Multiple Points of Use Exemption Certificate Ohio Gov Form

Understanding the Multiple Points of Use Exemption Certificate in Ohio

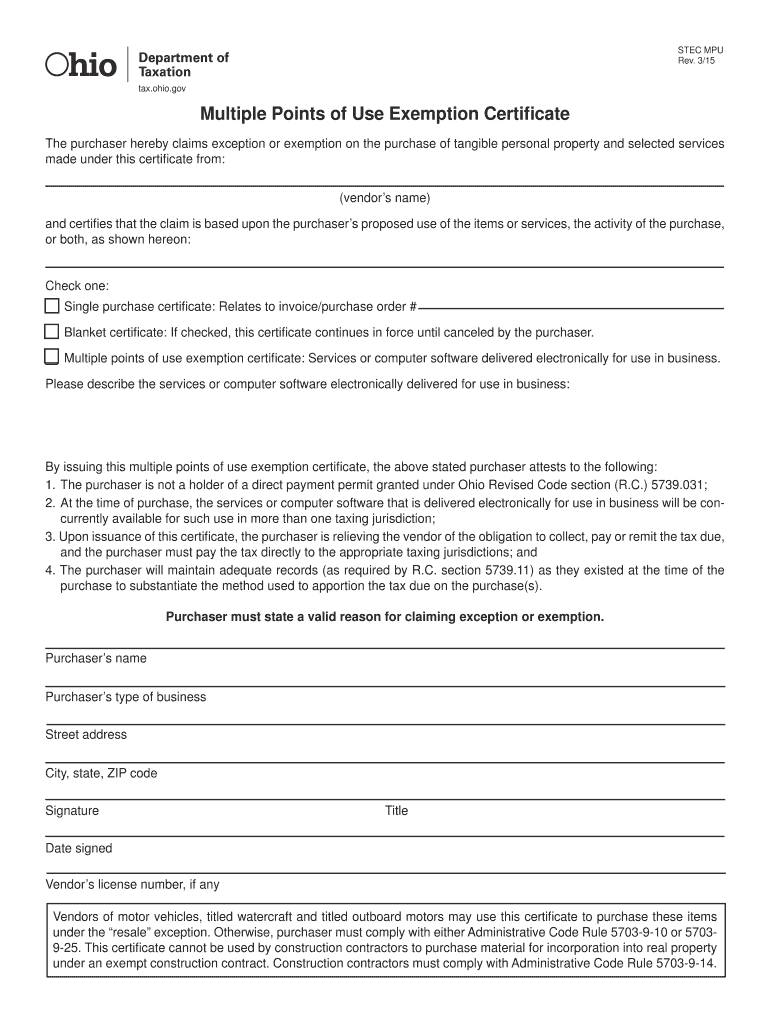

The Multiple Points of Use Exemption Certificate in Ohio is a crucial document for businesses that purchase items for resale or use in manufacturing. This certificate allows eligible entities to avoid paying sales tax on specific purchases, provided they meet the necessary criteria. The exemption applies to items that will be used in multiple locations or for various purposes, making it essential for businesses that operate in different jurisdictions within the state.

Steps to Complete the Multiple Points of Use Exemption Certificate

Completing the Multiple Points of Use Exemption Certificate involves several key steps to ensure compliance with Ohio state regulations. First, gather all necessary information about your business, including your tax identification number and details about the items being purchased. Next, accurately fill out the certificate, ensuring that all fields are completed. It is important to specify the nature of the purchases and the intended use to validate the exemption. Finally, retain a copy of the completed certificate for your records and provide the original to your supplier to avoid sales tax charges.

Legal Use of the Multiple Points of Use Exemption Certificate

The legal use of the Multiple Points of Use Exemption Certificate is governed by Ohio state tax laws. To qualify for the exemption, the purchases must be intended for resale or for use in manufacturing processes. Businesses must ensure that they are using the certificate correctly to avoid potential penalties or audits. Misuse of the exemption can lead to significant financial repercussions, including back taxes and fines. Therefore, it is vital to understand the specific legal requirements associated with the certificate.

Eligibility Criteria for the Multiple Points of Use Exemption Certificate

Eligibility for the Multiple Points of Use Exemption Certificate is primarily determined by the nature of the business and the intended use of the purchased items. Generally, businesses that are registered with the Ohio Department of Taxation and have a valid tax identification number may qualify. Additionally, the items purchased must be for resale or for use in manufacturing, and the business must operate in multiple locations within Ohio. It is essential to review the eligibility criteria thoroughly to ensure compliance.

Obtaining the Multiple Points of Use Exemption Certificate

To obtain the Multiple Points of Use Exemption Certificate in Ohio, businesses must complete an application process through the Ohio Department of Taxation. This process typically involves submitting necessary documentation that verifies the business's eligibility, including proof of registration and tax identification. Once the application is approved, businesses will receive the certificate, which they can then use for qualifying purchases. It is advisable to keep the certificate updated and to renew it as required to maintain compliance.

Examples of Using the Multiple Points of Use Exemption Certificate

Businesses can utilize the Multiple Points of Use Exemption Certificate in various scenarios. For instance, a manufacturer purchasing raw materials for production can present the certificate to suppliers to avoid paying sales tax on those materials. Similarly, a retailer acquiring inventory for resale can use the exemption certificate to reduce overall costs. Understanding practical applications of the certificate helps businesses maximize their tax savings while ensuring compliance with state regulations.

