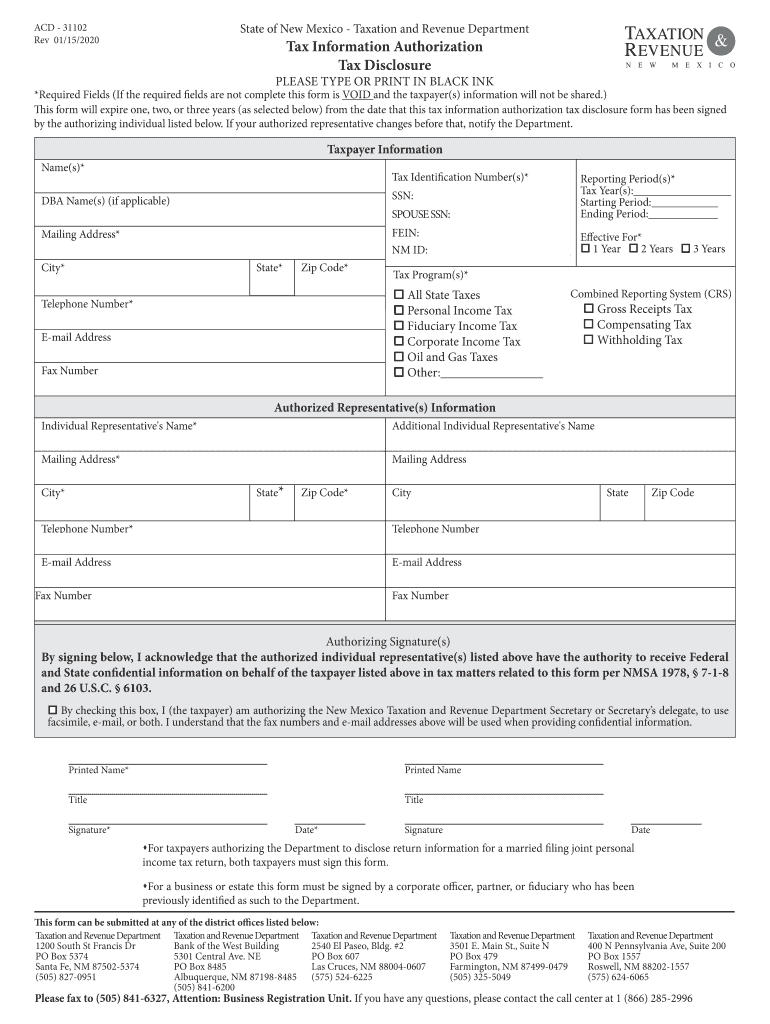

ACD 31102 Tax Information Authorization Tax Disclosure

Understanding the New Mexico Authorization

The New Mexico authorization, often referred to as the ACD 31102 Tax Information Authorization Tax Disclosure, is a crucial document for individuals and businesses in New Mexico. It allows taxpayers to authorize specific individuals or entities to receive confidential tax information on their behalf. This form is particularly important for those who may need assistance with tax matters, ensuring that the right people have access to necessary information while maintaining compliance with state regulations.

Steps to Complete the New Mexico Authorization

Completing the ACD 31102 Tax Information Authorization Tax Disclosure involves several key steps:

- Gather necessary information, including your taxpayer identification number and the details of the individual or entity you are authorizing.

- Fill out the form accurately, ensuring that all required fields are completed to avoid delays.

- Review the form for any errors or omissions before submission.

- Sign and date the form to validate your authorization.

- Submit the completed form as instructed, either online or via mail.

Legal Use of the New Mexico Authorization

The legal use of the ACD 31102 Tax Information Authorization Tax Disclosure is governed by New Mexico state tax laws. This form must be executed in compliance with the state’s regulations to ensure that the authorization is valid. It is essential to understand that improperly filled forms may lead to legal complications or delays in processing. The form serves as a protective measure for both the taxpayer and the authorized representative, safeguarding sensitive information while allowing for necessary disclosures.

Who Issues the New Mexico Authorization Form

The ACD 31102 Tax Information Authorization Tax Disclosure is issued by the New Mexico Taxation and Revenue Department. This department is responsible for managing tax-related matters in the state, including the issuance and processing of various tax forms. It is advisable to consult the department's official resources for the most current version of the form and any updates regarding submission procedures.

Required Documents for the New Mexico Authorization

To successfully complete the ACD 31102 Tax Information Authorization Tax Disclosure, certain documents may be required:

- Your Social Security number or taxpayer identification number.

- Identification details of the individual or entity you are authorizing.

- Any previous tax documents that may be relevant to the authorization.

Having these documents ready can streamline the process, ensuring that you provide all necessary information without delays.

