New York Form it 222 General Corporation Tax Credit for Full

What is the New York Form IT 222 General Corporation Tax Credit?

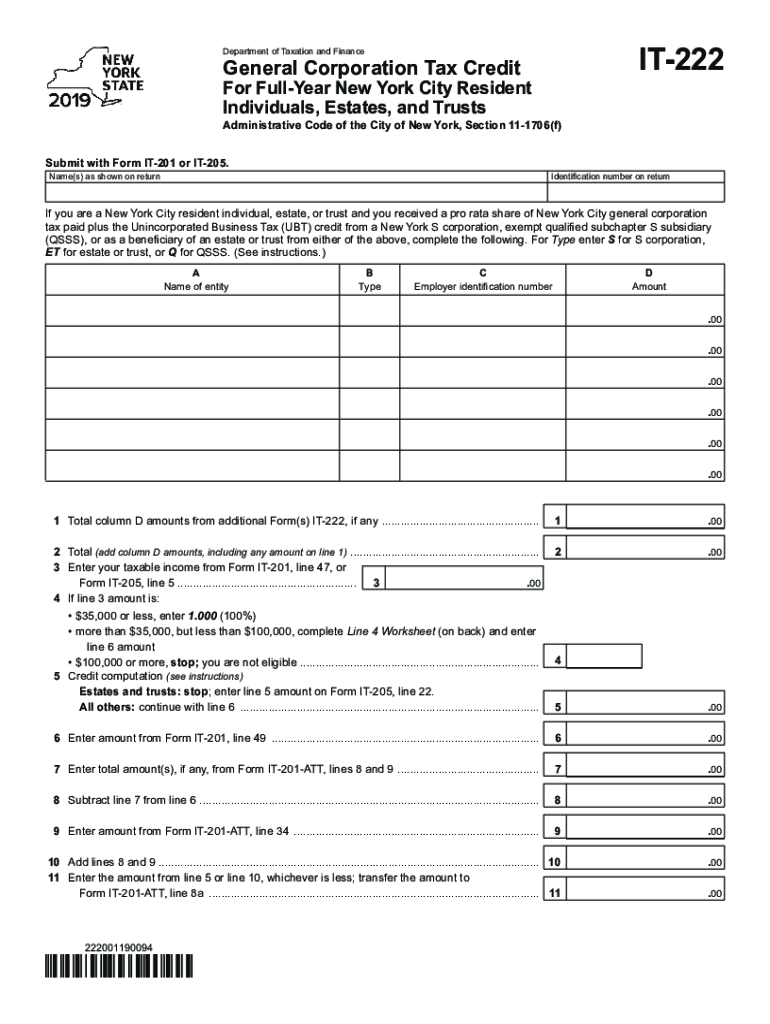

The New York Form IT 222 is a tax form designed for corporations to claim the General Corporation Tax Credit. This credit is aimed at providing tax relief to eligible corporations that meet specific criteria set by the state. The IT 222 form allows businesses to reduce their tax liability, thereby encouraging economic growth and investment within New York. It is essential for corporations to understand the eligibility requirements and the benefits this credit can provide to maximize their financial efficiency.

Steps to Complete the New York Form IT 222 General Corporation Tax Credit

Completing the New York Form IT 222 involves several key steps that ensure accurate submission and compliance with state regulations. Begin by gathering all necessary financial documents and information related to your corporation's income and expenses. Next, fill out the form by providing details such as your corporation's name, identification number, and the specific tax year for which you are claiming the credit. Be sure to calculate the credit amount correctly based on the guidelines provided by the New York State Department of Taxation and Finance. Finally, review the completed form for accuracy before submitting it by the specified deadline.

Eligibility Criteria for the New York Form IT 222 General Corporation Tax Credit

To qualify for the General Corporation Tax Credit using Form IT 222, corporations must meet certain eligibility criteria. Primarily, the corporation must be subject to the New York General Corporation Tax and must have incurred eligible expenses during the tax year. Additionally, the corporation should not be in default of any tax obligations or have any outstanding tax liabilities. It is crucial for businesses to carefully assess their compliance with these criteria to ensure successful application for the credit.

Required Documents for the New York Form IT 222 General Corporation Tax Credit

When preparing to submit the New York Form IT 222, corporations must compile a set of required documents to support their claim. These documents typically include financial statements, proof of eligible expenses, and any prior tax filings relevant to the current claim. Additionally, corporations may need to provide documentation that verifies their compliance with state tax obligations. Having these documents ready will facilitate a smoother submission process and enhance the credibility of the claim.

Filing Deadlines for the New York Form IT 222 General Corporation Tax Credit

Corporations must be aware of the filing deadlines associated with the New York Form IT 222 to avoid penalties and ensure timely processing of their credit claims. Generally, the form must be filed by the due date of the corporation's tax return for the year in which the credit is being claimed. It is advisable for corporations to check the New York State Department of Taxation and Finance website for any updates or changes to the deadlines to remain compliant.

