Kentucky Form 740 EZ Kentucky Simple Individual Income

What is the Kentucky Form 740 EZ?

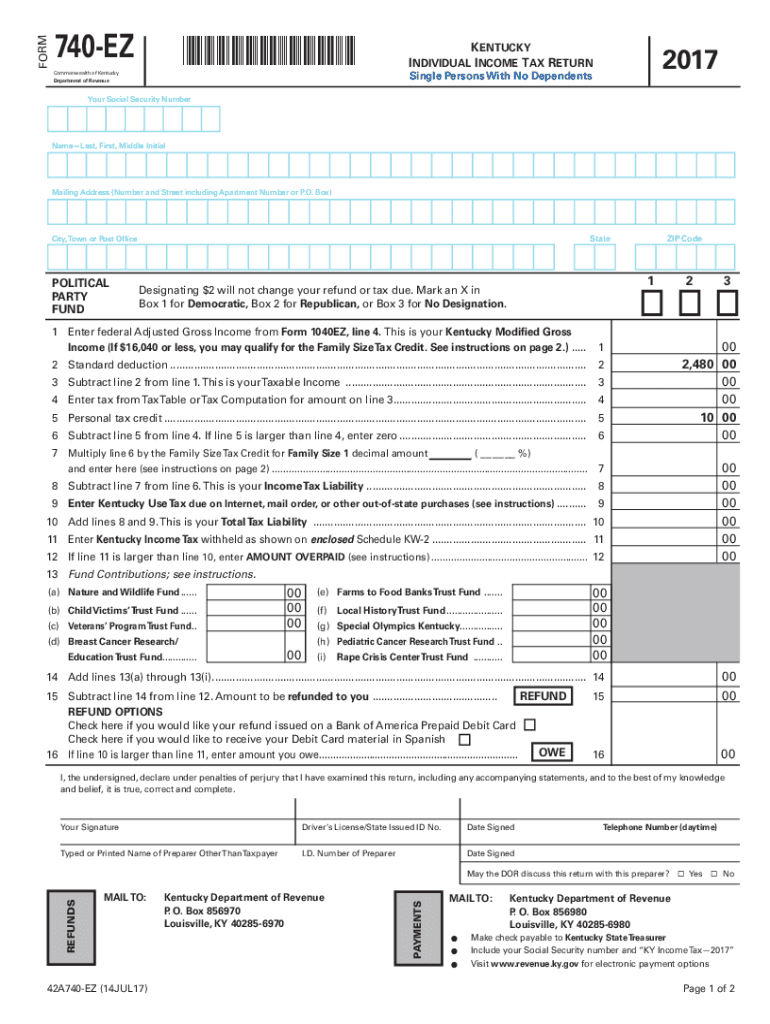

The Kentucky Form 740 EZ is a simplified version of the Kentucky individual income tax return, designed for eligible taxpayers with straightforward financial situations. This form allows individuals to report their income, claim deductions, and calculate their tax liability efficiently. It is specifically intended for those whose income is below a certain threshold and who do not have complex tax situations, such as multiple sources of income or extensive deductions.

How to use the Kentucky Form 740 EZ

Using the Kentucky Form 740 EZ involves several straightforward steps. First, gather all necessary financial documents, including W-2 forms and any other income statements. Next, fill out the form with your personal information, including your name, address, and Social Security number. Report your total income, and then apply any applicable deductions. The form will guide you through the calculation of your tax owed or refund due. Finally, ensure that you sign and date the form before submission.

Steps to complete the Kentucky Form 740 EZ

Completing the Kentucky Form 740 EZ requires careful attention to detail. Follow these steps for accurate filing:

- Gather necessary documents, including W-2 forms and any other income records.

- Input your personal information in the designated sections of the form.

- Report your total income from all sources accurately.

- Apply any deductions you may qualify for, such as personal exemptions.

- Calculate your total tax liability using the provided tables or formulas.

- Review the form for accuracy, ensuring all information is complete.

- Sign and date the form before submitting it to the appropriate state agency.

Key elements of the Kentucky Form 740 EZ

The Kentucky Form 740 EZ includes several key elements that are essential for accurate tax reporting. These elements consist of personal identification information, income reporting sections, and deduction claims. The form also features a calculation area for determining tax owed or refunds due. Understanding these components is crucial for ensuring compliance with state tax laws and for maximizing potential refunds.

Filing Deadlines / Important Dates

Filing deadlines for the Kentucky Form 740 EZ are crucial for avoiding penalties. Typically, the form must be submitted by April fifteenth of the year following the tax year. For the 2017 tax year, this means the form should have been filed by April fifteenth, 2018. If you require an extension, it is essential to file the appropriate forms before the original deadline to avoid late fees.

Form Submission Methods

The Kentucky Form 740 EZ can be submitted through various methods to accommodate different preferences. Taxpayers can file the form online through the Kentucky Department of Revenue’s e-filing system, which offers a secure and efficient way to submit tax returns. Alternatively, individuals may choose to mail the completed form to the designated address provided by the state. In-person submissions are also accepted at local tax offices, providing another option for taxpayers who prefer direct interaction.

