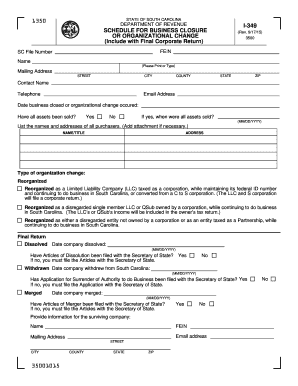

I 349 Form

What is the I-349?

The I-349 is a form utilized in South Carolina for reporting and managing various tax-related matters, particularly for businesses. It is essential for ensuring compliance with state tax regulations and allows businesses to report their income accurately. The form is specifically designed to facilitate the process of submitting tax information to the South Carolina Department of Revenue (SCDOR). Understanding the purpose and requirements of the I-349 is crucial for businesses to avoid potential penalties and ensure timely filing.

Steps to complete the I-349

Completing the I-349 involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary financial documents, including income statements and expense reports. Next, fill out the form with precise information regarding your business income, deductions, and any applicable credits. It is important to double-check entries for any errors or omissions. After completing the form, review it thoroughly before submission to ensure that all information is accurate and up-to-date.

Legal use of the I-349

The I-349 must be completed and submitted in accordance with South Carolina tax laws to be considered legally valid. This includes adhering to deadlines and providing truthful information. Failure to comply with these regulations can lead to penalties or legal repercussions. It is advisable for businesses to maintain accurate records and consult with tax professionals to ensure that their use of the I-349 aligns with state requirements.

Filing Deadlines / Important Dates

Filing deadlines for the I-349 can vary based on the type of business entity and the specific tax year. Generally, businesses should be aware of the annual filing deadline, which typically falls on the fifteenth day of the fourth month following the end of the tax year. It is crucial to stay informed about any changes to these deadlines, as late submissions may incur penalties. Keeping a calendar of important tax dates can help ensure timely compliance.

Required Documents

When preparing to file the I-349, businesses should gather several key documents. These include financial statements, proof of income, and records of expenses. Additionally, any relevant tax credits or deductions should be documented. Having these materials organized and readily available can streamline the completion process and help avoid errors that may delay filing.

Who Issues the Form

The I-349 is issued by the South Carolina Department of Revenue (SCDOR). This state agency is responsible for overseeing tax collection and ensuring compliance with tax laws. Businesses should refer to the SCDOR for the most current version of the form and any updates regarding filing procedures or requirements. Staying connected with the SCDOR can provide valuable resources and assistance for completing the I-349 accurately.

Quick guide on how to complete i 349

Complete I 349 effortlessly on any device

Online document management has gained popularity among companies and individuals. It serves as an ideal environmentally friendly substitute for traditional printed and signed documents, allowing you to obtain the correct form and securely save it online. airSlate SignNow supplies all the tools necessary to create, edit, and electronically sign your documents quickly without delays. Handle I 349 on any device using the airSlate SignNow Android or iOS applications and simplify any document-related task today.

The easiest way to edit and eSign I 349 without any hassle

- Find I 349 and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of your documents or obscure sensitive details using tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature with the Sign tool, which takes moments and carries the same legal validity as a conventional ink signature.

- Review the details and click on the Done button to retain your modifications.

- Select how you wish to send your form, via email, SMS, or invite link, or download it to your computer.

Forget about lost or misplaced files, frustrating form searches, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you choose. Edit and eSign I 349 and guarantee excellent communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is sc dor change and how does it work?

The sc dor change refers to the process of updating or modifying information with the South Carolina Department of Revenue. With airSlate SignNow, users can easily manage these updates by sending and eSigning necessary documents electronically, streamlining the process and reducing paperwork.

-

How can airSlate SignNow assist with the sc dor change process?

airSlate SignNow provides a user-friendly platform that enables businesses to prepare, send, and sign documents needed for sc dor change seamlessly. Our solution simplifies the workflows involved, making it easier to ensure compliance and accuracy in your submissions.

-

What are the costs associated with using airSlate SignNow for sc dor change?

Pricing for airSlate SignNow varies depending on the plan you choose. We offer several tiers to cater to different business needs, all designed to provide an affordable solution for managing sc dor change and other document-related tasks efficiently.

-

Are there any features specifically designed for managing sc dor change in airSlate SignNow?

Yes, airSlate SignNow includes features like customizable templates, automated reminders, and real-time tracking, all tailored to facilitate the sc dor change process. These features enhance user experience and ensure that important deadlines are met without hassle.

-

Can I integrate airSlate SignNow with other software for sc dor change?

Absolutely! airSlate SignNow supports integrations with various third-party applications, allowing you to streamline the sc dor change process. This flexibility ensures that you can work within your existing systems while enhancing document management and eSigning efficiency.

-

What benefits can I expect from using airSlate SignNow for sc dor change?

Using airSlate SignNow for sc dor change offers numerous benefits, such as increased efficiency, reduced turnaround time, and improved compliance. Our platform allows you to electronically complete and manage documents quickly, saving you time and resources in your business operations.

-

Is airSlate SignNow secure for handling sc dor change documents?

Yes, security is a top priority for airSlate SignNow. Our platform employs advanced encryption and authentication methods to protect sensitive information during the sc dor change process, ensuring that your data remains safe and confidential.

Get more for I 349

- Idaho full registration online form

- Notice of motor vehicle tow form

- Acknowledged before me this date form

- Department of revenue division of motor coloradogov form

- Change of financial institution address andor fein change form

- X cdlps yes no ctgov form

- 8 15 13 villager combo by weekly register call issuu form

- Information and instructions for prequalification of bidders

Find out other I 349

- Sign Wisconsin Applicant Appraisal Form Questions Easy

- Sign Alabama Deed of Indemnity Template Later

- Sign Alabama Articles of Incorporation Template Secure

- Can I Sign Nevada Articles of Incorporation Template

- Sign New Mexico Articles of Incorporation Template Safe

- Sign Ohio Articles of Incorporation Template Simple

- Can I Sign New Jersey Retainer Agreement Template

- Sign West Virginia Retainer Agreement Template Myself

- Sign Montana Car Lease Agreement Template Fast

- Can I Sign Illinois Attorney Approval

- Sign Mississippi Limited Power of Attorney Later

- How Can I Sign Kansas Attorney Approval

- How Do I Sign New Mexico Limited Power of Attorney

- Sign Pennsylvania Car Lease Agreement Template Simple

- Sign Rhode Island Car Lease Agreement Template Fast

- Sign Indiana Unlimited Power of Attorney Online

- Can I Sign Idaho Affidavit of No Lien

- Sign New York Affidavit of No Lien Online

- How To Sign Delaware Trademark License Agreement

- How To Sign Nevada Retainer for Attorney