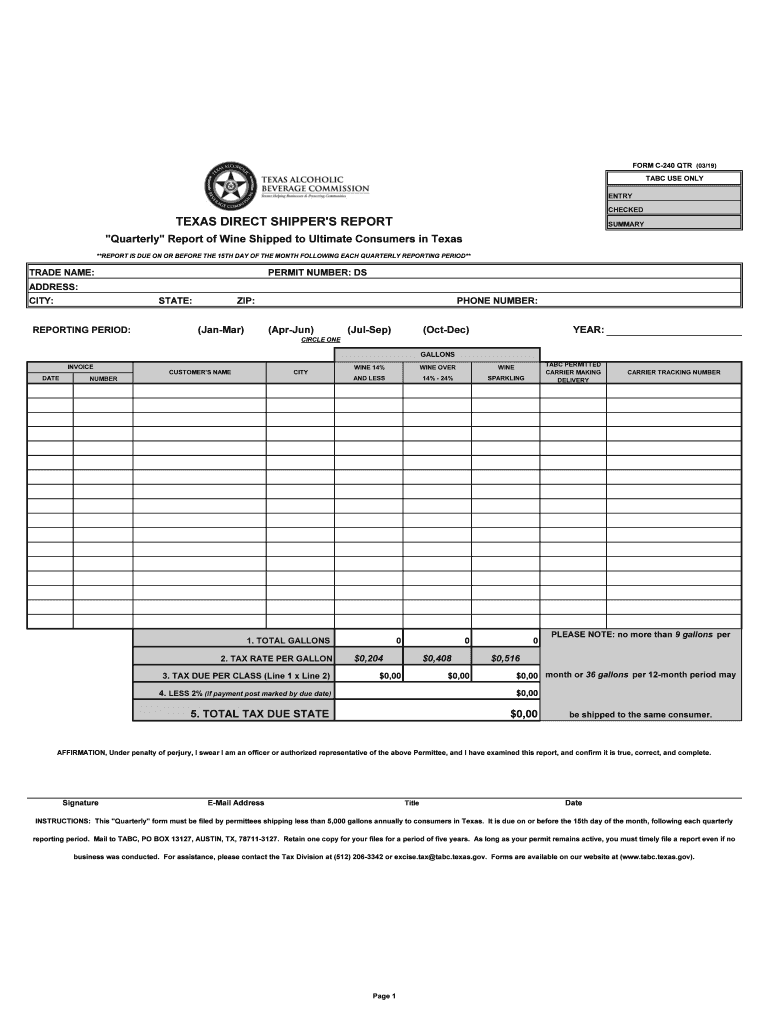

The TX C 240 QTR, commonly referred to as the Texas report quarterly form, is a document used by businesses in Texas to report sales and use tax collected during the quarter. This form is essential for compliance with state tax regulations and ensures that businesses accurately report their taxable sales, allowing for proper tax collection and remittance to the state. The form is specifically designed for entities that engage in retail sales, rental of tangible personal property, or taxable services within Texas.

Steps to complete the TX C 240 QTR

Completing the TX C 240 QTR involves several key steps to ensure accuracy and compliance. First, gather all necessary sales records for the reporting period. This includes invoices, receipts, and any documentation that reflects sales tax collected. Next, calculate the total sales for the quarter, distinguishing between taxable and non-taxable sales. Once totals are established, fill out the form with the required information, including your business details and the calculated sales tax amounts. Finally, review the form for accuracy before submitting it to the Texas Comptroller of Public Accounts.

Legal use of the TX C 240 QTR

The TX C 240 QTR must be completed and submitted in accordance with Texas state laws regarding sales tax reporting. This form serves as a legal declaration of the sales tax collected by the business and must be filed on time to avoid penalties. Electronic submission is permitted and often preferred, as it allows for quicker processing and confirmation of receipt. Adhering to the legal requirements associated with this form is crucial for maintaining compliance and avoiding potential legal issues.

Filing Deadlines / Important Dates

Businesses must be aware of the filing deadlines associated with the TX C 240 QTR to ensure timely compliance. The form is typically due on the 20th day of the month following the end of the quarter. For example, the deadline for the first quarter (January to March) is April 20. Missing these deadlines can result in penalties and interest on unpaid taxes, making it essential for businesses to track these dates carefully and plan accordingly.

Form Submission Methods (Online / Mail / In-Person)

The TX C 240 QTR can be submitted through various methods, providing flexibility for businesses. The most efficient method is electronic filing through the Texas Comptroller's website, which allows for immediate processing. Alternatively, businesses can mail the completed form to the appropriate address provided by the Comptroller's office. In-person submissions are also accepted at designated offices, although this method may involve longer wait times. Choosing the right submission method can help streamline the reporting process.

Key elements of the TX C 240 QTR

Understanding the key elements of the TX C 240 QTR is essential for accurate completion. The form typically includes sections for reporting total sales, taxable sales, and the amount of sales tax collected. Additionally, businesses must provide their Texas sales tax permit number, contact information, and any applicable exemptions. Each section must be filled out carefully to ensure that the reported figures are correct and reflect the business's sales activities for the quarter.

