Dte Cauv Oh 2005-2026

Understanding the Ohio DTE

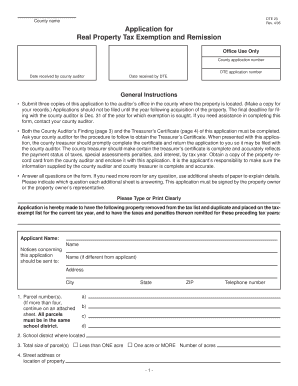

The Ohio DTE, or Department of Taxation Exemption, is a crucial form for property owners seeking tax exemptions in Ohio. This form is specifically designed to assist individuals in claiming exemptions on their real property taxes. The DTE is essential for those who qualify for exemptions such as the homestead exemption or other property tax relief programs. Understanding the specific requirements and eligibility criteria for the Ohio DTE is vital for successful completion and submission.

Steps to Complete the Ohio DTE

Completing the Ohio DTE involves several clear steps to ensure accuracy and compliance. First, gather all necessary information, including property details and personal identification. Next, fill out the form carefully, ensuring that all sections are completed accurately. It is important to review the form for any errors before submission. Finally, submit the completed Ohio DTE either online or via mail, depending on your preference and the requirements of your local tax authority.

Eligibility Criteria for the Ohio DTE

To qualify for the Ohio DTE, applicants must meet specific eligibility criteria. Generally, this includes being a property owner in Ohio and meeting age or income requirements for certain exemptions. For instance, the homestead exemption is available to homeowners who are at least sixty-five years old or permanently disabled. Additionally, applicants must provide proof of income and residency to validate their claims. Understanding these criteria is essential for a successful application.

Required Documents for the Ohio DTE

When applying for the Ohio DTE, several documents are typically required to support your application. These may include proof of identity, such as a driver's license or state ID, and documentation of property ownership, like a deed. If applying for specific exemptions, additional documents may be necessary, such as income statements or disability verification. Having these documents ready can streamline the application process and help ensure compliance with local regulations.

Legal Use of the Ohio DTE

The legal use of the Ohio DTE is governed by state tax laws, which dictate how exemptions are applied and enforced. Submitting the form accurately and on time is crucial to avoid penalties and ensure that property tax benefits are received. The Ohio DTE must be completed in accordance with the guidelines set forth by the Ohio Department of Taxation, which includes adhering to deadlines and providing truthful information. Understanding these legal requirements can help property owners navigate the exemption process effectively.

Form Submission Methods for the Ohio DTE

Submitting the Ohio DTE can be done through various methods, allowing flexibility for applicants. The form can be submitted online through the Ohio Department of Taxation's website, which offers a streamlined process for electronic filing. Alternatively, applicants may choose to mail the completed form to their local tax authority or submit it in person at designated offices. Each method has its own advantages, so it is important to choose the one that best suits your needs and ensures timely submission.

Quick guide on how to complete dte cauv oh

Complete Dte Cauv Oh effortlessly on any device

Digital document management has gained popularity among organizations and individuals. It offers an ideal eco-friendly substitute to traditional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Manage Dte Cauv Oh on any platform using the airSlate SignNow Android or iOS applications and enhance any document-centric process today.

Efficiently modify and electronically sign Dte Cauv Oh with ease

- Locate Dte Cauv Oh and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize pertinent sections of the documents or hide sensitive data with tools specifically designed for that purpose by airSlate SignNow.

- Generate your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Verify all the information and click the Done button to save your modifications.

- Select your preferred method to send your form—via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Modify and electronically sign Dte Cauv Oh to ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is Ohio DTE and how does it relate to airSlate SignNow?

Ohio DTE, or Ohio Digital Transformation Ecosystem, is a framework that supports businesses in enhancing their document workflows. With airSlate SignNow, companies in Ohio can streamline eSigning and document management, effectively becoming part of the Ohio DTE landscape.

-

How can airSlate SignNow improve my business processes under Ohio DTE?

airSlate SignNow complements Ohio DTE by providing an easy-to-use platform for electronic signatures and document handling. This allows businesses to digitize their workflows, reduce paperwork, and enhance productivity, aligning with the goals of the Ohio DTE.

-

What are the pricing options for airSlate SignNow for Ohio DTE users?

airSlate SignNow offers flexible pricing plans suitable for Ohio DTE users, catering to businesses of all sizes. You can choose from basic to premium plans based on your document volume and features needed, allowing you to maximize your investment while staying aligned with the Ohio DTE.

-

What features does airSlate SignNow offer that support Ohio DTE initiatives?

airSlate SignNow provides essential features such as secure eSigning, document templates, and automated workflows, which are integral to the Ohio DTE. These functionalities streamline operations and ensure compliance, helping businesses flourish in a digital environment.

-

How does airSlate SignNow ensure security for documents, particularly for Ohio DTE?

Security is a priority for airSlate SignNow, especially for users operating within the Ohio DTE. The platform employs advanced encryption and compliance standards, such as GDPR and HIPAA, ensuring that all your documents remain safe while you eSign and manage them.

-

Can airSlate SignNow integrate with other tools for Ohio DTE?

Yes, airSlate SignNow seamlessly integrates with various applications that support the Ohio DTE, including CRM systems, cloud storage services, and project management software. This enhances your overall workflow, making it easier to manage documents and communications.

-

What are the benefits of using airSlate SignNow for Ohio DTE compliance?

Using airSlate SignNow helps ensure that your business maintains compliance with the Ohio DTE standards. The platform’s features allow for detailed audit trails and secure document handling, which are crucial for meeting regulatory requirements.

Get more for Dte Cauv Oh

- Dr 2219 122118 form

- Faqs pa vehicle registration pa drivers license pa notary form

- Form mv 82r ampquotvehicle registrationtitle applicationampquot new

- J23 conneticut dmv form pdf fill online printable fillable blank

- Form vtr 60 ampquotapplication for replacement license plates

- Enrollment or deletion of drivers inf 1100 form

- 2018 2021 form ky tc 95 1 fill online printable fillable

- Illinois dealer renewal application and instructions form

Find out other Dte Cauv Oh

- Electronic signature Maine Contract for work Secure

- Electronic signature Utah Contract Myself

- How Can I Electronic signature Texas Electronic Contract

- How Do I Electronic signature Michigan General contract template

- Electronic signature Maine Email Contracts Later

- Electronic signature New Mexico General contract template Free

- Can I Electronic signature Rhode Island Email Contracts

- How Do I Electronic signature California Personal loan contract template

- Electronic signature Hawaii Personal loan contract template Free

- How To Electronic signature Hawaii Personal loan contract template

- Electronic signature New Hampshire Managed services contract template Computer

- Electronic signature Alabama Real estate sales contract template Easy

- Electronic signature Georgia Real estate purchase contract template Secure

- Electronic signature South Carolina Real estate sales contract template Mobile

- Can I Electronic signature Kentucky Residential lease contract

- Can I Electronic signature Nebraska Residential lease contract

- Electronic signature Utah New hire forms Now

- Electronic signature Texas Tenant contract Now

- How Do I Electronic signature Florida Home rental application

- Electronic signature Illinois Rental application Myself