Form 770, Virginia Fiduciary Income Tax Return Virginia Fiduciary Income Tax Return, Form 770

Understanding the Virginia Form 770

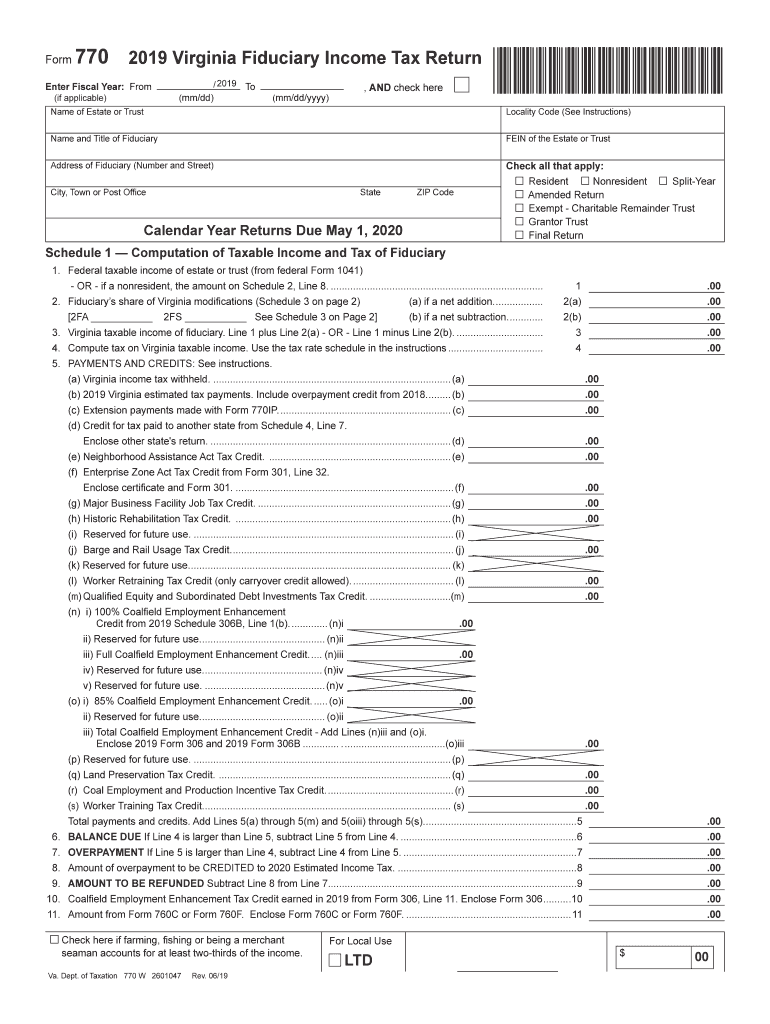

The Virginia Form 770 is the Fiduciary Income Tax Return used by estates and trusts in Virginia. This form is essential for reporting income generated by the estate or trust and is required to ensure compliance with state tax regulations. It allows fiduciaries to calculate the tax owed on income earned during the tax year. Proper completion of this form is crucial for avoiding penalties and ensuring that the estate or trust meets its tax obligations.

Steps to Complete the Virginia Form 770

Completing the Virginia Form 770 involves several key steps:

- Gather necessary documentation, including income statements, deductions, and any relevant tax credits.

- Fill out the general information section, including the name of the estate or trust and the tax identification number.

- Report all sources of income, including interest, dividends, and capital gains.

- Calculate allowable deductions, which may include administrative expenses and distributions to beneficiaries.

- Complete the tax computation section, determining the total tax liability based on the income reported.

- Review the form for accuracy before signing and dating it.

Obtaining the Virginia Form 770

The Virginia Form 770 can be obtained through the Virginia Department of Taxation's website or at local tax offices. It is available in both digital and paper formats. For those preferring to complete the form electronically, it can be filled out and submitted online using approved e-filing services that comply with state regulations.

Legal Use of the Virginia Form 770

The legal validity of the Virginia Form 770 hinges on its proper completion and submission. To ensure compliance, the form must be filed by the designated deadline, and any required payments must be made. Additionally, using a reliable eSignature solution can enhance the legal standing of the submitted form, ensuring that it meets all electronic signature regulations.

Key Elements of the Virginia Form 770

Several key elements are essential when completing the Virginia Form 770:

- Fiduciary Information: This includes the name, address, and tax identification number of the fiduciary.

- Income Reporting: All income sources must be accurately reported, including any distributions made to beneficiaries.

- Deductions: Properly documenting allowable deductions is critical for reducing taxable income.

- Tax Computation: Calculating the correct tax amount owed based on the income and deductions reported.

Filing Deadlines for the Virginia Form 770

It is important to be aware of the filing deadlines associated with the Virginia Form 770. Generally, the form is due on the fifteenth day of the fourth month following the close of the tax year. For estates and trusts with a fiscal year ending on December 31, the deadline would be April 15 of the following year. Extensions may be available, but they must be requested in advance.