Penalties for Non-Compliance

Failure to comply with the filing requirements of the TX C 240 QTR can result in significant penalties. Businesses that do not file the form on time may incur late fees, which can accumulate over time. Additionally, failure to report accurate sales tax amounts can lead to audits and further legal repercussions. It is crucial for businesses to stay informed about their responsibilities regarding this form to avoid financial penalties and maintain good standing with state authorities.

Quick guide on how to complete 2019 tx c 240 qtr

Effortlessly Prepare TX C 240 QTR on Any Device

Managing documents online has become increasingly favored by businesses and individuals alike. It offers an excellent eco-friendly substitute for conventional printed and signed paperwork, as you can easily find the necessary form and securely keep it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents rapidly without delays. Handle TX C 240 QTR on any device with airSlate SignNow’s applications for Android or iOS, and enhance any document-related workflow today.

How to Edit and eSign TX C 240 QTR with Ease

- Find TX C 240 QTR and click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize important sections of the documents or obscure sensitive information using tools provided by airSlate SignNow specifically for that purpose.

- Create your eSignature with the Sign feature, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review the information and click the Done button to save your modifications.

- Choose how you wish to share your form, via email, SMS, or a link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow addresses all your document management requirements in just a few clicks from any device of your choice. Modify and eSign TX C 240 QTR and guarantee effective communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2019 tx c 240 qtr

Create this form in 5 minutes!

How to create an eSignature for the 2019 tx c 240 qtr

The way to make an electronic signature for a PDF document online

The way to make an electronic signature for a PDF document in Google Chrome

The best way to generate an eSignature for signing PDFs in Gmail

How to generate an electronic signature straight from your smart phone

The way to generate an eSignature for a PDF document on iOS

How to generate an electronic signature for a PDF document on Android OS

People also ask

-

What is the Texas report quarterly form and why is it important?

The Texas report quarterly form is a required document for businesses to report their quarterly earnings and sales tax information. Filing this form accurately is crucial to comply with state regulations and avoid penalties. Using airSlate SignNow can simplify the process of completing and submitting your Texas report quarterly form efficiently.

-

How can airSlate SignNow help with the Texas report quarterly form?

airSlate SignNow offers an easy-to-use platform that allows you to fill out, sign, and submit your Texas report quarterly form digitally. Our solution streamlines the entire process, making it faster and more reliable. Plus, you can track and manage your submissions effortlessly from any device.

-

Is there a cost for using airSlate SignNow for the Texas report quarterly form?

Yes, there is a pricing structure in place for using airSlate SignNow. The service is cost-effective, especially for businesses that frequently file their Texas report quarterly form. Monthly subscription options are available, allowing you to choose a plan that fits your needs and budget.

-

What features does airSlate SignNow offer for managing the Texas report quarterly form?

airSlate SignNow provides dynamic features such as customizable templates, secure eSignature capabilities, and real-time collaboration tools. These features enhance your experience when completing the Texas report quarterly form, ensuring accuracy and efficiency. Additionally, you can automate reminders and notifications for filing deadlines.

-

Can airSlate SignNow integrate with other platforms for the Texas report quarterly form?

Absolutely! airSlate SignNow seamlessly integrates with various business tools and software, allowing for a smoother workflow when preparing your Texas report quarterly form. This integration helps consolidate your data and keeps everything organized, making it easier to generate accurate reports.

-

How secure is my data when using airSlate SignNow for the Texas report quarterly form?

We take data security seriously at airSlate SignNow. Our platform uses advanced encryption and secure storage solutions to protect your information when filling out the Texas report quarterly form. You can trust that your sensitive data remains confidential and secure throughout the process.

-

What are the benefits of using airSlate SignNow for the Texas report quarterly form?

Using airSlate SignNow for your Texas report quarterly form offers several benefits, including time-saving automation, accessibility from any device, and a user-friendly interface. Our platform helps reduce the chance of errors and streamlines the filing process, making it a smart choice for businesses looking to simplify their compliance efforts.

Get more for TX C 240 QTR

Find out other TX C 240 QTR

- How To Sign Michigan Lawers Document

- How To Sign New Jersey Lawers PPT

- How Do I Sign Arkansas Legal Document

- How Can I Sign Connecticut Legal Document

- How Can I Sign Indiana Legal Form

- Can I Sign Iowa Legal Document

- How Can I Sign Nebraska Legal Document

- How To Sign Nevada Legal Document

- Can I Sign Nevada Legal Form

- How Do I Sign New Jersey Legal Word

- Help Me With Sign New York Legal Document

- How Do I Sign Texas Insurance Document

- How Do I Sign Oregon Legal PDF

- How To Sign Pennsylvania Legal Word

- How Do I Sign Wisconsin Legal Form

- Help Me With Sign Massachusetts Life Sciences Presentation

- How To Sign Georgia Non-Profit Presentation

- Can I Sign Nevada Life Sciences PPT

- Help Me With Sign New Hampshire Non-Profit Presentation

- How To Sign Alaska Orthodontists Presentation