How to Obtain the New York Form IT 222 General Corporation Tax Credit

The New York Form IT 222 can be obtained through the New York State Department of Taxation and Finance website. Corporations can download the form directly from the site, ensuring they have the most current version. Additionally, businesses may contact the department for assistance or clarification regarding the form and its requirements. It is essential to use the official form to ensure compliance with state regulations.

Quick guide on how to complete new york form it 222 general corporation tax credit for full

Effortlessly Prepare New York Form IT 222 General Corporation Tax Credit For Full on Any Device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to find the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents swiftly without delays. Manage New York Form IT 222 General Corporation Tax Credit For Full on any device with airSlate SignNow's Android or iOS applications and simplify any document-related tasks today.

How to Modify and eSign New York Form IT 222 General Corporation Tax Credit For Full with Ease

- Find New York Form IT 222 General Corporation Tax Credit For Full and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize relevant sections of the documents or redact sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your eSignature using the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click the Done button to save your changes.

- Select how you'd like to share your form, via email, text message (SMS), or invite link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form navigation, or mistakes that necessitate printing new copies of documents. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choice. Edit and eSign New York Form IT 222 General Corporation Tax Credit For Full and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the new york form it 222 general corporation tax credit for full

The way to create an electronic signature for your PDF document online

The way to create an electronic signature for your PDF document in Google Chrome

How to make an electronic signature for signing PDFs in Gmail

The way to make an electronic signature right from your smart phone

The best way to create an electronic signature for a PDF document on iOS

The way to make an electronic signature for a PDF on Android OS

People also ask

-

What is airSlate SignNow and how does it relate to it 222?

airSlate SignNow is an intuitive platform designed to help businesses send and eSign documents efficiently. The integration of it 222 allows for seamless management of electronic signatures and document workflows, providing a streamlined solution tailored for modern business needs.

-

How much does it cost to use airSlate SignNow's it 222 features?

The pricing for airSlate SignNow varies based on the plan selected, with options that include essential features for businesses of all sizes. Each plan incorporates elements of it 222, ensuring clients receive robust functionality without overpaying. Visit our pricing page for detailed information on available packages.

-

What are the key features of airSlate SignNow with it 222?

airSlate SignNow offers numerous features, including customizable templates, team collaboration tools, and automated workflows, all powered by it 222 technology. These features are designed to enhance document management and improve efficiency, making it easier for businesses to handle their signing processes.

-

How does it 222 benefit businesses using airSlate SignNow?

By leveraging it 222, businesses using airSlate SignNow can access advanced features that streamline document signing and improve compliance. This ensures that businesses run more efficiently while reducing the time spent on paperwork, ultimately leading to higher productivity.

-

Can airSlate SignNow integrate with other tools using it 222?

Yes, airSlate SignNow easily integrates with numerous third-party applications and platforms using it 222 technology. This enhances the user experience by allowing businesses to connect their existing tools, such as CRM and project management software, for a more cohesive document management workflow.

-

Is airSlate SignNow secure when using it 222 features?

Absolutely! airSlate SignNow prioritizes security with industry-standard encryption and compliance with legal regulations, ensuring that all transactions involving it 222 are safe and secure. Businesses can confidently use our platform to handle sensitive documents without worrying about data bsignNowes.

-

How does it 222 simplify the document signing process?

The it 222 technology in airSlate SignNow automates many aspects of the document signing process, reducing manual entry and mistakes. With features like signature reminders and automated workflows, businesses can ensure timely and efficient document execution, freeing up resources to focus on core activities.

Get more for New York Form IT 222 General Corporation Tax Credit For Full

- New hampshire power of attorney forms pdf templates

- New hampshire acknowledgmentsindividualus legal forms

- 5a form public defender nj

- 5a form public defender nj 10671255

- Probate judges manual sample forms and checklists 2013

- Pdf download is not a pdf file but rather a string issue 2722 form

- How to transfer assets with a revocable trust after death form

- Counter petition form for child custody in texas

Find out other New York Form IT 222 General Corporation Tax Credit For Full

- How To eSign Kansas Non-Profit Business Plan Template

- eSign Indiana Non-Profit Cease And Desist Letter Free

- eSign Louisiana Non-Profit Quitclaim Deed Safe

- How Can I eSign Maryland Non-Profit Credit Memo

- eSign Maryland Non-Profit Separation Agreement Computer

- eSign Legal PDF New Jersey Free

- eSign Non-Profit Document Michigan Safe

- eSign New Mexico Legal Living Will Now

- eSign Minnesota Non-Profit Confidentiality Agreement Fast

- How Do I eSign Montana Non-Profit POA

- eSign Legal Form New York Online

- Can I eSign Nevada Non-Profit LLC Operating Agreement

- eSign Legal Presentation New York Online

- eSign Ohio Legal Moving Checklist Simple

- How To eSign Ohio Non-Profit LLC Operating Agreement

- eSign Oklahoma Non-Profit Cease And Desist Letter Mobile

- eSign Arizona Orthodontists Business Plan Template Simple

- eSign Oklahoma Non-Profit Affidavit Of Heirship Computer

- How Do I eSign Pennsylvania Non-Profit Quitclaim Deed

- eSign Rhode Island Non-Profit Permission Slip Online