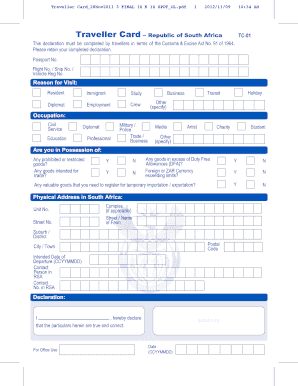

Form TC 01 Sars 2011-2026

What is the Form TC 01 Sars

The Form TC 01 Sars is a specific document utilized for reporting certain tax-related information to the Internal Revenue Service (IRS). It plays a critical role in ensuring compliance with U.S. tax laws and regulations. This form is primarily used by individuals and businesses to report income, deductions, and other relevant financial information. Understanding its purpose is essential for accurate tax reporting and avoiding potential penalties.

How to use the Form TC 01 Sars

Using the Form TC 01 Sars involves several key steps to ensure that the information submitted is accurate and complete. First, gather all necessary financial documents, including income statements and deduction records. Next, fill out the form carefully, ensuring that all sections are completed accurately. It is important to double-check for any errors before submission. Once completed, the form can be filed electronically or mailed to the appropriate IRS address, depending on your preference and the specific requirements for your situation.

Steps to complete the Form TC 01 Sars

Completing the Form TC 01 Sars can be streamlined by following these steps:

- Collect all relevant financial documents, such as W-2s, 1099s, and receipts for deductions.

- Download the form from the IRS website or access it through an approved tax software program.

- Fill in your personal information, including your name, address, and Social Security number.

- Report your income accurately in the designated sections.

- Detail any deductions or credits you are eligible for.

- Review the completed form for accuracy, ensuring all calculations are correct.

- Submit the form electronically or print it for mailing, following the IRS guidelines for submission.

Legal use of the Form TC 01 Sars

The legal use of the Form TC 01 Sars is governed by IRS regulations, which outline the requirements for filing and the consequences of non-compliance. This form must be filled out truthfully and accurately, as any discrepancies can lead to audits or penalties. Understanding the legal implications of submitting this form is crucial for both individuals and businesses, as it ensures adherence to tax laws and protects against potential legal issues.

Filing Deadlines / Important Dates

Filing deadlines for the Form TC 01 Sars are critical to ensure timely compliance with IRS regulations. Typically, the deadline for submitting this form aligns with the annual tax filing deadline, which is usually April fifteenth for individual taxpayers. However, it is important to verify specific dates each tax year, as they may vary due to weekends or holidays. Additionally, extensions may be available, but they must be requested in advance.

Required Documents

To complete the Form TC 01 Sars accurately, several documents are typically required. These may include:

- W-2 forms from employers

- 1099 forms for any freelance or contract work

- Receipts for deductible expenses

- Previous tax returns for reference

- Any other relevant financial statements

Having these documents organized and accessible will facilitate a smoother filing process.

Quick guide on how to complete form tc 01 sars

Complete Form TC 01 Sars effortlessly on any device

Digital document management has gained traction with organizations and individuals alike. It offers an ideal environmentally friendly substitute for conventional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents quickly without hold-ups. Manage Form TC 01 Sars on any device using airSlate SignNow's Android or iOS applications and enhance any document-focused process today.

The easiest way to modify and electronically sign Form TC 01 Sars with ease

- Find Form TC 01 Sars and click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize pertinent sections of the documents or redact sensitive data using tools that airSlate SignNow offers specifically for that reason.

- Generate your eSignature with the Sign tool, which takes moments and holds the same legal validity as a conventional wet ink signature.

- Review the information and then press the Done button to save your modifications.

- Select your preferred method to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Do away with lost or misplaced documents, tedious form hunting, or mistakes that necessitate reprinting new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Modify and electronically sign Form TC 01 Sars and ensure outstanding communication at any phase of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form tc 01 sars

The way to generate an eSignature for your PDF file in the online mode

The way to generate an eSignature for your PDF file in Chrome

How to make an eSignature for putting it on PDFs in Gmail

The way to generate an electronic signature right from your smartphone

The way to create an electronic signature for a PDF file on iOS devices

The way to generate an electronic signature for a PDF on Android

People also ask

-

What is Form TC 01 Sars and who needs it?

Form TC 01 Sars is a tax form required for specific tax submissions to the South African Revenue Service (SARS). It is essential for businesses and individuals who need to declare income or claim deductions. Understanding how to correctly fill out and submit this form is crucial for compliance.

-

How can airSlate SignNow help with Form TC 01 Sars submissions?

airSlate SignNow provides an easy-to-use platform for digitally signing and managing documents, including Form TC 01 Sars. With its intuitive interface, users can efficiently fill out the form and get necessary signatures quickly, ensuring compliance with SARS deadlines.

-

What features does airSlate SignNow offer for managing Form TC 01 Sars?

The features of airSlate SignNow include customizable templates, seamless eSignature options, and secure document storage. These tools simplify the process of completing and submitting Form TC 01 Sars, making it more efficient for users to handle their tax responsibilities.

-

Is airSlate SignNow suitable for small businesses needing to manage Form TC 01 Sars?

Yes, airSlate SignNow is highly suitable for small businesses looking to manage Form TC 01 Sars. Its cost-effective pricing plans and user-friendly tools make it an ideal choice for businesses of all sizes needing to simplify their document workflows.

-

Can I integrate airSlate SignNow with other software for handling Form TC 01 Sars?

Absolutely! airSlate SignNow offers integrations with popular applications like Google Drive and Microsoft Office. This means you can easily access and share documents related to Form TC 01 Sars while maintaining your existing workflows.

-

What are the benefits of using airSlate SignNow for Form TC 01 Sars?

Using airSlate SignNow for Form TC 01 Sars offers various benefits such as improved efficiency, reduced processing time, and enhanced security. The digital signing process ensures that your submissions are legally valid while keeping your documents safe.

-

What support does airSlate SignNow provide for users dealing with Form TC 01 Sars?

airSlate SignNow provides extensive customer support for users needing assistance with Form TC 01 Sars. Their knowledgeable support team is available to answer queries and guide you through the document preparation and eSignature process.

Get more for Form TC 01 Sars

Find out other Form TC 01 Sars

- Electronic signature Idaho Insurance Letter Of Intent Free

- How To Electronic signature Idaho Insurance POA

- Can I Electronic signature Illinois Insurance Last Will And Testament

- Electronic signature High Tech PPT Connecticut Computer

- Electronic signature Indiana Insurance LLC Operating Agreement Computer

- Electronic signature Iowa Insurance LLC Operating Agreement Secure

- Help Me With Electronic signature Kansas Insurance Living Will

- Electronic signature Insurance Document Kentucky Myself

- Electronic signature Delaware High Tech Quitclaim Deed Online

- Electronic signature Maine Insurance Quitclaim Deed Later

- Electronic signature Louisiana Insurance LLC Operating Agreement Easy

- Electronic signature West Virginia Education Contract Safe

- Help Me With Electronic signature West Virginia Education Business Letter Template

- Electronic signature West Virginia Education Cease And Desist Letter Easy

- Electronic signature Missouri Insurance Stock Certificate Free

- Electronic signature Idaho High Tech Profit And Loss Statement Computer

- How Do I Electronic signature Nevada Insurance Executive Summary Template

- Electronic signature Wisconsin Education POA Free

- Electronic signature Wyoming Education Moving Checklist Secure

- Electronic signature North Carolina Insurance Profit And Loss Statement Secure