IL 425Irs Tax FormsIdentity Document 2019-2026

What is the IL 425 form?

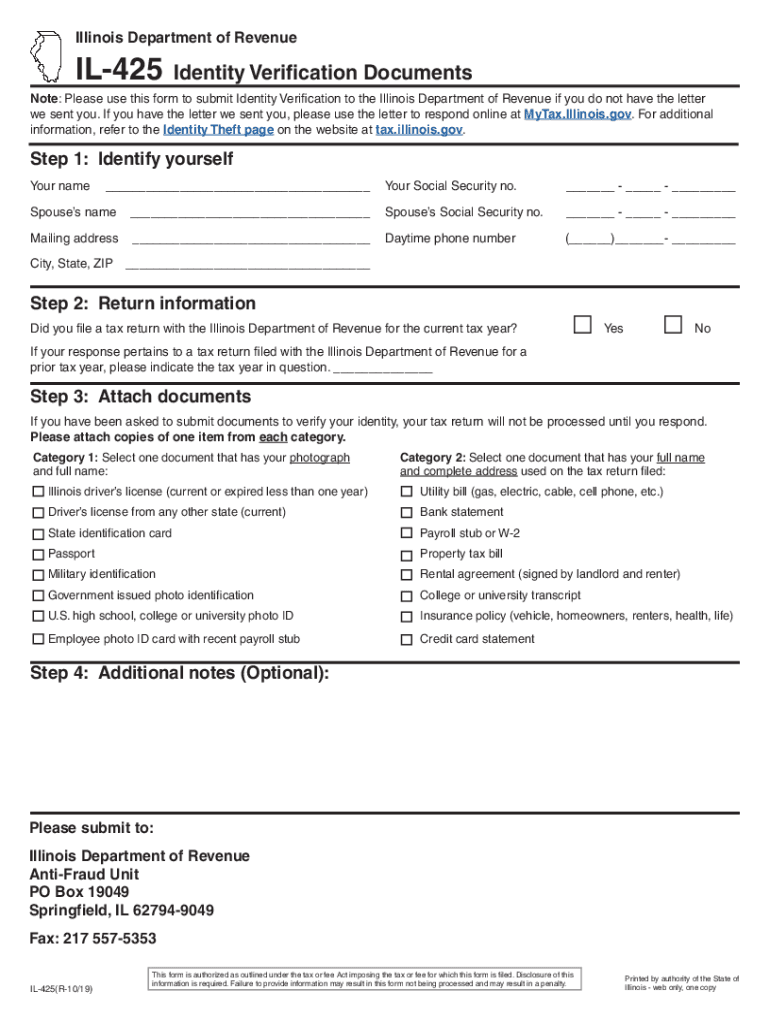

The IL 425 form is a crucial document used for identity verification purposes in various legal and administrative contexts. This form may be required by government agencies, financial institutions, or other organizations to confirm an individual's identity. It typically includes personal information such as name, address, date of birth, and other identifying details. Understanding the purpose and requirements of the IL 425 form is essential for ensuring compliance and successful processing.

Steps to complete the IL 425 form

Completing the IL 425 form involves several key steps to ensure accuracy and compliance. First, gather all necessary personal information, including identification numbers and contact details. Next, carefully fill out each section of the form, making sure to provide correct and up-to-date information. After completing the form, review it thoroughly to check for any errors or omissions. Finally, submit the form according to the specified guidelines, which may include online submission, mailing, or in-person delivery.

Legal use of the IL 425 form

The IL 425 form holds legal significance, as it serves as a formal declaration of identity. When properly filled out and submitted, it can be used in various legal proceedings or applications. For a document to be legally binding, it must meet specific requirements, including proper signatures and adherence to relevant laws governing eSignatures. Understanding the legal implications of the IL 425 form is vital for individuals and organizations to ensure its validity.

Key elements of the IL 425 form

Several key elements must be included in the IL 425 form to ensure its effectiveness. These elements typically consist of:

- Personal Information: Full name, address, and contact details.

- Identification Numbers: Social Security number or other relevant IDs.

- Signature: A signature or eSignature to validate the form.

- Date: The date when the form is completed and signed.

Ensuring that all these components are accurately filled out is essential for the form's acceptance by the requesting entity.

Form Submission Methods

The IL 425 form can be submitted through various methods, depending on the requirements of the requesting agency or organization. Common submission methods include:

- Online Submission: Many agencies allow for electronic submission through secure online portals.

- Mail: The form can often be printed and mailed to the appropriate address.

- In-Person: Some situations may require individuals to submit the form in person at designated offices.

Understanding the preferred submission method is crucial for ensuring timely processing of the IL 425 form.

Filing Deadlines / Important Dates

Filing deadlines for the IL 425 form vary depending on the context in which it is used. It is important to be aware of any specific deadlines set by the requesting agency to avoid penalties or delays. For example, if the form is required for tax purposes, it may need to be submitted by a particular date in the tax year. Checking the relevant guidelines and staying informed about important dates can help ensure compliance and avoid complications.

