Bensalem Contractor License Form 2009

What is the Bensalem Contractor License Form

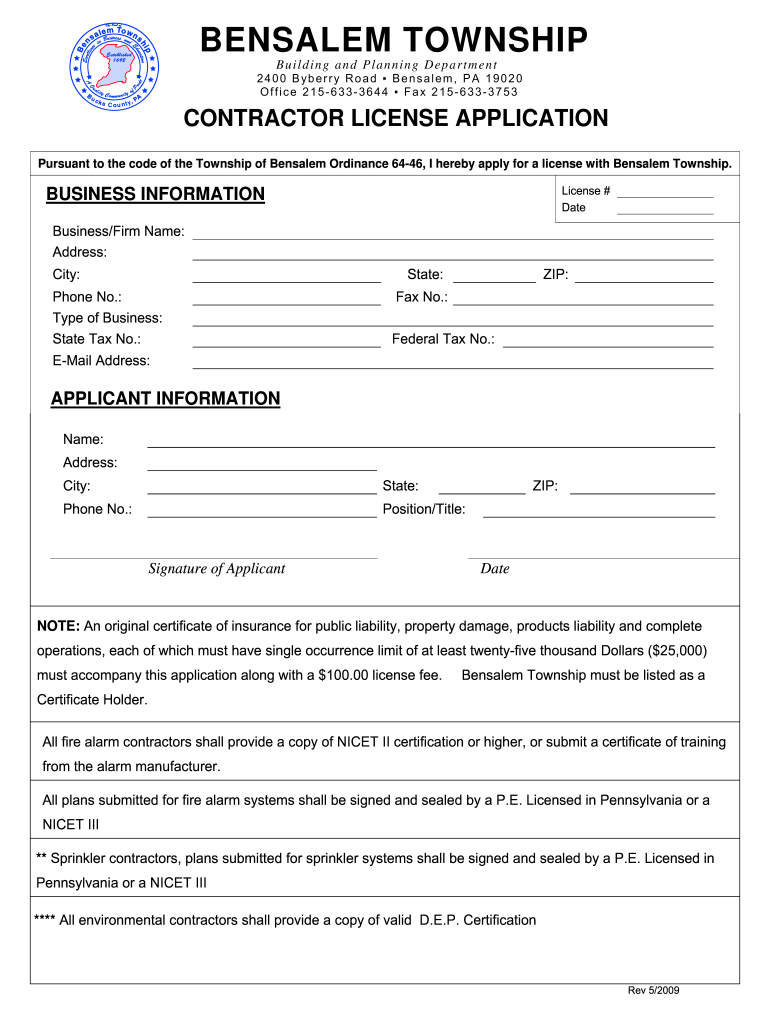

The Bensalem Contractor License Form is an official document required for contractors who wish to operate legally within Bensalem, Pennsylvania. This form is essential for ensuring that contractors meet local regulations and standards set by the municipality. It typically includes information about the contractor’s business, qualifications, and compliance with safety and building codes. By completing this form, contractors demonstrate their commitment to adhering to the legal requirements necessary for conducting business in the area.

How to use the Bensalem Contractor License Form

Using the Bensalem Contractor License Form involves several steps. First, contractors must obtain the form from the appropriate local government office or download it from an official source. After acquiring the form, contractors should carefully fill it out, ensuring all required information is accurate and complete. Once the form is completed, it must be submitted according to the specified guidelines, which may include in-person delivery or online submission. Proper use of the form helps ensure compliance with local laws and facilitates the licensing process.

Steps to complete the Bensalem Contractor License Form

Completing the Bensalem Contractor License Form requires attention to detail. Here are the steps involved:

- Gather necessary information, including business details, owner information, and any relevant licenses or certifications.

- Carefully read the instructions accompanying the form to understand all requirements.

- Fill out the form, ensuring all fields are completed accurately.

- Review the form for any errors or omissions before submission.

- Submit the completed form along with any required documents and fees to the appropriate local authority.

Legal use of the Bensalem Contractor License Form

The legal use of the Bensalem Contractor License Form is governed by local regulations that dictate how contractors must operate within the municipality. It is crucial for contractors to ensure that their form is filled out in accordance with these regulations to avoid penalties or legal issues. The form serves as a declaration of the contractor's qualifications and adherence to local laws, making it a vital component of legal compliance in the construction industry.