Quick guide on how to complete kentucky form 740 ez kentucky simple individual income

Effortlessly Prepare Kentucky Form 740 EZ Kentucky Simple Individual Income on Any Device

Digital document management has become increasingly popular among businesses and individuals. It offers a superb environmentally friendly option to conventional printed and signed paperwork, as you can easily locate the right form and securely save it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly without any holdups. Manage Kentucky Form 740 EZ Kentucky Simple Individual Income on any device with airSlate SignNow’s Android or iOS applications and enhance any document-focused task today.

The Easiest Way to Modify and eSign Kentucky Form 740 EZ Kentucky Simple Individual Income with Ease

- Find Kentucky Form 740 EZ Kentucky Simple Individual Income and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Mark important sections of the documents or obscure sensitive information using tools specifically designed for that by airSlate SignNow.

- Generate your eSignature with the Sign tool, which takes just seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the details and click the Done button to save your changes.

- Select how you want to send your form, either via email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form navigation, or errors that necessitate reprinting new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Modify and eSign Kentucky Form 740 EZ Kentucky Simple Individual Income and ensure clear communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the 2017 ky tax form?

The 2017 ky tax form is a tax document used by Kentucky residents to report their income and calculate their state taxes for the year 2017. It includes various sections for income, deductions, and credits. Properly completing this form is essential for accurate tax filing.

-

How can airSlate SignNow help with the 2017 ky tax form?

airSlate SignNow allows you to easily eSign and send the 2017 ky tax form electronically. This solution simplifies the signing process, making it quick and efficient, which is especially beneficial during the busy tax season. You can save time and ensure your documents are securely signed.

-

Is airSlate SignNow cost-effective for managing the 2017 ky tax form?

Yes, airSlate SignNow offers competitive pricing that makes it a cost-effective solution for managing the 2017 ky tax form. Affordable plans cater to both individuals and businesses, helping you keep your costs down while ensuring a seamless signing experience. This budget-friendly option is ideal for any taxpayer.

-

Can I integrate airSlate SignNow with accounting software for the 2017 ky tax form?

Absolutely! airSlate SignNow integrates seamlessly with various accounting software, allowing you to handle the 2017 ky tax form with ease. This integration simplifies document management and ensures your tax records are up-to-date and easily accessible.

-

What features does airSlate SignNow provide for the 2017 ky tax form?

With airSlate SignNow, you get features such as customizable templates, secure eSigning, and document tracking specifically for the 2017 ky tax form. These features enhance your workflow, making it easier to manage tax documents efficiently and securely.

-

Is it safe to eSign the 2017 ky tax form with airSlate SignNow?

Yes, airSlate SignNow prioritizes security, providing a safe environment to eSign the 2017 ky tax form. Your documents are encrypted, ensuring confidentiality and compliance with regulations. You can eSign with confidence, knowing your tax information is protected.

-

Can I save my completed 2017 ky tax form in airSlate SignNow?

Yes, you can save your completed 2017 ky tax form in airSlate SignNow for easy access and future reference. The platform allows you to store and manage documents securely, ensuring you can retrieve them whenever needed, especially during tax filing seasons.

Get more for Kentucky Form 740 EZ Kentucky Simple Individual Income

- Dala instructional employee application form

- Az1 to az70 websiiteincome tax in indiabioinformatics

- Gateway resilience fund offers grants for downtown st form

- Applicationbatch number form

- Dc beekeepers waiver revised dickinson college form

- Fillable online hometown veterinary clinic fax email print form

- Exam forms for mils crushing plant for sale in qatar

- Employee application small group dhmo rogers benefit group form

Find out other Kentucky Form 740 EZ Kentucky Simple Individual Income

- eSign Utah Plumbing Notice To Quit Secure

- eSign Alabama Real Estate Quitclaim Deed Mobile

- eSign Alabama Real Estate Affidavit Of Heirship Simple

- eSign California Real Estate Business Plan Template Free

- How Can I eSign Arkansas Real Estate Promissory Note Template

- eSign Connecticut Real Estate LLC Operating Agreement Later

- eSign Connecticut Real Estate LLC Operating Agreement Free

- eSign Real Estate Document Florida Online

- eSign Delaware Real Estate Quitclaim Deed Easy

- eSign Hawaii Real Estate Agreement Online

- Help Me With eSign Hawaii Real Estate Letter Of Intent

- eSign Florida Real Estate Residential Lease Agreement Simple

- eSign Florida Real Estate Limited Power Of Attorney Online

- eSign Hawaii Sports RFP Safe

- eSign Hawaii Sports Warranty Deed Myself

- eSign Louisiana Real Estate Last Will And Testament Easy

- eSign Louisiana Real Estate Work Order Now

- eSign Maine Real Estate LLC Operating Agreement Simple

- eSign Maine Real Estate Memorandum Of Understanding Mobile

- How To eSign Michigan Real Estate Business Plan Template