Maryland Sales Exemption Form

What is the Maryland Sales Exemption Form

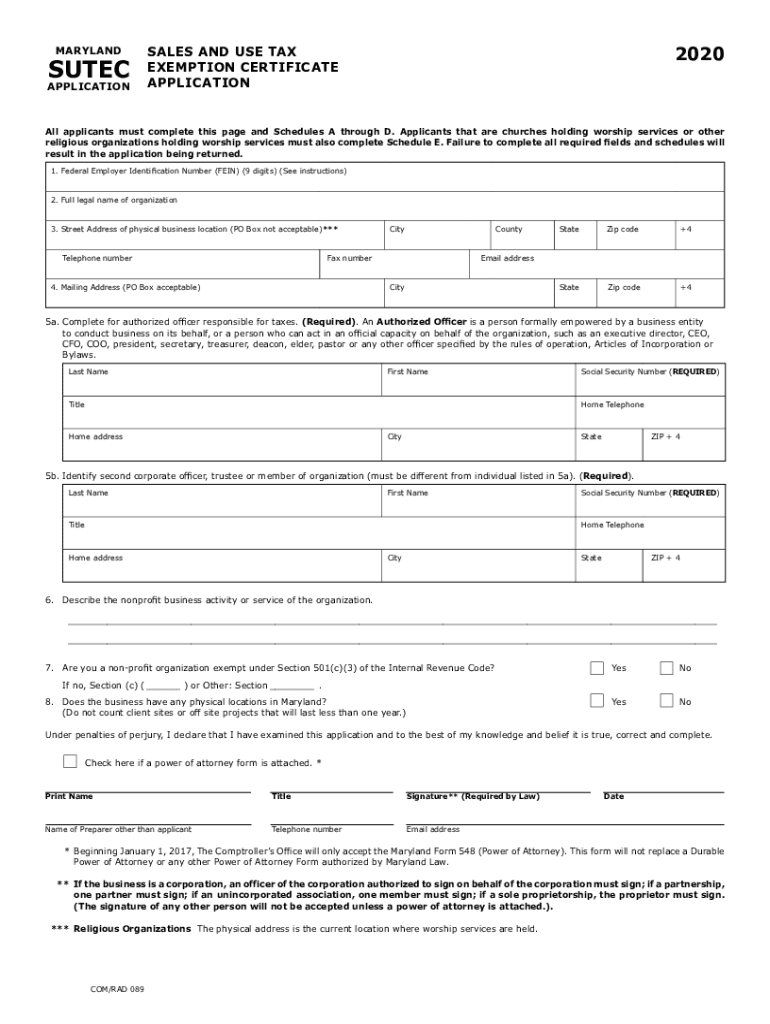

The Maryland Sales Exemption Form is a crucial document that allows eligible individuals and businesses to claim exemptions from sales tax on certain purchases. This form is particularly important for organizations that qualify as tax-exempt entities, such as non-profits, government agencies, and specific educational institutions. By submitting this form, these entities can avoid paying sales tax on goods and services directly related to their exempt purposes.

How to use the Maryland Sales Exemption Form

To effectively use the Maryland Sales Exemption Form, one must first determine eligibility based on the type of organization or purpose for which the exemption is sought. Once eligibility is confirmed, the form should be completed accurately, ensuring all required information is provided. After filling out the form, it can be presented to vendors at the time of purchase to claim the exemption. It is important to retain copies of the form for record-keeping and compliance purposes.

Steps to complete the Maryland Sales Exemption Form

Completing the Maryland Sales Exemption Form involves several key steps:

- Identify the specific exemption category that applies to your organization.

- Fill in the required information, including the name of the exempt organization, address, and the nature of the exemption.

- Provide a valid reason for the exemption, ensuring it aligns with Maryland tax regulations.

- Sign and date the form to certify the accuracy of the information provided.

Legal use of the Maryland Sales Exemption Form

The legal use of the Maryland Sales Exemption Form is governed by state tax laws. It is essential that the form is used in accordance with these laws to avoid potential penalties. Misuse of the form, such as claiming exemptions for ineligible purchases or providing false information, can lead to legal repercussions, including fines and back taxes. Therefore, understanding the legal implications and ensuring compliance is vital for all users of the form.

Eligibility Criteria

Eligibility for the Maryland Sales Exemption Form is determined by specific criteria set forth by the state. Generally, organizations that qualify include non-profit entities, government agencies, and educational institutions. Additionally, certain purchases related to the exempt purposes of these organizations may also qualify. It is important for applicants to review the eligibility requirements carefully to ensure compliance and avoid any issues during the exemption process.

Required Documents

When applying for the Maryland Sales Exemption Form, certain documents may be required to substantiate the claim. These typically include:

- A copy of the organization’s tax-exempt status documentation.

- Proof of the organization’s purpose, such as articles of incorporation or bylaws.

