Ct 8822 Form

What is the Ct 8822

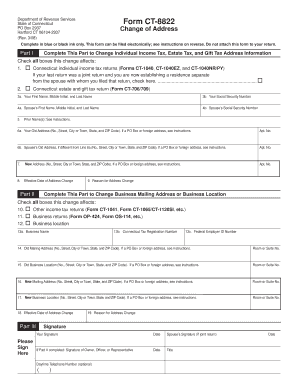

The Ct 8822 is a form used in Connecticut for individuals to notify the Department of Revenue Services (DRS) of a change of address. This form is essential for ensuring that taxpayers receive important correspondence and documentation related to their tax obligations. By completing the Ct 8822, individuals can update their records with the DRS, which helps maintain accurate tax information and facilitates proper communication regarding tax matters.

Steps to complete the Ct 8822

Completing the Ct 8822 involves several straightforward steps. First, gather the necessary personal information, including your name, Social Security number, and old and new addresses. Next, accurately fill out the form, ensuring that all details are correct. After completing the form, review it for any errors. Finally, submit the Ct 8822 either online, by mail, or in person at a designated location. Following these steps helps ensure that your address change is processed efficiently.

Legal use of the Ct 8822

The legal use of the Ct 8822 is crucial for maintaining compliance with state tax laws. This form serves as an official notification to the DRS, which is necessary for the accurate assessment of taxes and the delivery of tax-related documents. By using the Ct 8822, taxpayers fulfill their legal obligation to keep the state informed of their current address, thereby avoiding potential issues related to missed communications or penalties.

Form Submission Methods

The Ct 8822 can be submitted through various methods to accommodate different preferences. Taxpayers have the option to file the form online, which is often the quickest method for processing. Alternatively, the form can be mailed to the appropriate DRS address or submitted in person at a local DRS office. Each submission method has its advantages, and choosing the right one can help ensure timely updates to your address in the state’s records.

Required Documents

To complete the Ct 8822, certain documents may be required to verify your identity and address change. Typically, you will need to provide personal identification, such as your Social Security number, and proof of your new address, which could include a utility bill or lease agreement. Having these documents ready can streamline the process and help ensure that your form is processed without delays.

Filing Deadlines / Important Dates

It is important to be aware of any filing deadlines associated with the Ct 8822 to avoid complications. While there may not be a strict deadline for submitting the form, it is advisable to notify the DRS of your address change as soon as possible to ensure that you receive all relevant tax information. Keeping track of important tax dates and deadlines can help you stay compliant and avoid any potential issues with your tax filings.

Quick guide on how to complete ct 8822

Effortlessly Prepare Ct 8822 on Any Device

Online document management has become increasingly popular among businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to find the necessary form and securely store it online. airSlate SignNow equips you with all the tools you need to quickly create, modify, and eSign your documents without delays. Manage Ct 8822 on any platform with the airSlate SignNow apps for Android or iOS and simplify any document-related process today.

The Easiest Way to Edit and eSign Ct 8822 without Stress

- Find Ct 8822 and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight important sections of your documents or redact sensitive information using tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to secure your modifications.

- Select your preferred method for sharing your form: via email, text message (SMS), an invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that require printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Edit and eSign Ct 8822 to ensure excellent communication at every stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is CT 8822 and how does it relate to airSlate SignNow?

CT 8822 is a form used for tax purposes, and airSlate SignNow helps you eSign and manage such documents easily. With airSlate SignNow, you can quickly fill out and send CT 8822 forms securely, ensuring compliance and accuracy in your tax filings.

-

How much does airSlate SignNow cost for users completing the CT 8822?

airSlate SignNow offers competitive pricing plans that cater to various business needs, including those who need to manage CT 8822 forms. You can choose from monthly or annual subscriptions that provide great value for your eSigning needs, including unlimited document sends.

-

What features does airSlate SignNow offer for handling CT 8822?

airSlate SignNow includes robust features for completing CT 8822 forms, such as an intuitive drag-and-drop interface, templates, and the ability to add custom fields. These features streamline the signing process and enhance document management effectiveness.

-

Can airSlate SignNow integrate with other software for processing the CT 8822?

Yes, airSlate SignNow integrates with a variety of software applications, making it easy to handle CT 8822 forms in your existing workflows. Popular integrations include Google Workspace, Salesforce, and other productivity tools that enhance the efficiency of your document management.

-

Is airSlate SignNow secure for signing sensitive documents like CT 8822?

Absolutely! airSlate SignNow takes security seriously, employing robust encryption and secure cloud storage to protect your CT 8822 forms and personal information. This ensures that your sensitive documents are safe from unauthorized access.

-

What are the benefits of eSigning CT 8822 forms with airSlate SignNow?

Using airSlate SignNow for eSigning CT 8822 forms offers numerous benefits such as faster turnaround times and reduced paper waste. Additionally, the ability to track document status in real-time allows for greater efficiency and peace of mind.

-

Can I use airSlate SignNow on mobile devices for signing CT 8822?

Yes, airSlate SignNow offers a mobile-friendly platform that allows you to sign CT 8822 forms on the go. This feature is particularly useful for busy professionals who need to manage documents efficiently from their smartphones or tablets.

Get more for Ct 8822

- Reunification services terminated twelve month permanency form

- 125 printable temporary guardianship agreement forms and

- This worksheet may be used to collect the information to be reported on the certificate of divorce or annulment or through the

- Motion for use and occupancy payments and objection form

- Jd ac 8 rev form

- Fw 003 gc order on court fee waiver judicial council forms

- Fillable online courts ca order on court fee waiver after form

- Personal data sheet new hampshire judicial branch fill form

Find out other Ct 8822

- Can I Electronic signature South Dakota Engineering Proposal Template

- How Do I Electronic signature Arizona Proforma Invoice Template

- Electronic signature California Proforma Invoice Template Now

- Electronic signature New York Equipment Purchase Proposal Now

- How Do I Electronic signature New York Proforma Invoice Template

- How Can I Electronic signature Oklahoma Equipment Purchase Proposal

- Can I Electronic signature New Jersey Agreement

- How To Electronic signature Wisconsin Agreement

- Electronic signature Tennessee Agreement contract template Mobile

- How To Electronic signature Florida Basic rental agreement or residential lease

- Electronic signature California Business partnership agreement Myself

- Electronic signature Wisconsin Business associate agreement Computer

- eSignature Colorado Deed of Indemnity Template Safe

- Electronic signature New Mexico Credit agreement Mobile

- Help Me With Electronic signature New Mexico Credit agreement

- How Do I eSignature Maryland Articles of Incorporation Template

- How Do I eSignature Nevada Articles of Incorporation Template

- How Do I eSignature New Mexico Articles of Incorporation Template

- How To Electronic signature Georgia Home lease agreement

- Can I Electronic signature South Carolina Home lease agreement