Tax Statement for Leased Motor Vehicle 2019-2026

What is the Tax Statement for Leased Motor Vehicle

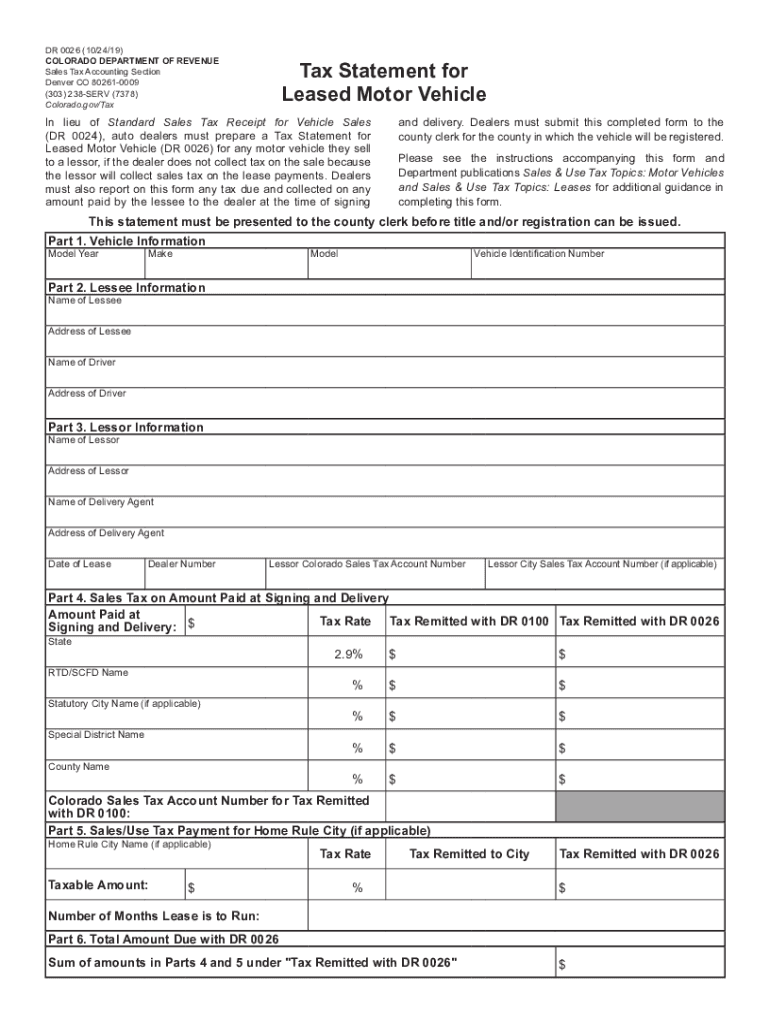

The Tax Statement for Leased Motor Vehicle, commonly referred to as the dr0026 form, is a document used to report the tax implications associated with leasing a vehicle. This form is essential for both individuals and businesses who lease vehicles, as it outlines the tax liabilities and deductions that may apply. Understanding this form is crucial for ensuring compliance with tax regulations and making informed financial decisions regarding leased vehicles.

How to Use the Tax Statement for Leased Motor Vehicle

Using the dr0026 form involves accurately completing the document to reflect the details of the leased vehicle. This includes entering information such as the lease terms, vehicle identification number (VIN), and the total amount of lease payments made during the tax year. Proper completion of the form ensures that the correct tax liabilities are reported, which can help in claiming deductions or credits associated with the lease.

Steps to Complete the Tax Statement for Leased Motor Vehicle

Completing the dr0026 form requires careful attention to detail. Follow these steps for accurate completion:

- Gather necessary information, including the lease agreement and payment records.

- Enter the vehicle's VIN and the total lease payments made during the tax year.

- Provide any additional information required, such as the lessor's details.

- Review the completed form for accuracy before submission.

Legal Use of the Tax Statement for Leased Motor Vehicle

The dr0026 form is legally recognized for reporting tax information related to leased vehicles. To ensure its legal validity, the form must be completed accurately and submitted according to IRS guidelines. Compliance with tax laws is essential, as inaccuracies can lead to penalties or audits.

Filing Deadlines / Important Dates

Timely filing of the dr0026 form is critical to avoid penalties. Generally, the form must be submitted by the tax filing deadline, which is typically April 15 for individual taxpayers. Businesses may have different deadlines based on their fiscal year. It is important to stay informed about any changes to these dates to ensure compliance.

Required Documents

When preparing to complete the dr0026 form, gather the following documents:

- The lease agreement for the vehicle.

- Records of all lease payments made during the tax year.

