4506 C Form PDF

What is the 4506 C Form PDF

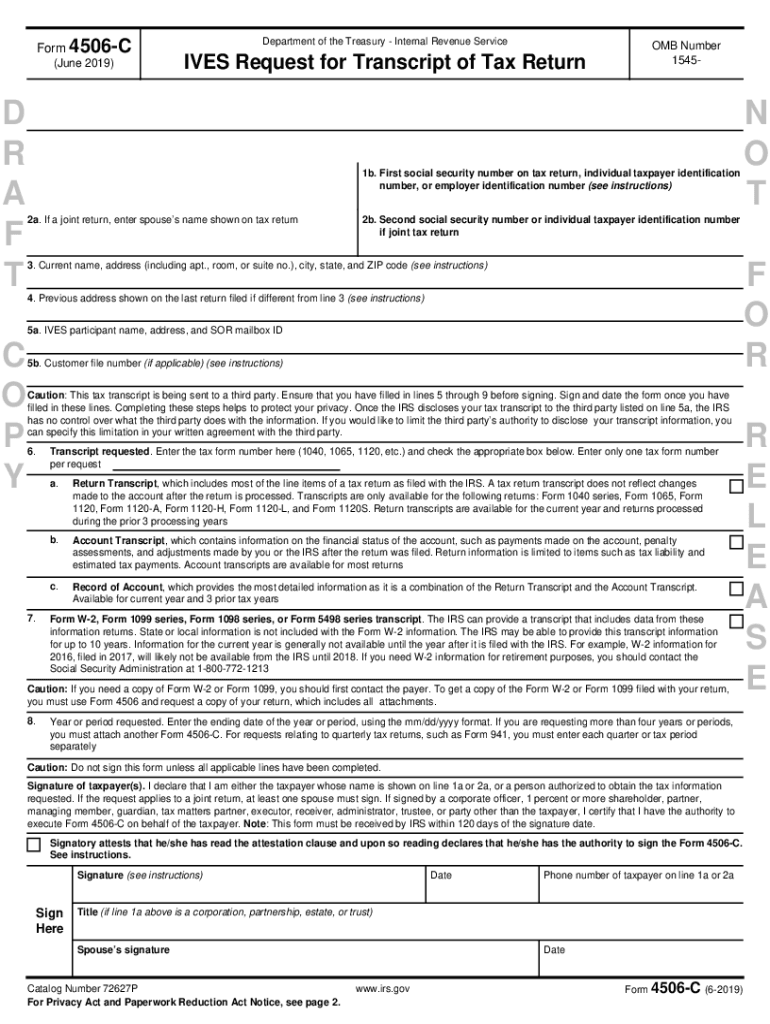

The 4506 C form, also known as the IRS Form 4506-C, is a document used by taxpayers in the United States to request a copy of their tax return transcript directly from the Internal Revenue Service (IRS). This form is particularly useful for individuals and businesses that need to verify income or tax filing status for various purposes, such as applying for loans, mortgages, or government assistance programs. Unlike the traditional 4506-T form, the 4506 C allows for direct electronic transmission of tax return information to third parties, making it a preferred choice for many financial institutions.

How to Use the 4506 C Form PDF

Using the 4506 C form is straightforward. First, download the fillable 4506 C form PDF from the IRS website or a trusted source. After downloading, fill in the required information, which includes your name, Social Security number, and the tax year for which you are requesting the transcript. You will also need to provide the name and contact information of the third party to whom the IRS will send your tax information. Once completed, you can submit the form electronically or by mail, depending on the method you choose.

Steps to Complete the 4506 C Form PDF

Completing the 4506 C form involves several key steps:

- Download the latest version of the 4506 C form PDF.

- Fill in your personal information, including your name, address, and Social Security number.

- Indicate the type of tax return you are requesting and the tax year.

- Provide the name and address of the third party that will receive your tax information.

- Sign and date the form to authorize the release of your tax information.

- Submit the completed form either electronically or by mail to the IRS.

Legal Use of the 4506 C Form PDF

The 4506 C form is legally recognized as a valid request for tax return information, provided it is completed accurately and submitted according to IRS guidelines. It is essential to ensure that all information is correct to avoid delays or rejections. Additionally, the form must be signed by the taxpayer or an authorized representative, as this signature serves as consent for the IRS to release the requested information to the specified third party.

IRS Guidelines

The IRS has specific guidelines regarding the use of the 4506 C form. Taxpayers should ensure they are using the most current version of the form, as outdated forms may not be accepted. The IRS typically processes requests within a few weeks, but processing times can vary based on the volume of requests. It is advisable to check the IRS website for any updates or changes to the guidelines related to the 4506 C form.