Quick guide on how to complete 2019 form 770 virginia fiduciary income tax return virginia fiduciary income tax return 2019 form 770

Easily Prepare Form 770, Virginia Fiduciary Income Tax Return Virginia Fiduciary Income Tax Return, Form 770 on Any Device

The management of online documents has become increasingly favored by businesses and individuals. It offers an ideal environmentally-friendly substitute for conventional printed and signed documents, as you can find the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Manage Form 770, Virginia Fiduciary Income Tax Return Virginia Fiduciary Income Tax Return, Form 770 on any platform with the airSlate SignNow Android or iOS applications and enhance any document-centric process today.

Effortlessly Edit and Electronically Sign Form 770, Virginia Fiduciary Income Tax Return Virginia Fiduciary Income Tax Return, Form 770

- Find Form 770, Virginia Fiduciary Income Tax Return Virginia Fiduciary Income Tax Return, Form 770 and click on Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize pertinent sections of the documents or cover sensitive information with tools that airSlate SignNow offers specifically for this purpose.

- Create your signature using the Sign tool, which takes just seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you want to send your form: via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Form 770, Virginia Fiduciary Income Tax Return Virginia Fiduciary Income Tax Return, Form 770 and ensure excellent communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the Virginia Form 770?

The Virginia Form 770 is the state's individual income tax return form, used by residents and part-year residents to report their income and calculate their tax liability. Properly completing the Virginia Form 770 is essential for accurate tax filings in the state.

-

How can airSlate SignNow assist with Virginia Form 770 e-signatures?

airSlate SignNow provides a secure and efficient way to e-sign the Virginia Form 770, making the signing process faster for individuals and businesses alike. With our easy-to-use platform, you can send the form for signature and track its status in real-time.

-

What are the pricing options for using airSlate SignNow for Virginia Form 770?

airSlate SignNow offers flexible pricing plans suitable for individuals and businesses. Whether you need basic e-signature functionality for the Virginia Form 770 or advanced features such as document templates, there’s a plan to fit your needs and budget.

-

Are there specific features of airSlate SignNow relevant to the Virginia Form 770?

Yes, airSlate SignNow offers features such as customizable templates and bulk sending that streamline the completion of the Virginia Form 770. This allows users to organize, send, and e-sign documents with ease, ensuring compliance with state requirements.

-

Can I integrate airSlate SignNow with my current accounting software for handling Virginia Form 770?

Absolutely! airSlate SignNow provides integrations with various accounting software, enabling seamless handling of the Virginia Form 770. This allows users to efficiently manage their income tax documents directly from their preferred accounting platforms.

-

What are the benefits of using airSlate SignNow for the Virginia Form 770?

Using airSlate SignNow for the Virginia Form 770 offers increased efficiency, enhanced security, and reduced turnaround times for document signing. You'll save time on administrative tasks and ensure that your tax documents are signed quickly and securely.

-

Is airSlate SignNow legally compliant for e-signing the Virginia Form 770?

Yes, airSlate SignNow complies with all state and federal e-signature laws, making it legally binding for signing the Virginia Form 770. This compliance helps ensure that your electronically signed documents hold up in legal contexts.

Get more for Form 770, Virginia Fiduciary Income Tax Return Virginia Fiduciary Income Tax Return, Form 770

- Msf 4259 rev 0221 form

- Irasincome tax forms for employers

- Iowa application turtle form

- Civil aviation safety authority of papua new guinea form

- The hart beat oct 26 the hart beat form

- Domestic builder form

- The office of vital statistics cabinet for health and family services form

- 2020 form au vrpin02589 fill online printable fillable

Find out other Form 770, Virginia Fiduciary Income Tax Return Virginia Fiduciary Income Tax Return, Form 770

- How Do I Sign Nebraska Healthcare / Medical Word

- How Do I Sign Washington Healthcare / Medical Word

- How Can I Sign Indiana High Tech PDF

- How To Sign Oregon High Tech Document

- How Do I Sign California Insurance PDF

- Help Me With Sign Wyoming High Tech Presentation

- How Do I Sign Florida Insurance PPT

- How To Sign Indiana Insurance Document

- Can I Sign Illinois Lawers Form

- How To Sign Indiana Lawers Document

- How To Sign Michigan Lawers Document

- How To Sign New Jersey Lawers PPT

- How Do I Sign Arkansas Legal Document

- How Can I Sign Connecticut Legal Document

- How Can I Sign Indiana Legal Form

- Can I Sign Iowa Legal Document

- How Can I Sign Nebraska Legal Document

- How To Sign Nevada Legal Document

- Can I Sign Nevada Legal Form

- How Do I Sign New Jersey Legal Word