Filing Deadlines for the New Mexico Authorization

Filing deadlines for the ACD 31102 Tax Information Authorization Tax Disclosure can vary depending on specific circumstances, such as the type of tax return being filed. Generally, it is advisable to submit the form well in advance of any tax deadlines to allow for processing time. Staying informed about important dates can help ensure compliance and prevent any potential issues with your tax filings.

Quick guide on how to complete acd 31102 tax information authorization tax disclosure

Complete ACD 31102 Tax Information Authorization Tax Disclosure effortlessly on any device

Web-based document management has become increasingly popular among organizations and individuals. It serves as an ideal environmentally friendly alternative to traditional printed and signed paperwork, allowing you to locate the right form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and eSign your documents swiftly without delays. Manage ACD 31102 Tax Information Authorization Tax Disclosure on any device using the airSlate SignNow Android or iOS applications, and enhance any document-driven process today.

The easiest way to edit and eSign ACD 31102 Tax Information Authorization Tax Disclosure without hassle

- Locate ACD 31102 Tax Information Authorization Tax Disclosure and then click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize important sections of your documents or conceal sensitive information with the specific tools that airSlate SignNow offers for that purpose.

- Craft your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Verify the details and then click on the Done button to save your modifications.

- Select your preferred method to share your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and eSign ACD 31102 Tax Information Authorization Tax Disclosure and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is new mexico authorization in the context of airSlate SignNow?

New Mexico authorization refers to the legal permission required to eSign documents in New Mexico using airSlate SignNow. This ensures that electronically signed documents are valid and enforceable under New Mexico law, providing businesses with confidence in their digital transactions.

-

How does airSlate SignNow ensure compliance with new mexico authorization?

airSlate SignNow complies with new mexico authorization by adhering to state-specific e-sign legislation. Our platform incorporates best practices and legal standards to ensure that all eSignatures are secure, verifiable, and legally binding within New Mexico.

-

What are the pricing options for airSlate SignNow related to new mexico authorization?

airSlate SignNow offers competitive pricing plans that cater to businesses needing new mexico authorization for their documents. We provide various subscription tiers, ensuring that companies of all sizes can find a suitable option that meets their needs while staying cost-effective.

-

What features does airSlate SignNow provide for managing new mexico authorization?

AirSlate SignNow offers features such as customizable templates, automated workflows, and secure storage to streamline the process of obtaining new mexico authorization. These tools help businesses efficiently manage their documents while maintaining compliance with local regulations.

-

Can airSlate SignNow integrate with my existing systems while handling new mexico authorization?

Yes, airSlate SignNow can seamlessly integrate with various business applications to facilitate new mexico authorization processes. By connecting with CRM systems, document storage solutions, and other tools, you can optimize your workflow and ensure compliance with minimal disruption.

-

What are the benefits of using airSlate SignNow for new mexico authorization?

Using airSlate SignNow for new mexico authorization allows businesses to save time and reduce paperwork. The platform simplifies document management and ensures all signatures are legally compliant, which enhances trust and efficiency in business transactions.

-

Is airSlate SignNow suitable for small businesses needing new mexico authorization?

Absolutely! AirSlate SignNow is designed to be user-friendly and cost-effective, making it an ideal choice for small businesses that need new mexico authorization for their documents. With its simple interface and robust features, even small teams can manage their eSign processes effectively.

Get more for ACD 31102 Tax Information Authorization Tax Disclosure

- Liability release waiver brownstone park eaglehillschool form

- Adult adhd self report scale asrs v i form

- Classroom walkthrough template form

- Job application for kids form

- Nikah nama form in urdu pdf download

- Pnb kyc form

- New government application form 2021

- Lockout tagout program safety audit guide safety infocom form

Find out other ACD 31102 Tax Information Authorization Tax Disclosure

- How Can I Electronic signature Alabama Finance & Tax Accounting Document

- How To Electronic signature Delaware Government Document

- Help Me With Electronic signature Indiana Education PDF

- How To Electronic signature Connecticut Government Document

- How To Electronic signature Georgia Government PDF

- Can I Electronic signature Iowa Education Form

- How To Electronic signature Idaho Government Presentation

- Help Me With Electronic signature Hawaii Finance & Tax Accounting Document

- How Can I Electronic signature Indiana Government PDF

- How Can I Electronic signature Illinois Finance & Tax Accounting PPT

- How To Electronic signature Maine Government Document

- How To Electronic signature Louisiana Education Presentation

- How Can I Electronic signature Massachusetts Government PDF

- How Do I Electronic signature Montana Government Document

- Help Me With Electronic signature Louisiana Finance & Tax Accounting Word

- How To Electronic signature Pennsylvania Government Document

- Can I Electronic signature Texas Government PPT

- How To Electronic signature Utah Government Document

- How To Electronic signature Washington Government PDF

- How Can I Electronic signature New Mexico Finance & Tax Accounting Word