Arkansas Form AR1023CT Application for Income Tax Exemption

What is the Arkansas Form AR1023CT Application For Income Tax Exemption

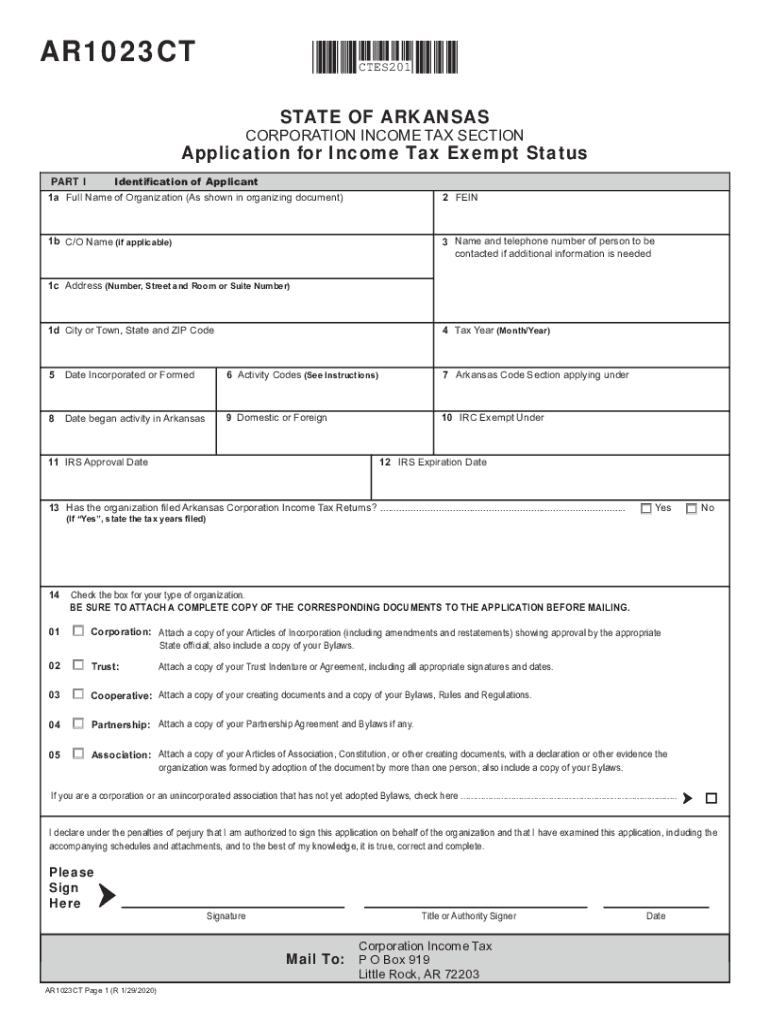

The Arkansas Form AR1023CT is an official document used by organizations seeking income tax exemption in the state of Arkansas. This application is specifically designed for entities that qualify under certain categories, such as charitable, religious, or educational organizations. By submitting this form, applicants can request to be recognized as tax-exempt, which can significantly reduce their tax liabilities and enhance their operational capabilities.

How to use the Arkansas Form AR1023CT Application For Income Tax Exemption

Using the Arkansas Form AR1023CT involves several steps to ensure that your application is complete and compliant with state regulations. First, gather all necessary information about your organization, including its mission, structure, and activities. Next, fill out the form accurately, providing detailed descriptions of your organization’s purpose and how it meets the criteria for tax exemption. Finally, submit the completed form along with any required documentation to the appropriate state department for review.

Steps to complete the Arkansas Form AR1023CT Application For Income Tax Exemption

Completing the Arkansas Form AR1023CT requires careful attention to detail. Follow these steps:

- Review the eligibility criteria to ensure your organization qualifies for tax exemption.

- Download the form from the official state website or obtain a physical copy.

- Fill in the required fields, including your organization’s name, address, and tax identification number.

- Provide a thorough explanation of your organization’s activities and how they align with tax-exempt purposes.

- Attach any supporting documents, such as bylaws, financial statements, and a statement of activities.

- Double-check all information for accuracy before submission.

Eligibility Criteria

To qualify for tax exemption using the Arkansas Form AR1023CT, organizations must meet specific criteria set by the state. Generally, eligible entities include non-profit organizations that operate for charitable, educational, or religious purposes. Additionally, the organization must demonstrate that it serves a public benefit and does not operate for profit. It is essential to review the detailed eligibility requirements to ensure compliance before submitting the application.

Key elements of the Arkansas Form AR1023CT Application For Income Tax Exemption

The Arkansas Form AR1023CT includes several key elements that applicants must address. These elements typically consist of:

- Organization information: Name, address, and contact details.

- Tax identification number: Essential for processing the application.

- Purpose statement: A clear description of the organization’s mission and activities.

- Financial information: Details about the organization’s funding sources and expenditures.

- Supporting documentation: Evidence that supports the claims made in the application.

Form Submission Methods

Organizations can submit the Arkansas Form AR1023CT through various methods, ensuring flexibility for applicants. The primary submission methods include:

- Online submission: Many organizations may have the option to submit the form electronically through the state’s official website.

- Mail: Applicants can print the completed form and send it via postal service to the designated state office.

