Form 472 Request for Sales or Use Tax Cash Bond Refund

What is the Form 472 Request For Sales Or Use Tax Cash Bond Refund

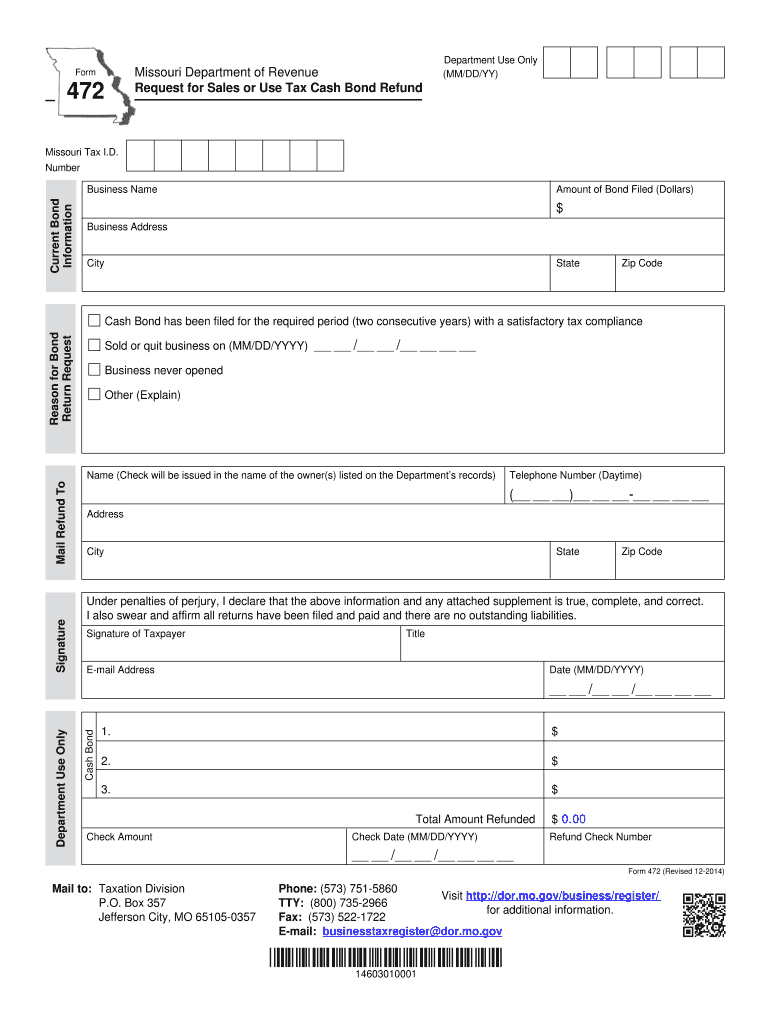

The Form 472 is a specific document used in the United States for requesting a refund of sales or use tax cash bonds. This form is essential for businesses that have previously submitted cash bonds to ensure compliance with state tax regulations. By completing this form, businesses can reclaim funds that were initially deposited as a security measure against unpaid sales or use taxes. Understanding the purpose and function of Form 472 is crucial for any business seeking to manage their tax obligations effectively.

How to Use the Form 472 Request For Sales Or Use Tax Cash Bond Refund

Using Form 472 involves several steps to ensure accurate completion and submission. First, gather all necessary information, including your business details and the specifics of the cash bond. Next, fill out the form by providing required data, such as the bond amount and the reason for the refund request. It is important to review the form for accuracy before submission to avoid delays. Once completed, the form can be submitted through the designated channels, either online or via mail, depending on the state’s requirements.

Steps to Complete the Form 472 Request For Sales Or Use Tax Cash Bond Refund

Completing Form 472 requires careful attention to detail. Follow these steps for successful completion:

- Begin by entering your business name and contact information at the top of the form.

- Provide the bond number associated with your cash bond.

- Indicate the amount of the cash bond you are requesting to be refunded.

- Explain the reason for the refund request in the designated section.

- Sign and date the form to certify that the information provided is accurate.

After filling out the form, ensure that you keep a copy for your records before submitting it to the appropriate tax authority.

Legal Use of the Form 472 Request For Sales Or Use Tax Cash Bond Refund

The legal use of Form 472 is governed by state tax laws, which dictate the circumstances under which a cash bond refund may be requested. It is important for businesses to understand these regulations to ensure compliance. Submitting this form correctly can help avoid potential legal issues, such as penalties for improper refund requests. The form serves as an official request and must be completed in accordance with the guidelines set forth by the relevant tax authority.