- Any relevant correspondence with the lessor.

Who Issues the Form

The dr0026 form is typically issued by the IRS. It is important to ensure that you are using the most current version of the form, as updates may occur. Always verify that you are accessing the correct documentation to avoid any compliance issues.

Quick guide on how to complete tax statement for leased motor vehicle

Complete Tax Statement For Leased Motor Vehicle effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal environmentally friendly substitute for traditional printed and signed documents, allowing you to locate the correct form and securely store it online. airSlate SignNow equips you with all the resources necessary to formulate, modify, and electronically sign your documents swiftly without delays. Manage Tax Statement For Leased Motor Vehicle on any platform through airSlate SignNow's Android or iOS applications and simplify any document-based process today.

The easiest way to modify and electronically sign Tax Statement For Leased Motor Vehicle effortlessly

- Locate Tax Statement For Leased Motor Vehicle and click Get Form to begin.

- Utilize the resources we offer to finish your document.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your electronic signature using the Sign tool, which takes mere seconds and holds the same legal significance as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your modifications.

- Select how you wish to send your form—via email, text message (SMS), an invitation link, or download it to your computer.

Forget the hassle of lost or misplaced documents, tedious form navigation, or mistakes that necessitate printing new copies. airSlate SignNow meets all your document management needs within a few clicks from any device you prefer. Modify and electronically sign Tax Statement For Leased Motor Vehicle and facilitate superior communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct tax statement for leased motor vehicle

Create this form in 5 minutes!

People also ask

-

What is dr0026 in relation to airSlate SignNow?

The term dr0026 refers to a specific feature or resource that enhances the document signing process on airSlate SignNow. It helps users streamline their workflows and improve efficiency when sending and eSigning documents.

-

How does pricing work for airSlate SignNow services?

AirSlate SignNow offers competitive pricing plans to suit various business needs. Depending on the features you select, such as dr0026, you can choose from individual, team, or enterprise plans that provide flexibility and value.

-

What key features does airSlate SignNow offer?

AirSlate SignNow provides a robust set of features including document templates, team collaboration, and mobile access. The dr0026 feature enhances the user experience by ensuring secure and effortless electronic signatures.

-

How can dr0026 benefit my business?

Implementing the dr0026 feature can signNowly reduce the time spent on document management and signing. It simplifies the process, allowing your team to focus on more important tasks, ultimately improving productivity.

-

Does airSlate SignNow support integrations with other platforms?

Yes, airSlate SignNow seamlessly integrates with a variety of platforms like Google Drive, Salesforce, and more. The integration capabilities, including the dr0026 feature, enhance its functionality, providing a comprehensive solution for users.

-

Is airSlate SignNow secure for handling sensitive documents?

Absolutely! AirSlate SignNow implements industry-leading security protocols, ensuring that all documents, including those utilized in the dr0026 feature, are protected. Your data's security and compliance are top priorities.

-

Can I try airSlate SignNow before committing to a plan?

Yes, airSlate SignNow offers a free trial that allows you to explore its features, including dr0026, without any commitment. This trial period is a great way to see how the service fits your business needs.

Get more for Tax Statement For Leased Motor Vehicle

- Bls 3023 form

- Annual refiling survey ars web reporting instructions form

- Complaint information form complaint information form

- Virginia workers compensation commission coal workers pneumoconiosis claim form virginia workers compensation commission coal

- Pneumoconiosis claim form

- Workers compensation insurance pennsylvania department form

- Sample enrollment agreement ohio state board of career form

- Erie county pistol permit application form

Find out other Tax Statement For Leased Motor Vehicle

- How To eSign New York Legal Form

- How Can I eSign North Carolina Non-Profit Document

- How To eSign Vermont Non-Profit Presentation

- How Do I eSign Hawaii Orthodontists PDF

- How Can I eSign Colorado Plumbing PDF

- Can I eSign Hawaii Plumbing PDF

- How Do I eSign Hawaii Plumbing Form

- Can I eSign Hawaii Plumbing Form

- How To eSign Hawaii Plumbing Word

- Help Me With eSign Hawaii Plumbing Document

- How To eSign Hawaii Plumbing Presentation

- How To eSign Maryland Plumbing Document

- How Do I eSign Mississippi Plumbing Word

- Can I eSign New Jersey Plumbing Form

- How Can I eSign Wisconsin Plumbing PPT

- Can I eSign Colorado Real Estate Form

- How To eSign Florida Real Estate Form

- Can I eSign Hawaii Real Estate Word

- How Do I eSign Hawaii Real Estate Word

- How To eSign Hawaii Real Estate Document