MO 1040 Book Individual Income Tax Long Form and

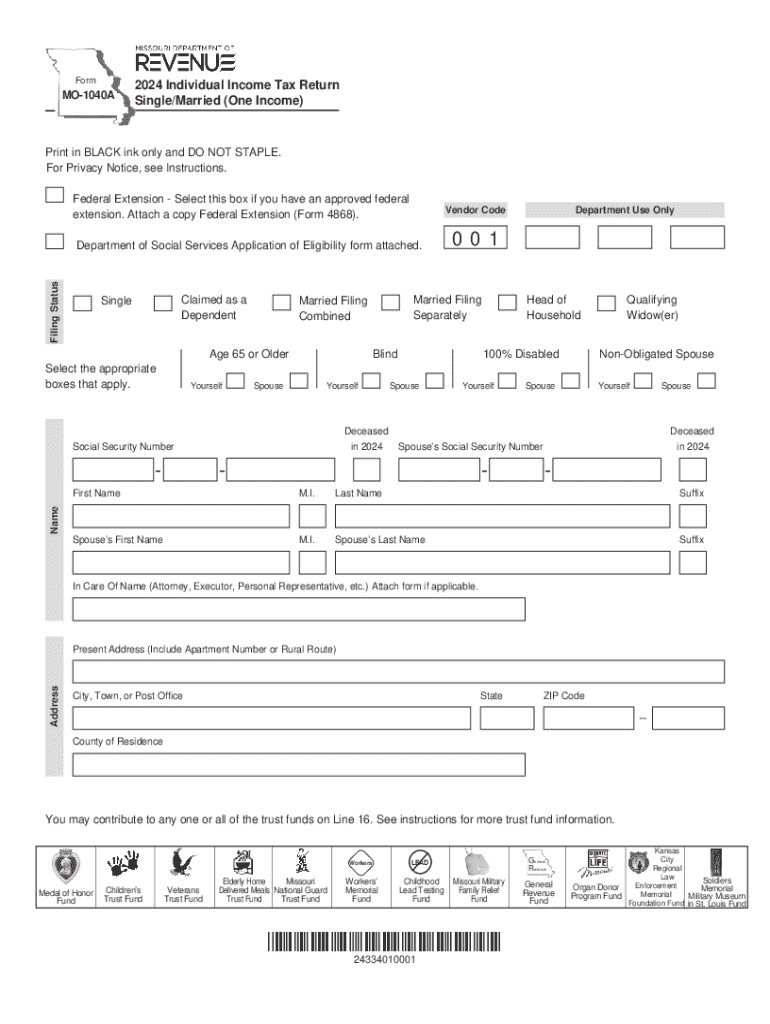

Understanding the MO 1040A Form

The MO 1040A form is a simplified version of the Missouri Individual Income Tax Return. It is designed for taxpayers with straightforward tax situations, allowing them to report their income and claim deductions without the complexity of the longer MO 1040 form. This form is typically used by individuals who do not have business income or extensive itemized deductions. It is important to ensure that you meet the eligibility criteria for using this form to avoid complications during the filing process.

Steps to Complete the MO 1040A Form

Filling out the MO 1040A form involves several key steps:

- Gather Required Documents: Collect your W-2 forms, 1099s, and any other income documentation.

- Fill Out Personal Information: Input your name, address, and Social Security number at the top of the form.

- Report Income: Enter your total income from various sources, including wages and interest.

- Claim Deductions: Utilize the standard deduction or any applicable credits to reduce your taxable income.

- Calculate Tax Liability: Use the tax tables provided to determine your tax obligation based on your taxable income.

- Sign and Date: Ensure you sign and date the form before submission to validate it.

Required Documents for Filing the MO 1040A Form

To accurately complete the MO 1040A form, you will need several documents:

- W-2 Forms: These forms report your wages and taxes withheld by your employer.

- 1099 Forms: If you have income from freelance work or other sources, these forms will document that income.

- Proof of Deductions: Gather any documentation that supports your claimed deductions, such as receipts for charitable contributions.

- Bank Statements: These may be necessary if you are reporting interest income.

Filing Deadlines for the MO 1040A Form

The filing deadline for the MO 1040A form generally aligns with the federal tax deadline, which is typically April 15. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. It is crucial to file your return by this deadline to avoid penalties and interest on any taxes owed.

Form Submission Methods for the MO 1040A

You can submit the MO 1040A form through various methods:

- Online Filing: Use approved e-filing software to submit your form electronically.

