8821 VT Department of Taxes Tax Vermont Form

What is the 8821 VT Department of Taxes Tax Vermont

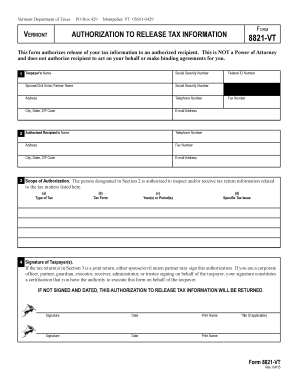

The 8821 VT Department of Taxes Tax Vermont form is a crucial document used by individuals and businesses in Vermont to authorize the Vermont Department of Taxes to disclose tax information to designated third parties. This form is particularly important for taxpayers who want to ensure that their tax matters are handled efficiently and that their representatives can access necessary information on their behalf. Understanding the purpose and implications of this form is essential for anyone navigating the Vermont tax system.

How to use the 8821 VT Department of Taxes Tax Vermont

Using the 8821 VT Department of Taxes Tax Vermont form involves a straightforward process. First, you need to fill out the form with accurate information, including your name, address, and Social Security number or Employer Identification Number (EIN). Next, you must specify the third party you are authorizing to receive your tax information. Once completed, the form should be signed and dated by you, the taxpayer. This ensures that the Vermont Department of Taxes can legally disclose your information to the designated representative.

Steps to complete the 8821 VT Department of Taxes Tax Vermont

Completing the 8821 VT Department of Taxes Tax Vermont form requires careful attention to detail. Follow these steps:

- Obtain the form from the Vermont Department of Taxes website or a local office.

- Fill in your personal information, including your full name, address, and identification number.

- Clearly identify the third party you are authorizing and provide their contact details.

- Sign and date the form to validate your authorization.

- Submit the completed form to the Vermont Department of Taxes via mail or in person.

Legal use of the 8821 VT Department of Taxes Tax Vermont

The legal use of the 8821 VT Department of Taxes Tax Vermont form is governed by state tax laws. By signing this form, you grant permission for the Vermont Department of Taxes to share your tax information with the specified third party. This is particularly useful in situations where you may require assistance from tax professionals or legal representatives. It is important to ensure that the third party is trustworthy, as they will have access to sensitive financial information.

Filing Deadlines / Important Dates

Filing deadlines for the 8821 VT Department of Taxes Tax Vermont form are generally aligned with the tax year. It is advisable to submit the form as soon as you decide to authorize a third party to handle your tax matters. By doing so, you ensure that your representative has timely access to your tax information, which can facilitate smoother communication with the Vermont Department of Taxes. Always check for any specific deadlines related to your tax situation to avoid complications.

Form Submission Methods (Online / Mail / In-Person)

The 8821 VT Department of Taxes Tax Vermont form can be submitted through various methods, providing flexibility for taxpayers. You can choose to mail the completed form to the Vermont Department of Taxes or deliver it in person at a local office. Currently, online submission options may not be available for this specific form, so it is essential to verify the submission method that best suits your needs. Regardless of the method chosen, ensure that you keep a copy of the submitted form for your records.

Quick guide on how to complete 8821 vt department of taxes tax vermont

Prepare 8821 VT Department Of Taxes Tax Vermont effortlessly on any device

Web-based document management has become increasingly popular among enterprises and individuals. It offers an ideal eco-friendly substitute to conventional printed and signed paperwork, as you can easily find the right format and securely retain it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents quickly without delays. Manage 8821 VT Department Of Taxes Tax Vermont on any device using the airSlate SignNow applications for Android or iOS and improve any document-related task today.

The easiest way to modify and eSign 8821 VT Department Of Taxes Tax Vermont with minimal effort

- Find 8821 VT Department Of Taxes Tax Vermont and click Get Form to begin.

- Utilize the tools we offer to finish your document.

- Emphasize important sections of the documents or hide sensitive information with tools that airSlate SignNow provides specifically for this purpose.

- Generate your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional handwritten signature.

- Review all the details and click the Done button to save your modifications.

- Choose how you would like to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that require reprinting new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign 8821 VT Department Of Taxes Tax Vermont to ensure exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a VT tax form?

The VT tax form is a document used by Vermont residents to report their income and calculate their tax obligations. It is essential for individuals and businesses to accurately complete and eSign this form to ensure compliance with state regulations. airSlate SignNow simplifies this process through its user-friendly platform.

-

How can airSlate SignNow help with the VT tax form?

airSlate SignNow provides an efficient way to prepare, send, and eSign your VT tax form electronically. Our platform ensures that your documents are secure and easily accessible, making tax filing straightforward. With templates available, you can quickly complete your form each year without hassle.

-

Is there a cost to use airSlate SignNow for eSigning a VT tax form?

Yes, airSlate SignNow offers a variety of pricing plans to meet different needs, including options for individuals and businesses needing to eSign VT tax forms. Our plans provide excellent value, with features like unlimited document sending and customization options. Explore our pricing page to find the best plan for you.

-

Can I integrate airSlate SignNow with other software for my VT tax form processes?

Absolutely! airSlate SignNow integrates with a wide range of accounting and productivity software. This capability allows you to streamline your workflow when dealing with your VT tax form and other documents, ensuring a seamless experience in your business operations.

-

What features does airSlate SignNow offer for managing the VT tax form?

Our platform offers several features to manage your VT tax form efficiently, including template creation, document editing, and real-time tracking of signature requests. Additionally, you can easily share your form with collaborators for review and approval. These features are designed to simplify your tax form management.

-

How secure is my information when using airSlate SignNow for my VT tax form?

Security is a priority at airSlate SignNow. We utilize industry-standard encryption protocols to protect your data while you eSign and store your VT tax form. You can have peace of mind knowing that your sensitive financial information is safeguarded throughout the process.

-

Can I save my VT tax form as a template for future use?

Yes, airSlate SignNow allows you to create and save your VT tax form as a template. This feature saves you time in subsequent years, as you can easily update and re-send the form without having to start from scratch. Simply customize your saved template each tax season.

Get more for 8821 VT Department Of Taxes Tax Vermont

Find out other 8821 VT Department Of Taxes Tax Vermont

- eSignature Missouri Car Dealer Purchase Order Template Easy

- eSignature Indiana Charity Residential Lease Agreement Simple

- How Can I eSignature Maine Charity Quitclaim Deed

- How Do I eSignature Michigan Charity LLC Operating Agreement

- eSignature North Carolina Car Dealer NDA Now

- eSignature Missouri Charity Living Will Mobile

- eSignature New Jersey Business Operations Memorandum Of Understanding Computer

- eSignature North Dakota Car Dealer Lease Agreement Safe

- eSignature Oklahoma Car Dealer Warranty Deed Easy

- eSignature Oregon Car Dealer Rental Lease Agreement Safe

- eSignature South Carolina Charity Confidentiality Agreement Easy

- Can I eSignature Tennessee Car Dealer Limited Power Of Attorney

- eSignature Utah Car Dealer Cease And Desist Letter Secure

- eSignature Virginia Car Dealer Cease And Desist Letter Online

- eSignature Virginia Car Dealer Lease Termination Letter Easy

- eSignature Alabama Construction NDA Easy

- How To eSignature Wisconsin Car Dealer Quitclaim Deed

- eSignature California Construction Contract Secure

- eSignature Tennessee Business Operations Moving Checklist Easy

- eSignature Georgia Construction Residential Lease Agreement Easy