Information & Instructions for Business WV State Tax Information & Instructions for BusinessInformation & Instructio 2019-2026

Understanding the Information & Instructions for Business WV State Tax

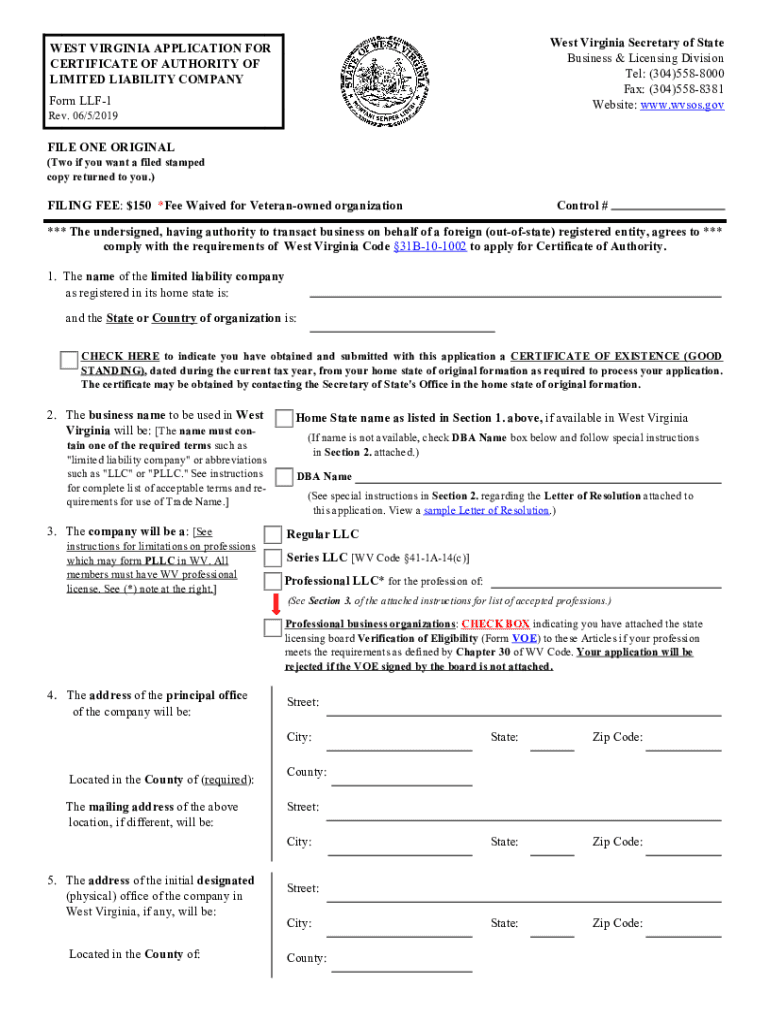

The Information & Instructions for Business regarding West Virginia state tax is essential for businesses operating within the state. This document provides detailed guidelines on tax obligations, including the types of taxes applicable, filing requirements, and payment methods. It is crucial for businesses to familiarize themselves with this information to ensure compliance with state regulations and avoid potential penalties.

Steps to Complete the Information & Instructions for Business WV State Tax

Completing the Information & Instructions for Business involves several steps to ensure accuracy and compliance. First, gather all necessary financial documents, including income statements and expense records. Next, follow the structured format outlined in the instructions, ensuring that all required fields are filled out completely. It is important to double-check calculations and ensure that all information aligns with supporting documents. Finally, submit the completed form either electronically or via mail, adhering to the specified deadlines.

Legal Use of the Information & Instructions for Business WV State Tax

The legal use of the Information & Instructions for Business is governed by various state and federal regulations. To be considered valid, the completed documents must meet specific legal criteria, including proper signatures and adherence to filing protocols. Utilizing a reliable eSignature platform, such as signNow, enhances the legal standing of your documents by providing an electronic certificate and maintaining compliance with eSignature laws like ESIGN and UETA.

Required Documents for the Information & Instructions for Business WV State Tax

When preparing the Information & Instructions for Business, several documents are typically required. These may include financial statements, previous tax returns, and any relevant business licenses. It is essential to compile all necessary documentation before starting the form to ensure a smooth and efficient completion process. Having these documents ready helps in accurately reporting income and expenses, which is critical for tax compliance.

Filing Deadlines and Important Dates for WV State Tax

Filing deadlines for the Information & Instructions for Business are crucial to avoid late fees and penalties. Generally, businesses must submit their tax forms by specific dates set by the West Virginia State Tax Department. It is advisable to mark these important dates on your calendar and set reminders to ensure timely submission. Staying informed about any changes in deadlines is also essential, as state regulations may evolve.

Examples of Using the Information & Instructions for Business WV State Tax

Understanding practical applications of the Information & Instructions for Business can enhance compliance and efficiency. For instance, a small business owner may use the document to accurately report sales tax collected from customers. Similarly, an LLC may refer to the instructions to determine its tax obligations based on its earnings. These examples illustrate how the information serves various business entities in fulfilling their tax responsibilities.

State-Specific Rules for the Information & Instructions for Business WV State Tax

Each state has unique tax regulations that affect how businesses must complete the Information & Instructions for Business. In West Virginia, specific rules dictate the types of taxes applicable to different business structures, such as corporations, partnerships, and sole proprietorships. Familiarizing oneself with these state-specific rules is essential for ensuring compliance and optimizing tax obligations. Consulting the official guidelines can provide clarity on any nuances that may apply to your business type.

