Waiver Minimum 2006-2026

What is the Waiver Minimum

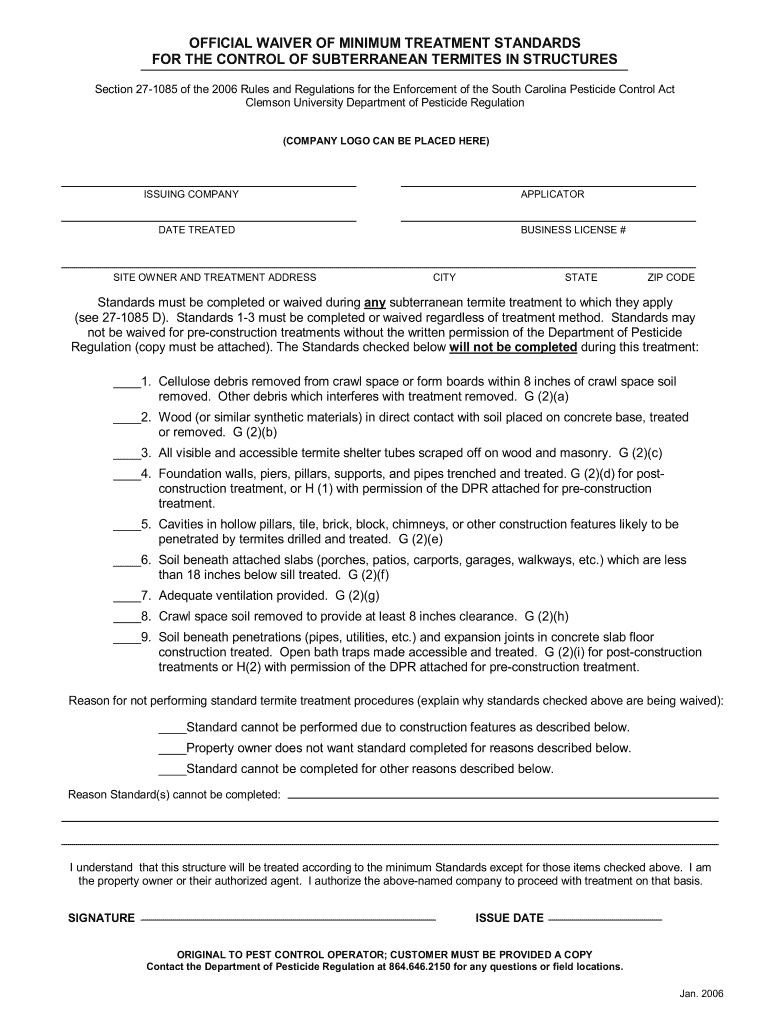

The Waiver Minimum refers to the established standards and requirements that govern the treatment of termites in South Carolina. This waiver allows property owners to opt for a reduced level of treatment under specific circumstances, particularly when certain conditions are met. Understanding the Waiver Minimum is crucial for homeowners and businesses to ensure compliance with state regulations while effectively managing termite infestations.

How to use the Waiver Minimum

Utilizing the Waiver Minimum involves understanding the specific criteria that qualify for this option. Property owners must assess their situation to determine if they meet the necessary conditions for a waiver. Consulting with a licensed pest control professional can provide clarity on whether your property qualifies for reduced treatment standards. If eligible, the pest control operator will guide you through the process of applying for the waiver, ensuring all necessary documentation is completed accurately.

Steps to complete the Waiver Minimum

Completing the Waiver Minimum involves several key steps:

- Assess your property for termite activity and damage.

- Consult with a licensed pest control professional to determine eligibility for the waiver.

- Gather required documentation, including any previous treatment records.

- Complete the necessary forms as advised by your pest control operator.

- Submit the forms to the appropriate state authority for approval.

Following these steps ensures that you adhere to the legal requirements while potentially reducing treatment costs.

Legal use of the Waiver Minimum

The legal use of the Waiver Minimum is governed by South Carolina state regulations. It is essential for property owners to familiarize themselves with these laws to avoid non-compliance. The waiver must be applied for and granted before any reduced treatment is enacted. Failure to adhere to the legal framework can result in penalties or the requirement to undergo full treatment, which may be more costly in the long run.

Key elements of the Waiver Minimum

Several key elements define the Waiver Minimum in South Carolina:

- Eligibility criteria that must be met for the waiver to be applicable.

- Documentation requirements that must be submitted with the waiver application.

- Specific treatment standards that are permitted under the waiver.

- Compliance with state regulations to ensure the waiver is legally recognized.

