How to Transfer Assets with a Revocable Trust After Death Form

What is the How To Transfer Assets With A Revocable Trust After Death

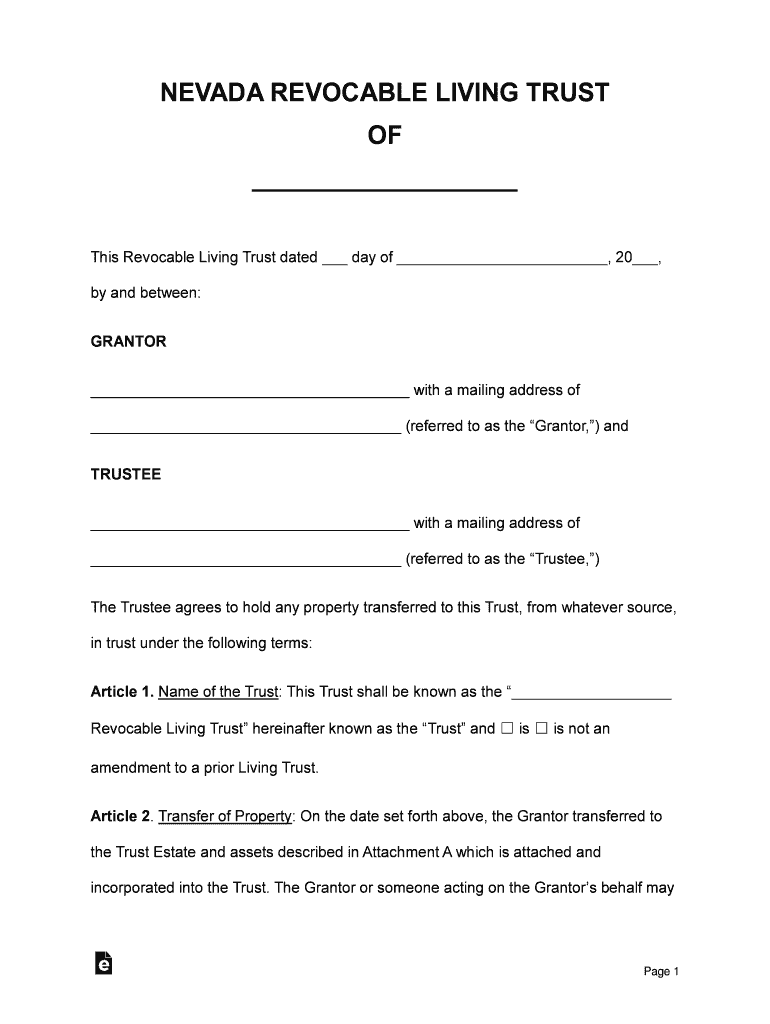

The process of transferring assets with a revocable trust after death involves a legal mechanism that allows for the seamless distribution of an individual's assets according to their wishes. A revocable trust is a type of trust that can be altered or revoked by the grantor during their lifetime. Upon the grantor's death, the trust becomes irrevocable, meaning the terms cannot be changed. The assets held within the trust are then distributed to beneficiaries without going through the probate process, which can be time-consuming and costly.

Steps to complete the How To Transfer Assets With A Revocable Trust After Death

Transferring assets from a revocable trust after death involves several key steps:

- Review the trust document: Ensure that you understand the terms of the trust and the designated beneficiaries.

- Gather necessary documents: Collect any required documents, such as the death certificate and identification of the successor trustee.

- Notify beneficiaries: Inform all beneficiaries about the trust and their entitlements under its terms.

- Transfer assets: Work with financial institutions and property title companies to transfer assets to the beneficiaries as outlined in the trust.

- Close the trust: Once all assets have been distributed, formally close the trust to finalize the process.

Legal use of the How To Transfer Assets With A Revocable Trust After Death

The legal use of a revocable trust to transfer assets after death is governed by state laws, which can vary significantly. Generally, the trust must comply with the applicable state statutes regarding trust administration and distribution. The successor trustee is responsible for managing the trust assets and ensuring that the distribution aligns with the grantor's wishes. It is important to consult with a legal professional to navigate any specific legal requirements or challenges that may arise during the transfer process.

Key elements of the How To Transfer Assets With A Revocable Trust After Death

Several key elements are essential for the effective transfer of assets with a revocable trust after death:

- Successor Trustee: Appointing a reliable successor trustee is crucial, as they will oversee the trust's administration after the grantor's death.

- Asset Inventory: A comprehensive inventory of trust assets should be maintained to facilitate the transfer process.

- Beneficiary Designations: Clear beneficiary designations must be outlined in the trust document to avoid disputes.

- Compliance with State Laws: Adhering to state-specific laws regarding trust administration is necessary to ensure legal validity.

State-specific rules for the How To Transfer Assets With A Revocable Trust After Death

Each state has its own rules and regulations regarding the transfer of assets through a revocable trust after death. These rules can affect the process of trust administration, the rights of beneficiaries, and the responsibilities of the successor trustee. It is essential to familiarize yourself with the specific laws in your state, as they may dictate how assets are transferred, what documentation is required, and any potential tax implications that could arise.

Required Documents

To successfully transfer assets with a revocable trust after death, certain documents are typically required:

- Death certificate: A certified copy of the grantor's death certificate is necessary for legal and financial institutions.

- Trust document: The original trust document outlines the terms of the trust and the distribution of assets.

- Identification of the successor trustee: Proof of identity for the individual designated to manage the trust after the grantor's death.

- Asset documentation: Any relevant documents related to the assets held in the trust, such as titles or deeds.

