ST556 R, Resale and Rolling Stock Fleet Exemption Schedule Resale and Rolling Stock Fleet Exemption Schedule Form

What is the ST 556 R, Resale and Rolling Stock Fleet Exemption Schedule?

The ST 556 R, also known as the Resale and Rolling Stock Fleet Exemption Schedule, is a specific form used in the United States that allows businesses to claim exemptions on certain sales tax for rolling stock and related items. This form is particularly relevant for companies involved in the transportation sector or those that frequently purchase rolling stock for their operations. By utilizing this form, eligible businesses can streamline their tax obligations and ensure compliance with state regulations regarding resale and fleet exemptions.

How to Use the ST 556 R, Resale and Rolling Stock Fleet Exemption Schedule

Using the ST 556 R requires a clear understanding of your business's eligibility and the specific items that qualify for exemption. To use the form effectively, businesses should first verify their eligibility based on state-specific guidelines. Once confirmed, the next step involves accurately filling out the form with details about the items being purchased, including their descriptions and intended use. After completing the form, it should be presented to the seller at the time of purchase to ensure that the sales tax exemption is applied correctly.

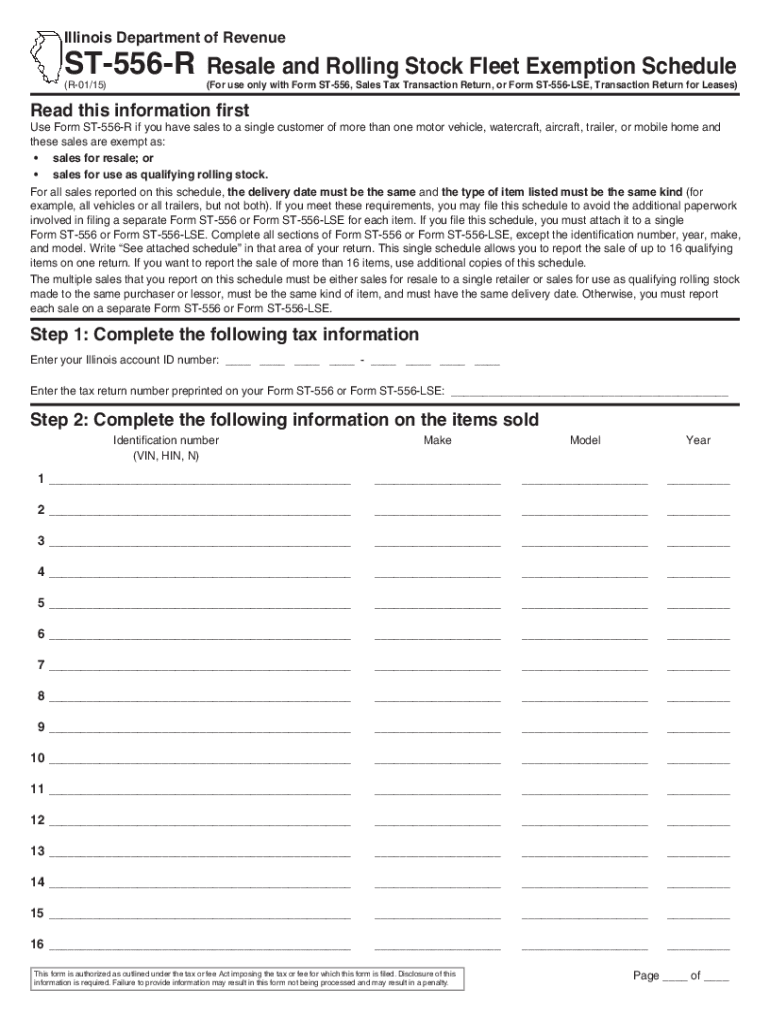

Steps to Complete the ST 556 R, Resale and Rolling Stock Fleet Exemption Schedule

Completing the ST 556 R involves several important steps. First, gather all necessary information about your business and the items for which you are claiming an exemption. This includes your business name, address, and tax identification number. Next, list the items being purchased, providing clear descriptions and quantities. After filling out the form, review it carefully to ensure all information is accurate. Finally, submit the completed form to the seller to validate the tax exemption during the transaction.

Legal Use of the ST 556 R, Resale and Rolling Stock Fleet Exemption Schedule

The legal use of the ST 556 R is governed by state tax laws, which outline the specific criteria that must be met for the exemption to be valid. It is crucial for businesses to understand these regulations to avoid potential penalties. The form must be used only for qualifying purchases, and providing false information can lead to legal repercussions. Ensuring compliance with all relevant laws protects both the business and the seller involved in the transaction.

Key Elements of the ST 556 R, Resale and Rolling Stock Fleet Exemption Schedule

Several key elements are essential when dealing with the ST 556 R. These include the business's tax identification number, a detailed description of the items being purchased, and the intended use of these items. Additionally, the form must be signed by an authorized representative of the business to validate the exemption claim. Each of these components is critical for ensuring that the form is accepted by sellers and complies with state tax regulations.

State-Specific Rules for the ST 556 R, Resale and Rolling Stock Fleet Exemption Schedule

State-specific rules play a significant role in the application of the ST 556 R. Each state may have different criteria for what qualifies as rolling stock and the types of exemptions available. Businesses should consult their state’s tax authority or official resources to understand the specific regulations that apply to their situation. This ensures that they are correctly utilizing the form and adhering to all legal requirements.