Understanding these elements helps property owners navigate the waiver process effectively.

State-specific rules for the Waiver Minimum

South Carolina has specific rules governing the Waiver Minimum, including the types of properties that qualify and the conditions under which a waiver can be granted. These rules are designed to protect both property owners and the environment. It is important to stay informed about any changes to these regulations, as they can impact the availability and terms of the waiver.

Quick guide on how to complete south carolina official waiver of minimum treatment standards form

Manage Waiver Minimum anytime, anywhere

Your daily operational tasks may require additional attention when handling state-specific business paperwork. Regain your office hours and reduce the costs associated with document-driven processes using airSlate SignNow. airSlate SignNow provides you with a variety of pre-built business documents, including Waiver Minimum, which you can utilize and distribute to your business associates. Manage your Waiver Minimum effortlessly with robust editing and eSignature features and send it straight to your recipients.

Steps to obtain Waiver Minimum in a few clicks:

- Select a form that corresponds to your state.

- Click on Learn More to view the document and ensure it is accurate.

- Click Get Form to begin working on it.

- Waiver Minimum will instantly open in the editor. No further steps are needed.

- Utilize airSlate SignNow’s sophisticated editing tools to complete or modify the form.

- Select the Sign option to create your signature and eSign your document.

- When prepared, click Done, save your changes, and access your document.

- Send the document via email or text, or employ a link-to-fill method with partners or allow them to download the file.

airSlate SignNow signNowly saves your time managing Waiver Minimum and enables you to locate needed documents in one place. A comprehensive collection of forms is organized and designed to address crucial business functions essential for your operations. The advanced editor minimizes the chance of errors, allowing you to easily fix issues and review your documents on any device before sending them out. Start your free trial today to explore all the benefits of airSlate SignNow for your daily business processes.

Create this form in 5 minutes or less

FAQs

-

Why should it be so complicated just figuring out how much tax to pay? (record keeping, software, filling out forms . . . many times cost much more than the amount of taxes due) The cost of compliance makes the U.S. uncompetitive and costs jobs and lowers our standard of living.

Taxes can be viewed as having 4 uses (or purposes) in our (and most) governments:Revenue generation (to pay for public services).Fiscal policy control (e.g., If the government wishes to reduce the money supply in order to reduce the risk of inflation, they can raise interest rates, sell fewer bonds, burn money, or raise taxes. In the last case, this represents excess tax revenue over the actual spending needs of the government).Wealth re-distribution. One argument for this is that the earnings of a country can be perceived as belonging to all of its citizens since the we all have a stake in the resources of the country (natural resources, and intangibles such as culture, good citizenship, civic duties). Without some tax policy complexity, the free market alone does not re-distribute wealth according to this "shared" resources concept. However, this steps into the boundary of Purpose # 4...A way to implement Social Policy (and similar government mandated policies, such as environmental policy, health policy, savings and debt policy, etc.). As Government spending can be use to implement policies (e.g., spending money on public health care, environmental cleanup, education, etc.), it is equivalent to provide tax breaks (income deductions or tax credits) for the private sector to act in certain ways -- e.g., spend money on R&D, pay for their own education or health care, avoid spending money on polluting cars by having a higher sales tax on these cars or offering a credit for trade-ins [ref: Cash for Clunkers]).Uses # 1 & 2 are rather straight-forward, and do not require a complex tax code to implement. Flat income and/or consumption (sales) taxes can easily be manipulated up or down overall for these top 2 uses. Furthermore, there is clarity when these uses are invoked. For spending, we publish a budget. For fiscal policy manipulation, the official economic agency (The Fed) publishes their outlook and agenda.Use # 3 is controversial because there is no Constitutional definition for the appropriate level of wealth re-distribution, and the very concept of wealth re-distribution is considered by some to be inappropriate and unconstitutional. Thus, the goal of wealth re-distribution is pretty much hidden in with the actions and policies of Use #4 (social policy manipulation).Use # 4, however, is where the complexity enters the Taxation system. Policy implementation through taxation (or through spending) occurs via legislation. Legislation (law making) is inherently complex and subject to gross manipulation by special interests during formation and amendments. Legislation is subject to interpretation, is prone to errors (leading to loopholes) and both unintentional or intentional (criminal / fraudulent) avoidance.The record keeping and forms referred to in the question are partially due to the basic formula for calculating taxes (i.e., percentage of income, cost of property, amount of purchase for a sales tax, ...). However, it is the complexity (and associated opportunities for exploitation) of taxation legislation for Use # 4 (Social Policy implementation) that naturally leads to complexity in the reporting requirements for the tax system.

