Fillable Form it 150 Resident Income Tax Return Short Form, It150

What is the Fillable Form IT 150 Resident Income Tax Return Short Form

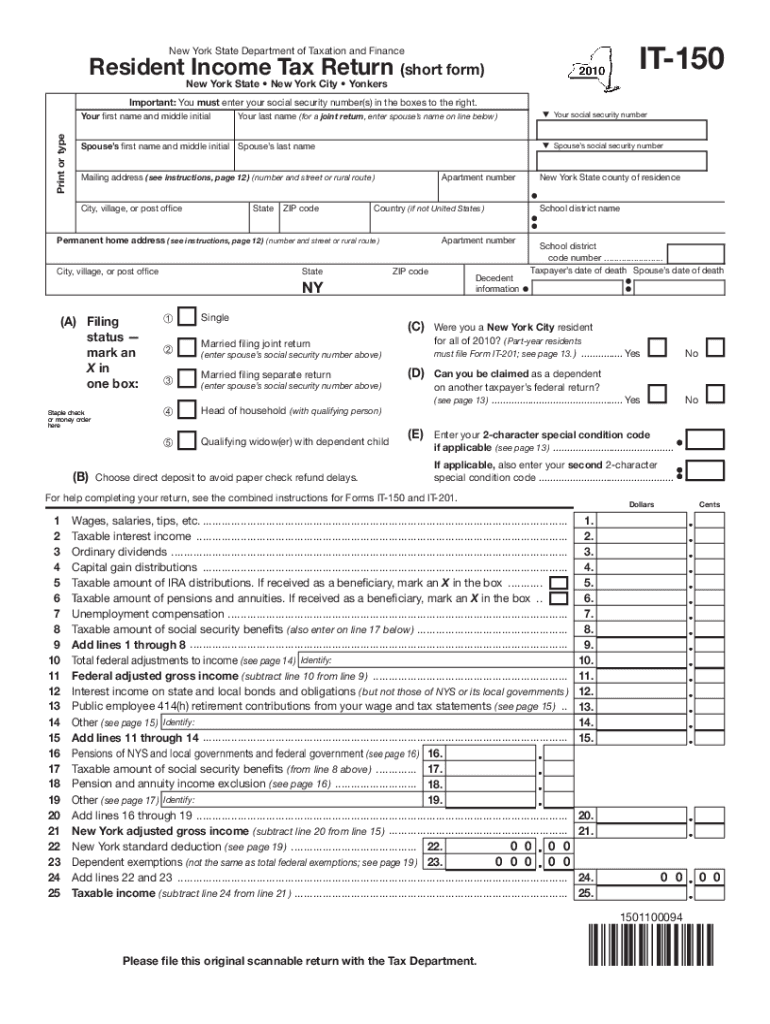

The IT 150 form is a resident income tax return short form used by individuals in New York State to report their income and calculate their tax liability. This form is designed for taxpayers who meet specific criteria, allowing for a simplified filing process. It is particularly beneficial for those with straightforward tax situations, such as single filers or those without complex deductions. By utilizing the IT 150, taxpayers can efficiently fulfill their state tax obligations while ensuring compliance with New York tax laws.

Steps to Complete the Fillable Form IT 150 Resident Income Tax Return Short Form

Filling out the IT 150 form involves several key steps to ensure accuracy and compliance. Start by gathering all necessary documents, including W-2s, 1099s, and any other income statements. Next, follow these steps:

- Begin by entering your personal information, including your name, address, and Social Security number.

- Report your total income from all sources, ensuring to include all taxable income.

- Calculate your adjustments to income, if applicable, and deduct any eligible amounts.

- Determine your taxable income by subtracting adjustments from your total income.

- Apply the appropriate tax rates to calculate your tax liability based on your taxable income.

- Finally, review your completed form for accuracy and submit it according to the submission guidelines.

Legal Use of the Fillable Form IT 150 Resident Income Tax Return Short Form

The IT 150 form is legally recognized as a valid document for filing state income taxes in New York. To ensure its legal standing, it must be filled out accurately and submitted by the designated filing deadline. The form must be signed, either electronically or in print, to validate the information provided. Adhering to the legal requirements associated with the IT 150 helps prevent issues with the New York State Department of Taxation and Finance, ensuring that your tax return is processed smoothly.

Key Elements of the Fillable Form IT 150 Resident Income Tax Return Short Form

Understanding the key elements of the IT 150 form is crucial for accurate completion. The form typically includes sections for personal information, income reporting, adjustments, tax calculations, and signature fields. Important components include:

- Personal Information: This section captures essential taxpayer details.

- Income Reporting: Taxpayers must list all sources of income, ensuring comprehensive reporting.

- Adjustments: Any applicable deductions or adjustments to income should be clearly stated.

- Tax Calculation: The form provides a framework for calculating the total tax owed.

Filing Deadlines / Important Dates

Timely submission of the IT 150 form is essential to avoid penalties. The filing deadline for most taxpayers is typically April fifteenth of each year. However, if this date falls on a weekend or holiday, the deadline may be extended to the next business day. It is advisable to keep track of any changes to deadlines announced by the New York State Department of Taxation and Finance, as well as to stay informed about any potential extensions for filing.

