Utah Tc 546 Form

What is the Utah TC 546?

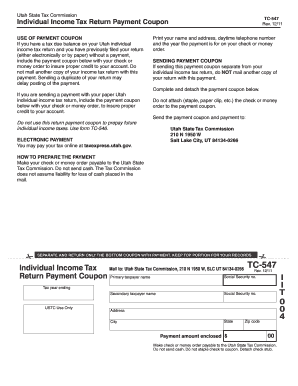

The Utah TC 546 is a form used for reporting and paying individual income tax in the state of Utah. This form is essential for taxpayers who need to reconcile their tax obligations, ensuring that they meet state requirements. It is specifically designed to assist individuals in calculating their tax due based on their income, deductions, and credits. Understanding the TC 546 is crucial for anyone looking to fulfill their tax responsibilities accurately.

Steps to Complete the Utah TC 546

Completing the Utah TC 546 involves several key steps to ensure accuracy and compliance. Here’s a straightforward guide:

- Gather Necessary Documents: Collect all relevant financial documents, including W-2s, 1099s, and any other income statements.

- Calculate Your Income: Sum up all sources of income to determine your total taxable income.

- Apply Deductions and Credits: Identify applicable deductions and credits to reduce your taxable income.

- Fill Out the Form: Enter your calculated figures into the TC 546 form accurately, following the instructions provided.

- Review the Form: Double-check all entries for accuracy to prevent errors that could lead to penalties.

- Submit the Form: Choose your submission method—online, by mail, or in person—and ensure it is sent by the deadline.

Legal Use of the Utah TC 546

The Utah TC 546 is legally binding when completed and submitted according to state regulations. It serves as an official record of your tax obligations and payments. To ensure its legal standing, taxpayers must adhere to all filing requirements and deadlines. Failure to comply with these regulations may result in penalties or legal repercussions.

Filing Deadlines / Important Dates

Timely filing of the Utah TC 546 is crucial to avoid penalties. The typical deadline for submitting this form is the same as the federal tax deadline, which is usually April fifteenth. However, if this date falls on a weekend or holiday, the deadline may be extended. It is important to stay informed about any changes to filing deadlines announced by the state of Utah.

Form Submission Methods

Taxpayers have several options for submitting the Utah TC 546. These include:

- Online Submission: Many taxpayers prefer to file electronically, which can expedite processing times.

- Mail Submission: You can print the completed form and send it to the appropriate state address.

- In-Person Submission: For those who prefer direct interaction, submitting the form at designated state offices is an option.

Required Documents

When completing the Utah TC 546, certain documents are necessary to ensure accurate reporting. These may include:

- W-2 forms from employers

- 1099 forms for additional income sources

- Records of any deductions or credits claimed

- Previous year’s tax return for reference

Penalties for Non-Compliance

Failure to comply with the requirements associated with the Utah TC 546 can lead to various penalties. These may include fines, interest on unpaid taxes, and potential legal action. It is essential for taxpayers to understand these consequences and ensure timely and accurate filing to avoid complications.

Quick guide on how to complete utah tc 546

Effortlessly Prepare Utah Tc 546 on Any Device

Digital document management has gained traction among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, alter, and electronically sign your documents swiftly without any delays. Manage Utah Tc 546 on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

The Easiest Way to Alter and Electronically Sign Utah Tc 546 Without Effort

- Obtain Utah Tc 546 and then click Get Form to begin.

- Utilize the available tools to fill out your document.

- Emphasize important sections of the documents or obscure sensitive information with the tools that airSlate SignNow provides explicitly for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal significance as a conventional ink signature.

- Review the information and then click the Done button to save your modifications.

- Select your preferred method to send your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, cumbersome form searches, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Utah Tc 546 to ensure effective communication at any stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the process for making a Utah tax return payment with airSlate SignNow?

To make a Utah tax return payment using airSlate SignNow, simply create and eSign your tax document online. Once your document is ready, you can securely submit it for payment. The platform ensures that your transaction is efficient and compliant with Utah state regulations.

-

Are there any fees associated with using airSlate SignNow for Utah tax return payments?

Yes, while airSlate SignNow offers a cost-effective solution, there may be transaction fees applicable when processing Utah tax return payments. It's advisable to review our pricing plans for detailed information about any associated fees. This will help you budget effectively for your tax payment needs.

-

How secure is the airSlate SignNow platform for processing Utah tax return payments?

AirSlate SignNow prioritizes the security of your data and transactions. Our platform uses advanced encryption technology to protect your information during the eSigning and payment process. You can confidently make your Utah tax return payment knowing that your sensitive data is safe with us.

-

Can I integrate airSlate SignNow with other accounting software for my Utah tax return payment?

Yes, airSlate SignNow allows for seamless integration with various accounting and financial software. This means you can easily streamline your Utah tax return payment process by connecting your preferred tools. This integration facilitates better management of documents and transactions.

-

What features does airSlate SignNow offer that assist with Utah tax return payments?

AirSlate SignNow offers features such as customizable templates, automated reminders, and secure eSigning that facilitate Utah tax return payments. These tools simplify the document management process and ensure you don't miss any important deadlines. Using our features will enhance your overall experience when handling tax payments.

-

Is there customer support available for issues related to Utah tax return payments?

Absolutely! AirSlate SignNow provides dedicated customer support for all users, including assistance with Utah tax return payments. Our knowledgeable team is ready to help you navigate any challenges you may face, ensuring a smooth and hassle-free payment experience.

-

Can I use airSlate SignNow to modify my Utah tax return after submission?

Yes, you can use airSlate SignNow to access and modify your submitted Utah tax return documents. However, be mindful of submission deadlines and potential penalties. Making changes promptly can help ensure your tax return payment is accurate and compliant with state regulations.

Get more for Utah Tc 546

Find out other Utah Tc 546

- eSign Florida Legal Warranty Deed Safe

- Help Me With eSign North Dakota Insurance Residential Lease Agreement

- eSign Life Sciences Word Kansas Fast

- eSign Georgia Legal Last Will And Testament Fast

- eSign Oklahoma Insurance Business Associate Agreement Mobile

- eSign Louisiana Life Sciences Month To Month Lease Online

- eSign Legal Form Hawaii Secure

- eSign Hawaii Legal RFP Mobile

- How To eSign Hawaii Legal Agreement

- How Can I eSign Hawaii Legal Moving Checklist

- eSign Hawaii Legal Profit And Loss Statement Online

- eSign Hawaii Legal Profit And Loss Statement Computer

- eSign Hawaii Legal Profit And Loss Statement Now

- How Can I eSign Hawaii Legal Profit And Loss Statement

- Can I eSign Hawaii Legal Profit And Loss Statement

- How To eSign Idaho Legal Rental Application

- How To eSign Michigan Life Sciences LLC Operating Agreement

- eSign Minnesota Life Sciences Lease Template Later

- eSign South Carolina Insurance Job Description Template Now

- eSign Indiana Legal Rental Application Free