Printable Arizona Form 202 Personal Exemption Allocation Election

What is the Printable Arizona Form 202 Personal Exemption Allocation Election

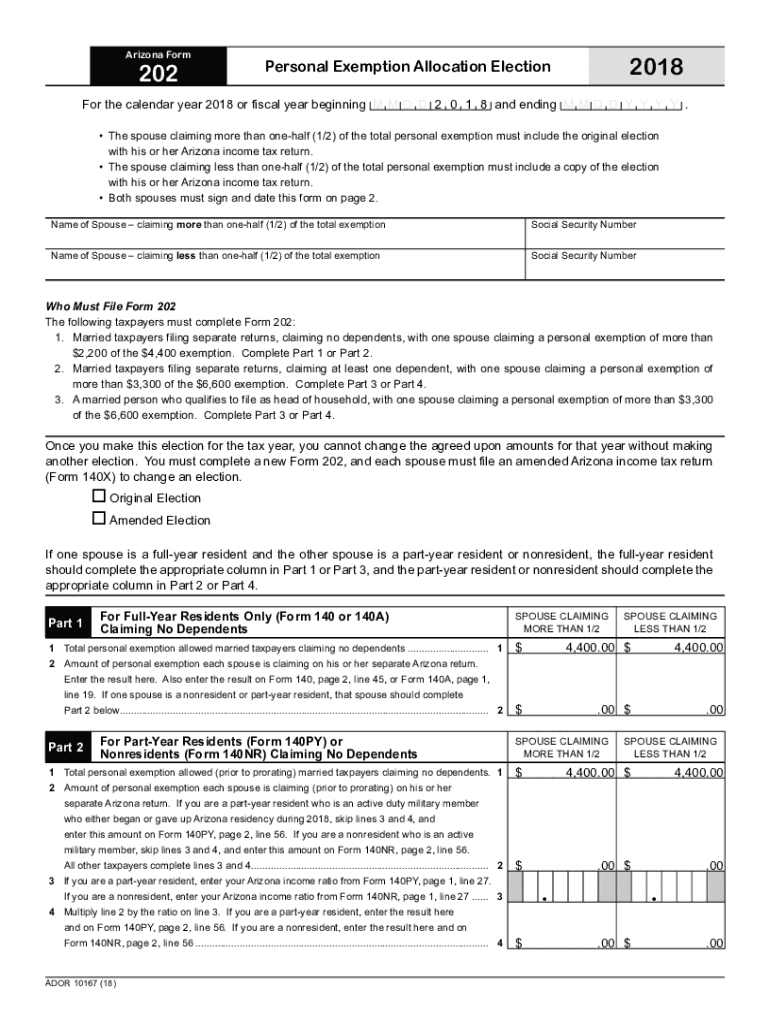

The Printable Arizona Form 202 Personal Exemption Allocation Election is a tax form used by Arizona residents to allocate personal exemptions among various entities or individuals. This form is particularly relevant for those who need to declare exemptions for tax purposes, ensuring compliance with state tax regulations. It is essential for individuals and businesses to accurately complete this form to avoid potential issues with the Arizona Department of Revenue.

How to use the Printable Arizona Form 202 Personal Exemption Allocation Election

Using the Printable Arizona Form 202 Personal Exemption Allocation Election involves several steps. First, download the form from a reliable source. Next, fill in the required information, including personal details and the allocation of exemptions. It is crucial to ensure that all information is accurate and complete to prevent delays in processing. After completing the form, it can be submitted either electronically or via mail, depending on the specific requirements of the Arizona Department of Revenue.

Steps to complete the Printable Arizona Form 202 Personal Exemption Allocation Election

Completing the Printable Arizona Form 202 Personal Exemption Allocation Election involves the following steps:

- Download the form from an official source.

- Provide your personal information, including your name, address, and Social Security number.

- Indicate the number of exemptions you are claiming and how they are allocated.

- Review all entries for accuracy.

- Sign and date the form to certify its correctness.

- Submit the form according to the guidelines provided by the Arizona Department of Revenue.

Legal use of the Printable Arizona Form 202 Personal Exemption Allocation Election

The Printable Arizona Form 202 Personal Exemption Allocation Election is legally binding when completed and submitted in accordance with state regulations. To ensure its legal validity, it is important to adhere to the guidelines set forth by the Arizona Department of Revenue. This includes providing accurate information and proper signatures. Electronic submissions are also recognized as valid, provided they comply with relevant eSignature laws.

Filing Deadlines / Important Dates

Filing deadlines for the Printable Arizona Form 202 Personal Exemption Allocation Election typically align with the state tax filing deadlines. It is important to check the Arizona Department of Revenue's official website for specific dates each tax year. Missing these deadlines may result in penalties or complications with your tax filings, so timely submission is crucial.

Eligibility Criteria

Eligibility to use the Printable Arizona Form 202 Personal Exemption Allocation Election generally includes Arizona residents who are filing their state tax returns and need to allocate personal exemptions. This form is particularly relevant for those who have multiple sources of income or are filing jointly with a spouse. It is advisable to review specific eligibility requirements as outlined by the Arizona Department of Revenue to ensure compliance.

