Printable Montana Form 2 Worksheet V Tax Credits DISCONTINUED

What is the Printable Montana Form 2 Worksheet V Tax Credits DISCONTINUED

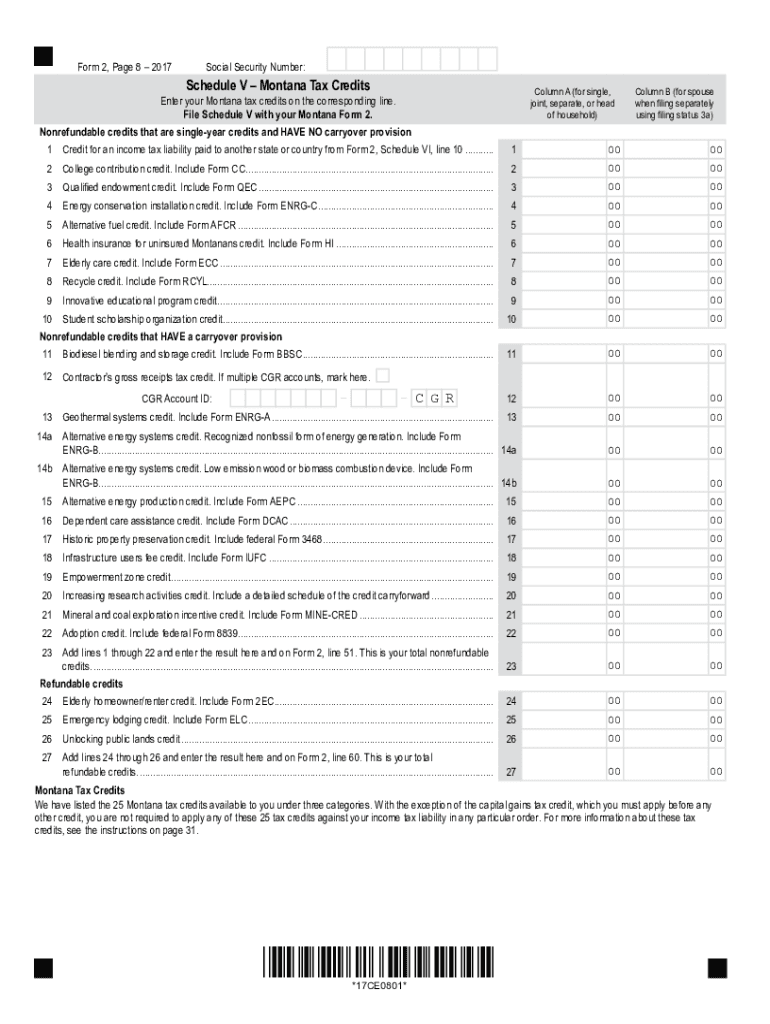

The Printable Montana Form 2 Worksheet V Tax Credits DISCONTINUED was a specific tax form used by residents of Montana to calculate and claim various tax credits. This form was designed to assist taxpayers in determining their eligibility for credits that could reduce their overall tax liability. Although the form has been discontinued, understanding its purpose is essential for individuals who may have previously utilized it for tax purposes.

How to use the Printable Montana Form 2 Worksheet V Tax Credits DISCONTINUED

Even though the Printable Montana Form 2 Worksheet V Tax Credits DISCONTINUED is no longer in use, it is important to know how it functioned. Taxpayers would typically fill out this form by providing relevant financial information, including income details and potential deductions. The completed worksheet would then be used to calculate the total tax credits available, which could be applied to their tax return. For those looking for similar forms or processes, it is advisable to check current tax guidelines provided by the Montana Department of Revenue.

Steps to complete the Printable Montana Form 2 Worksheet V Tax Credits DISCONTINUED

Completing the Printable Montana Form 2 Worksheet V Tax Credits DISCONTINUED involved several key steps. First, taxpayers would gather necessary financial documents, such as W-2 forms and other income statements. Next, they would enter their income figures and any applicable deductions into the worksheet. After calculating the total eligible tax credits, the taxpayer would ensure that all information was accurate before submitting it with their tax return. Understanding these steps can help taxpayers navigate similar forms that may be currently available.

Key elements of the Printable Montana Form 2 Worksheet V Tax Credits DISCONTINUED

The key elements of the Printable Montana Form 2 Worksheet V Tax Credits DISCONTINUED included sections for personal information, income reporting, and a detailed breakdown of various tax credits. Each section was designed to capture specific data necessary for accurately calculating tax liabilities. Additionally, there were instructions provided to guide users through the completion process, ensuring that all required information was included for proper assessment by tax authorities.

Legal use of the Printable Montana Form 2 Worksheet V Tax Credits DISCONTINUED

The legal use of the Printable Montana Form 2 Worksheet V Tax Credits DISCONTINUED was governed by state tax laws and regulations. Taxpayers were required to complete the form accurately to ensure compliance with Montana tax requirements. Failure to do so could result in penalties or delays in processing tax returns. Understanding the legal implications of using such forms is crucial for maintaining compliance with state tax regulations.

Filing Deadlines / Important Dates

Although the Printable Montana Form 2 Worksheet V Tax Credits DISCONTINUED is no longer applicable, awareness of filing deadlines and important dates is essential for current tax forms. Typically, state tax returns must be filed by April 15 each year, unless an extension is granted. Taxpayers should remain informed about any changes in deadlines to avoid late filing penalties and ensure timely processing of their tax returns.

Eligibility Criteria

The eligibility criteria for the Printable Montana Form 2 Worksheet V Tax Credits DISCONTINUED included specific income thresholds and residency requirements. Taxpayers needed to meet these criteria to qualify for the associated tax credits. Understanding the eligibility requirements for past forms can help individuals assess their current tax situations and determine their eligibility for available credits under current tax laws.