Quick guide on how to complete multiple points of use exemption certificate ohiogov

Complete Multiple Points Of Use Exemption Certificate Ohio gov seamlessly on any device

Online document management has gained traction among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, as you can locate the necessary form and securely store it online. airSlate SignNow provides all the tools you require to create, modify, and eSign your documents swiftly without delays. Manage Multiple Points Of Use Exemption Certificate Ohio gov on any platform using airSlate SignNow Android or iOS applications and enhance any document-centric process today.

How to modify and eSign Multiple Points Of Use Exemption Certificate Ohio gov effortlessly

- Locate Multiple Points Of Use Exemption Certificate Ohio gov and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize relevant sections of the documents or redact sensitive information with tools provided by airSlate SignNow specifically for that purpose.

- Create your signature using the Sign tool, which takes seconds and holds the same legal validity as a traditional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose how you want to deliver your form, via email, SMS, or invite link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searching, or errors necessitating printing new document copies. airSlate SignNow manages all your document management needs in just a few clicks from any device you prefer. Edit and eSign Multiple Points Of Use Exemption Certificate Ohio gov and ensure smooth communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is airSlate SignNow and how can it help with ohio multiple documents?

airSlate SignNow is a powerful eSignature solution that enables businesses to efficiently manage and send ohio multiple documents. It streamlines the signing process, reducing turnaround time and enhancing productivity. By allowing users to handle multiple documents simultaneously, airSlate SignNow helps ensure that all paperwork is completed seamlessly and securely.

-

Is airSlate SignNow suitable for businesses dealing with ohio multiple contracts?

Yes, airSlate SignNow is ideal for businesses that frequently handle ohio multiple contracts. Its user-friendly interface allows teams to manage various contracts with ease, ensuring that all necessary parties can review and sign documents quickly. This minimizes delays and keeps your company's operations running smoothly.

-

What are the pricing options for airSlate SignNow regarding ohio multiple usage?

airSlate SignNow offers flexible pricing plans that cater to businesses needing to manage ohio multiple transactions. Depending on your company’s size and requirements, you can choose a plan that fits your budget while still providing access to essential features. This makes airSlate SignNow a cost-effective choice for organizations of all sizes.

-

Are there any integrations available with airSlate SignNow for handling ohio multiple documents?

Yes, airSlate SignNow seamlessly integrates with various applications and platforms, allowing you to handle ohio multiple documents effortlessly. Whether you use Google Workspace, Salesforce, or Microsoft applications, airSlate SignNow ensures that your workflows remain uninterrupted. These integrations enhance your document management capabilities signNowly.

-

What features does airSlate SignNow provide for ohio multiple document management?

airSlate SignNow offers features such as customizable templates, bulk sending, and advanced security measures for managing ohio multiple documents. These tools ensure that all documents can be prepared, sent, and signed efficiently. Additionally, you can track the signing status of each document in real-time, simplifying the entire process.

-

How does airSlate SignNow enhance collaboration on ohio multiple projects?

With airSlate SignNow, collaboration on ohio multiple projects becomes easier due to its shared workspace feature. Team members can access, comment, and sign documents simultaneously, ensuring everyone is on the same page. This collaborative approach fosters better communication and quicker decision-making.

-

Can airSlate SignNow ensure compliance when managing ohio multiple documents?

Absolutely! airSlate SignNow is designed to comply with various legal standards, ensuring that your ohio multiple documents are handled in accordance with regulations. Its robust security measures protect your data while providing legally binding eSignatures, giving you peace of mind as you manage sensitive documents.

Get more for Multiple Points Of Use Exemption Certificate Ohio gov

- Announcement peer specialist certification training may 2012docx dbhdd georgia form

- Wic medical documentation form hawaii department of health

- Womens medical request form

- Burial transit permit form

- Public adjuster contract template form

- Danh sch 1 triu website c ranking pr khochatcom form

- State form 49607 r9 6 18

- Application for search and certified copy of birth record form

Find out other Multiple Points Of Use Exemption Certificate Ohio gov

- eSign New Hampshire Sports IOU Safe

- eSign Delaware Courts Operating Agreement Easy

- eSign Georgia Courts Bill Of Lading Online

- eSign Hawaii Courts Contract Mobile

- eSign Hawaii Courts RFP Online

- How To eSign Hawaii Courts RFP

- eSign Hawaii Courts Letter Of Intent Later

- eSign Hawaii Courts IOU Myself

- eSign Hawaii Courts IOU Safe

- Help Me With eSign Hawaii Courts Cease And Desist Letter

- How To eSign Massachusetts Police Letter Of Intent

- eSign Police Document Michigan Secure

- eSign Iowa Courts Emergency Contact Form Online

- eSign Kentucky Courts Quitclaim Deed Easy

- How To eSign Maryland Courts Medical History

- eSign Michigan Courts Lease Agreement Template Online

- eSign Minnesota Courts Cease And Desist Letter Free

- Can I eSign Montana Courts NDA

- eSign Montana Courts LLC Operating Agreement Mobile

- eSign Oklahoma Sports Rental Application Simple