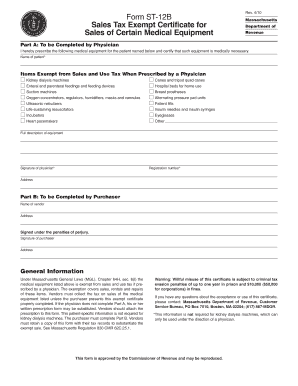

Tax Exempt Certificate Form

What is the Massachusetts Tax Exempt Certificate?

The Massachusetts Tax Exempt Certificate is a legal document that allows certain organizations and individuals to make purchases without paying sales tax. This form is particularly beneficial for non-profit organizations, government entities, and specific educational institutions. By presenting this certificate at the time of purchase, the buyer can avoid the additional costs associated with sales tax, which can significantly reduce expenses for eligible entities.

In Massachusetts, the most commonly used form for this purpose is the ST-2 form, which serves as the official tax exemption certificate. This document must be properly filled out and presented to sellers to ensure that the transaction is recognized as tax-exempt under state law.

How to Obtain the Massachusetts Tax Exempt Certificate

To obtain a Massachusetts Tax Exempt Certificate, eligible organizations must complete the appropriate application process. This typically involves submitting a request to the Massachusetts Department of Revenue. Organizations may need to provide documentation that verifies their tax-exempt status, such as a letter from the IRS or state recognition of their non-profit status.

Once approved, the organization will receive the certificate, which must be kept on file and presented when making tax-exempt purchases. It is essential to ensure that all information is accurate and up to date to avoid complications during transactions.

Steps to Complete the Massachusetts Tax Exempt Certificate

Completing the Massachusetts Tax Exempt Certificate involves several key steps:

- Obtain the correct form, typically the ST-2, from the Massachusetts Department of Revenue or authorized sources.

- Fill in the required fields, including the name of the organization, address, and tax identification number.

- Specify the type of exemption being claimed and include any relevant details that support the claim.

- Ensure that the form is signed by an authorized representative of the organization.

- Keep a copy of the completed certificate for your records.

Following these steps carefully will help ensure that the certificate is valid and accepted by sellers.

Legal Use of the Massachusetts Tax Exempt Certificate

The legal use of the Massachusetts Tax Exempt Certificate is governed by state tax laws. Organizations must ensure that they are genuinely eligible for tax exemption under Massachusetts regulations. Misuse of the certificate, such as using it for personal purchases or for items not covered under the exemption, can lead to penalties and legal repercussions.

It is crucial for organizations to understand the specific criteria that qualify them for tax exemption and to maintain compliance with all applicable laws. Regular audits and reviews of tax-exempt purchases can help organizations stay compliant and avoid potential issues.

Key Elements of the Massachusetts Tax Exempt Certificate

Key elements of the Massachusetts Tax Exempt Certificate include:

- Organization Name: The legal name of the entity claiming the exemption.

- Address: The physical address of the organization.

- Tax Identification Number: The unique number assigned to the organization for tax purposes.

- Type of Exemption: A clear indication of the reason for the tax exemption, such as non-profit status.

- Signature: An authorized representative must sign the certificate to validate it.

These elements are essential for the certificate to be recognized as valid by sellers and tax authorities.

Form Submission Methods for the Massachusetts Tax Exempt Certificate

The Massachusetts Tax Exempt Certificate can be submitted in various ways, depending on the preferences of the organization and the seller:

- In-Person: The certificate can be presented directly to the seller at the time of purchase.

- Online: Some sellers may allow the submission of the certificate electronically, which can streamline the purchasing process.

- Mail: Organizations may also choose to send the certificate via mail to sellers who require it for their records.

Choosing the appropriate submission method can facilitate smoother transactions and ensure compliance with tax regulations.

Quick guide on how to complete tax exempt certificate

Prepare Tax Exempt Certificate effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to access the correct form and securely save it online. airSlate SignNow provides you with all the resources necessary to create, modify, and eSign your documents promptly without delays. Manage Tax Exempt Certificate on any platform using airSlate SignNow's Android or iOS applications and enhance any document-centric workflow today.