- Mail: Print the completed form and send it to the appropriate Missouri Department of Revenue address.

- In-Person: You may also file in person at designated state tax offices if you prefer direct assistance.

Eligibility Criteria for the MO 1040A Form

To qualify for the MO 1040A form, you must meet specific criteria:

- Income Limits: Generally, your total income must fall below a certain threshold, which is updated annually.

- Filing Status: You should be filing as single, married filing jointly, or head of household.

- No Business Income: The form is not suitable for individuals with business income or extensive itemized deductions.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the mo 1040 book individual income tax long form and

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the MO 1040A form?

The MO 1040A form is a simplified version of the Missouri individual income tax return. It is designed for taxpayers with straightforward tax situations, allowing them to report their income and claim deductions efficiently. Using the MO 1040A form can help streamline your tax filing process.

-

How can airSlate SignNow help with the MO 1040A form?

airSlate SignNow provides an easy-to-use platform for electronically signing and sending the MO 1040A form. Our solution ensures that your documents are securely signed and delivered, making tax filing more efficient. With airSlate SignNow, you can manage your tax documents from anywhere.

-

Is there a cost associated with using airSlate SignNow for the MO 1040A form?

Yes, airSlate SignNow offers various pricing plans to accommodate different needs, including options for individuals and businesses. The cost is competitive and reflects the value of our secure eSigning and document management features. You can choose a plan that best fits your requirements for handling the MO 1040A form.

-

What features does airSlate SignNow offer for the MO 1040A form?

airSlate SignNow includes features such as customizable templates, secure eSigning, and document tracking specifically for forms like the MO 1040A. These features enhance the efficiency of your tax filing process and ensure compliance with state regulations. Our platform is designed to simplify the management of your tax documents.

-

Can I integrate airSlate SignNow with other software for the MO 1040A form?

Absolutely! airSlate SignNow offers integrations with various software applications, allowing you to streamline your workflow when handling the MO 1040A form. Whether you use accounting software or document management systems, our integrations can enhance your productivity and efficiency.

-

What are the benefits of using airSlate SignNow for the MO 1040A form?

Using airSlate SignNow for the MO 1040A form provides numerous benefits, including time savings, enhanced security, and ease of use. Our platform allows you to complete and sign your tax documents quickly, reducing the stress associated with tax season. Additionally, our secure environment ensures your sensitive information is protected.

-

Is airSlate SignNow compliant with tax regulations for the MO 1040A form?

Yes, airSlate SignNow is compliant with all relevant tax regulations, ensuring that your use of the MO 1040A form meets legal requirements. Our platform adheres to industry standards for electronic signatures, providing you with peace of mind when filing your taxes. You can trust airSlate SignNow to handle your tax documents securely.

Get more for MO 1040 Book Individual Income Tax Long Form And

- Library card application bnoplb nopl form

- Form 1040 schedule aampb itemized deductions and interest

- Unit iv cell energy worksheet form

- Discretionary housing payment central bedfordshire form

- Apprenticeship completion form 232208178

- Assessment of nociceptive versus neuropathic pain in older adults form

- Record information cori massachusetts registry of motor vehicles

- Sfn53065 form

Find out other MO 1040 Book Individual Income Tax Long Form And

- How To Electronic signature Utah Legal PDF

- How Do I Electronic signature Arkansas Real Estate Word

- How Do I Electronic signature Colorado Real Estate Document

- Help Me With Electronic signature Wisconsin Legal Presentation

- Can I Electronic signature Hawaii Real Estate PPT

- How Can I Electronic signature Illinois Real Estate Document

- How Do I Electronic signature Indiana Real Estate Presentation

- How Can I Electronic signature Ohio Plumbing PPT

- Can I Electronic signature Texas Plumbing Document

- How To Electronic signature Michigan Real Estate Form

- How To Electronic signature Arizona Police PDF

- Help Me With Electronic signature New Hampshire Real Estate PDF

- Can I Electronic signature New Hampshire Real Estate Form

- Can I Electronic signature New Mexico Real Estate Form

- How Can I Electronic signature Ohio Real Estate Document

- How To Electronic signature Hawaii Sports Presentation

- How To Electronic signature Massachusetts Police Form

- Can I Electronic signature South Carolina Real Estate Document

- Help Me With Electronic signature Montana Police Word

- How To Electronic signature Tennessee Real Estate Document