Quick guide on how to complete il 425irs tax formsidentity document

Complete IL 425Irs Tax FormsIdentity Document effortlessly on any device

Managing documents online has gained traction among businesses and individuals. It presents an excellent environmentally-friendly substitute for conventional printed and signed documents, allowing you to locate the correct form and securely save it online. airSlate SignNow provides all the necessary tools to create, edit, and eSign your documents rapidly and without issues. Manage IL 425Irs Tax FormsIdentity Document on any device using airSlate SignNow’s Android or iOS applications and simplify any document-related task today.

How to edit and eSign IL 425Irs Tax FormsIdentity Document without any hassle

- Find IL 425Irs Tax FormsIdentity Document and click Get Form to get started.

- Utilize the tools at your disposal to complete your document.

- Highlight important sections of the documents or redact sensitive information using tools specifically designed by airSlate SignNow for that purpose.

- Generate your eSignature with the Sign tool, which takes moments and has the same legal validity as a traditional handwritten signature.

- Verify the details and click on the Done button to save your changes.

- Select how you wish to send your form, whether by email, text message (SMS), or invite link, or download it to your computer.

Eliminate concerns about misplaced documents, time-consuming form searches, or errors necessitating the printing of new document copies. airSlate SignNow meets all your document management needs with just a few clicks from any device of your choice. Modify and eSign IL 425Irs Tax FormsIdentity Document to ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct il 425irs tax formsidentity document

Create this form in 5 minutes!

How to create an eSignature for the il 425irs tax formsidentity document

The way to create an eSignature for a PDF file online

The way to create an eSignature for a PDF file in Google Chrome

The best way to create an electronic signature for signing PDFs in Gmail

The best way to make an electronic signature from your mobile device

The best way to generate an eSignature for a PDF file on iOS

The best way to make an electronic signature for a PDF file on Android devices

People also ask

-

What is the IL 425 form and why is it important?

The IL 425 form is a critical document used for various purposes in Illinois, often related to state benefits or tax filings. Understanding the significance of the IL 425 form can help individuals and businesses streamline their processes, ensuring compliance with state regulations and timely submissions.

-

How can airSlate SignNow help with the IL 425 form?

airSlate SignNow offers a seamless solution for eSigning and managing the IL 425 form. With its user-friendly interface, you can easily prepare, send, and get the IL 425 form signed by multiple parties, saving time and reducing paperwork.

-

What pricing plans does airSlate SignNow offer for handling forms like the IL 425?

airSlate SignNow provides competitive pricing plans that cater to different business sizes and needs when managing forms like the IL 425. You can choose from basic to advanced plans, ensuring you find a cost-effective solution that meets your requirements.

-

Does airSlate SignNow support integrations for submitting the IL 425 form?

Yes, airSlate SignNow seamlessly integrates with popular applications to help you manage and submit the IL 425 form efficiently. This includes integrations with cloud storage services, CRM systems, and accounting software, making your workflow smoother.

-

What features does airSlate SignNow offer for the IL 425 form?

airSlate SignNow includes features such as customizable templates, secure eSigning, and real-time tracking specifically designed for documents like the IL 425 form. These features enhance the efficiency and security of your document workflows.

-

Can I use airSlate SignNow for recurring submissions of the IL 425 form?

Absolutely, airSlate SignNow provides the functionality to create workflows for recurring submissions of the IL 425 form. This ensures that you can automate the process and maintain compliance without needing to manually submit each time.

-

Is the IL 425 form secure when signed through airSlate SignNow?

Yes, the IL 425 form signed through airSlate SignNow is highly secure. The platform adheres to industry-standard encryption and security protocols, ensuring that your sensitive information is protected throughout the signing process.

Get more for IL 425Irs Tax FormsIdentity Document

- Independent school district no 727 big lake minnesota form

- Swchs staff applicationdocx form

- Pera form

- Maine department of labor bureau of unemployment insurance ui tax form

- Download file pecan haven form

- Quarterly filers form 501q

- Facilities reservation form camp gallahue girl scouts of

- Iowa work permit form

Find out other IL 425Irs Tax FormsIdentity Document

- eSignature Alabama Plumbing Confidentiality Agreement Later

- How Can I eSignature Wyoming Lawers Quitclaim Deed

- eSignature California Plumbing Profit And Loss Statement Easy

- How To eSignature California Plumbing Business Letter Template

- eSignature Kansas Plumbing Lease Agreement Template Myself

- eSignature Louisiana Plumbing Rental Application Secure

- eSignature Maine Plumbing Business Plan Template Simple

- Can I eSignature Massachusetts Plumbing Business Plan Template

- eSignature Mississippi Plumbing Emergency Contact Form Later

- eSignature Plumbing Form Nebraska Free

- How Do I eSignature Alaska Real Estate Last Will And Testament

- Can I eSignature Alaska Real Estate Rental Lease Agreement

- eSignature New Jersey Plumbing Business Plan Template Fast

- Can I eSignature California Real Estate Contract

- eSignature Oklahoma Plumbing Rental Application Secure

- How Can I eSignature Connecticut Real Estate Quitclaim Deed

- eSignature Pennsylvania Plumbing Business Plan Template Safe

- eSignature Florida Real Estate Quitclaim Deed Online

- eSignature Arizona Sports Moving Checklist Now

- eSignature South Dakota Plumbing Emergency Contact Form Mobile