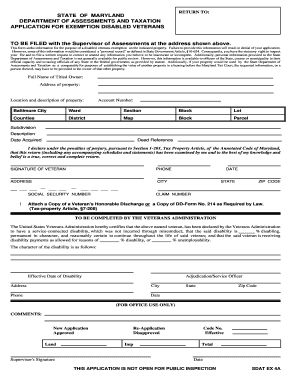

STATE of MARYLAND DEPARTMENT of ASSESSMENTS and TAXATION APPLICATION for EXEMPTION DISABLED VETERANS Dat State Md Form

Understanding the Maryland SDAT Application for Disabled Veterans

The Maryland State Department of Assessments and Taxation (SDAT) application for exemption for disabled veterans is a crucial document that allows eligible veterans to receive property tax relief. This application is specifically designed for veterans who have been certified as disabled by the Department of Veterans Affairs. It is important to understand the eligibility criteria and the benefits that come with this exemption, which can significantly reduce the financial burden of property taxes for those who have served the country.

Steps to Complete the Maryland SDAT Application for Disabled Veterans

Completing the Maryland SDAT application involves several key steps to ensure that the process is smooth and efficient. First, gather all necessary documentation, including proof of disability from the Department of Veterans Affairs and any other relevant identification. Next, fill out the application form accurately, providing all required information. After completing the form, review it for accuracy and completeness before submission. Finally, submit the application either online or via mail, ensuring you keep a copy for your records.

Eligibility Criteria for the Maryland SDAT Exemption

To qualify for the Maryland SDAT exemption for disabled veterans, applicants must meet specific criteria. The veteran must have a service-connected disability rated by the Department of Veterans Affairs. Additionally, the property for which the exemption is sought must be the primary residence of the veteran. It's essential to verify that all eligibility requirements are met before submitting the application to avoid delays or rejections.

Required Documents for the Maryland SDAT Application

When applying for the Maryland SDAT exemption, certain documents are required to substantiate the application. These typically include a copy of the veteran's disability rating letter from the Department of Veterans Affairs, proof of residency, and any other documentation that may support the claim for exemption. Ensuring that all required documents are submitted with the application can help expedite the review process.

Form Submission Methods for the Maryland SDAT Application

The Maryland SDAT application for disabled veterans can be submitted through various methods. Applicants have the option to complete the application online through the SDAT website, which provides a user-friendly interface for submission. Alternatively, the application can be printed and mailed to the appropriate local SDAT office. In-person submissions may also be possible, depending on local office policies. Each method has its benefits, and applicants should choose the one that best suits their needs.

Legal Use of the Maryland SDAT Application for Disabled Veterans

The Maryland SDAT application for exemption is legally binding and must be completed in accordance with state laws. The application process adheres to the legal requirements set forth by the state of Maryland, ensuring that all submissions are compliant with relevant regulations. Understanding the legal implications of the application can help applicants navigate the process more effectively and ensure that their rights are protected.

Quick guide on how to complete state of maryland department of assessments and taxation application for exemption disabled veterans dat state md

Effortlessly Prepare STATE OF MARYLAND DEPARTMENT OF ASSESSMENTS AND TAXATION APPLICATION FOR EXEMPTION DISABLED VETERANS Dat State Md on Any Device

Digital document management has gained traction among organizations and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing easy access to the right form and secure online storage. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents promptly without delays. Manage STATE OF MARYLAND DEPARTMENT OF ASSESSMENTS AND TAXATION APPLICATION FOR EXEMPTION DISABLED VETERANS Dat State Md on any device using airSlate SignNow apps for Android or iOS, simplifying your document-related tasks today.

The Simplest Way to Edit and Electronically Sign STATE OF MARYLAND DEPARTMENT OF ASSESSMENTS AND TAXATION APPLICATION FOR EXEMPTION DISABLED VETERANS Dat State Md with Ease

- Find STATE OF MARYLAND DEPARTMENT OF ASSESSMENTS AND TAXATION APPLICATION FOR EXEMPTION DISABLED VETERANS Dat State Md and click Get Form to begin.

- Utilize the tools at your disposal to complete your form.

- Highlight important sections of the documents or redact sensitive information using the features that airSlate SignNow specifically provides for that task.

- Generate your eSignature with the Sign tool, which takes just seconds and carries the same legal authority as a conventional wet ink signature.

- Verify the details and click on the Done button to confirm your changes.

