Business Entities Records, P Form

What is the Business Entities Records, P?

The Business Entities Records, P form serves as a crucial document for businesses operating in the United States. It provides essential information regarding the legal structure and status of a business entity, such as a corporation, partnership, or limited liability company (LLC). This form is often used to maintain transparency and compliance with state regulations, ensuring that all necessary details about the business are accurately recorded.

How to Use the Business Entities Records, P

Using the Business Entities Records, P form involves several steps to ensure accurate completion and submission. First, gather all relevant information about your business, including its legal name, address, and type of entity. Next, fill out the form with the required details, ensuring that all information is current and correct. Once completed, the form can be submitted according to the specific guidelines set forth by the state in which your business operates.

Steps to Complete the Business Entities Records, P

Completing the Business Entities Records, P form requires careful attention to detail. Follow these steps:

- Gather necessary business information, including legal name, address, and entity type.

- Access the form through the appropriate state agency's website or office.

- Fill in all required fields accurately, ensuring compliance with state-specific regulations.

- Review the completed form for any errors or omissions.

- Submit the form either online, by mail, or in person as per state guidelines.

Legal Use of the Business Entities Records, P

The Business Entities Records, P form is legally binding when completed and submitted according to state laws. It serves as an official record of the business entity's existence and compliance with relevant regulations. Proper use of this form helps protect the business's legal standing and can be critical in various legal situations, such as disputes or audits.

Key Elements of the Business Entities Records, P

Several key elements must be included in the Business Entities Records, P form for it to be valid:

- Legal name of the business entity.

- Type of business entity (e.g., corporation, LLC, partnership).

- Business address and contact information.

- Date of formation and state of registration.

- Names and addresses of the principal officers or members.

State-Specific Rules for the Business Entities Records, P

Each state in the U.S. has its own rules and regulations regarding the Business Entities Records, P form. It is essential to review the specific requirements for your state, as they may vary significantly. This includes understanding filing fees, submission methods, and any additional documentation that may be required to accompany the form.

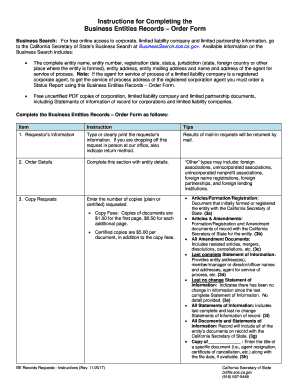

Quick guide on how to complete business entities records p

Effortlessly Prepare [SKS] on Any Device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed paperwork, allowing you to access the right form and securely retain it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly without any hold-ups. Manage [SKS] on any device using the airSlate SignNow Android or iOS applications and simplify any document-related process today.

How to Modify and Electronically Sign [SKS] Effortlessly

- Find [SKS] and click on Get Form to initiate the process.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of the documents or obscure sensitive information with the tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click the Done button to save your changes.

- Choose your preferred method to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form navigation, or mistakes needing new document copies. airSlate SignNow addresses all your document management requirements in just a few clicks from any device you choose. Alter and electronically sign [SKS] and maintain exceptional communication at every stage of your form completion process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Business Entities Records, P

Create this form in 5 minutes!

How to create an eSignature for the business entities records p

How to make an eSignature for a PDF file in the online mode

How to make an eSignature for a PDF file in Chrome

The way to create an electronic signature for putting it on PDFs in Gmail

How to create an electronic signature right from your smartphone

The best way to make an eSignature for a PDF file on iOS devices

How to create an electronic signature for a PDF on Android

People also ask

-

What are Business Entities Records, P. and how can airSlate SignNow help?

Business Entities Records, P. are essential documents that establish the existence of a business, including incorporation papers and bylaws. airSlate SignNow simplifies this process by allowing users to send and eSign these important documents quickly and securely, ensuring compliance and accuracy.

-

How does airSlate SignNow ensure the security of my Business Entities Records, P.?

Security is a top priority for airSlate SignNow. With industry-standard encryption and secure cloud storage, your Business Entities Records, P. are protected against unauthorized access, ensuring peace of mind when managing sensitive documents.

-

What pricing plans does airSlate SignNow offer for managing Business Entities Records, P.?

airSlate SignNow provides several pricing plans tailored for businesses of all sizes. Each plan offers a range of features suitable for handling Business Entities Records, P., with options to suit varying transaction volumes and organizational needs.

-

Can airSlate SignNow integrate with other software for managing Business Entities Records, P.?

Yes, airSlate SignNow seamlessly integrates with various applications, enhancing your efficiency in managing Business Entities Records, P. Integrations with platforms like Google Drive and Dropbox allow you to streamline document management and eSigning processes.

-

What features does airSlate SignNow offer for eSigning Business Entities Records, P.?

airSlate SignNow offers intuitive features tailored for eSigning Business Entities Records, P., including customizable templates and automated workflows. This user-friendly interface reduces the time needed to execute contracts and formalize business documents.

-

How can the use of airSlate SignNow benefit my business when dealing with Business Entities Records, P.?

Utilizing airSlate SignNow for Business Entities Records, P. not only speeds up the signing process but also reduces paper usage and improves document management. This can lead to signNow cost savings and increased operational efficiency for your business.

-

Is it easy to transition my current workflow to airSlate SignNow for Business Entities Records, P.?

Absolutely! airSlate SignNow offers an intuitive interface and excellent support to help you transition your current workflow smoothly. The platform provides resources and guidance specifically designed to facilitate the management of Business Entities Records, P.

Get more for Business Entities Records, P

- Gcb link to home account fill out ampamp sign online form

- Asensjac 9102 rev a first article inspection sheet studylib form

- Thank you for helping us protect you form

- Antrag auf kostenerstattung behandlung im ausland form

- Request for quotation wojan window amp door corporation form

- Harley davidson ride in custom bike show registration amp relase form

- The university of corona application for enrollmen form

- Order shipping for participating dealers sample clauses form

Find out other Business Entities Records, P

- eSignature Missouri Charity Living Will Mobile

- eSignature New Jersey Business Operations Memorandum Of Understanding Computer

- eSignature North Dakota Car Dealer Lease Agreement Safe

- eSignature Oklahoma Car Dealer Warranty Deed Easy

- eSignature Oregon Car Dealer Rental Lease Agreement Safe

- eSignature South Carolina Charity Confidentiality Agreement Easy

- Can I eSignature Tennessee Car Dealer Limited Power Of Attorney

- eSignature Utah Car Dealer Cease And Desist Letter Secure

- eSignature Virginia Car Dealer Cease And Desist Letter Online

- eSignature Virginia Car Dealer Lease Termination Letter Easy

- eSignature Alabama Construction NDA Easy

- How To eSignature Wisconsin Car Dealer Quitclaim Deed

- eSignature California Construction Contract Secure

- eSignature Tennessee Business Operations Moving Checklist Easy

- eSignature Georgia Construction Residential Lease Agreement Easy

- eSignature Kentucky Construction Letter Of Intent Free

- eSignature Kentucky Construction Cease And Desist Letter Easy

- eSignature Business Operations Document Washington Now

- How To eSignature Maine Construction Confidentiality Agreement

- eSignature Maine Construction Quitclaim Deed Secure