Ma M4506 Form

What is the Ma M4506

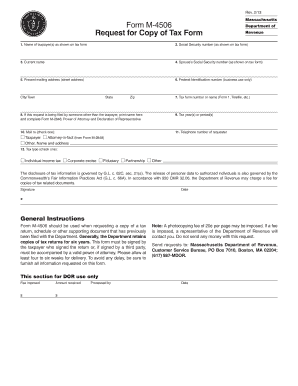

The Ma M4506 form is a request for a copy of a tax return that individuals or businesses have filed with the Internal Revenue Service (IRS). This form is particularly useful for those who need to obtain their tax records for various reasons, such as applying for loans, verifying income, or resolving tax issues. The Ma M4506 allows taxpayers to request transcripts or copies of their previously filed federal tax returns, ensuring they have access to important financial information when needed.

How to use the Ma M4506

Using the Ma M4506 form involves a straightforward process. Taxpayers must fill out the form with their personal information, including name, address, and Social Security number. Additionally, they need to specify the tax years for which they are requesting copies. Once completed, the form can be submitted to the IRS either online or by mail, depending on the taxpayer's preference. It is essential to ensure that all information is accurate to avoid delays in processing the request.

Steps to complete the Ma M4506

Completing the Ma M4506 form requires careful attention to detail. Here are the steps to follow:

- Download the Ma M4506 form from the IRS website.

- Provide your personal information, including your full name, address, and Social Security number.

- Indicate the specific tax years for which you are requesting copies of your returns.

- Choose whether you want a copy of the tax return or a tax return transcript.

- Sign and date the form to certify the request.

- Submit the completed form to the IRS via the preferred method: online or by mail.

Legal use of the Ma M4506

The Ma M4506 form is legally recognized as a valid request for tax documents. When completed correctly, it complies with IRS regulations and ensures that taxpayers can obtain their records for legitimate purposes. This form is essential for maintaining accurate financial records and can be used in various legal and financial contexts, such as loan applications or audits. Understanding the legal implications of using the Ma M4506 helps ensure that taxpayers are protected and informed throughout the process.

Required Documents

When submitting the Ma M4506 form, certain documents may be required to verify your identity and support your request. Typically, you will need:

- A valid form of identification, such as a driver's license or passport.

- Any previous tax returns or documents that may assist in identifying your records.

- Proof of address, if different from the address listed on your tax return.

Having these documents ready can facilitate a smoother process when requesting your tax records.

Form Submission Methods

The Ma M4506 form can be submitted to the IRS through various methods, ensuring flexibility for taxpayers. The primary submission methods include:

- Online submission through the IRS website, which allows for quicker processing.

- Mailing the completed form to the appropriate IRS address, which may vary based on the taxpayer's location.

- In-person submission at designated IRS offices, if preferred.

Choosing the right method can depend on individual circumstances and the urgency of the request.

Quick guide on how to complete ma m4506

Complete Ma M4506 effortlessly on any device

Managing documents online has gained popularity among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed papers, enabling you to find the correct form and securely save it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly without delays. Handle Ma M4506 on any platform with the airSlate SignNow Android or iOS applications and streamline any document-related task today.

How to modify and eSign Ma M4506 effortlessly

- Obtain Ma M4506 and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize pertinent sections of the documents or conceal sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign feature, which takes seconds and has the same legal validity as a traditional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Select your preferred method for sharing your form, whether by email, text message (SMS), invite link, or downloading it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Alter and eSign Ma M4506 to guarantee outstanding communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the ma m4506 form and why is it important?

The ma m4506 form is a document used for requesting a copy of your tax return from the IRS. It is crucial for individuals and businesses needing to verify their income or tax history for loan applications or other financial transactions. Understanding how to properly complete and submit the ma m4506 can streamline this process.

-

How can airSlate SignNow help with the ma m4506 form?

AirSlate SignNow simplifies the process of sending and eSigning the ma m4506 form. With our platform, users can easily prepare their documents, add signatures, and track their submission status in real-time. This makes it an efficient solution for individuals and businesses needing quick access to their tax documents.

-

Is there a fee to use airSlate SignNow for filing the ma m4506?

While airSlate SignNow offers a free trial, users must select a suitable subscription plan for ongoing access to all features. Overall, the service is cost-effective, allowing you to manage the ma m4506 form and other documents without incurring hefty fees. Detailed pricing information can be found on our website.

-

What features does airSlate SignNow offer for handling the ma m4506?

AirSlate SignNow provides advanced features like document templates, customizable workflows, and secure eSigning options for the ma m4506 form. Users can collaborate in real-time, ensuring all necessary parties can review and sign documents swiftly and securely. This dramatically minimizes the time spent on paperwork.

-

Can I integrate airSlate SignNow with other apps for the ma m4506 process?

Yes, airSlate SignNow integrates seamlessly with popular applications such as Google Drive, Salesforce, and Dropbox, enhancing your workflow for the ma m4506 form. These integrations enable you to store and share your signed documents efficiently, making the entire process more streamlined.

-

How secure is airSlate SignNow when handling sensitive information like the ma m4506?

AirSlate SignNow prioritizes security, utilizing advanced encryption protocols to protect sensitive information associated with the ma m4506 form. Our platform complies with data protection regulations, ensuring that your documents remain confidential throughout the signing process.

-

What benefits does eSigning the ma m4506 offer over traditional methods?

eSigning the ma m4506 form through airSlate SignNow offers speed, convenience, and improved tracking capabilities compared to traditional signing methods. Users can sign documents from anywhere, eliminate paper waste, and receive instant notifications when documents are signed. This makes for a much more efficient experience overall.

Get more for Ma M4506

Find out other Ma M4506

- Electronic signature Connecticut Award Nomination Form Fast

- eSignature South Dakota Apartment lease agreement template Free

- eSignature Maine Business purchase agreement Simple

- eSignature Arizona Generic lease agreement Free

- eSignature Illinois House rental agreement Free

- How To eSignature Indiana House rental agreement

- Can I eSignature Minnesota House rental lease agreement

- eSignature Missouri Landlord lease agreement Fast

- eSignature Utah Landlord lease agreement Simple

- eSignature West Virginia Landlord lease agreement Easy

- How Do I eSignature Idaho Landlord tenant lease agreement

- eSignature Washington Landlord tenant lease agreement Free

- eSignature Wisconsin Landlord tenant lease agreement Online

- eSignature Wyoming Landlord tenant lease agreement Online

- How Can I eSignature Oregon lease agreement

- eSignature Washington Lease agreement form Easy

- eSignature Alaska Lease agreement template Online

- eSignature Alaska Lease agreement template Later

- eSignature Massachusetts Lease agreement template Myself

- Can I eSignature Arizona Loan agreement