Business Credit Application with Personal Guarantee Form

What is the Business Credit Application With Personal Guarantee

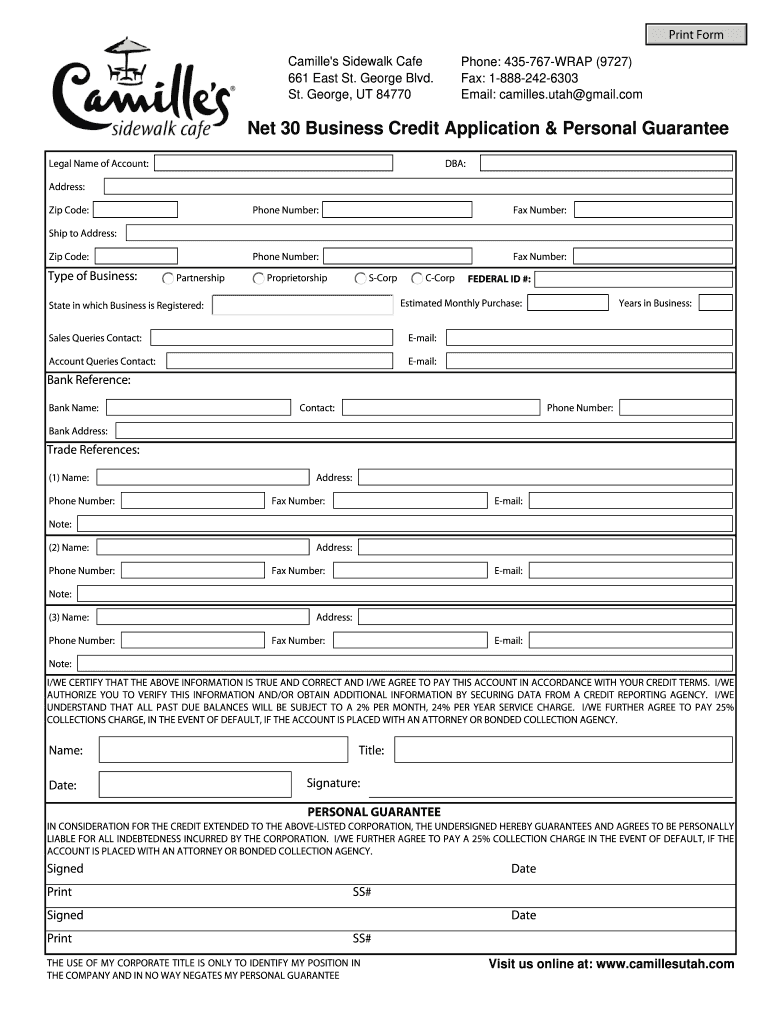

The business credit application with personal guarantee is a formal document that allows a business to apply for credit while requiring the owner or another individual to personally guarantee the repayment of the debt. This means that if the business fails to repay the loan, the individual who signed the guarantee is personally liable for the debt. This type of application is commonly used by small businesses seeking financing, as it provides lenders with an added layer of security.

Key elements of the Business Credit Application With Personal Guarantee

When completing a business credit application with personal guarantee, several key elements must be included to ensure its validity:

- Business Information: This includes the legal name, address, and structure of the business (e.g., LLC, Corporation).

- Owner Information: Personal details of the guarantor, including name, address, and Social Security number.

- Financial Information: Current financial statements, including income, expenses, and any existing debts.

- Loan Purpose: A clear statement outlining the intended use of the funds being requested.

- Signature: The personal guarantee must be signed by the individual guaranteeing the loan, indicating their acceptance of liability.

Steps to complete the Business Credit Application With Personal Guarantee

Completing the business credit application with personal guarantee involves several straightforward steps:

- Gather Required Information: Collect all necessary business and personal financial documents.

- Fill Out the Application: Carefully complete the application form, ensuring all sections are filled accurately.

- Review the Application: Double-check for any errors or missing information to avoid delays.

- Sign the Personal Guarantee: Ensure that the guarantor signs the document, acknowledging their responsibility.

- Submit the Application: Send the completed application to the lender, either online or via mail.

Legal use of the Business Credit Application With Personal Guarantee

The legal enforceability of a business credit application with personal guarantee depends on compliance with applicable laws. In the United States, electronic signatures are recognized under the ESIGN Act and UETA, provided certain conditions are met. It is essential that the document clearly states the terms of the guarantee and is signed by the guarantor to be considered legally binding. Additionally, lenders may require the application to adhere to state-specific regulations concerning credit agreements.

Examples of using the Business Credit Application With Personal Guarantee

There are various scenarios in which a business credit application with personal guarantee may be utilized:

- A small business owner seeking a loan to purchase inventory may need to provide a personal guarantee to secure favorable loan terms.

- A startup may require a personal guarantee from its founders when applying for a line of credit to cover initial operating expenses.

- A business looking to lease commercial property may be asked to complete a credit application with a personal guarantee to assure the landlord of payment.