Create this form in 5 minutes!

How to create an eSignature for the south carolina official waiver of minimum treatment standards form

How to make an eSignature for the South Carolina Official Waiver Of Minimum Treatment Standards Form in the online mode

How to create an electronic signature for the South Carolina Official Waiver Of Minimum Treatment Standards Form in Google Chrome

How to generate an eSignature for signing the South Carolina Official Waiver Of Minimum Treatment Standards Form in Gmail

How to generate an electronic signature for the South Carolina Official Waiver Of Minimum Treatment Standards Form right from your smart phone

How to create an eSignature for the South Carolina Official Waiver Of Minimum Treatment Standards Form on iOS devices

How to create an electronic signature for the South Carolina Official Waiver Of Minimum Treatment Standards Form on Android devices

People also ask

-

What is the Waiver Minimum for using airSlate SignNow?

The Waiver Minimum refers to the minimum requirements or conditions set by airSlate SignNow for utilizing its eSignature services. To use our platform effectively, businesses should ensure they meet these requirements, which typically include having appropriate documentation ready for eSigning and compliance with local regulations regarding electronic signatures.

-

How does the Waiver Minimum affect pricing for airSlate SignNow?

The Waiver Minimum can influence the pricing structure of airSlate SignNow, as certain features or integrations may only be available to users who meet specific criteria. By understanding the Waiver Minimum, you can choose the right plan that aligns with your business needs and budget, ensuring you get the most value out of our cost-effective solution.

-

What features are included at the Waiver Minimum level?

At the Waiver Minimum level, users can access essential features such as document templates, customizable workflows, and secure electronic signatures. These functionalities are designed to streamline the signing process, making it easier for businesses to manage their documents efficiently while maintaining compliance with legal standards.

-

Are there any benefits to meeting the Waiver Minimum with airSlate SignNow?

Yes, meeting the Waiver Minimum allows users to unlock additional features and integrations that enhance the eSigning experience. By adhering to these minimum requirements, businesses gain access to more advanced tools, improving efficiency, collaboration, and overall document management.

-

Can I integrate airSlate SignNow with other software if I meet the Waiver Minimum?

Absolutely! Meeting the Waiver Minimum enables seamless integration with various software applications, enhancing your workflow. Whether you're using CRM systems, document management tools, or project management platforms, airSlate SignNow's integration capabilities ensure that your eSignature process fits right into your existing systems.

-

Is there support available for businesses at the Waiver Minimum level?

Yes, airSlate SignNow provides robust customer support for all users, including those at the Waiver Minimum level. Our dedicated team is available to assist with any questions or issues related to the platform, ensuring you have the resources you need to utilize our services effectively.

-

What types of documents can I send under the Waiver Minimum with airSlate SignNow?

Under the Waiver Minimum, you can send various types of documents for eSigning, including contracts, waivers, agreements, and forms. The flexibility of airSlate SignNow allows businesses to handle all their signing needs digitally, making it a versatile solution for any document management strategy.

Get more for Waiver Minimum

- Dc dmvadj online form

- Parental consent form department of motor vehicles the district dmv dc

- Dmv dc 6966466 form

- District of columbia driver license form

- Dwi reinstatement hearing application dmv the district of dmv dc form

- Driving manual driving manual bdmvb the district of bb dmv dc form

- Virginia voter photo id card virginia department of motor vehicles form

- Dmv dc 6966468 form

Find out other Waiver Minimum

- How To Sign Wisconsin Domain Name Registration Agreement

- Sign Wyoming Domain Name Registration Agreement Safe

- Sign Maryland Delivery Order Template Myself

- Sign Minnesota Engineering Proposal Template Computer

- Sign Washington Engineering Proposal Template Secure

- Sign Delaware Proforma Invoice Template Online

- Can I Sign Massachusetts Proforma Invoice Template

- How Do I Sign Oklahoma Equipment Purchase Proposal

- Sign Idaho Basic rental agreement or residential lease Online

- How To Sign Oregon Business agreements

- Sign Colorado Generic lease agreement Safe

- How Can I Sign Vermont Credit agreement

- Sign New York Generic lease agreement Myself

- How Can I Sign Utah House rent agreement format

- Sign Alabama House rental lease agreement Online

- Sign Arkansas House rental lease agreement Free

- Sign Alaska Land lease agreement Computer

- How Do I Sign Texas Land lease agreement

- Sign Vermont Land lease agreement Free

- Sign Texas House rental lease Now