SDAT Application for Exemption for Disabled Veterans SDAT Application for Exemption for Disabled Veterans Form

What is the SDAT Application For Exemption For Disabled Veterans

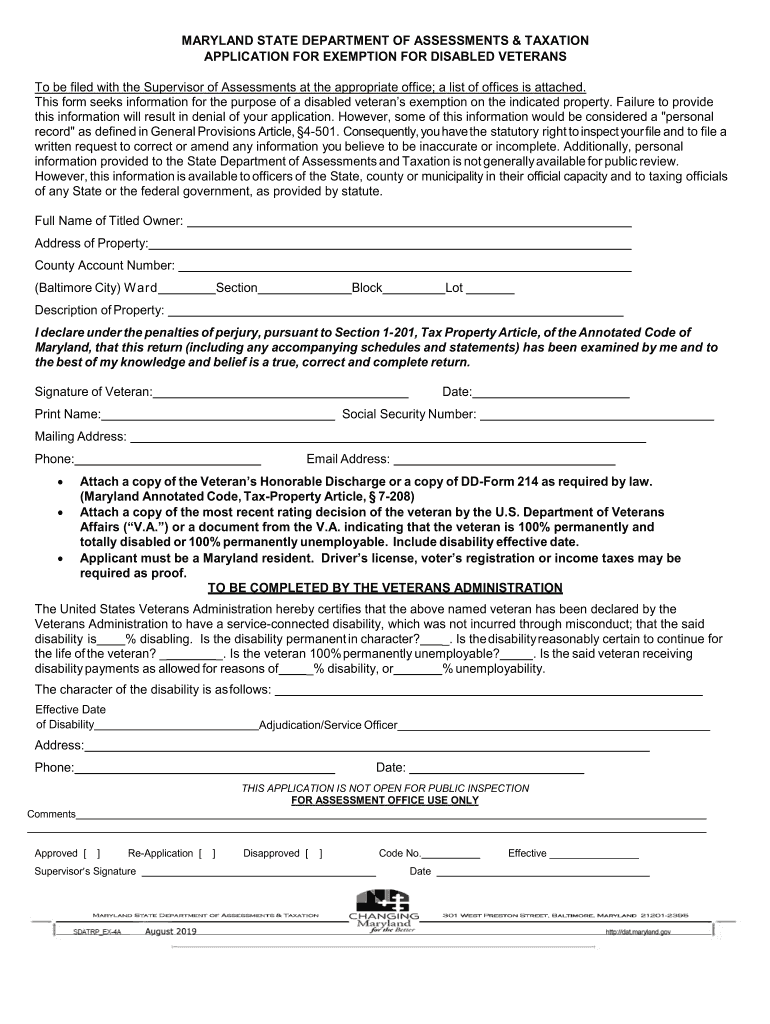

The SDAT Application for Exemption for Disabled Veterans is a form designed to provide eligible veterans with property tax exemptions. This application allows disabled veterans to reduce their property tax burden, making homeownership more affordable. The exemption is typically available to veterans who have been certified as having a service-connected disability by the U.S. Department of Veterans Affairs. Each state may have specific criteria and benefits associated with this exemption, so understanding local regulations is essential for applicants.

Steps to complete the SDAT Application For Exemption For Disabled Veterans

Completing the SDAT Application for Exemption for Disabled Veterans involves several key steps to ensure accuracy and compliance. First, gather all necessary documentation, including proof of disability and military service. Next, fill out the application form carefully, providing all required information. It's important to double-check for any errors or omissions. Once completed, submit the application to the appropriate local government office, either online, by mail, or in person, depending on state guidelines. Keeping a copy of the submitted application for your records is also advisable.

Eligibility Criteria

To qualify for the SDAT Application for Exemption for Disabled Veterans, applicants must meet specific eligibility criteria. Generally, the applicant must be a veteran with a service-connected disability rating from the U.S. Department of Veterans Affairs. Some states may also require the veteran to be a resident of the state where the property is located. Additionally, there may be age or income restrictions in certain jurisdictions. It is crucial to review state-specific requirements to ensure full compliance and eligibility.

Required Documents

When applying for the SDAT Application for Exemption for Disabled Veterans, several documents are typically required. These may include:

- Proof of military service, such as a DD Form 214.

- Documentation of the service-connected disability from the U.S. Department of Veterans Affairs.

- Identification verification, such as a state-issued ID or driver's license.

- Property ownership documents, if applicable.

Gathering these documents in advance can streamline the application process and help avoid delays.

Form Submission Methods

The SDAT Application for Exemption for Disabled Veterans can be submitted through various methods, depending on state regulations. Common submission methods include:

- Online submission via the state or local government website.

- Mailing the completed application to the designated office.

- In-person submission at a local government office or veteran services office.

Choosing the most convenient method for submission can help ensure a smooth application process.

Legal use of the SDAT Application For Exemption For Disabled Veterans

The legal use of the SDAT Application for Exemption for Disabled Veterans is governed by state laws and regulations. This form must be completed accurately and submitted within the designated time frames to be considered valid. States often have specific statutes that outline the rights of disabled veterans regarding property tax exemptions. Understanding these legal frameworks can help applicants navigate the process effectively and ensure compliance with all necessary requirements.

