Oh Form Ut 1000

What is the Ohio UT 1000 Form?

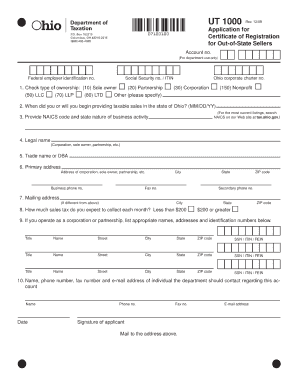

The Ohio UT 1000 form is a crucial document used for sales tax registration in the state of Ohio. This form is officially titled the Ohio Sales Tax Registration Form and is required for businesses that wish to collect sales tax from customers. It serves as a means for the Ohio Department of Taxation to gather essential information about the business, including its legal structure, ownership details, and the types of products or services offered. Completing the Ohio UT 1000 online streamlines the registration process, allowing businesses to establish their sales tax accounts efficiently.

Steps to Complete the Ohio UT 1000 Form

Completing the Ohio UT 1000 form involves several key steps to ensure accuracy and compliance. Begin by gathering necessary information, including your business's legal name, address, and federal employer identification number (EIN). Next, access the form through the Ohio Department of Taxation's website. Fill out the required fields, ensuring that all information is correct and up to date. After completing the form, review it for any errors before submitting it electronically. This process not only saves time but also enhances the accuracy of your submission.

Legal Use of the Ohio UT 1000 Form

The Ohio UT 1000 form is legally binding when filled out correctly and submitted according to state regulations. It is essential to understand that the information provided must be truthful and complete, as any discrepancies can lead to penalties or delays in processing. The form complies with the Electronic Signatures in Global and National Commerce (ESIGN) Act, ensuring that electronic submissions are recognized as valid under U.S. law. This legal framework provides businesses with confidence in the legitimacy of their online filings.

Filing Deadlines / Important Dates

Understanding the filing deadlines for the Ohio UT 1000 form is vital for businesses to maintain compliance. Generally, new businesses must register for a sales tax permit before they begin collecting sales tax. It is advisable to submit the form at least 30 days before the anticipated start of sales. Additionally, businesses should be aware of any specific deadlines related to their industry or type of goods sold, as these can vary. Staying informed about these dates helps prevent potential fines and ensures smooth operations.

Form Submission Methods

The Ohio UT 1000 form can be submitted through various methods, providing flexibility for businesses. The preferred method is online submission through the Ohio Department of Taxation's website, which allows for immediate processing. Alternatively, businesses can print the completed form and mail it to the appropriate address provided by the department. In-person submissions are also accepted at designated tax offices. Each method has its own processing times, so businesses should choose the one that best fits their needs.

Key Elements of the Ohio UT 1000 Form

Several key elements must be included in the Ohio UT 1000 form to ensure its completeness. These elements include the business's legal name, physical address, mailing address, and the owner's contact information. Additionally, the form requires details about the type of business entity, such as sole proprietorship, partnership, or corporation. It is also important to specify the nature of the business activities and any relevant tax exemptions. Providing accurate information in these sections is essential for proper registration and compliance with state tax laws.

Examples of Using the Ohio UT 1000 Form

The Ohio UT 1000 form is commonly used by various types of businesses, ranging from retail stores to service providers. For instance, a local boutique that sells clothing must complete this form to collect sales tax from customers. Similarly, a contractor providing home improvement services would need to register for sales tax to charge clients appropriately. Each business type has unique requirements, but all must adhere to the regulations set forth by the Ohio Department of Taxation when utilizing the UT 1000 form.

Quick guide on how to complete oh form ut 1000

Accomplish Oh Form Ut 1000 effortlessly on any device

Online document administration has become increasingly favored by businesses and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed documents, as you can easily find the necessary form and securely store it online. airSlate SignNow provides you with all the tools you need to create, amend, and eSign your documents quickly without delays. Manage Oh Form Ut 1000 on any platform with airSlate SignNow's Android or iOS applications and streamline any document-based task today.

How to modify and eSign Oh Form Ut 1000 effortlessly

- Find Oh Form Ut 1000 and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize relevant sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your eSignature with the Sign feature, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Select how you wish to send your form, whether by email, text message (SMS), invitation link, or download it to the computer.

Eliminate concerns about lost or mislaid files, tedious form hunting, or mistakes that necessitate printing new document copies. airSlate SignNow manages all your document administration needs in just a few clicks from any device of your choice. Modify and eSign Oh Form Ut 1000 and ensure outstanding communication at any point of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the UT 1000 online and how does it work?

The UT 1000 online is an advanced eSignature tool that enables users to sign documents electronically with ease. It streamlines the signing process, allowing for quicker document turnaround while ensuring compliance and security. By utilizing the UT 1000 online, businesses can improve their workflow and reduce the need for paper-based documents.

-

How much does using the UT 1000 online cost?

Pricing for the UT 1000 online varies based on the plan you choose, with options tailored for both individuals and enterprises. Typically, competitive packages provide excellent value for businesses looking to enhance their document management processes. Contact airSlate SignNow for specific pricing details and to find the best fit for your needs.

-

What are the key features of the UT 1000 online?

The UT 1000 online offers a range of powerful features including custom branding, real-time document tracking, and robust security protocols. Users can easily create templates, automate workflows, and manage multiple signers in one platform. These features make the UT 1000 online a versatile choice for businesses of all sizes.

-

What types of documents can be signed with the UT 1000 online?

You can sign various document types with the UT 1000 online, including contracts, agreements, forms, and more. The platform supports multiple file formats, allowing you to upload and send any document that requires a signature. This flexibility makes it ideal for numerous business use cases.

-

Is the UT 1000 online secure and compliant with regulations?

Yes, the UT 1000 online is designed with security at its core, incorporating features like encryption and multi-factor authentication. It complies with major eSignature laws and regulations, ensuring your documents are legally binding and protected. This commitment to security gives users peace of mind when signing sensitive documents.

-

Can the UT 1000 online be integrated with other tools?

Absolutely! The UT 1000 online offers seamless integrations with popular applications like Google Drive, Salesforce, and Microsoft Office. This capability allows you to streamline your existing workflow and enhance productivity by connecting your favorite tools to your eSignature process.

-

What are the benefits of using the UT 1000 online for my business?

By adopting the UT 1000 online, businesses can signNowly reduce the time spent on document management and signing processes. It enhances efficiency, cuts costs associated with paper and printing, and helps you maintain an organized digital workflow. The convenience of eSigning ensures faster transactions and improved customer satisfaction.

Get more for Oh Form Ut 1000

Find out other Oh Form Ut 1000

- How To Sign Maine Share Donation Agreement

- Sign Maine Share Donation Agreement Simple

- Sign New Jersey Share Donation Agreement Simple

- How To Sign Arkansas Collateral Debenture

- Sign Arizona Bill of Lading Simple

- Sign Oklahoma Bill of Lading Easy

- Can I Sign Massachusetts Credit Memo

- How Can I Sign Nevada Agreement to Extend Debt Payment

- Sign South Dakota Consumer Credit Application Computer

- Sign Tennessee Agreement to Extend Debt Payment Free

- Sign Kentucky Outsourcing Services Contract Simple

- Sign Oklahoma Outsourcing Services Contract Fast

- How Can I Sign Rhode Island Outsourcing Services Contract

- Sign Vermont Outsourcing Services Contract Simple

- Sign Iowa Interview Non-Disclosure (NDA) Secure

- Sign Arkansas Resignation Letter Simple

- Sign California Resignation Letter Simple

- Sign Florida Leave of Absence Agreement Online

- Sign Florida Resignation Letter Easy

- Sign Maine Leave of Absence Agreement Safe