Form 740

What is the Form 740

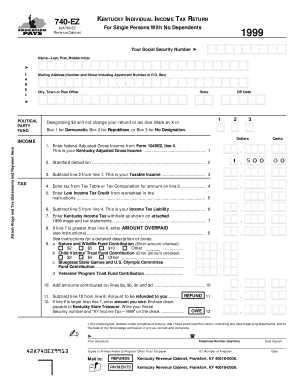

The Form 740 is a state income tax return used by residents of Kentucky to report their income and calculate their tax liability. This form is essential for individuals who earn income within the state, as it helps determine the amount of tax owed or any refund due. The 740 tax form is designed to capture various sources of income, deductions, and credits that may apply to the taxpayer's situation. Understanding this form is crucial for compliance with state tax laws and for ensuring accurate reporting of financial information.

Steps to complete the Form 740

Completing the Form 740 involves several key steps to ensure accuracy and compliance. Here’s a streamlined process:

- Gather necessary documents, including W-2s, 1099s, and any other income statements.

- Determine your filing status, which may include options such as single, married filing jointly, or head of household.

- Fill out personal information, including your name, address, and Social Security number.

- Report all sources of income, ensuring to include wages, dividends, and any additional earnings.

- Claim applicable deductions and credits to reduce your taxable income.

- Calculate your total tax liability using the provided tax tables or software.

- Review your completed form for accuracy before submission.

How to obtain the Form 740

The Form 740 can be obtained from the Kentucky Department of Revenue's website or by visiting local tax offices. It is available in both printable and digital formats, allowing taxpayers to choose their preferred method of completion. Additionally, many tax preparation software programs include the Form 740, making it easier for individuals to fill it out electronically. For those who prefer a physical copy, it can be printed directly from the website or requested through mail.

Legal use of the Form 740

The Form 740 is legally binding when completed and submitted according to Kentucky state tax laws. To ensure its legal validity, taxpayers must provide accurate information and sign the form. Filing the form electronically through a compliant platform can enhance its legal standing, as eSignatures are recognized under the ESIGN Act and UETA. It is important to maintain records of the submitted form and any supporting documents for future reference or potential audits.

Filing Deadlines / Important Dates

Taxpayers should be aware of key deadlines associated with the Form 740 to avoid penalties. Typically, the filing deadline for the Form 740 is April 15 of each year, coinciding with the federal tax return deadline. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. It is advisable to file the form as early as possible to ensure timely processing and to avoid any last-minute issues.

Required Documents

To complete the Form 740 accurately, several documents are required. These include:

- W-2 forms from employers detailing annual earnings.

- 1099 forms for any freelance or contract work.

- Documentation for any additional income sources, such as rental income or dividends.

- Records of deductions, such as mortgage interest statements or educational expenses.

- Previous year’s tax return for reference.

Form Submission Methods (Online / Mail / In-Person)

Taxpayers have multiple options for submitting the Form 740. The form can be filed online through the Kentucky Department of Revenue's e-filing system, which is often the fastest method. Alternatively, individuals can mail their completed forms to the appropriate tax office or submit them in person at local revenue offices. Each method has its advantages, with online filing typically providing quicker processing times and immediate confirmation of receipt.

Quick guide on how to complete form 740 6168257

Complete Form 740 effortlessly on any device

Managing documents online has become favored by companies and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can locate the appropriate form and securely save it online. airSlate SignNow provides you with all the resources you need to create, modify, and electronically sign your documents quickly without delays. Handle Form 740 on any device through airSlate SignNow Android or iOS applications and streamline any document-related process today.

The simplest way to modify and electronically sign Form 740 effortlessly

- Obtain Form 740 and then click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize pertinent sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for this purpose.

- Generate your signature using the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your changes.

- Choose how you wish to share your form—via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow takes care of your needs in document management in just a few clicks from your chosen device. Modify and electronically sign Form 740 and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the form 740 tax filer household information?

The form 740 tax filer household information is a tax document that collects essential details about a taxpayer's household. It allows the IRS to assess eligibility for various tax credits and deductions. Accurate reporting of this information helps ensure compliance and can optimize your tax filings.

-

How can airSlate SignNow assist with form 740 tax filer household information?

airSlate SignNow provides tools to streamline the process of collecting form 740 tax filer household information. Our eSigning features make it easy for you to gather signatures and share documents securely. This ensures that your household information is collected accurately and efficiently.

-

Is there a cost associated with using airSlate SignNow for form 740 tax filer household information?

airSlate SignNow offers a variety of pricing plans designed to fit different needs and budgets. For those looking to handle form 740 tax filer household information effectively, our plans are both cost-effective and customizable. This means you can choose a plan that suits your volume of document handling without breaking the bank.

-

What features does airSlate SignNow offer for managing document workflows, including form 740 tax filer household information?

With airSlate SignNow, you gain access to advanced features such as templates, automated reminders, and customizable workflows. These features facilitate the smooth handling of form 740 tax filer household information, ensuring that documents signNow the right parties quickly and efficiently. Additionally, our platform offers secure cloud storage for all your important documents.

-

Can I integrate airSlate SignNow with other software for managing form 740 tax filer household information?

Yes, airSlate SignNow integrates seamlessly with numerous third-party applications, which enhances your ability to manage form 740 tax filer household information. This includes popular accounting and tax software, enabling a smoother workflow. By integrating these tools, you can reduce manual data entry and improve accuracy.

-

How does airSlate SignNow ensure the security of my form 740 tax filer household information?

airSlate SignNow prioritizes your data security, employing robust encryption protocols and secure servers to protect your form 740 tax filer household information. We comply with industry standards to ensure that your documents remain confidential and safe from unauthorized access. Your peace of mind is our top priority.

-

Can airSlate SignNow help with the organization of form 740 tax filer household information during tax season?

Absolutely! airSlate SignNow offers tools that help you organize and categorize your form 740 tax filer household information effectively. By using our platform, you can keep track of submissions, responses, and deadlines, making the tax season much less stressful. Efficient organization translates to a smoother filing process.

Get more for Form 740

Find out other Form 740

- Electronic signature New Jersey Rental Invoice Template Computer

- Electronic signature Utah Rental Invoice Template Online

- Electronic signature Louisiana Commercial Lease Agreement Template Free

- eSignature Delaware Sales Invoice Template Free

- Help Me With eSignature Oregon Sales Invoice Template

- How Can I eSignature Oregon Sales Invoice Template

- eSignature Pennsylvania Sales Invoice Template Online

- eSignature Pennsylvania Sales Invoice Template Free

- eSignature Pennsylvania Sales Invoice Template Secure

- Electronic signature California Sublease Agreement Template Myself

- Can I Electronic signature Florida Sublease Agreement Template

- How Can I Electronic signature Tennessee Sublease Agreement Template

- Electronic signature Maryland Roommate Rental Agreement Template Later

- Electronic signature Utah Storage Rental Agreement Easy

- Electronic signature Washington Home office rental agreement Simple

- Electronic signature Michigan Email Cover Letter Template Free

- Electronic signature Delaware Termination Letter Template Now

- How Can I Electronic signature Washington Employee Performance Review Template

- Electronic signature Florida Independent Contractor Agreement Template Now

- Electronic signature Michigan Independent Contractor Agreement Template Now