How to edit and eSign Tax Exempt Certificate seamlessly

- Find Tax Exempt Certificate and click on Get Form to begin.

- Make use of the tools we offer to complete your form.

- Emphasize important sections of the documents or redact sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Generate your eSignature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow meets all your document management requirements in just a few clicks from any device you prefer. Edit and eSign Tax Exempt Certificate and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Massachusetts sales tax exempt form?

A Massachusetts sales tax exempt form is a legal document that allows certain organizations, such as non-profits and government entities, to make purchases without paying sales tax. This form verifies the buyer's exemption status and is essential for businesses looking to save on tax expenses.

-

How can I obtain a Massachusetts sales tax exempt form?

You can obtain a Massachusetts sales tax exempt form by visiting the official Massachusetts Department of Revenue website. The form is usually available for download in a PDF format, allowing you to print and complete it for your transactions.

-

What features does airSlate SignNow offer for handling Massachusetts sales tax exempt forms?

airSlate SignNow offers features like easy document uploading, eSignature capabilities, and automated workflows specifically designed for handling Massachusetts sales tax exempt forms. This streamlined process helps you manage compliance efficiently and reduces administrative burdens.

-

Is there a cost associated with using airSlate SignNow for Massachusetts sales tax exempt forms?

Yes, airSlate SignNow provides various pricing plans based on your business needs. These plans are economical and designed to provide value for businesses processing Massachusetts sales tax exempt forms and other document types.

-

Can airSlate SignNow integrate with other systems for Massachusetts sales tax exempt forms?

Absolutely! airSlate SignNow easily integrates with numerous platforms, such as CRM systems and accounting software. This integration allows for a seamless flow of data regarding your Massachusetts sales tax exempt forms, enhancing overall efficiency.

-

What are the benefits of using airSlate SignNow for Massachusetts sales tax exempt forms?

Using airSlate SignNow for Massachusetts sales tax exempt forms offers numerous benefits, including time savings, reduced paperwork, and improved compliance. The digital eSigning process ensures your forms are quickly completed and securely managed.

-

How does airSlate SignNow enhance the security of Massachusetts sales tax exempt forms?

airSlate SignNow enhances the security of Massachusetts sales tax exempt forms through robust encryption, secure cloud storage, and comprehensive audit trails. These security measures ensure that your sensitive documents are protected throughout the signing process.

Get more for Tax Exempt Certificate

- Appointment deposit cancellation ampampamp late arrival policy form

- 10 procedures and forms berkeley unified school district

- 20 sample proof of income letter from employer free to edit form

- Brnprob113 california board of registered nursing form

- Business consumer services and housing agency governor edmund g vmb ca form

- Commissary or permitted kitchen verification form for caterers

- Alliance grants partner organization form nserc crsnggcca

- Budget period 1 supplemental massachusetts department of form

Find out other Tax Exempt Certificate

- eSign Pennsylvania Mutual non-disclosure agreement Now

- Help Me With eSign Utah Non disclosure agreement sample

- How Can I eSign Minnesota Partnership agreements

- eSign Pennsylvania Property management lease agreement Secure

- eSign Hawaii Rental agreement for house Fast

- Help Me With eSign Virginia Rental agreement contract

- eSign Alaska Rental lease agreement Now

- How To eSign Colorado Rental lease agreement

- How Can I eSign Colorado Rental lease agreement

- Can I eSign Connecticut Rental lease agreement

- eSign New Hampshire Rental lease agreement Later

- Can I eSign North Carolina Rental lease agreement

- How Do I eSign Pennsylvania Rental lease agreement

- How To eSign South Carolina Rental lease agreement

- eSign Texas Rental lease agreement Mobile

- eSign Utah Rental agreement lease Easy

- How Can I eSign North Dakota Rental lease agreement forms

- eSign Rhode Island Rental lease agreement forms Now

- eSign Georgia Rental lease agreement template Simple

- Can I eSign Wyoming Rental lease agreement forms