St556 Form

What is the St556 Form

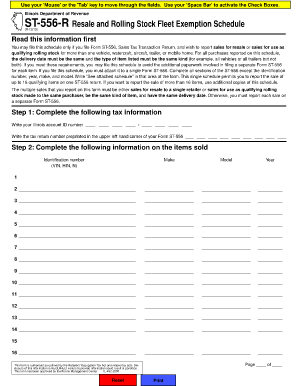

The St556 form, also known as the Illinois Department of Revenue Official Form St 556, is a tax-related document used primarily for the exemption from sales tax on specific purchases. This form is essential for individuals and businesses who qualify for sales tax exemptions in Illinois. Understanding the purpose and requirements of the St556 form is crucial for ensuring compliance with state tax regulations.

How to Use the St556 Form

Using the St556 form involves several steps to ensure that it is filled out correctly and submitted properly. First, identify the specific exemption you are claiming. Next, complete the form with accurate information, including your name, address, and the details of the purchase. It is important to provide any required documentation that supports your exemption claim. Once completed, submit the form to the appropriate vendor or retailer to validate your tax-exempt status.

Steps to Complete the St556 Form

Completing the St556 form requires careful attention to detail. Follow these steps:

- Download the St556 form from a reliable source.

- Fill in your personal information, including your name and address.

- Specify the type of exemption you are claiming.

- Provide details about the purchase, including the date and description of the items.

- Sign and date the form to certify that the information is accurate.

After completing these steps, ensure that you keep a copy for your records and submit the original to the vendor.

Legal Use of the St556 Form

The St556 form is legally binding when filled out correctly and used for its intended purpose. It must comply with the Illinois Department of Revenue regulations to be considered valid. Misuse of the form, such as claiming exemptions without proper eligibility, can lead to penalties and fines. Therefore, it is important to understand the legal implications and ensure that all claims are legitimate.

Required Documents

When submitting the St556 form, certain documents may be required to support your exemption claim. These may include:

- Proof of tax-exempt status, such as a certificate or letter from the Illinois Department of Revenue.

- Invoices or receipts related to the purchase in question.

- Any additional documentation that verifies your eligibility for the exemption.

Having these documents ready will facilitate a smoother submission process and help avoid delays.

Form Submission Methods

The St556 form can be submitted through various methods, depending on the vendor's requirements. Common submission methods include:

- In-person delivery at the point of sale.

- Mailing the completed form to the vendor.

- Submitting electronically if the vendor accepts digital forms.

It is advisable to confirm the preferred submission method with the vendor to ensure compliance.

Quick guide on how to complete st556 form

Accomplish St556 Form effortlessly on any gadget

Web-based document organization has become increasingly popular among businesses and individuals. It serves as an ideal environmentally friendly alternative to conventional printed and signed documents, as you can easily locate the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents quickly without delays. Manage St556 Form on any gadget with airSlate SignNow Android or iOS applications and enhance any document-centered operation today.

The simplest way to modify and eSign St556 Form without hassle

- Locate St556 Form and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize pertinent sections of your documents or obscure sensitive data with tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature using the Sign tool, which takes only seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from a device of your choice. Modify and eSign St556 Form to ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the ST 556 form PDF and why is it needed?

The ST 556 form PDF is a document used in the state of Illinois for the collection of sales tax on certain transactions. It is essential for businesses to accurately complete this form to ensure compliance with tax regulations and avoid penalties.

-

How can I fill out the ST 556 form PDF using airSlate SignNow?

You can easily fill out the ST 556 form PDF using airSlate SignNow's intuitive document editor. Simply upload the PDF, add the necessary fields for signatures and data entry, and then share it with necessary parties for signing and submission.

-

Is there a cost associated with using airSlate SignNow for the ST 556 form PDF?

airSlate SignNow offers a range of pricing plans that cater to various business needs, including options for those who need to regularly complete ST 556 form PDFs. Pricing is competitive and provides excellent value for the comprehensive features offered.

-

What features does airSlate SignNow offer for managing the ST 556 form PDF?

airSlate SignNow provides features such as customizable templates, secure eSigning, document tracking, and integration capabilities that make managing the ST 556 form PDF efficient. These tools enhance productivity and streamline the entire document workflow.

-

Can I integrate airSlate SignNow with my existing tools for ST 556 form PDF handling?

Yes, airSlate SignNow offers integration capabilities with popular platforms such as Google Drive, Dropbox, and various CRM systems. This ensures that you can seamlessly manage your ST 556 form PDF alongside other business tools.

-

What are the benefits of using airSlate SignNow for the ST 556 form PDF?

Using airSlate SignNow for the ST 556 form PDF simplifies the process of document signing and management. You benefit from enhanced security, reduced turnaround times, and the ability to store and share documents easily, all of which improve overall efficiency.

-

Is it safe to store ST 556 form PDFs in airSlate SignNow?

Absolutely! airSlate SignNow prioritizes security, implementing top-notch encryption protocols for storing ST 556 form PDFs. This protects your sensitive information from unauthorized access while ensuring compliance with legal standards.

Get more for St556 Form

- Adap residency verification affidavit cdph 8727 form

- Form csfa 03 01 form csfa 03 01

- Charter school facilities program application california school finance authority charter school facilities program application form

- Financial statement de 926b rev 18 7 19 form

- Financial statement de 926b edd ca form

- State department of education administration of medication form

- Medicare select enrollment application quartz form

- Es 935 maryland form

Find out other St556 Form

- Can I Electronic signature Hawaii Insurance PDF

- Help Me With Electronic signature Colorado High Tech Form

- How To Electronic signature Indiana Insurance Document

- Can I Electronic signature Virginia Education Word

- How To Electronic signature Louisiana Insurance Document

- Can I Electronic signature Florida High Tech Document

- Can I Electronic signature Minnesota Insurance PDF

- How Do I Electronic signature Minnesota Insurance Document

- How To Electronic signature Missouri Insurance Form

- How Can I Electronic signature New Jersey Insurance Document

- How To Electronic signature Indiana High Tech Document

- How Do I Electronic signature Indiana High Tech Document

- How Can I Electronic signature Ohio Insurance Document

- Can I Electronic signature South Dakota Insurance PPT

- How Can I Electronic signature Maine Lawers PPT

- How To Electronic signature Maine Lawers PPT

- Help Me With Electronic signature Minnesota Lawers PDF

- How To Electronic signature Ohio High Tech Presentation

- How Can I Electronic signature Alabama Legal PDF

- How To Electronic signature Alaska Legal Document