Eligibility Criteria for Form 472 Request For Sales Or Use Tax Cash Bond Refund

Eligibility for submitting Form 472 typically includes businesses that have previously posted a cash bond for sales or use tax purposes. To qualify for a refund, the business must demonstrate that it has met all tax obligations and that the bond is no longer necessary. Additionally, businesses must ensure that they are within the appropriate time frame for requesting a refund, as specified by state regulations. Understanding these criteria is essential for a successful refund process.

Form Submission Methods (Online / Mail / In-Person)

Form 472 can be submitted through various methods, depending on state guidelines. Common submission methods include:

- Online: Many states allow for electronic submission through their tax department's website, which may expedite processing times.

- Mail: Businesses can print the completed form and send it via postal service to the designated tax authority.

- In-Person: Some jurisdictions may permit in-person submissions at local tax offices, providing an opportunity for immediate confirmation of receipt.

It is advisable to check the specific submission methods available in your state to ensure compliance and efficiency.

Quick guide on how to complete form 472 request for sales or use tax cash bond refund

Complete Form 472 Request For Sales Or Use Tax Cash Bond Refund effortlessly on any device

Web-based document management has gained popularity among businesses and individuals. It offers an excellent eco-friendly alternative to traditional printed and signed papers, allowing you to obtain the required form and securely store it online. airSlate SignNow provides all the tools you need to create, modify, and eSign your documents swiftly without delays. Handle Form 472 Request For Sales Or Use Tax Cash Bond Refund on any platform with airSlate SignNow Android or iOS applications and enhance any document-related process today.

How to alter and eSign Form 472 Request For Sales Or Use Tax Cash Bond Refund with ease

- Find Form 472 Request For Sales Or Use Tax Cash Bond Refund and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of the documents or redact sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your eSignature with the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to save your changes.

- Select how you wish to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, laborious form searches, or errors that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choice. Edit and eSign Form 472 Request For Sales Or Use Tax Cash Bond Refund and ensure exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is form 472 and how can airSlate SignNow help with it?

Form 472 is a specific document often used for regulatory compliance. With airSlate SignNow, you can easily create, send, and eSign form 472, streamlining the process and ensuring all necessary signatures are collected efficiently.

-

What features does airSlate SignNow offer for managing form 472?

airSlate SignNow provides features like customizable templates, automated workflows, and real-time tracking for form 472. This ensures that you can manage documents more effectively, reducing time spent on paperwork.

-

Is there a cost associated with using airSlate SignNow for form 472?

Yes, airSlate SignNow offers various pricing plans to fit different business needs. Evaluating options based on your volume of form 472 signing will help you choose the most cost-effective solution for your organization.

-

Can I integrate airSlate SignNow with other software for form 472?

Absolutely! airSlate SignNow integrates seamlessly with many applications, allowing you to manage form 472 alongside other software. This integration improves the overall workflow and efficiency of your document processes.

-

What are the benefits of using airSlate SignNow for form 472?

Using airSlate SignNow for form 472 provides numerous benefits including increased speed in document processing, enhanced security features, and improved collaboration among team members, leading to better workflows and compliance adherence.

-

How secure is the process for signing form 472 with airSlate SignNow?

The security of your documents is a top priority with airSlate SignNow. Form 472 signing is conducted over a secure platform with encryption and authentication measures in place, ensuring your sensitive information is protected.

-

Can I access form 472 on mobile devices using airSlate SignNow?

Yes, airSlate SignNow is designed for mobile access, allowing you to manage and sign form 472 on the go. This flexibility enables users to stay productive and responsive, no matter where they are.

Get more for Form 472 Request For Sales Or Use Tax Cash Bond Refund

- Limited power of attorney for specific motor vehiclevessel form

- Cristalextendedblogspotcom202104application for duplicate registration certificate form

- Vr 008 fill and sign printable template onlineus form

- Application for change of address on valid texas driver form

- 22pdf vsa 17a application for certificate of title and form

- I need a clearance letter from new york so i can get my form

- Dmv renew license online ny terrier form

- Open government florida highway safety and motor vehicles form

Find out other Form 472 Request For Sales Or Use Tax Cash Bond Refund

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors