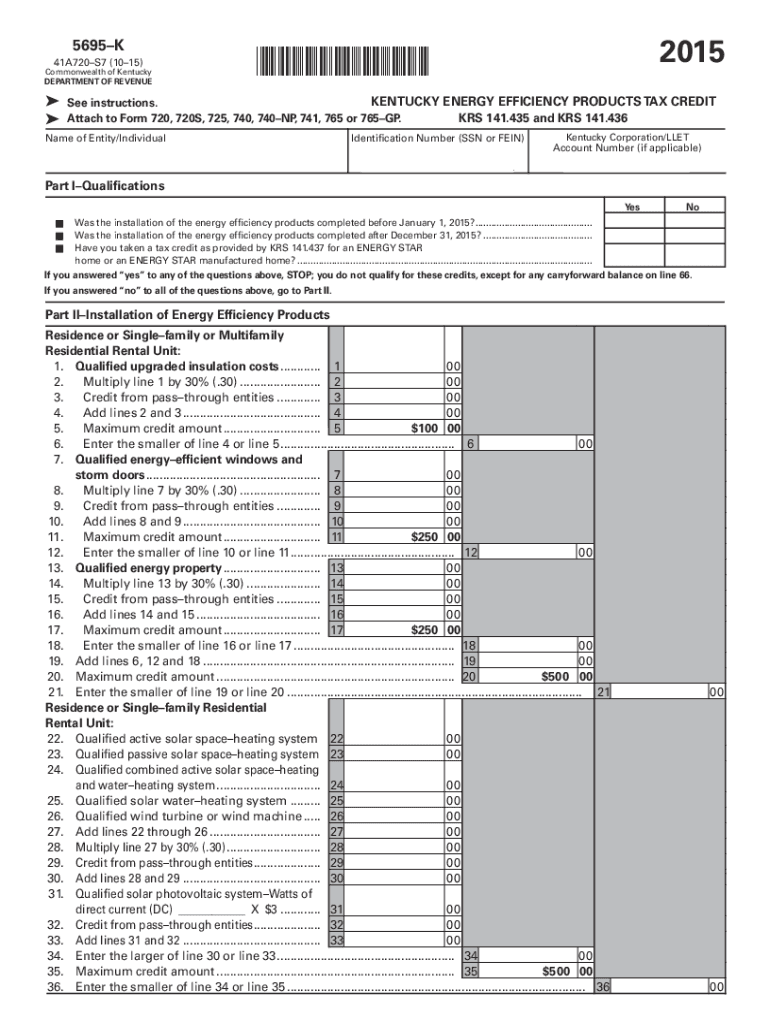

Printable Kentucky Form 5695 K Kentucky Energy Efficiency Products Tax Credit OBSOLETE

What is the 2020 Form 5695?

The 2020 Form 5695 is a tax form used by individuals in the United States to claim tax credits for energy-efficient home improvements. This form allows taxpayers to report qualifying expenditures related to energy-efficient products and systems installed in their homes. The credits available through this form can significantly reduce tax liability, making it an important document for homeowners looking to improve energy efficiency while benefiting financially.

Key Elements of the 2020 Form 5695

Understanding the key elements of the 2020 Form 5695 is essential for accurate completion. The form typically includes sections for personal information, details about the energy-efficient improvements made, and calculations for the tax credits being claimed. Important components include:

- Personal Information: Taxpayer's name, Social Security number, and address.

- Qualified Improvements: A list of energy-efficient products installed, such as solar panels, insulation, or energy-efficient windows.

- Credit Calculations: Detailed calculations to determine the total credit amount based on the expenses incurred.

Steps to Complete the 2020 Form 5695

Completing the 2020 Form 5695 involves several steps to ensure accuracy and compliance with IRS guidelines. Follow these steps:

- Gather Documentation: Collect receipts and documentation for all qualifying energy-efficient improvements.

- Fill Out Personal Information: Enter your name, Social Security number, and address at the top of the form.

- List Improvements: In the designated section, detail each qualifying improvement, including costs and installation dates.

- Calculate Credits: Use the provided instructions to calculate the total tax credit based on your expenditures.

- Review and Sign: Ensure all information is accurate, then sign and date the form before submission.

Eligibility Criteria for the 2020 Form 5695

To successfully claim tax credits using the 2020 Form 5695, taxpayers must meet specific eligibility criteria. These criteria include:

- Home Ownership: The improvements must be made to a primary residence owned by the taxpayer.

- Qualifying Products: Only specific energy-efficient products and systems qualify for credits, as outlined in the IRS guidelines.

- Installation Dates: The improvements must be installed during the tax year for which the credit is being claimed.

Filing Deadlines for the 2020 Form 5695

Filing deadlines are crucial for ensuring that taxpayers can claim their credits without penalties. The 2020 Form 5695 must be submitted along with the taxpayer's annual tax return. Generally, the deadline for filing individual tax returns is April 15 of the following year. However, if additional time is needed, taxpayers may file for an extension, which typically extends the deadline by six months.

Form Submission Methods for the 2020 Form 5695

Taxpayers have several options for submitting the 2020 Form 5695. These methods include:

- Online Submission: Many taxpayers choose to file electronically using tax preparation software that supports Form 5695.

- Mail: The form can also be printed and mailed to the IRS, following the instructions provided for the appropriate mailing address.

- In-Person: Some taxpayers may opt to deliver their forms directly to a local IRS office, though this is less common.