Quick guide on how to complete st556 r resale and rolling stock fleet exemption schedule resale and rolling stock fleet exemption schedule

Effortlessly create ST556 R, Resale And Rolling Stock Fleet Exemption Schedule Resale And Rolling Stock Fleet Exemption Schedule on any device

Digital document management has gained traction among companies and individuals alike. It serves as an ideal environmentally friendly substitute for traditional printed and signed documents, allowing you to obtain the correct format and securely store it online. airSlate SignNow provides you with all the tools necessary to generate, modify, and electronically sign your documents quickly without any hold-ups. Handle ST556 R, Resale And Rolling Stock Fleet Exemption Schedule Resale And Rolling Stock Fleet Exemption Schedule on any device with airSlate SignNow's Android or iOS applications and simplify any document-related process today.

The most effective method to alter and electronically sign ST556 R, Resale And Rolling Stock Fleet Exemption Schedule Resale And Rolling Stock Fleet Exemption Schedule effortlessly

- Find ST556 R, Resale And Rolling Stock Fleet Exemption Schedule Resale And Rolling Stock Fleet Exemption Schedule and then click Get Form to initiate.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all entries and then click the Done button to save your changes.

- Choose your preferred method for sending your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate the hassle of lost or misplaced files, tedious form hunting, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and electronically sign ST556 R, Resale And Rolling Stock Fleet Exemption Schedule Resale And Rolling Stock Fleet Exemption Schedule and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the st 556 r feature in airSlate SignNow?

The st 556 r feature in airSlate SignNow allows users to easily sign and manage documents online. This feature streamlines the document signing process, making it efficient and user-friendly for both individuals and businesses.

-

How much does airSlate SignNow with st 556 r cost?

airSlate SignNow offers competitive pricing for its solutions, including the st 556 r feature. Various plans are available to fit different business sizes and needs, ensuring that you can find a cost-effective solution that meets your requirements.

-

What benefits does using the st 556 r provide?

The st 556 r feature offers numerous benefits, including enhanced security, faster turnaround times for document signing, and improved workflow efficiency. By using airSlate SignNow, businesses can signNowly reduce the time and resources spent on manual document handling.

-

Can I integrate st 556 r with other software?

Yes, airSlate SignNow with the st 556 r feature can be integrated with popular tools like Salesforce, Google Drive, and Microsoft Office. This integration allows for a seamless flow of information, enhancing productivity and ensuring all your documents are easily accessible.

-

Is the st 556 r feature easy to use?

Absolutely! The st 556 r feature in airSlate SignNow is designed for ease of use, even for those who may not be tech-savvy. The intuitive interface allows users to navigate through the document signing process effortlessly.

-

How secure is the st 556 r feature?

The st 556 r feature is built with top-notch security measures to protect sensitive documents. airSlate SignNow utilizes encryption and secure protocols to ensure that all signed documents remain confidential and secure throughout the process.

-

What types of documents can I sign using st 556 r?

You can use the st 556 r feature in airSlate SignNow to sign a wide variety of documents, including contracts, agreements, and forms. The flexibility of this tool makes it ideal for both personal and business-related document needs.

Get more for ST556 R, Resale And Rolling Stock Fleet Exemption Schedule Resale And Rolling Stock Fleet Exemption Schedule

- Hud community service exemption form

- Live in caregiver program mandatory employment contract live in caregiver program mandatory employment contract schedual i form

- Supporting high school completion a tool kit for success form

- Medical history statement escambia county board of county commissioners 12985 754403pdf gr 80382 form

- Craig cohen saint louis missouriprofessional profile form

- Equi vest strategiessm form

- Equi vest equi vest express equi vest axa equitable form

- Neuron cigna reimbursement form

Find out other ST556 R, Resale And Rolling Stock Fleet Exemption Schedule Resale And Rolling Stock Fleet Exemption Schedule

- How Can I Sign California Lawers Lease Agreement

- Sign Colorado Lawers Operating Agreement Later

- Sign Connecticut Lawers Limited Power Of Attorney Online

- Sign Hawaii Lawers Cease And Desist Letter Easy

- Sign Kansas Insurance Rental Lease Agreement Mobile

- Sign Kansas Insurance Rental Lease Agreement Free

- Sign Kansas Insurance Rental Lease Agreement Fast

- Sign Kansas Insurance Rental Lease Agreement Safe

- How To Sign Kansas Insurance Rental Lease Agreement

- How Can I Sign Kansas Lawers Promissory Note Template

- Sign Kentucky Lawers Living Will Free

- Sign Kentucky Lawers LLC Operating Agreement Mobile

- Sign Louisiana Lawers Quitclaim Deed Now

- Sign Massachusetts Lawers Quitclaim Deed Later

- Sign Michigan Lawers Rental Application Easy

- Sign Maine Insurance Quitclaim Deed Free

- Sign Montana Lawers LLC Operating Agreement Free

- Sign Montana Lawers LLC Operating Agreement Fast

- Can I Sign Nevada Lawers Letter Of Intent

- Sign Minnesota Insurance Residential Lease Agreement Fast