Quick guide on how to complete sdat application for exemption for disabled veterans sdat application for exemption for disabled veterans

Complete SDAT Application For Exemption For Disabled Veterans SDAT Application For Exemption For Disabled Veterans effortlessly on any device

Digital document management has become increasingly popular among companies and individuals. It serves as an ideal environmentally friendly alternative to conventional printed and signed paperwork, allowing you to find the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and eSign your documents quickly and efficiently. Manage SDAT Application For Exemption For Disabled Veterans SDAT Application For Exemption For Disabled Veterans on any device through airSlate SignNow's Android or iOS applications and streamline any document-related task today.

How to edit and eSign SDAT Application For Exemption For Disabled Veterans SDAT Application For Exemption For Disabled Veterans with ease

- Locate SDAT Application For Exemption For Disabled Veterans SDAT Application For Exemption For Disabled Veterans and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes seconds and holds the same legal validity as a traditional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from your preferred device. Edit and eSign SDAT Application For Exemption For Disabled Veterans SDAT Application For Exemption For Disabled Veterans and ensure effective communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the SDAT Application For Exemption For Disabled Veterans?

The SDAT Application For Exemption For Disabled Veterans is a specialized application designed to help disabled veterans qualify for property tax exemptions. This application streamlines the process, ensuring that eligible veterans can easily access the benefits they deserve. By utilizing the SDAT Application For Exemption For Disabled Veterans, veterans can simplify paperwork and improve their chances of approval.

-

How can airSlate SignNow help with the SDAT Application For Exemption For Disabled Veterans?

airSlate SignNow provides an efficient platform for managing the SDAT Application For Exemption For Disabled Veterans. You can easily create, send, and sign documents related to the application electronically. This user-friendly interface allows disabled veterans to focus on their benefits without getting bogged down by paperwork.

-

What are the costs associated with the SDAT Application For Exemption For Disabled Veterans?

Using airSlate SignNow for the SDAT Application For Exemption For Disabled Veterans is cost-effective, with subscription plans tailored to different needs. You can choose from various pricing options that best suit your budget, ensuring that veterans can access essential features at an affordable price. Start optimizing your application process without breaking the bank.

-

What features does airSlate SignNow offer for the SDAT Application For Exemption For Disabled Veterans?

airSlate SignNow includes features such as document templates, electronic signatures, and automated workflows to assist in the SDAT Application For Exemption For Disabled Veterans. These tools streamline the application process, allowing disabled veterans to complete their forms accurately and efficiently. The platform is designed to enhance usability and save time.

-

What are the benefits of using airSlate SignNow for the SDAT Application For Exemption For Disabled Veterans?

Using airSlate SignNow signNowly benefits disabled veterans by simplifying the SDAT Application For Exemption For Disabled Veterans process. The platform reduces the time spent on paperwork, allowing veterans to receive their exemptions quicker. Moreover, the ability to securely send and manage documents online enhances the overall experience.

-

Is airSlate SignNow secure for handling the SDAT Application For Exemption For Disabled Veterans?

Yes, airSlate SignNow prioritizes security for users handling the SDAT Application For Exemption For Disabled Veterans. The platform employs advanced encryption technology to protect sensitive information throughout the signing process. Veterans can trust that their data is safe while managing important documents.

-

Can I integrate airSlate SignNow with other applications for the SDAT Application For Exemption For Disabled Veterans?

Absolutely! airSlate SignNow offers various integrations with popular applications that can be helpful for the SDAT Application For Exemption For Disabled Veterans. This allows for seamless data transfer and a more cohesive approach to managing your application process, enhancing overall efficiency.

Get more for SDAT Application For Exemption For Disabled Veterans SDAT Application For Exemption For Disabled Veterans

- Instructions for using this petition form

- Omb number 3235 0065 expires october 31 202 form s 1

- How do i fill out the form ssa 820 bk when it isnt an

- Disability report child disability report child ssa 3820 bk form

- The best way to make an impression form

- Ps form 3602 r ampquotpostage statement usps marketing mailampquot

- Ps form 3615 mailing permit application and usps

- Fillable online con 10129 p fax email print pdffiller form

Find out other SDAT Application For Exemption For Disabled Veterans SDAT Application For Exemption For Disabled Veterans

- Can I eSignature Vermont Government Form

- How Do I eSignature West Virginia Government PPT

- How Do I eSignature Maryland Healthcare / Medical PDF

- Help Me With eSignature New Mexico Healthcare / Medical Form

- How Do I eSignature New York Healthcare / Medical Presentation

- How To eSignature Oklahoma Finance & Tax Accounting PPT

- Help Me With eSignature Connecticut High Tech Presentation

- How To eSignature Georgia High Tech Document

- How Can I eSignature Rhode Island Finance & Tax Accounting Word

- How Can I eSignature Colorado Insurance Presentation

- Help Me With eSignature Georgia Insurance Form

- How Do I eSignature Kansas Insurance Word

- How Do I eSignature Washington Insurance Form

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form