Quick guide on how to complete printable 2020 arizona form 202 personal exemption allocation election

Prepare Printable Arizona Form 202 Personal Exemption Allocation Election effortlessly on any device

Online document management has gained signNow traction among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can easily locate the appropriate form and securely store it online. airSlate SignNow provides you with all the necessary tools to create, modify, and electronically sign your documents quickly without delays. Manage Printable Arizona Form 202 Personal Exemption Allocation Election on any platform using airSlate SignNow's Android or iOS applications and streamline any document-centric process today.

The simplest way to alter and electronically sign Printable Arizona Form 202 Personal Exemption Allocation Election without difficulty

- Locate Printable Arizona Form 202 Personal Exemption Allocation Election and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight important sections of your documents or conceal sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your electronic signature using the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to save your modifications.

- Select your preferred method to share your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate the worry of lost or misfiled documents, tedious form hunting, or errors needing the printing of new copies. airSlate SignNow fulfills all your document management requirements with just a few clicks from any device. Modify and electronically sign Printable Arizona Form 202 Personal Exemption Allocation Election to ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the printable 2020 arizona form 202 personal exemption allocation election

The best way to create an electronic signature for your PDF file online

The best way to create an electronic signature for your PDF file in Google Chrome

How to make an eSignature for signing PDFs in Gmail

The best way to generate an eSignature straight from your mobile device

The way to create an electronic signature for a PDF file on iOS

The best way to generate an eSignature for a PDF document on Android devices

People also ask

-

What is the Printable Arizona Form 202 Personal Exemption Allocation Election?

The Printable Arizona Form 202 Personal Exemption Allocation Election allows taxpayers to allocate their personal exemptions for tax purposes in Arizona. This form is essential for individuals who want to ensure proper reporting of their exemptions when filing taxes.

-

How can I fill out the Printable Arizona Form 202 Personal Exemption Allocation Election?

Filling out the Printable Arizona Form 202 Personal Exemption Allocation Election is simple with airSlate SignNow. Users can easily complete the form online, ensuring all information is accurately entered and ready for submission.

-

Is there a cost associated with accessing the Printable Arizona Form 202 Personal Exemption Allocation Election?

Accessing the Printable Arizona Form 202 Personal Exemption Allocation Election is cost-effective with airSlate SignNow. Our solutions offer competitive pricing plans that fit different business needs, making it easy to manage forms without breaking the bank.

-

What features does airSlate SignNow offer for managing the Printable Arizona Form 202 Personal Exemption Allocation Election?

AirSlate SignNow provides several features for managing the Printable Arizona Form 202 Personal Exemption Allocation Election, including easy electronic signing, document collaboration, and secure storage. These features enhance the overall experience, making tax filing more efficient.

-

Can I integrate airSlate SignNow with other applications for the Printable Arizona Form 202 Personal Exemption Allocation Election?

Yes, airSlate SignNow offers seamless integrations with various applications to streamline the process of handling the Printable Arizona Form 202 Personal Exemption Allocation Election. This allows users to connect with their favorite tools, enhancing productivity and efficiency.

-

What are the benefits of using airSlate SignNow for the Printable Arizona Form 202 Personal Exemption Allocation Election?

Using airSlate SignNow for the Printable Arizona Form 202 Personal Exemption Allocation Election provides numerous benefits, including reduced paperwork, faster processing times, and improved accuracy in tax filings. Our platform ensures that forms are completed and submitted in a timely manner.

-

How does airSlate SignNow ensure the security of my Printable Arizona Form 202 Personal Exemption Allocation Election?

AirSlate SignNow prioritizes your security by implementing robust encryption standards and secure access controls for the Printable Arizona Form 202 Personal Exemption Allocation Election. This helps protect sensitive information and gives users peace of mind while managing their documents.

Get more for Printable Arizona Form 202 Personal Exemption Allocation Election

- 2020 in zone player release application form fillable template

- Ocf 3 disability certificate 2003 form

- Notice of proposal to conduct outdoor laser operations form

- Seed purchase order form

- 90 day security guard under supervision license form

- Ins5242a form

- Health card renewal application form

- Bc security guard supervision form

Find out other Printable Arizona Form 202 Personal Exemption Allocation Election

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document

- How Can I eSignature New Jersey Real Estate Word

- Can I eSignature Tennessee Police Form

- How Can I eSignature Vermont Police Presentation

- How Do I eSignature Pennsylvania Real Estate Document

- How Do I eSignature Texas Real Estate Document

- How Can I eSignature Colorado Courts PDF

- Can I eSignature Louisiana Courts Document

- How To Electronic signature Arkansas Banking Document

- How Do I Electronic signature California Banking Form

- How Do I eSignature Michigan Courts Document

- Can I eSignature Missouri Courts Document

- How Can I Electronic signature Delaware Banking PDF