Taxes Form

What is the IRS Refund?

The IRS refund refers to the amount of money that the Internal Revenue Service returns to taxpayers after they have overpaid their taxes. This can occur when individuals or businesses have withheld more in taxes than they owe, or if they qualify for tax credits that reduce their overall tax liability. Understanding the refund process is crucial for taxpayers, as it can significantly impact personal finances and budgeting.

Steps to Complete the IRS Refund Form

Completing the IRS refund form requires careful attention to detail to ensure accuracy and compliance. Here are the essential steps:

- Gather all necessary documents, including W-2 forms, 1099s, and any relevant receipts.

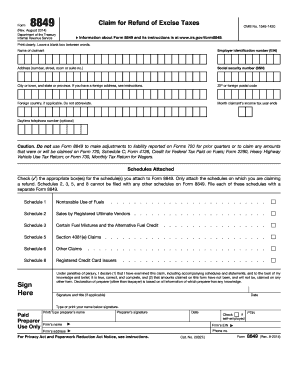

- Choose the appropriate IRS refund form, such as Form 1040 or Form 8849, depending on your tax situation.

- Fill out the form accurately, ensuring that all income, deductions, and credits are correctly reported.

- Review the completed form for any errors or omissions that could delay processing.

- Sign and date the form to validate your submission.

- Submit the form electronically or via mail, based on your preference and the form's requirements.

IRS Guidelines for Refunds

The IRS has established specific guidelines for processing refunds to ensure fairness and efficiency. These guidelines include:

- Filing deadlines: Taxpayers must file their returns by the due date to qualify for a refund.

- Refund processing time: Generally, refunds are issued within twenty-one days for electronically filed returns.

- Eligibility for refunds: Taxpayers must meet certain criteria, such as income thresholds and filing status, to receive a refund.

Required Documents for IRS Refunds

To successfully claim an IRS refund, taxpayers must provide specific documentation, including:

- W-2 forms from employers, detailing annual earnings and withheld taxes.

- 1099 forms for other income sources, such as freelance work or investments.

- Receipts for deductible expenses, which can help reduce taxable income.

- Any prior year tax returns, if applicable, to support claims for carryover credits.

Digital vs. Paper Version of IRS Refund Forms

Taxpayers have the option to submit IRS refund forms digitally or via paper. Each method has its advantages:

- Digital submission is generally faster, with quicker processing times and immediate confirmation.

- Paper submissions may take longer to process and require additional time for mailing.

- Digital forms often come with built-in error checks, reducing the likelihood of mistakes.

Eligibility Criteria for IRS Refunds

To qualify for an IRS refund, taxpayers must meet specific eligibility criteria, including:

- Having a valid Social Security number or Individual Taxpayer Identification Number.

- Filing a return for the tax year in question.

- Overpaying taxes through withholding or estimated tax payments.

- Meeting income limits for certain tax credits that may increase refund amounts.

Quick guide on how to complete 2014 taxes

Effortlessly Prepare Taxes on Any Device

Digital document management has become increasingly favored by both businesses and individuals. It offers an ideal eco-friendly substitute to traditional printed and signed papers, allowing you to access the required form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents promptly without delays. Handle Taxes on any device using airSlate SignNow’s Android or iOS apps and simplify any document-related task today.

How to Modify and eSign Taxes with Ease

- Locate Taxes and click Get Form to begin.

- Utilize the tools provided to fill out your form.

- Emphasize pertinent sections of your documents or conceal sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Generate your eSignature using the Sign tool, which takes seconds and holds the same legal significance as a conventional wet ink signature.

- Verify all the details and click the Done button to save your changes.

- Choose your preferred method to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns over lost or misfiled documents, cumbersome form navigation, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your choice. Modify and eSign Taxes and ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

How can airSlate SignNow help me with my IRS refund get process?

With airSlate SignNow, you can easily manage all your IRS documents within a secure platform. Our eSigning feature allows you to quickly sign any required forms for your IRS refund get process, ensuring you don't miss out on any opportunities.

-

What pricing options are available for airSlate SignNow?

airSlate SignNow offers a variety of pricing plans to cater to different business needs. Whether you are a small business or a large enterprise looking to streamline your IRS refund get process, you’ll find a plan that fits your budget.

-

What features does airSlate SignNow provide for my IRS refund get documentation?

Our platform offers advanced features like document tracking, templates for IRS forms, and automated workflows that simplify your IRS refund get documentation. These tools ensure that you have everything organized and ready for submission.

-

Is airSlate SignNow secure for handling IRS documents?

Yes, airSlate SignNow utilizes bank-level security measures to protect all your documents, including those related to your IRS refund get needs. Your data is encrypted and safely stored, giving you peace of mind.

-

Can I integrate airSlate SignNow with other applications for easier access to my IRS documents?

Absolutely! airSlate SignNow seamlessly integrates with various applications such as Google Drive, Dropbox, and more. This integration facilitates quick access to your IRS refund get documents without switching platforms.

-

How do I get started with airSlate SignNow for my IRS refund get tasks?

Getting started with airSlate SignNow is simple. Sign up for a free trial and explore our intuitive interface that guides you through the steps of eSigning and managing your IRS refund get documentation with ease.

-

Are there any mobile options available for airSlate SignNow when processing my IRS refund get?

Yes, airSlate SignNow offers a mobile application, allowing you to handle your IRS refund get processes on the go. You can sign, send, and manage your documents right from your smartphone or tablet.

Get more for Taxes

- Csub id form

- Participation liability form

- Consent amp liability waiver cocc form

- Email financialaiddocsfamu form

- To verify that you provided correct information the office of financial aid will compare your fafsa with the information on

- Request for off campus trips form

- What need to knowhttpswwwstueduportalslawdocsregistrarconsentforreleaseofpersonalinformationpdf

- Personal training client information packet

Find out other Taxes

- Electronic signature Michigan Email Cover Letter Template Free

- Electronic signature Delaware Termination Letter Template Now

- How Can I Electronic signature Washington Employee Performance Review Template

- Electronic signature Florida Independent Contractor Agreement Template Now

- Electronic signature Michigan Independent Contractor Agreement Template Now

- Electronic signature Oregon Independent Contractor Agreement Template Computer

- Electronic signature Texas Independent Contractor Agreement Template Later

- Electronic signature Florida Employee Referral Form Secure

- How To Electronic signature Florida CV Form Template

- Electronic signature Mississippi CV Form Template Easy

- Electronic signature Ohio CV Form Template Safe

- Electronic signature Nevada Employee Reference Request Mobile

- How To Electronic signature Washington Employee Reference Request

- Electronic signature New York Working Time Control Form Easy

- How To Electronic signature Kansas Software Development Proposal Template

- Electronic signature Utah Mobile App Design Proposal Template Fast

- Electronic signature Nevada Software Development Agreement Template Free

- Electronic signature New York Operating Agreement Safe

- How To eSignature Indiana Reseller Agreement

- Electronic signature Delaware Joint Venture Agreement Template Free