Key elements of the Bensalem Contractor License Form

Several key elements are typically included in the Bensalem Contractor License Form. These may consist of:

- Contractor's name and business name

- Contact information, including address and phone number

- Type of work the contractor is licensed to perform

- Proof of insurance and bonding, if applicable

- Signature of the contractor, affirming the accuracy of the information

Required Documents

To successfully complete the Bensalem Contractor License Form, contractors must provide several supporting documents. These may include:

- Proof of identity, such as a driver's license or state ID

- Business registration documents

- Certificates of insurance and bonding

- Any relevant trade licenses or certifications

Application Process & Approval Time

The application process for the Bensalem Contractor License involves submitting the completed form along with all required documents to the local licensing authority. Once submitted, the review process typically takes several weeks, depending on the volume of applications and the complexity of the review. Contractors are advised to check the status of their application periodically and ensure they respond promptly to any requests for additional information from the licensing authority.

Quick guide on how to complete bensalem contractor license form

Handle Bensalem Contractor License Form anytime, anywhere

Your daily business activities may need extra focus when managing state-specific business documentation. Reclaim your work hours and reduce the paper costs linked to document-heavy processes with airSlate SignNow. airSlate SignNow provides a vast array of pre-made business documents, including Bensalem Contractor License Form, which you can utilize and share with your business associates. Manage your Bensalem Contractor License Form seamlessly with robust editing and eSignature capabilities, delivering it straight to your recipients.

How to obtain Bensalem Contractor License Form in just a few clicks:

- Choose a form appropriate to your state.

- Click Learn More to access the document and verify its accuracy.

- Select Get Form to start using it.

- Bensalem Contractor License Form will promptly open in the editor. No further actions are necessary.

- Utilize airSlate SignNow’s advanced editing features to complete or modify the form.

- Click on the Sign option to create your signature and eSign your document.

- When ready, select Done, save changes, and access your document.

- Send the form via email or text, or use a link-to-fill option with partners or enable them to download the documents.

airSlate SignNow signNowly reduces your time spent managing Bensalem Contractor License Form and allows you to locate necessary documents all in one place. An extensive library of forms is organized and designed to address essential business processes required for your company. The state-of-the-art editor minimizes the chance of mistakes, as you can swiftly amend errors and review your documents on any device before dispatching them. Start your complimentary trial today to explore all the advantages of airSlate SignNow for your everyday business workflows.

Create this form in 5 minutes or less

Find and fill out the correct bensalem contractor license form

FAQs

-

How do you fill out a W2 tax form if I'm an independent contractor?

Thanks for asking.If you are asking how to report your income as an independent contractor, then you do not fill out a W-2. You will report your income on your federal tax return on Schedule C which will have on which you list all of your non-employee income and associated expenses. The resulting net income, transferred to Schedule A is what you will pay self-employment and federal income tax on. If this too confusing, either get some good tax reporting software or get a tax professional to help you with it.If you are asking how to fill out a W-2 for someone that worked for you, either get some good tax reporting software or get a tax professional to help you with it.This is not tax advice, it is only my opinion on how to answer this question.

-

Which GST form should I fill out for filing a return as a building work contractor?

You need to file GSTR 3b and GSTR 1 ,if it government contract make sure to claim INPUT for TDS deducted amount.

-

Does a NAFTA TN Management consultant in the U.S. still need to fill out an i-9 form even though they are an independent contractor?

Yes.You must still prove work authorization even though you are a contractor. You will fill out the I9 and indicate that you are an alien authorized to work, and provide the relevant details of your TN visa in support of your application.Hope this helps.

-

When you start working as an independent contractor for companies like Leapforce/Appen, how do you file for taxes? Do you fill out the W-8BEN form?

Austin Martin’s answer is spot on. When you are an independent contractor, you are in business for yourself. In other words, you are the business! That means you must pay taxes, and since you aren’t an employee of someone else, you have to make estimated tax payments, which will be “squared up” at year end when you file your tax return

-

Do military members have to pay any fee for leave or fiancee forms?