- In-person: Some applicants may choose to deliver the form directly to the state office for immediate processing.

Quick guide on how to complete arkansas form ar1023ct application for income tax exemption

Complete Arkansas Form AR1023CT Application For Income Tax Exemption effortlessly on any device

Online document management has become increasingly popular among companies and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed paperwork, as you can access the correct template and securely store it online. airSlate SignNow provides you with all the tools you need to create, modify, and eSign your documents swiftly without delays. Handle Arkansas Form AR1023CT Application For Income Tax Exemption on any device with airSlate SignNow’s Android or iOS applications and streamline any document-related tasks today.

The easiest way to modify and eSign Arkansas Form AR1023CT Application For Income Tax Exemption without hassle

- Obtain Arkansas Form AR1023CT Application For Income Tax Exemption and then click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your eSignature with the Sign tool, which takes mere seconds and has the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you want to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that necessitate reprinting new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign Arkansas Form AR1023CT Application For Income Tax Exemption and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the arkansas form ar1023ct application for income tax exemption

The best way to create an electronic signature for your PDF online

The best way to create an electronic signature for your PDF in Google Chrome

How to generate an electronic signature for signing PDFs in Gmail

The best way to generate an eSignature straight from your smartphone

The way to create an electronic signature for a PDF on iOS

The best way to generate an eSignature for a PDF document on Android

People also ask

-

What isairSlate SignNow and how does it relate to ar1023ct?

airSlate SignNow is a powerful platform that allows businesses to send and eSign documents efficiently. The term ar1023ct represents a specific model or feature within the airSlate SignNow ecosystem, aiming to enhance the signing process. Utilizing ar1023ct can streamline documentation tasks signNowly for small to large businesses.

-

How does ar1023ct improve document management?

The ar1023ct feature of airSlate SignNow simplifies document management by providing tools for easy organization, tracking, and storage of signed documents. It automates repetitive tasks and reduces the risk of human error, ultimately saving time and resources. With ar1023ct, businesses can manage their important documents more effectively.

-

What are the pricing options for ar1023ct?

Pricing for the ar1023ct feature within airSlate SignNow is flexible, catering to different business sizes and needs. Customized plans are available that include various features such as unlimited templates and advanced integrations. You can find more details on specific pricing tiers on the airSlate SignNow website.

-

Can ar1023ct be integrated with other applications?

Yes, ar1023ct supports integration with numerous applications to enhance workflow efficiency. Businesses can connect airSlate SignNow with platforms like Google Drive, Salesforce, and more to streamline their operations. This integration capability allows users to manage documents across different tools seamlessly.

-

What benefits does ar1023ct offer for small businesses?

For small businesses, ar1023ct offers a cost-effective solution for document management and eSigning needs. It reduces administrative overheads, enhances productivity, and ensures compliance with legal standards. By adopting ar1023ct, small businesses can operate more efficiently and customer-centric.

-

Is the user interface of airSlate SignNow with ar1023ct easy to navigate?

Absolutely! The user interface of airSlate SignNow, particularly with the ar1023ct feature, is designed to be intuitive and user-friendly. This system allows users of any technical skill level to navigate easily and complete eSigning tasks without extensive training. It focuses on delivering a straightforward experience.

-

What security measures does ar1023ct implement?

airSlate SignNow with ar1023ct prioritizes the security of your documents through advanced encryption and authentication protocols. It ensures that all signed documents are securely stored and can be accessed only by authorized users. Businesses can trust ar1023ct to protect sensitive information throughout the signing process.

Get more for Arkansas Form AR1023CT Application For Income Tax Exemption

- Admissions office consent form brandon university

- Instructions applicant declaration natural person form

- Use this form when recipient is not bcca or vch or cfri

- Card request form

- Secretary of state nameaddress change request form

- Esophageal thoracic oncology dsg referral guidelines form

- 1ces application form designate third party release information form des v1pdf

- Guardianship of incapacitated or disabled persons findlaw form

Find out other Arkansas Form AR1023CT Application For Income Tax Exemption

- Sign Ohio Non-Solicitation Agreement Now

- How Can I Sign Alaska Travel Agency Agreement

- How Can I Sign Missouri Travel Agency Agreement

- How Can I Sign Alabama Amendment to an LLC Operating Agreement

- Can I Sign Alabama Amendment to an LLC Operating Agreement

- How To Sign Arizona Amendment to an LLC Operating Agreement

- Sign Florida Amendment to an LLC Operating Agreement Now

- How To Sign Florida Amendment to an LLC Operating Agreement

- How Do I Sign Illinois Amendment to an LLC Operating Agreement

- How Do I Sign New Hampshire Amendment to an LLC Operating Agreement

- How To Sign New York Amendment to an LLC Operating Agreement

- Sign Washington Amendment to an LLC Operating Agreement Now

- Can I Sign Wyoming Amendment to an LLC Operating Agreement

- How To Sign California Stock Certificate

- Sign Louisiana Stock Certificate Free

- Sign Maine Stock Certificate Simple

- Sign Oregon Stock Certificate Myself

- Sign Pennsylvania Stock Certificate Simple

- How Do I Sign South Carolina Stock Certificate

- Sign New Hampshire Terms of Use Agreement Easy