- Choose how you wish to deliver your form—via email, text message (SMS), invite link, or download it to your computer.

Eliminate worries about lost or mislaid documents, tedious form searches, or errors that necessitate printing new document versions. airSlate SignNow meets your document management needs in a few clicks from any device you prefer. Edit and electronically sign STATE OF MARYLAND DEPARTMENT OF ASSESSMENTS AND TAXATION APPLICATION FOR EXEMPTION DISABLED VETERANS Dat State Md to ensure efficient communication throughout your document preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What are the main features of airSlate SignNow for sdat veterans?

airSlate SignNow offers features such as secure eSigning, document templates, and real-time collaboration, specifically designed to meet the needs of sdat veterans. These tools enable users to streamline their document processes efficiently, ensuring that important paperwork is signed and managed without hassle.

-

How much does airSlate SignNow cost for sdat veterans?

Pricing for airSlate SignNow varies depending on the plan selected. For sdat veterans, there are flexible pricing options that can accommodate both small and large organizations, ensuring access to essential eSigning features without breaking the budget.

-

Can airSlate SignNow integrate with other tools for sdat veterans?

Yes, airSlate SignNow can seamlessly integrate with various applications, which is beneficial for sdat veterans looking to enhance their workflow. Integrations with tools like Google Drive, Salesforce, and Microsoft Office simplify document handling and make collaboration easier.

-

What benefits does airSlate SignNow offer specifically for sdat veterans?

For sdat veterans, airSlate SignNow provides a cost-effective solution for managing documents efficiently. It helps reduce paperwork, enhances security, and improves turnaround times, which is crucial for veterans balancing multiple obligations.

-

Is airSlate SignNow user-friendly for sdat veterans?

Absolutely! airSlate SignNow is designed with an intuitive interface that is easy for sdat veterans to navigate. This user-friendly approach ensures that even those who may not be tech-savvy can quickly adapt and utilize the platform effectively.

-

Does airSlate SignNow offer customer support for sdat veterans?

Yes, airSlate SignNow provides dedicated customer support for sdat veterans. Users can access various resources, including live chat, email support, and a comprehensive knowledge base to help resolve any issues they may encounter.

-

How does airSlate SignNow ensure document security for sdat veterans?

Document security is a top priority for airSlate SignNow, especially for sdat veterans who handle sensitive documentation. The platform employs advanced encryption protocols and security features to protect all signed documents and user data.

Get more for STATE OF MARYLAND DEPARTMENT OF ASSESSMENTS AND TAXATION APPLICATION FOR EXEMPTION DISABLED VETERANS Dat State Md

- Esic form

- How to check my firearm competency online form

- Tourism grade 10 exam papers and memos 2019 form

- Nco form 15779642

- Sample of construction safety and health program approved by dole form

- How to convert pdf to fillable form software testing help

- Guidelines for i 765 form

- Form b new enrolment child makivik corporation

Find out other STATE OF MARYLAND DEPARTMENT OF ASSESSMENTS AND TAXATION APPLICATION FOR EXEMPTION DISABLED VETERANS Dat State Md

- Electronic signature Banking Word Massachusetts Free

- eSignature Wyoming Courts Quitclaim Deed Later

- Electronic signature Michigan Banking Lease Agreement Computer

- Electronic signature Michigan Banking Affidavit Of Heirship Fast

- Electronic signature Arizona Business Operations Job Offer Free

- Electronic signature Nevada Banking NDA Online

- Electronic signature Nebraska Banking Confidentiality Agreement Myself

- Electronic signature Alaska Car Dealer Resignation Letter Myself

- Electronic signature Alaska Car Dealer NDA Mobile

- How Can I Electronic signature Arizona Car Dealer Agreement

- Electronic signature California Business Operations Promissory Note Template Fast

- How Do I Electronic signature Arkansas Car Dealer Claim

- Electronic signature Colorado Car Dealer Arbitration Agreement Mobile

- Electronic signature California Car Dealer Rental Lease Agreement Fast

- Electronic signature Connecticut Car Dealer Lease Agreement Now

- Electronic signature Connecticut Car Dealer Warranty Deed Computer

- Electronic signature New Mexico Banking Job Offer Online

- How Can I Electronic signature Delaware Car Dealer Purchase Order Template

- How To Electronic signature Delaware Car Dealer Lease Template

- Electronic signature North Carolina Banking Claim Secure