Form MT 903 FUT January , Fuel Use Tax Return, MT903FUT Tax Ny

Understanding the MT 903 FUT: Fuel Use Tax Return

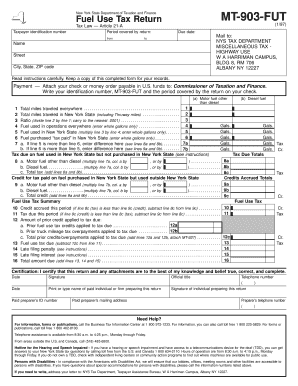

The MT 903 FUT, or Fuel Use Tax Return, is a crucial form for businesses that operate vehicles in New York and utilize fuel for transportation purposes. This form is specifically designed to report and pay fuel use tax based on the miles driven in the state. It is essential for ensuring compliance with state tax regulations, particularly for companies that transport goods or services across state lines.

Steps to Complete the MT 903 FUT

Completing the MT 903 FUT involves several key steps to ensure accuracy and compliance:

- Gather necessary information, including your business details and vehicle mileage records.

- Calculate the total miles driven in New York and the corresponding fuel use tax owed.

- Fill out the MT 903 FUT form accurately, ensuring all sections are completed.

- Review the form for any errors or omissions before submission.

- Submit the completed form by the designated deadline to avoid penalties.

Obtaining the MT 903 FUT Form

The MT 903 FUT form can be obtained through the New York State Department of Taxation and Finance website. It is available in a downloadable PDF format, allowing users to fill it out electronically or print it for manual completion. Ensure you have the latest version of the form to comply with current regulations.

Legal Use of the MT 903 FUT

The legal use of the MT 903 FUT is governed by New York State tax laws. It is essential for businesses to file this form accurately and on time to avoid legal repercussions. Failure to comply with these regulations can result in penalties and interest on unpaid taxes. The form must be signed and dated by an authorized representative of the business to be considered valid.

Key Elements of the MT 903 FUT

Several key elements must be included when completing the MT 903 FUT:

- Business identification information, including the name and address.

- Details of the vehicles used, including registration numbers and fuel type.

- Mileage records, indicating the total miles driven in New York.

- The calculation of the fuel use tax based on the reported mileage.

- Signature of the authorized representative, affirming the accuracy of the information provided.

Filing Deadlines for the MT 903 FUT

Filing deadlines for the MT 903 FUT are critical for compliance. Typically, the form is due quarterly, with specific dates set by the New York State Department of Taxation and Finance. It is important to keep track of these deadlines to avoid late fees and potential legal issues. Businesses should mark their calendars and prepare the necessary documentation well in advance of the due dates.

Quick guide on how to complete form mt 903 fut january 1997 fuel use tax return mt903fut tax ny

Effortlessly Prepare Form MT 903 FUT January , Fuel Use Tax Return, MT903FUT Tax Ny on Any Device

Digital document management has gained traction among companies and individuals alike. It offers an ideal environmentally friendly substitute to traditional printed and signed documents, as you can access the necessary form and securely store it online. airSlate SignNow equips you with all the resources needed to create, modify, and electronically sign your documents quickly and without interruptions. Manage Form MT 903 FUT January , Fuel Use Tax Return, MT903FUT Tax Ny on any device using airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

How to Modify and eSign Form MT 903 FUT January , Fuel Use Tax Return, MT903FUT Tax Ny Effortlessly

- Find Form MT 903 FUT January , Fuel Use Tax Return, MT903FUT Tax Ny and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight important sections of the documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes just seconds and carries the same legal validity as a traditional handwritten signature.

- Review the information and click the Done button to save your changes.

- Select your preferred method for submitting your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searches, or mistakes that require printing new copies. airSlate SignNow caters to your document management needs with just a few clicks from any device of your choice. Modify and eSign Form MT 903 FUT January , Fuel Use Tax Return, MT903FUT Tax Ny and guarantee excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is an MT 903 in the context of document transactions?

