51a113 2005

What is the Kentucky Form 51A113?

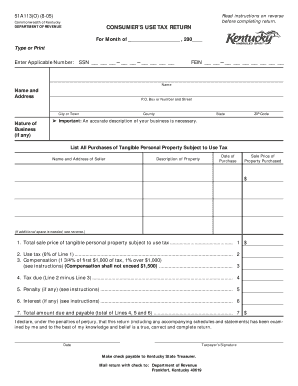

The Kentucky Form 51A113 is a specific document used for reporting consumer use tax in the state of Kentucky. This form is essential for individuals and businesses who purchase goods for use in Kentucky but do not pay sales tax at the time of purchase. The form helps ensure compliance with state tax regulations and allows taxpayers to report and remit the appropriate tax amount owed to the state.

Steps to Complete the Kentucky Form 51A113

Completing the Kentucky Form 51A113 involves several key steps:

- Gather Information: Collect all necessary details regarding your purchases, including dates, descriptions, and purchase amounts.

- Fill Out the Form: Accurately enter your information on the form, ensuring that all fields are completed as required.

- Calculate Tax Owed: Determine the amount of consumer use tax owed based on your purchases and the applicable tax rate.

- Review for Accuracy: Double-check all entries to ensure there are no errors before submission.

- Submit the Form: Choose your preferred submission method—online, by mail, or in-person—and ensure it is sent by the due date.

Legal Use of the Kentucky Form 51A113

The Kentucky Form 51A113 is legally recognized for reporting consumer use tax obligations. To ensure its legal validity, the form must be completed accurately and submitted in accordance with Kentucky state tax laws. Failure to use the form correctly may result in penalties or additional tax liabilities. Utilizing a reliable eSignature solution can further enhance the legal standing of the completed form, ensuring compliance with electronic signature regulations.

Key Elements of the Kentucky Form 51A113

Understanding the key elements of the Kentucky Form 51A113 is crucial for proper completion:

- Taxpayer Information: Includes the name, address, and identification number of the taxpayer.

- Purchase Details: Lists the items purchased, including descriptions and purchase amounts.

- Tax Calculation: A section for calculating the total consumer use tax owed based on the reported purchases.

- Signature Section: Requires the taxpayer's signature to validate the information provided.

Form Submission Methods

The Kentucky Form 51A113 can be submitted through various methods, providing flexibility for taxpayers:

- Online Submission: Many taxpayers prefer to file electronically through the Kentucky Department of Revenue's online portal.

- Mail Submission: The completed form can be printed and mailed to the appropriate address as indicated on the form.

- In-Person Submission: Taxpayers may also choose to deliver the form in person at designated state tax offices.

Filing Deadlines / Important Dates

It is important to be aware of the filing deadlines associated with the Kentucky Form 51A113. Typically, the form must be submitted by the due date specified by the Kentucky Department of Revenue, which is often aligned with the end of the tax year. Late submissions may incur penalties and interest on any unpaid tax amounts. Keeping track of these deadlines ensures compliance and helps avoid additional costs.

Quick guide on how to complete 51a113

Complete 51a113 effortlessly on any device

Online document management has gained popularity among organizations and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed paperwork, allowing you to locate the suitable form and securely store it online. airSlate SignNow provides all the tools you need to create, modify, and eSign your documents swiftly without delays. Manage 51a113 on any device with airSlate SignNow's Android or iOS applications and streamline any document-centric procedure today.

The easiest way to edit and eSign 51a113 with ease

- Locate 51a113 and click on Get Form to begin.

- Use the tools we provide to fill out your document.

- Highlight pertinent sections of your documents or conceal sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your signature with the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Verify the details and click on the Done button to save your changes.

- Decide how you want to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that require printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from your chosen device. Edit and eSign 51a113 and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 51a113

Create this form in 5 minutes!

People also ask

-

What is the Kentucky Form 51A113 PDF used for?

The Kentucky Form 51A113 PDF is used for reporting and filing state income tax for individuals and specific businesses in Kentucky. This form captures essential financial information required by the Kentucky Department of Revenue, ensuring compliance with state tax laws.

-

How can airSlate SignNow help with the Kentucky Form 51A113 PDF?

airSlate SignNow allows users to easily fill out, sign, and manage the Kentucky Form 51A113 PDF digitally. The platform streamlines the process, making it simple to complete and eSign the form without the hassle of printing and mailing.

-

Is there a cost associated with using airSlate SignNow for Kentucky Form 51A113 PDF?

Yes, airSlate SignNow offers various pricing plans to accommodate different business needs. The cost is competitive, and exploring the pricing options helps determine the best fit for handling the Kentucky Form 51A113 PDF efficiently.

-

Can the Kentucky Form 51A113 PDF be integrated with other software?

Absolutely! airSlate SignNow supports integrations with numerous software applications, enhancing your ability to manage the Kentucky Form 51A113 PDF seamlessly with your existing tools. Popular integrations include CRM systems, project management platforms, and cloud storage services.

-

What features does airSlate SignNow offer for managing the Kentucky Form 51A113 PDF?

airSlate SignNow provides a range of features for managing the Kentucky Form 51A113 PDF, including secure eSignature options, document templates, collaborative editing, and tracking capabilities. These features enhance efficiency and ensure accuracy in document management.

-

What are the benefits of using airSlate SignNow for the Kentucky Form 51A113 PDF?

Using airSlate SignNow for the Kentucky Form 51A113 PDF offers several benefits, including increased efficiency, reduced processing time, and enhanced security through electronic signatures. It simplifies the workflow, making it easier to handle tax documentation.

-

Is it easy to fill out the Kentucky Form 51A113 PDF using airSlate SignNow?

Yes, airSlate SignNow is designed to be user-friendly, making it easy for anyone to fill out the Kentucky Form 51A113 PDF. The intuitive interface guides users through the process, eliminating confusion and ensuring all required fields are completed accurately.

Get more for 51a113

- 009 information online

- Kentucky search warrant form

- 60 day involuntary latest form

- Illinois secretary of state spanish edition form

- Corporation x washington state department of transportation form

- Form hsmv96020 ampquotrequest to withhold personal informationampquot florida templateroller

- Adult literacy classes illinois secretary of state form

- Washington state drivers license barcode form

Find out other 51a113

- Help Me With eSignature Tennessee Banking PDF

- How Can I eSignature Virginia Banking PPT

- How Can I eSignature Virginia Banking PPT

- Can I eSignature Washington Banking Word

- Can I eSignature Mississippi Business Operations Document

- How To eSignature Missouri Car Dealer Document

- How Can I eSignature Missouri Business Operations PPT

- How Can I eSignature Montana Car Dealer Document

- Help Me With eSignature Kentucky Charity Form

- How Do I eSignature Michigan Charity Presentation

- How Do I eSignature Pennsylvania Car Dealer Document

- How To eSignature Pennsylvania Charity Presentation

- Can I eSignature Utah Charity Document

- How Do I eSignature Utah Car Dealer Presentation

- Help Me With eSignature Wyoming Charity Presentation

- How To eSignature Wyoming Car Dealer PPT

- How To eSignature Colorado Construction PPT

- How To eSignature New Jersey Construction PDF

- How To eSignature New York Construction Presentation

- How To eSignature Wisconsin Construction Document