NOOOOOOO. You are talking to a military romance scammer. I received an email from the US Army that directly answers your question that is pasted below please keep reading.I believe you are the victim of a military Romance Scam whereas the person you are talking to is a foreign national posing as an American Soldier claiming to be stationed overseas on a peacekeeping mission. That's the key to the scam they always claim to be on a peacekeeping mission.Part of their scam is saying that they have no access to their money that their mission is highly dangerous.If your boyfriend girlfriend/future husband/wife is asking you to do the following or has exhibited this behavior, it is a most likely a scam:Moves to private messaging site immediately after meeting you on Facebook or SnapChat or Instagram or some dating or social media site. Often times they delete the site you met them on right after they asked you to move to a more private messaging siteProfesses love to you very quickly & seems to quote poems and song lyrics along with using their own sort of broken language, as they profess their love and devotion quickly. They also showed concern for your health and love for your family.Promises marriage as soon as he/she gets to state for leave that they asked you to pay for.They Requests money (wire transfers) and Amazon, iTune ,Verizon, etc gift cards, for medicine, religious practices, and leaves to come home, internet access, complete job assignments, help sick friend, get him out of trouble, or anything that sounds fishy.The military does provide all the soldier needs including food medical Care and transportation for leave. Trust me, I lived it, you are probably being scammed. I am just trying to show you examples that you are most likely being connned.Below is an email response I received after I sent an inquiry to the US government when I discovered I was scammed. I received this wonderful response back with lots of useful links on how to find and report your scammer. And how to learn more about Romance Scams.Right now you can also copy the picture he gave you and do a google image search and you will hopefully see the pictures of the real person he is impersonating. this doesn't always work and take some digging. if you find the real person you can direct message them and alert them that their image is being used for scamming.Good Luck to you and I'm sorry this may be happening to you. please continue reading the government response I received below it's very informative. You have contacted an email that is monitored by the U.S. Army Criminal Investigation Command. Unfortunately, this is a common concern. We assure you there is never any reason to send money to anyone claiming to be a Soldier online. If you have only spoken with this person online, it is likely they are not a U.S. Soldier at all. If this is a suspected imposter social media profile, we urge you to report it to that platform as soon as possible. Please continue reading for more resources and answers to other frequently asked questions: How to report an imposter Facebook profile: Caution-https://www.facebook.com/help/16... < Caution-https://www.facebook.com/help/16... > Answers to frequently asked questions: - Soldiers and their loved ones are not charged money so that the Soldier can go on leave. - Soldiers are not charged money for secure communications or leave. - Soldiers do not need permission to get married. - Soldiers emails are in this format: john.doe.mil@mail.mil < Caution-mailto: john.doe.mil@mail.mil > anything ending in .us or .com is not an official email account. - Soldiers have medical insurance, which pays for their medical costs when treated at civilian health care facilities worldwide – family and friends do not need to pay their medical expenses. - Military aircraft are not used to transport Privately Owned Vehicles. - Army financial offices are not used to help Soldiers buy or sell items of any kind. - Soldiers deployed to Combat Zones do not need to solicit money from the public to feed or house themselves or their troops. - Deployed Soldiers do not find large unclaimed sums of money and need your help to get that money out of the country. Anyone who tells you one of the above-listed conditions/circumstances is true is likely posing as a Soldier and trying to steal money from you. We would urge you to immediately cease all contact with this individual. For more information on avoiding online scams and to report this crime, please see the following sites and articles: This article may help clarify some of the tricks social media scammers try to use to take advantage of people: Caution-https://www.army.mil/article/61432/< Caution-https://www.army.mil/article/61432/> CID advises vigilance against 'romance scams,' scammers impersonating Soldiers Caution-https://www.army.mil/article/180749 < Caution-https://www.army.mil/article/180749 > FBI Internet Crime Complaint Center: Caution-http://www.ic3.gov/default.aspx< Caution-http://www.ic3.gov/default.aspx> U.S. Army investigators warn public against romance scams: Caution-https://www.army.mil/article/130...< Caution-https://www.army.mil/article/130...> DOD warns troops, families to be cybercrime smart -Caution-http://www.army.mil/article/1450...< Caution-http://www.army.mil/article/1450...> Use caution with social networking Caution-https://www.army.mil/article/146...< Caution-https://www.army.mil/article/146...> Please see our frequently asked questions section under scams and legal issues. Caution-http://www.army.mil/faq/ < Caution-http://www.army.mil/faq/ > or visit Caution-http://www.cid.army.mil/ < Caution-http://www.cid.army.mil/ >. The challenge with most scams is determining if an individual is a legitimate member of the US Army. Based on the Privacy Act of 1974, we cannot provide this information. If concerned about a scam you may contact the Better Business Bureau (if it involves a solicitation for money), or local law enforcement. If you're involved in a Facebook or dating site scam, you are free to contact us direct; (571) 305-4056. If you have a social security number, you can find information about Soldiers online at Caution-https://www.dmdc.osd.mil/appj/sc... < Caution-https://www.dmdc.osd.mil/appj/sc... > . While this is a free search, it does not help you locate a retiree, but it can tell you if the Soldier is active duty or not. If more information is needed such as current duty station or location, you can contact the Commander Soldier's Records Data Center (SRDC) by phone or mail and they will help you locate individuals on active duty only, not retirees. There is a fee of $3.50 for businesses to use this service. The check or money order must be made out to the U.S. Treasury. It is not refundable. The address is: Commander Soldier's Records Data Center (SRDC) 8899 East 56th Street Indianapolis, IN 46249-5301 Phone: 1-866-771-6357 In addition, it is not possible to remove social networking site profiles without legitimate proof of identity theft or a scam. If you suspect fraud on this site, take a screenshot of any advances for money or impersonations and report the account on the social networking platform immediately. Please submit all information you have on this incident to Caution-www.ic3.gov < Caution-http://www.ic3.gov > (FBI website, Internet Criminal Complaint Center), immediately stop contact with the scammer (you are potentially providing them more information which can be used to scam you), and learn how to protect yourself against these scams at Caution-http://www.ftc.gov < Caution-http://www.ftc.gov > (Federal Trade Commission's website)