An MT 903 is a specific message type used in financial transactions to confirm the credit of funds. With airSlate SignNow, you can easily send and eSign documents that include important transaction confirmations like the MT 903, streamlining your financial workflows.

-

How does airSlate SignNow integrate with my existing software for MT 903 transactions?

airSlate SignNow offers seamless integrations with various financial software and tools that can handle MT 903 transactions. This allows you to manage your document workflows more efficiently without disrupting your current processes.

-

What are the pricing options for using airSlate SignNow for MT 903 transactions?

airSlate SignNow provides flexible pricing plans that cater to businesses of all sizes. The cost-effective solutions include features relevant for MT 903 document handling, ensuring you get the best value without sacrificing functionality.

-

Can airSlate SignNow help with compliance regarding MT 903 documents?

Yes, airSlate SignNow adheres to strict compliance regulations, allowing businesses to confidently send and eSign MT 903 documents. Our platform is designed to ensure that your documents are secure and compliant with industry standards.

-

What features does airSlate SignNow offer for managing MT 903 transactions?

airSlate SignNow offers advanced features such as templates, document tracking, and secure eSignature capabilities specifically designed for managing MT 903 transactions. This functionality helps optimize your document management process.

-

Is it easy to eSign MT 903 documents using airSlate SignNow?

Absolutely! airSlate SignNow provides a user-friendly interface that makes it easy to eSign MT 903 documents. With just a few clicks, you can complete your documents securely and efficiently.

-

What are the benefits of using airSlate SignNow for MT 903 confirmations?

Using airSlate SignNow for your MT 903 confirmations offers numerous benefits, including enhanced efficiency, reduced paper usage, and improved turnaround times. Our platform supports your business with an easy-to-use and cost-effective solution for all your documentation needs.

Get more for Form MT 903 FUT January , Fuel Use Tax Return, MT903FUT Tax Ny

- Child reunified welf ampamp inst code 36621f california form

- Fl 570 notice of registration of out of state support order judicial council forms

- Fl 910 request of minor to marry or judicial council forms

- I have not yet been able to complete the inquiry about the childs indian status because form

- Wwwformsworkflowcomformdetailsorder after hearing on motion to cancel set aside judgment

- Pretrial alcohol education program application form

- Wwwformsworkflowcomformdetailspetition for custody and support of minor children fl 260

- Get the free pdf attorney or party without attorney name form

Find out other Form MT 903 FUT January , Fuel Use Tax Return, MT903FUT Tax Ny

- How Can I Sign New Jersey Car Dealer Arbitration Agreement

- How Can I Sign Ohio Car Dealer Cease And Desist Letter

- How To Sign Ohio Car Dealer Arbitration Agreement

- How To Sign Oregon Car Dealer Limited Power Of Attorney

- How To Sign Pennsylvania Car Dealer Quitclaim Deed

- How Can I Sign Pennsylvania Car Dealer Quitclaim Deed

- Sign Rhode Island Car Dealer Agreement Safe

- Sign South Dakota Car Dealer Limited Power Of Attorney Now

- Sign Wisconsin Car Dealer Quitclaim Deed Myself

- Sign Wisconsin Car Dealer Quitclaim Deed Free

- Sign Virginia Car Dealer POA Safe

- Sign Wisconsin Car Dealer Quitclaim Deed Fast

- How To Sign Wisconsin Car Dealer Rental Lease Agreement

- How To Sign Wisconsin Car Dealer Quitclaim Deed

- How Do I Sign Wisconsin Car Dealer Quitclaim Deed

- Sign Wyoming Car Dealer Purchase Order Template Mobile

- Sign Arizona Charity Business Plan Template Easy

- Can I Sign Georgia Charity Warranty Deed

- How To Sign Iowa Charity LLC Operating Agreement

- Sign Kentucky Charity Quitclaim Deed Myself