Who Issues the Form

The IT 150 form is issued by the New York State Department of Taxation and Finance. This agency is responsible for administering tax laws and collecting taxes in the state. Taxpayers can obtain the IT 150 from the department's official website or through authorized distribution channels. It is important to ensure that you are using the most current version of the form to comply with state regulations.

Quick guide on how to complete fillable form it 1502010 resident income tax return short form it150

Easily Prepare Fillable Form IT 150 Resident Income Tax Return short Form, It150 on Any Device

Managing documents online has gained traction among businesses and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed paperwork, as you can easily locate the right form and securely save it online. airSlate SignNow equips you with all the tools necessary to create, edit, and electronically sign your documents swiftly without delays. Manage Fillable Form IT 150 Resident Income Tax Return short Form, It150 on any device using the airSlate SignNow Android or iOS applications and enhance any document-related process today.

How to Edit and Electronically Sign Fillable Form IT 150 Resident Income Tax Return short Form, It150 Effortlessly

- Locate Fillable Form IT 150 Resident Income Tax Return short Form, It150 and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize relevant sections of the documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your electronic signature using the Sign tool, which takes only seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Choose how you would like to send your form, whether by email, SMS, invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from your preferred device. Modify and electronically sign Fillable Form IT 150 Resident Income Tax Return short Form, It150 to ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the it150 form and how does airSlate SignNow assist in its completion?

The it150 form is an essential document for tax purposes, particularly geared towards tax credits in certain jurisdictions. airSlate SignNow streamlines the process of filling out this form by providing an intuitive platform for electronic signatures and document editing, ensuring compliance and efficiency.

-

Is there a fee associated with using airSlate SignNow for the it150 form?

Yes, airSlate SignNow offers various pricing plans that accommodate different business needs, including the eSigning of the it150 form. The cost is competitive and provides excellent value for businesses looking for efficient document management solutions.

-

What features does airSlate SignNow offer for managing the it150 form?

AirSlate SignNow includes features such as document templates, electronic signatures, and secure cloud storage, which are particularly beneficial for managing the it150 form. These tools ensure that users can create, send, and sign documents quickly and securely.

-

Can I integrate other applications with airSlate SignNow when working on the it150 form?

Absolutely! airSlate SignNow supports seamless integrations with various applications, including CRM systems and productivity tools. This flexibility allows users to access their it150 form alongside other critical documents and applications, optimizing workflow.

-

What are the benefits of using airSlate SignNow for electronic signatures on the it150 form?

Using airSlate SignNow for electronic signatures on the it150 form offers multiple benefits, including enhanced security, reduced turnaround time, and the convenience of signing from any device. This ensures that your documents are processed quickly and securely.

-

Is airSlate SignNow compliant with legal regulations for the it150 form?

Yes, airSlate SignNow complies with all necessary legal standards for electronic signatures, ensuring that your use of the it150 form is valid and enforceable. This compliance is crucial for avoiding potential legal issues when submitting tax documents.

-

How does airSlate SignNow ensure the security of my it150 form data?

AirSlate SignNow prioritizes the security of your documents, including the it150 form, by employing advanced encryption methods and secure servers. Regular security audits and compliance with industry standards further protect your sensitive information.

Get more for Fillable Form IT 150 Resident Income Tax Return short Form, It150

- Change of financial institution address andor fein change form

- X cdlps yes no ctgov form

- 8 15 13 villager combo by weekly register call issuu form

- Information and instructions for prequalification of bidders

- State form 20070 r5 5 21

- Form pd 7 ampquotplate surrender applicationampquot new york

- Booklet for new residents form

- Certificate of compliance for daily dotstatepaus form

Find out other Fillable Form IT 150 Resident Income Tax Return short Form, It150

- Electronic signature Delaware Healthcare / Medical Limited Power Of Attorney Free

- Electronic signature Finance & Tax Accounting Word South Carolina Later

- How Do I Electronic signature Illinois Healthcare / Medical Purchase Order Template

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Online

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Computer

- How Do I Electronic signature Louisiana Healthcare / Medical Limited Power Of Attorney

- Electronic signature Maine Healthcare / Medical Letter Of Intent Fast

- How To Electronic signature Mississippi Healthcare / Medical Month To Month Lease

- Electronic signature Nebraska Healthcare / Medical RFP Secure

- Electronic signature Nevada Healthcare / Medical Emergency Contact Form Later

- Electronic signature New Hampshire Healthcare / Medical Credit Memo Easy

- Electronic signature New Hampshire Healthcare / Medical Lease Agreement Form Free

- Electronic signature North Dakota Healthcare / Medical Notice To Quit Secure

- Help Me With Electronic signature Ohio Healthcare / Medical Moving Checklist

- Electronic signature Education PPT Ohio Secure

- Electronic signature Tennessee Healthcare / Medical NDA Now

- Electronic signature Tennessee Healthcare / Medical Lease Termination Letter Online

- Electronic signature Oklahoma Education LLC Operating Agreement Fast

- How To Electronic signature Virginia Healthcare / Medical Contract

- How To Electronic signature Virginia Healthcare / Medical Operating Agreement