Quick guide on how to complete business credit application with personal guarantee

Complete Business Credit Application With Personal Guarantee effortlessly on any device

Online document management has gained traction among businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed paperwork, allowing you to access the necessary form and securely store it online. airSlate SignNow provides all the resources needed to create, update, and electronically sign your documents quickly and efficiently. Manage Business Credit Application With Personal Guarantee on any platform using airSlate SignNow's Android or iOS applications and enhance any document-centric workflow today.

How to modify and electronically sign Business Credit Application With Personal Guarantee with ease

- Find Business Credit Application With Personal Guarantee and click Get Form to initiate the process.

- Utilize the tools available to complete your form.

- Emphasize key sections of the documents or obscure sensitive information with tools specifically provided by airSlate SignNow for this purpose.

- Create your electronic signature using the Sign feature, which takes only seconds and holds the same legal significance as a conventional wet ink signature.

- Review the details and then click on the Done button to save your modifications.

- Choose your method for sharing your form: via email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or mislaid documents, tedious form searching, or errors that require reprinting new document copies. airSlate SignNow meets your document management demands in just a few clicks from any device you prefer. Adjust and electronically sign Business Credit Application With Personal Guarantee and ensure smooth communication throughout the form preparation phase with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the business credit application with personal guarantee

How to generate an eSignature for a PDF online

How to generate an eSignature for a PDF in Google Chrome

How to create an eSignature for signing PDFs in Gmail

How to make an eSignature right from your smartphone

The best way to create an eSignature for a PDF on iOS

How to make an eSignature for a PDF on Android

People also ask

-

What is a credit application with personal guarantee template?

A credit application with personal guarantee template is a document that allows businesses to request credit while ensuring that a personal guarantee is provided by an individual. This template streamlines the application process, making it easy to collect necessary information and safeguards for lenders. Using an integrated eSigning solution like airSlate SignNow can facilitate quick approvals.

-

How can I customize the credit application with personal guarantee template?

Customizing the credit application with personal guarantee template is straightforward with airSlate SignNow. Users can easily modify fields, add company logos, and tailor specific requirements to suit their business needs. This flexibility ensures that the application aligns with your company's branding and specific policies.

-

Are there any costs associated with using the credit application with personal guarantee template?

Yes, there are costs associated with utilizing the credit application with personal guarantee template through airSlate SignNow, but it remains a cost-effective solution. Pricing plans depend on the features you choose, and they provide great value by streamlining the signing process. For specific pricing details, you can visit our pricing page.

-

What are the key benefits of using an eSigning solution for a credit application with personal guarantee template?

Using an eSigning solution like airSlate SignNow for a credit application with personal guarantee template offers numerous benefits. It enhances document security, speeds up turnaround times, and reduces paper usage. Additionally, it makes the process more convenient for both the applicant and the lender.

-

Can I track the status of my credit application with personal guarantee template?

Absolutely! With airSlate SignNow, you can easily track the status of your credit application with personal guarantee template. The platform provides real-time updates and notifications, allowing both parties to know when the application has been sent, viewed, and signed. This visibility simplifies the follow-up process.

-

Is my data safe when using the credit application with personal guarantee template on airSlate SignNow?

Yes, your data is secure when using the credit application with personal guarantee template on airSlate SignNow. The platform employs robust security measures, including encryption and compliance with industry standards, to protect your sensitive information. You can confidently manage your documents knowing they're stored securely.

-

What integrations are available for the credit application with personal guarantee template?

airSlate SignNow offers various integrations that enhance the functionality of your credit application with personal guarantee template. You can connect it with popular applications like CRM systems, cloud storage services, and workflow tools. These integrations streamline processes and help you manage documents more efficiently.

Get more for Business Credit Application With Personal Guarantee

Find out other Business Credit Application With Personal Guarantee

- eSign New York Courts Business Plan Template Later

- Can I eSign North Carolina Courts Limited Power Of Attorney

- eSign North Dakota Courts Quitclaim Deed Safe

- How To eSign Rhode Island Sports Quitclaim Deed

- Help Me With eSign Oregon Courts LLC Operating Agreement

- eSign North Dakota Police Rental Lease Agreement Now

- eSign Tennessee Courts Living Will Simple

- eSign Utah Courts Last Will And Testament Free

- eSign Ohio Police LLC Operating Agreement Mobile

- eSign Virginia Courts Business Plan Template Secure

- How To eSign West Virginia Courts Confidentiality Agreement

- eSign Wyoming Courts Quitclaim Deed Simple

- eSign Vermont Sports Stock Certificate Secure

- eSign Tennessee Police Cease And Desist Letter Now

- Help Me With eSign Texas Police Promissory Note Template

- eSign Utah Police LLC Operating Agreement Online

- eSign West Virginia Police Lease Agreement Online

- eSign Wyoming Sports Residential Lease Agreement Online

- How Do I eSign West Virginia Police Quitclaim Deed

- eSignature Arizona Banking Moving Checklist Secure