-

As one of the cofounders of a multi-member LLC taxed as a partnership, how do I pay myself for work I am doing as a contractor for the company? What forms do I need to fill out?

First, the LLC operates as tax partnership (“TP”) as the default tax status if no election has been made as noted in Treasury Regulation Section 301.7701-3(b)(i). For legal purposes, we have a LLC. For tax purposes we have a tax partnership. Since we are discussing a tax issue here, we will discuss the issue from the perspective of a TP.A partner cannot under any circumstances be an employee of the TP as Revenue Ruling 69-184 dictated such. And, the 2016 preamble to Temporary Treasury Regulation Section 301.7701-2T notes the Treasury still supports this revenue ruling.Though a partner can engage in a transaction with the TP in a non partner capacity (Section 707a(a)).A partner receiving a 707(a) payment from the partnership receives the payment as any stranger receives a payment from the TP for services rendered. This partner gets treated for this transaction as if he/she were not a member of the TP (Treasury Regulation Section 1.707-1(a).As an example, a partner owns and operates a law firm specializing in contract law. The TP requires advice on terms and creation for new contracts the TP uses in its business with clients. This partner provides a bid for this unique job and the TP accepts it. Here, the partner bills the TP as it would any other client, and the partner reports the income from the TP client job as he/she would for any other client. The TP records the job as an expense and pays the partner as it would any other vendor. Here, I am assuming the law contract job represents an expense versus a capital item. Of course, the partner may have a law corporation though the same principle applies.Further, a TP can make fixed payments to a partner for services or capital — called guaranteed payments as noted in subsection (c).A 707(c) guaranteed payment shows up in the membership agreement drawn up by the business attorney. This payment provides a service partner with a guaranteed payment regardless of the TP’s income for the year as noted in Treasury Regulation Section 1.707-1(c).As an example, the TP operates an exclusive restaurant. Several partners contribute capital for the venture. The TP’s key service partner is the chef for the restaurant. And, the whole restaurant concept centers on this chef’s experience and creativity. The TP’s operating agreement provides the chef receives a certain % profit interest but as a minimum receives yearly a fixed $X guaranteed payment regardless of TP’s income level. In the first year of operations the TP has low profits as expected. The chef receives the guaranteed $X payment as provided in the membership agreement.The TP allocates the guaranteed payment to the capital interest partners on their TP k-1s as business expense. And, the TP includes the full $X guaranteed payment as income on the chef’s K-1. Here, the membership agreement demonstrates the chef only shares in profits not losses. So, the TP only allocates the guaranteed expense to those partners responsible for making up losses (the capital partners) as noted in Treasury Regulation Section 707-1(c) Example 3. The chef gets no allocation for the guaranteed expense as he/she does not participate in losses.If we change the situation slightly, we may change the tax results. If the membership agreement says the chef shares in losses, we then allocate a portion of the guaranteed expense back to the chef following the above treasury regulation.As a final note, a TP return requires knowledge of primary tax law if the TP desires filing a completed an accurate partnership tax return.I have completed the above tax analysis based on primary partnership tax law. If the situation changes in any manner, the tax outcome may change considerably. www.rst.tax

-

If you pay a contractor (in the US) do you need to fill out tax forms? Is it different if I am in the US paying contractors outside the US?

If you are paying contractors in the U.S. in connection with a trade or business, and you pay any one of them in aggregate in excess of $600, you are required to prepare a 1099 form. In aggregate means that if you paid someone $ 400, and then later paid them $ 201, you’d be liable to prepare the 1099.If you pay persons that are not in the U.S., then your only requirement is to ascertain that they are not U.S. citizens or U.S. permanent residents. If either of those situations apply, then the $ 600 rule applies.