Quick guide on how to complete printable 2020 montana form 2 worksheet v tax credits discontinued

Complete Printable Montana Form 2 Worksheet V Tax Credits DISCONTINUED effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an optimal eco-friendly alternative to traditional printed and signed paperwork, as you can easily locate the correct form and securely store it online. airSlate SignNow provides all the tools necessary to create, edit, and electronically sign your documents swiftly without delays. Manage Printable Montana Form 2 Worksheet V Tax Credits DISCONTINUED on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The easiest way to modify and electronically sign Printable Montana Form 2 Worksheet V Tax Credits DISCONTINUED with ease

- Locate Printable Montana Form 2 Worksheet V Tax Credits DISCONTINUED and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize relevant sections of the documents or redact sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes only seconds and holds the same legal legitimacy as a traditional handwritten signature.

- Review all the details and click on the Done button to save your modifications.

- Select your preferred method to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow fulfills your document management needs in just a few clicks from your preferred device. Modify and electronically sign Printable Montana Form 2 Worksheet V Tax Credits DISCONTINUED and ensure excellent communication at every step of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the printable 2020 montana form 2 worksheet v tax credits discontinued

The way to make an eSignature for a PDF file in the online mode

The way to make an eSignature for a PDF file in Chrome

The way to create an electronic signature for putting it on PDFs in Gmail

How to make an electronic signature right from your smartphone

The way to make an eSignature for a PDF file on iOS devices

How to make an electronic signature for a PDF on Android

People also ask

-

What is the Printable Montana Form 2 Worksheet V Tax Credits DISCONTINUED?

The Printable Montana Form 2 Worksheet V Tax Credits DISCONTINUED is a form used to calculate tax credits for Montana residents. Although it has been discontinued, understanding its requirements can still be useful for historical tax purposes or record-keeping.

-

How can I access the Printable Montana Form 2 Worksheet V Tax Credits DISCONTINUED?

While the Printable Montana Form 2 Worksheet V Tax Credits DISCONTINUED is no longer actively provided, you can typically find copies through state archives or tax resource websites. Make sure to verify any historical forms with a qualified tax professional.

-

Are there alternative forms to the Printable Montana Form 2 Worksheet V Tax Credits DISCONTINUED?

Yes, since the Printable Montana Form 2 Worksheet V Tax Credits DISCONTINUED is obsolete, you should look for the most current tax credit forms available from the Montana Department of Revenue. Always use the latest forms to ensure compliance with state tax laws.

-

Why was the Printable Montana Form 2 Worksheet V Tax Credits DISCONTINUED?

The Printable Montana Form 2 Worksheet V Tax Credits DISCONTINUED may have been phased out as tax laws evolved or due to changes in tax credit eligibility criteria. It’s essential to stay updated on new tax regulations to utilize the most relevant documentation.

-

How does airSlate SignNow support tax-related document management?

airSlate SignNow provides businesses with the ability to easily send, sign, and store documents, including tax worksheets like the Printable Montana Form 2 Worksheet V Tax Credits DISCONTINUED. Our platform ensures that your document workflows are efficient and secure, even for potentially outdated forms.

-

What are the pricing options for using airSlate SignNow?

airSlate SignNow offers various pricing tiers to suit different business needs, including affordable options for startups and small businesses. Each tier provides features to help users streamline their document management processes, including support for forms like the Printable Montana Form 2 Worksheet V Tax Credits DISCONTINUED.

-

Can I integrate airSlate SignNow with other software tools?

Yes, airSlate SignNow seamlessly integrates with various business tools such as CRM systems, cloud storage services, and accounting software, enhancing your ability to manage essential documents like the Printable Montana Form 2 Worksheet V Tax Credits DISCONTINUED. This integration makes it easier to maintain organized records.

Get more for Printable Montana Form 2 Worksheet V Tax Credits DISCONTINUED

- Certificate of occupancy form 2 aliso viejo california

- Phone 949425 2540 form

- What are dsas and who is eligibleabilitynet form

- Form llc 12 state of california

- Business property statementpdf marin county form

- Form llc 5 state of california

- California form llp2

- Generator inspection checklist templates form

Find out other Printable Montana Form 2 Worksheet V Tax Credits DISCONTINUED

- Electronic signature Texas Car Dealer Purchase Order Template Online

- Electronic signature Texas Car Dealer Purchase Order Template Fast

- Electronic signature Maryland Business Operations NDA Myself

- Electronic signature Washington Car Dealer Letter Of Intent Computer

- Electronic signature Virginia Car Dealer IOU Fast

- How To Electronic signature Virginia Car Dealer Medical History

- Electronic signature Virginia Car Dealer Separation Agreement Simple

- Electronic signature Wisconsin Car Dealer Contract Simple

- Electronic signature Wyoming Car Dealer Lease Agreement Template Computer

- How Do I Electronic signature Mississippi Business Operations Rental Application

- Electronic signature Missouri Business Operations Business Plan Template Easy

- Electronic signature Missouri Business Operations Stock Certificate Now

- Electronic signature Alabama Charity Promissory Note Template Computer

- Electronic signature Colorado Charity Promissory Note Template Simple

- Electronic signature Alabama Construction Quitclaim Deed Free

- Electronic signature Alaska Construction Lease Agreement Template Simple

- Electronic signature Construction Form Arizona Safe

- Electronic signature Kentucky Charity Living Will Safe

- Electronic signature Construction Form California Fast

- Help Me With Electronic signature Colorado Construction Rental Application