Quick guide on how to complete information amp instructions for business wv state tax information amp instructions for businessinformation amp instructions

Complete Information & Instructions For Business WV State Tax Information & Instructions For BusinessInformation & Instructio effortlessly on any device

Online document management has become popular among businesses and individuals. It offers an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to find the right form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents swiftly without any holdups. Handle Information & Instructions For Business WV State Tax Information & Instructions For BusinessInformation & Instructio on any platform with airSlate SignNow Android or iOS applications and simplify any document-related task today.

The easiest way to edit and eSign Information & Instructions For Business WV State Tax Information & Instructions For BusinessInformation & Instructio without hassle

- Find Information & Instructions For Business WV State Tax Information & Instructions For BusinessInformation & Instructio and click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Highlight important sections of your documents or redact sensitive information using tools that airSlate SignNow specifically offers for this purpose.

- Create your signature with the Sign tool, which takes just seconds and carries the same legal validity as a traditional wet signature.

- Review the information and click the Done button to save your changes.

- Select how you want to send your form, whether via email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or missing documents, tedious form navigation, or errors that necessitate printing new copies. airSlate SignNow addresses your document management requirements in just a few clicks from any device of your preference. Edit and eSign Information & Instructions For Business WV State Tax Information & Instructions For BusinessInformation & Instructio and guarantee excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct information amp instructions for business wv state tax information amp instructions for businessinformation amp instructions

Create this form in 5 minutes!

How to create an eSignature for the information amp instructions for business wv state tax information amp instructions for businessinformation amp instructions

The best way to generate an electronic signature for a PDF file in the online mode

The best way to generate an electronic signature for a PDF file in Chrome

The way to create an electronic signature for putting it on PDFs in Gmail

How to make an electronic signature right from your smartphone

The way to make an eSignature for a PDF file on iOS devices

How to make an electronic signature for a PDF on Android

People also ask

-

What is mywvtaxes and how does it work with airSlate SignNow?

mywvtaxes is an online platform that allows West Virginia residents to manage their tax documents efficiently. With airSlate SignNow, users can easily eSign and send these documents securely, ensuring quick processing and compliance with state regulations.

-

How much does airSlate SignNow cost for mywvtaxes users?

airSlate SignNow offers flexible pricing plans that cater to different budgets, including options for mywvtaxes users. You can choose a monthly or annual subscription, with features tailored to streamline the signing process of tax documents that meet your specific needs.

-

What features does airSlate SignNow offer for managing mywvtaxes documents?

airSlate SignNow provides robust features such as templates for tax forms, real-time collaboration, and secure storage for your mywvtaxes documents. This makes it easy to create, edit, and sign your tax documents effectively while ensuring data security.

-

Is airSlate SignNow easy to integrate with mywvtaxes?

Yes, airSlate SignNow offers seamless integrations that work well with various financial systems, including mywvtaxes. This allows users to link their accounts and streamline the document management process without hassle.

-

What are the benefits of using airSlate SignNow for mywvtaxes?

Using airSlate SignNow for mywvtaxes enhances efficiency by allowing taxpayers to eSign and send their tax documents effortlessly. The platform also reduces errors and saves time, helping users focus on more important aspects of their finances.

-

Can I edit my mywvtaxes documents after signing with airSlate SignNow?

Once a document is signed using airSlate SignNow, it is considered finalized for legal purposes. However, if you need to make changes to your mywvtaxes documents, you can revert to the original template for modifications before sending it out for eSigning.

-

What security measures does airSlate SignNow implement for mywvtaxes users?

airSlate SignNow employs top-notch security protocols, including encryption and secure cloud storage to protect your mywvtaxes documents. This ensures that sensitive information remains confidential and is only accessible to authorized users.

Get more for Information & Instructions For Business WV State Tax Information & Instructions For BusinessInformation & Instructio

- T shirt order form team rosters columbia youth football

- Extra release form

- Sponsorship contribution form city of dallas

- Sunrise powerlink grant 2021 form

- Declaration form for literary works monologues and sketches sabam

- Sicko movie questions and answers form

- Form r 1 report of repair national board

- Palkkatodistus form

Find out other Information & Instructions For Business WV State Tax Information & Instructions For BusinessInformation & Instructio

- How To Electronic signature Arkansas Construction Word

- How Do I Electronic signature Arkansas Construction Document

- Can I Electronic signature Delaware Construction PDF

- How Can I Electronic signature Ohio Business Operations Document

- How Do I Electronic signature Iowa Construction Document

- How Can I Electronic signature South Carolina Charity PDF

- How Can I Electronic signature Oklahoma Doctors Document

- How Can I Electronic signature Alabama Finance & Tax Accounting Document

- How To Electronic signature Delaware Government Document

- Help Me With Electronic signature Indiana Education PDF

- How To Electronic signature Connecticut Government Document

- How To Electronic signature Georgia Government PDF

- Can I Electronic signature Iowa Education Form

- How To Electronic signature Idaho Government Presentation

- Help Me With Electronic signature Hawaii Finance & Tax Accounting Document

- How Can I Electronic signature Indiana Government PDF

- How Can I Electronic signature Illinois Finance & Tax Accounting PPT

- How To Electronic signature Maine Government Document

- How To Electronic signature Louisiana Education Presentation

- How Can I Electronic signature Massachusetts Government PDF