Required Documents

When submitting the 4506 C form, you may need to provide additional documentation depending on the purpose of your request. Commonly required documents include:

- Proof of identity, such as a government-issued photo ID.

- Any relevant financial documents that support your request.

- Additional forms or authorizations if the request is made by a third party.

Quick guide on how to complete 4506 c form pdf

Complete 4506 C Form Pdf effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to find the appropriate form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents quickly without delays. Manage 4506 C Form Pdf on any platform with airSlate SignNow's Android or iOS applications and simplify any document-centric task today.

The easiest way to modify and eSign 4506 C Form Pdf seamlessly

- Obtain 4506 C Form Pdf and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight relevant sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that task.

- Create your eSignature with the Sign tool, which takes seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Select how you want to share your form, via email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form navigation, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign 4506 C Form Pdf and ensure effective communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 4506 c form pdf

The way to create an e-signature for your PDF in the online mode

The way to create an e-signature for your PDF in Chrome

The best way to generate an electronic signature for putting it on PDFs in Gmail

The way to create an e-signature right from your smart phone

The best way to generate an electronic signature for a PDF on iOS devices

The way to create an e-signature for a PDF on Android OS

People also ask

-

What is the 4506 C form American Express used for?

The 4506 C form American Express is used to allow third parties to obtain tax return information from the IRS. This is particularly useful for verifying income information when applying for credit or loans. It's a crucial document that can facilitate the lending process.

-

How can airSlate SignNow help with the 4506 C form American Express?

With airSlate SignNow, you can easily send, eSign, and manage the 4506 C form American Express. Our platform streamlines the document workflow, making it simple to collect signatures from all necessary parties. This efficiency ensures that your forms are processed quickly and securely.

-

Is there a cost associated with using the 4506 C form American Express on airSlate SignNow?

While using the 4506 C form American Express through airSlate SignNow does come with a subscription cost, it offers a cost-effective solution compared to traditional methods. You can save time and resources by utilizing our digital platform for document management. Check our pricing plans for more details on affordability.

-

Can I customize the 4506 C form American Express using airSlate SignNow?

Yes, airSlate SignNow allows you to customize the 4506 C form American Express to meet your specific needs. You can add your branding, adjust the layout, or include additional fields as required. This flexibility ensures that your documents are tailored to your business requirements.

-

What benefits does airSlate SignNow offer for signing the 4506 C form American Express?

Signing the 4506 C form American Express with airSlate SignNow offers numerous benefits, including enhanced security and ease of use. Our platform allows you to eSign documents quickly from any device while maintaining compliance with legal standards. This streamlined approach saves you time and minimizes the risk of errors.

-

Are there integrations available for the 4506 C form American Express with airSlate SignNow?

Absolutely! airSlate SignNow integrates seamlessly with various software, making it easy to manage the 4506 C form American Express. You can connect with CRM systems, payment processors, and other essential tools to enhance your document workflow, ensuring a smooth operation tailored to your business needs.

-

How secure is the 4506 C form American Express when using airSlate SignNow?

Security is a top priority for airSlate SignNow, especially when handling sensitive documents like the 4506 C form American Express. Our platform employs advanced encryption protocols and compliance measures to protect your data. You can rest assured knowing your information is secure throughout the signing process.

Get more for 4506 C Form Pdf

- Washington warranty deed from husband and us legal forms

- Wisconsin warranty deed for conversion of us legal forms

- Alabama warranty deed to separate property us legal forms

- Warranty deed law and legal definitionuslegal inc form

- Control number wa sdeed 8 1 form

- Washington warranty deed from individual to us legal forms

- Additional secured partys name or name of total assignee insert only one name 25a or 25b form

- To be deleted in item 6a or 6b form

Find out other 4506 C Form Pdf

- How Do I Sign Hawaii Sports Presentation

- How Do I Sign Kentucky Sports Presentation

- Can I Sign North Carolina Orthodontists Presentation

- How Do I Sign Rhode Island Real Estate Form

- Can I Sign Vermont Real Estate Document

- How To Sign Wyoming Orthodontists Document

- Help Me With Sign Alabama Courts Form

- Help Me With Sign Virginia Police PPT

- How To Sign Colorado Courts Document

- Can I eSign Alabama Banking PPT

- How Can I eSign California Banking PDF

- How To eSign Hawaii Banking PDF

- How Can I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- Help Me With eSign Hawaii Banking Document

- How To eSign Hawaii Banking Document

- Can I eSign Hawaii Banking Presentation

- Can I Sign Iowa Courts Form

- Help Me With eSign Montana Banking Form