Quick guide on how to complete printable 2020 kentucky form 5695 k kentucky energy efficiency products tax credit obsolete

Accomplish Printable Kentucky Form 5695 K Kentucky Energy Efficiency Products Tax Credit OBSOLETE effortlessly on any device

Web-based document management has become favored by businesses and individuals alike. It offers an excellent environmentally friendly alternative to traditional printed and signed documents, allowing you to access the necessary form and safely save it online. airSlate SignNow equips you with all the resources required to create, modify, and eSign your files swiftly without any delays. Manage Printable Kentucky Form 5695 K Kentucky Energy Efficiency Products Tax Credit OBSOLETE on any device using airSlate SignNow Android or iOS applications and simplify any document-centric process today.

The simplest method to edit and eSign Printable Kentucky Form 5695 K Kentucky Energy Efficiency Products Tax Credit OBSOLETE with ease

- Locate Printable Kentucky Form 5695 K Kentucky Energy Efficiency Products Tax Credit OBSOLETE and click Get Form to begin.

- Leverage the tools we offer to complete your document.

- Emphasize relevant portions of the documents or obscure sensitive details with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, exhausting form searches, or errors that necessitate printing new document copies. airSlate SignNow caters to your document management needs with just a few clicks from any device of your preference. Modify and eSign Printable Kentucky Form 5695 K Kentucky Energy Efficiency Products Tax Credit OBSOLETE and guarantee exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the printable 2020 kentucky form 5695 k kentucky energy efficiency products tax credit obsolete

The best way to generate an eSignature for a PDF file in the online mode

The best way to generate an eSignature for a PDF file in Chrome

How to create an electronic signature for putting it on PDFs in Gmail

The way to create an eSignature from your smartphone

How to create an eSignature for a PDF file on iOS devices

The way to create an eSignature for a PDF file on Android

People also ask

-

What are the key features of the 2020 form 5695 instructions?

The 2020 form 5695 instructions provide clear guidance on how to claim residential energy credits. The instructions detail eligibility criteria, required information, and how to fill out the form accurately to maximize your benefits.

-

How do I get started with the 2020 form 5695 instructions using airSlate SignNow?

To get started with the 2020 form 5695 instructions, simply create an account on airSlate SignNow. You can then upload your form, fill in the required details, and eSign it seamlessly, ensuring a streamlined process for submitting your tax credits.

-

Are there any costs associated with using the 2020 form 5695 instructions on airSlate SignNow?

Using the 2020 form 5695 instructions on airSlate SignNow is cost-effective. Their competitive pricing plans ensure you can access eSigning features and manage your documents without breaking the bank, making it an ideal choice for individuals and businesses alike.

-

Can I integrate airSlate SignNow with other software for handling the 2020 form 5695 instructions?

Yes, airSlate SignNow offers integrations with various software solutions to enhance your workflow for the 2020 form 5695 instructions. Whether it's CRM systems or cloud storage services, you can easily connect to manage your documents more efficiently.

-

What benefits do I gain from using airSlate SignNow for the 2020 form 5695 instructions?

Using airSlate SignNow for the 2020 form 5695 instructions simplifies the eSigning process, ensuring that you can complete your documentation quickly and efficiently. You benefit from increased security, tracking features, and easy access to your signed documents.

-

How can airSlate SignNow ensure the accuracy of my 2020 form 5695 instructions?

airSlate SignNow aids in maintaining the accuracy of your 2020 form 5695 instructions through its user-friendly interface and intuitive features. You can review your entries, utilize templates, and collaborate with others for better accuracy before submission.

-

Is support available if I have questions about the 2020 form 5695 instructions?

Absolutely! airSlate SignNow provides excellent customer support to help you with your queries about the 2020 form 5695 instructions. Their team is available to assist you with any issues or questions you may encounter during the eSigning process.

Get more for Printable Kentucky Form 5695 K Kentucky Energy Efficiency Products Tax Credit OBSOLETE

- Groundwater hazard statement a solid waste disposal check form

- Iowa secretary of state oath of office form

- Hawaii subcontractor agreement template form

- Appendix c dewatering bdischarge formsb municipality of anchorage muni

- Alabama subcontractor agreement template form

- Contact us alsdeedu form

- Supplement exp alabama department of education alsde form

- Adeq emissions exeption form code 52

Find out other Printable Kentucky Form 5695 K Kentucky Energy Efficiency Products Tax Credit OBSOLETE

- Electronic signature Montana Doctors Last Will And Testament Safe

- Electronic signature New York Doctors Permission Slip Free

- Electronic signature South Dakota Construction Quitclaim Deed Easy

- Electronic signature Texas Construction Claim Safe

- Electronic signature Texas Construction Promissory Note Template Online

- How To Electronic signature Oregon Doctors Stock Certificate

- How To Electronic signature Pennsylvania Doctors Quitclaim Deed

- Electronic signature Utah Construction LLC Operating Agreement Computer

- Electronic signature Doctors Word South Dakota Safe

- Electronic signature South Dakota Doctors Confidentiality Agreement Myself

- How Do I Electronic signature Vermont Doctors NDA

- Electronic signature Utah Doctors Promissory Note Template Secure

- Electronic signature West Virginia Doctors Bill Of Lading Online

- Electronic signature West Virginia Construction Quitclaim Deed Computer

- Electronic signature Construction PDF Wisconsin Myself

- How Do I Electronic signature Wyoming Doctors Rental Lease Agreement

- Help Me With Electronic signature Wyoming Doctors Rental Lease Agreement

- How Do I Electronic signature Colorado Education RFP

- Electronic signature Colorado Education Lease Agreement Form Online

- How To Electronic signature Colorado Education Business Associate Agreement