- Identification details of the individual completing the form, including their role within the organization.

Form Submission Methods

The Maryland Sales Exemption Form can be submitted through various methods, including:

- Online submission via the Maryland Comptroller's website.

- Mailing a hard copy of the completed form to the appropriate state office.

- In-person submission at designated tax offices or events.

Quick guide on how to complete maryland sales exemption form

Complete Maryland Sales Exemption Form seamlessly on any device

Digital document management has become increasingly prevalent among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, as you can easily locate the necessary form and securely store it online. airSlate SignNow equips you with all the resources you need to create, edit, and eSign your documents swiftly without delays. Handle Maryland Sales Exemption Form on any device using airSlate SignNow's Android or iOS applications and streamline any document-related task today.

The easiest way to edit and eSign Maryland Sales Exemption Form without stress

- Obtain Maryland Sales Exemption Form and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize relevant sections of the documents or conceal sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature with the Sign tool, which takes moments and carries the same legal validity as a traditional wet ink signature.

- Review all the details and click on the Done button to apply your changes.

- Select your preferred method for sending your form, by email, SMS, or invitation link, or download it to your computer.

Eliminate the worries of lost or misplaced documents, tedious form searches, or errors that require printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Edit and eSign Maryland Sales Exemption Form and ensure superior communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Maryland tax exempt form PDF?

The Maryland tax exempt form PDF is a document that allows eligible organizations in Maryland to make purchases without paying sales tax. This form is essential for non-profits, government agencies, and certain businesses to save costs on eligible purchases. By using the Maryland tax exempt form PDF, entities can ensure compliance with state tax regulations.

-

How can I obtain a Maryland tax exempt form PDF?

You can obtain a Maryland tax exempt form PDF directly from the Maryland Comptroller's website or through various online resources. This form is usually available for download, allowing you to print and complete it for your specific needs. Make sure to verify that you meet the eligibility requirements before applying.

-

Can I fill out the Maryland tax exempt form PDF electronically?

Yes, you can fill out the Maryland tax exempt form PDF electronically using most PDF editing software. This makes it convenient to complete the form without having to print it first. Once filled out, you can save and send the form as needed.

-

How does airSlate SignNow help with the Maryland tax exempt form PDF?

airSlate SignNow provides an efficient platform to eSign and manage your Maryland tax exempt form PDF. With its user-friendly interface, you can complete and send the form quickly, ensuring that all parties involved can review and sign it easily. This streamlines the process and enhances collaboration.

-

What are the benefits of using airSlate SignNow for my Maryland tax exempt form PDF?

Using airSlate SignNow for your Maryland tax exempt form PDF offers numerous benefits, including time savings and cost-effectiveness. The platform automates document workflows and provides robust tracking features, allowing you to stay organized. Additionally, eSigning the form leads to quicker approvals and processing.

-

Is airSlate SignNow compatible with other software tools for managing tax exempt forms?

Yes, airSlate SignNow integrates seamlessly with various software tools and applications, enhancing your workflow for managing tax exempt forms like the Maryland tax exempt form PDF. These integrations allow for easy data transfer and improved efficiency in your business operations. You'll be able to connect your existing tools effortlessly.

-

What pricing plans does airSlate SignNow offer for document management?

airSlate SignNow offers competitive pricing plans that cater to different business needs when managing documents such as the Maryland tax exempt form PDF. The plans vary based on features, number of users, and document volume, making it easy to find a suitable option. Explore their pricing page for detailed information.

Get more for Maryland Sales Exemption Form

- Va forms barry university miami shores florida

- Fillable online 1040nr instructions tax table fax email form

- Aa1a form

- Instructions application for employment department of state form

- Paperwork reduction act supporting statement department of form

- Form pers282 ampquotemployment application templateroller

- Date of birthssn form

- Csd form

Find out other Maryland Sales Exemption Form

- How Do I eSign New Mexico Healthcare / Medical Word

- How To eSign Washington High Tech Presentation

- Help Me With eSign Vermont Healthcare / Medical PPT

- How To eSign Arizona Lawers PDF

- How To eSign Utah Government Word

- How Can I eSign Connecticut Lawers Presentation

- Help Me With eSign Hawaii Lawers Word

- How Can I eSign Hawaii Lawers Document

- How To eSign Hawaii Lawers PPT

- Help Me With eSign Hawaii Insurance PPT

- Help Me With eSign Idaho Insurance Presentation

- Can I eSign Indiana Insurance Form

- How To eSign Maryland Insurance PPT

- Can I eSign Arkansas Life Sciences PDF

- How Can I eSign Arkansas Life Sciences PDF

- Can I eSign Connecticut Legal Form

- How Do I eSign Connecticut Legal Form

- How Do I eSign Hawaii Life Sciences Word

- Can I eSign Hawaii Life Sciences Word

- How Do I eSign Hawaii Life Sciences Document