Quick guide on how to complete how to transfer assets with a revocable trust after death

Complete How To Transfer Assets With A Revocable Trust After Death effortlessly on any device

Digital document management has gained traction with businesses and individuals alike. It offers an excellent eco-friendly substitute to conventional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, modify, and eSign your documents quickly and efficiently. Manage How To Transfer Assets With A Revocable Trust After Death on any device using airSlate SignNow's Android or iOS applications and streamline any document-oriented process today.

How to modify and eSign How To Transfer Assets With A Revocable Trust After Death effortlessly

- Find How To Transfer Assets With A Revocable Trust After Death and click Get Form to begin.

- Use the tools we offer to finalize your form.

- Emphasize important sections of the documents or redact sensitive information with tools designed specifically for that purpose by airSlate SignNow.

- Create your signature using the Sign feature, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you wish to submit your form, via email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced documents, laborious form searching, or errors that require reprinting new copies. airSlate SignNow caters to all your document management needs in just a few clicks from any device you prefer. Edit and eSign How To Transfer Assets With A Revocable Trust After Death and ensure exceptional communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the how to transfer assets with a revocable trust after death

The best way to create an eSignature for your PDF file in the online mode

The best way to create an eSignature for your PDF file in Chrome

The best way to make an eSignature for putting it on PDFs in Gmail

The best way to make an eSignature from your smartphone

The way to generate an electronic signature for a PDF file on iOS devices

The best way to make an eSignature for a PDF file on Android

People also ask

-

What is a revocable trust and how does it help in transferring assets after death?

A revocable trust is a legal entity that allows you to manage your assets during your lifetime and specify how they should be distributed after your death. Implementing a revocable trust simplifies the process of transferring assets by avoiding probate and ensuring that your wishes are followed. To learn more about how to transfer assets with a revocable trust after death, consider consulting with a legal professional.

-

How do I ensure my assets are included in my revocable trust?

To ensure your assets are included in your revocable trust, you need to formally transfer ownership of those assets into the trust. This process is known as funding the trust and typically involves re-titling bank accounts, real estate, and other property. Understanding how to transfer assets with a revocable trust after death starts with proper funding during your lifetime.

-

What are the costs associated with creating a revocable trust?

The costs of creating a revocable trust can vary, typically ranging from a few hundred to a few thousand dollars depending on the complexity of your financial situation and the fees charged by legal professionals. While there may be initial costs involved, a revocable trust can help you save on probate fees and estate taxes. Understanding how to transfer assets with a revocable trust after death can mitigate long-term financial burdens on your heirs.

-

Can I change or revoke my trust after establishing it?

Yes, one of the key features of a revocable trust is that you can modify or completely revoke it at any time during your lifetime. This flexibility allows you to remain in control of your assets as your circumstances or wishes change. Knowing how to transfer assets with a revocable trust after death means that your updated wishes can be easily accommodated.

-

What happens to my revocable trust when I die?

Upon your passing, a revocable trust typically becomes irrevocable, meaning that the terms cannot be changed. The successor trustee named in your trust document will then be responsible for distributing your assets according to your instructions. Understanding how to transfer assets with a revocable trust after death can ensure a smooth transition of your estate to your beneficiaries.

-

How does a revocable trust impact my estate plan?

A revocable trust plays a crucial role in estate planning as it helps manage and distribute your assets efficiently after death. It allows you to avoid probate, which can be time-consuming and costly. Learning how to transfer assets with a revocable trust after death is essential for ensuring your heirs receive their inheritance promptly and according to your wishes.

-

Are there any tax implications when transferring assets with a revocable trust?

In general, transferring assets into a revocable trust does not incur immediate tax implications, as you retain control over the assets. However, it’s important to consult with a tax professional to understand any potential estate tax considerations. Knowledge about how to transfer assets with a revocable trust after death can help you make informed decisions regarding your estate’s tax strategy.

Get more for How To Transfer Assets With A Revocable Trust After Death

- What is an ab trust in an estate plan the balance form

- More and the trustee designated below and shall be governed and administered form

- Uniform enforcement of

- State of north dakota hereinafter referred to as the trustor and the trustee form

- Nebraska legal forms nebraska legal documents uslegalforms

- How to form a professional llc pllc in new hampshire step by

- New hampshire dissolution of a corporation lawcorporations form

- State of new hampshire hereinafter referred to as the trustor whether one or form

Find out other How To Transfer Assets With A Revocable Trust After Death

- Electronic signature North Carolina Insurance Profit And Loss Statement Secure

- Help Me With Electronic signature Oklahoma Insurance Contract

- Electronic signature Pennsylvania Insurance Letter Of Intent Later

- Electronic signature Pennsylvania Insurance Quitclaim Deed Now

- Electronic signature Maine High Tech Living Will Later

- Electronic signature Maine High Tech Quitclaim Deed Online

- Can I Electronic signature Maryland High Tech RFP

- Electronic signature Vermont Insurance Arbitration Agreement Safe

- Electronic signature Massachusetts High Tech Quitclaim Deed Fast

- Electronic signature Vermont Insurance Limited Power Of Attorney Easy

- Electronic signature Washington Insurance Last Will And Testament Later

- Electronic signature Washington Insurance Last Will And Testament Secure

- Electronic signature Wyoming Insurance LLC Operating Agreement Computer

- How To Electronic signature Missouri High Tech Lease Termination Letter

- Electronic signature Montana High Tech Warranty Deed Mobile

- Electronic signature Florida Lawers Cease And Desist Letter Fast

- Electronic signature Lawers Form Idaho Fast

- Electronic signature Georgia Lawers Rental Lease Agreement Online

- How Do I Electronic signature Indiana Lawers Quitclaim Deed

- How To Electronic signature Maryland Lawers Month To Month Lease