Create this form in 5 minutes!

How to create an eSignature for the bensalem contractor license form

How to make an electronic signature for the Bensalem Contractor License Form in the online mode

How to generate an electronic signature for the Bensalem Contractor License Form in Chrome

How to make an electronic signature for signing the Bensalem Contractor License Form in Gmail

How to generate an eSignature for the Bensalem Contractor License Form straight from your mobile device

How to create an electronic signature for the Bensalem Contractor License Form on iOS devices

How to make an eSignature for the Bensalem Contractor License Form on Android

People also ask

-

What is the Bensalem Contractor License Form?

The Bensalem Contractor License Form is a crucial document required for contractors operating in Bensalem to legally perform services. This form ensures that contractors comply with local regulations and provides necessary information to the authorities. Completing this form accurately is essential for obtaining or renewing a contractor's license in Bensalem.

-

How can airSlate SignNow assist with the Bensalem Contractor License Form?

airSlate SignNow streamlines the process of completing and submitting the Bensalem Contractor License Form by allowing users to easily fill out, sign, and send the document electronically. Our intuitive platform eliminates the need for printing and mailing, ensuring a faster and more efficient submission. Additionally, you can track the status of your form directly through our interface.

-

What are the costs associated with using airSlate SignNow for the Bensalem Contractor License Form?

Using airSlate SignNow for the Bensalem Contractor License Form is cost-effective, with competitive pricing plans tailored to meet the needs of businesses of all sizes. We offer flexible subscription options that allow you to choose the plan that best fits your budget and usage requirements. Check our website for detailed pricing information and any available promotions.

-

Are there any features specifically designed for the Bensalem Contractor License Form?

Yes, airSlate SignNow offers features specifically tailored for the Bensalem Contractor License Form, including customizable templates and automated workflows. These features enable you to create a compliant form quickly and accurately, reducing the likelihood of errors that could delay your license approval. Additionally, our eSignature functionality ensures that all necessary approvals are obtained seamlessly.

-

Can I integrate airSlate SignNow with other applications for managing the Bensalem Contractor License Form?

Absolutely! airSlate SignNow integrates with various applications, such as Google Drive, Dropbox, and CRM systems, making it easier to access and manage your Bensalem Contractor License Form. These integrations help you streamline your workflow, ensuring that your documents are organized and easily accessible for future reference.

-

What benefits does airSlate SignNow provide for the Bensalem Contractor License Form process?

Using airSlate SignNow for the Bensalem Contractor License Form offers numerous benefits, including time savings, enhanced security, and improved compliance. Our platform allows for quick electronic signatures and document submission, reducing turnaround times signNowly. Furthermore, your documents are stored securely, ensuring compliance with local regulations.

-

Is the Bensalem Contractor License Form easy to complete with airSlate SignNow?

Yes, the Bensalem Contractor License Form is designed to be user-friendly when using airSlate SignNow. Our platform features an intuitive interface that guides you through each step of the form completion process. You can fill out the form at your own pace, making it accessible for all users, regardless of their technical skills.

Get more for Bensalem Contractor License Form

Find out other Bensalem Contractor License Form

- How Can I eSign Iowa Car Dealer Limited Power Of Attorney

- How To eSign Illinois Business Operations Stock Certificate

- Can I eSign Louisiana Car Dealer Quitclaim Deed

- eSign Michigan Car Dealer Operating Agreement Mobile

- Can I eSign Mississippi Car Dealer Resignation Letter

- eSign Missouri Car Dealer Lease Termination Letter Fast

- Help Me With eSign Kentucky Business Operations Quitclaim Deed

- eSign Nevada Car Dealer Warranty Deed Myself

- How To eSign New Hampshire Car Dealer Purchase Order Template

- eSign New Jersey Car Dealer Arbitration Agreement Myself

- eSign North Carolina Car Dealer Arbitration Agreement Now

- eSign Ohio Car Dealer Business Plan Template Online

- eSign Ohio Car Dealer Bill Of Lading Free

- How To eSign North Dakota Car Dealer Residential Lease Agreement

- How Do I eSign Ohio Car Dealer Last Will And Testament

- Sign North Dakota Courts Lease Agreement Form Free

- eSign Oregon Car Dealer Job Description Template Online

- Sign Ohio Courts LLC Operating Agreement Secure

- Can I eSign Michigan Business Operations POA

- eSign Car Dealer PDF South Dakota Computer