TC 40CB, Renter Refund Application Forms & Publications Tax Utah

What is the TC 40CB, Renter Refund Application Forms & Publications Tax Utah

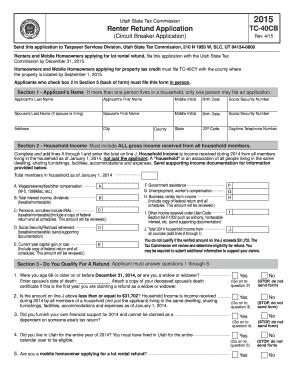

The TC 40CB is a specific form used in Utah for renters to apply for a refund on certain taxes. This form is part of the state's initiative to provide financial relief to eligible renters who meet specific criteria. The TC 40CB allows individuals to claim a refund based on their rental payments, ensuring they receive the financial support they may be entitled to. Understanding the purpose and requirements of this form is essential for those looking to benefit from the renter refund program.

How to use the TC 40CB, Renter Refund Application Forms & Publications Tax Utah

Using the TC 40CB involves several steps that ensure the application is completed accurately. First, gather all necessary documentation, including proof of residency and rental payments. Next, fill out the TC 40CB form carefully, ensuring that all information is correct and complete. Once the form is filled out, it can be submitted either online or through traditional mail, depending on the preferred method. Familiarizing yourself with the instructions provided with the form will help streamline the process and ensure compliance with state requirements.

Steps to complete the TC 40CB, Renter Refund Application Forms & Publications Tax Utah

Completing the TC 40CB requires careful attention to detail. Follow these steps:

- Collect necessary documents, including proof of income and rental agreements.

- Access the TC 40CB form through the Utah State Tax Commission website or other official sources.

- Fill in personal information, including your name, address, and Social Security number.

- Provide details about your rental payments, including the total amount paid during the year.

- Review the form for accuracy and completeness before submission.

- Submit the form electronically or by mail, ensuring it is sent to the correct address.

Legal use of the TC 40CB, Renter Refund Application Forms & Publications Tax Utah

The TC 40CB is legally recognized as a valid application for claiming renter refunds in Utah. To ensure the form is legally binding, it must be completed in accordance with state laws and regulations. This includes providing accurate information and submitting the form within the designated filing period. Utilizing an electronic signature can enhance the legal standing of the application, as it complies with the ESIGN and UETA acts, which govern electronic signatures in the United States.

Eligibility Criteria

To qualify for the TC 40CB renter refund, applicants must meet specific eligibility criteria set by the state of Utah. Generally, these criteria include:

- Being a resident of Utah for the tax year in question.

- Having a valid rental agreement and proof of rental payments.

- Meeting income limits as defined by the state.

- Not owning property or having a mortgage on a home during the tax year.

Form Submission Methods (Online / Mail / In-Person)

The TC 40CB can be submitted through various methods, providing flexibility for applicants. Options include:

- Online Submission: Many users prefer to submit the form electronically through the Utah State Tax Commission's official website, which allows for a quicker processing time.

- Mail Submission: Applicants can print the completed form and send it via postal service to the appropriate tax office.

- In-Person Submission: Some individuals may choose to submit their application in person at designated tax offices, allowing for immediate assistance if needed.

Quick guide on how to complete tc 40cb renter refund application forms amp publications tax utah

Complete TC 40CB, Renter Refund Application Forms & Publications Tax Utah effortlessly on any device

Digital document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly substitute to traditional printed and signed papers, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides all the tools you require to create, modify, and eSign your documents quickly without delays. Manage TC 40CB, Renter Refund Application Forms & Publications Tax Utah on any device with airSlate SignNow Android or iOS applications and streamline any document-related operation today.

The easiest way to change and eSign TC 40CB, Renter Refund Application Forms & Publications Tax Utah without difficulty

- Locate TC 40CB, Renter Refund Application Forms & Publications Tax Utah and then click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your eSignature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and then click on the Done button to save your modifications.

- Select how you wish to share your form, via email, SMS, or invitation link, or download it to your computer.

Forget about lost or misfiled documents, tedious form searches, or errors requiring the reprinting of new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choice. Alter and eSign TC 40CB, Renter Refund Application Forms & Publications Tax Utah and ensure seamless communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the TC 40CB, Renter Refund Application Forms & Publications Tax Utah?

The TC 40CB, Renter Refund Application Forms & Publications Tax Utah is a form used by eligible renters in Utah to claim a refund on a portion of their rent paid. By utilizing this form, individuals can navigate the state's tax system effectively. This is crucial to ensure that you receive the financial benefits that you are entitled to, particularly if you meet the eligibility requirements.

-

How can airSlate SignNow assist with the TC 40CB, Renter Refund Application Forms & Publications Tax Utah?

airSlate SignNow offers a streamlined, user-friendly platform for filling out and signing the TC 40CB, Renter Refund Application Forms & Publications Tax Utah. With our solution, you can easily manage your documents and ensure they are completed correctly and securely. This efficiency helps reduce the potential for errors, ensuring a smoother submission process.

-

Is there a cost associated with using airSlate SignNow for the TC 40CB application?

Yes, airSlate SignNow operates on a subscription-based pricing model that is cost-effective for individuals and businesses alike. The pricing varies depending on features and the number of users but is generally affordable, especially when considering the time and effort saved in managing the TC 40CB, Renter Refund Application Forms & Publications Tax Utah efficiently.

-

Are there any benefits of using airSlate SignNow for tax documents like TC 40CB?

Using airSlate SignNow for your TC 40CB, Renter Refund Application Forms & Publications Tax Utah provides numerous benefits, such as increased efficiency, reduced turnaround time, and enhanced security for your sensitive information. Moreover, our platform facilitates easy tracking and reminders for document completion, ensuring you never miss a deadline for tax submissions.

-

Can I integrate airSlate SignNow with other tools for tax preparation?

Absolutely! airSlate SignNow integrates seamlessly with various accounting and tax preparation software, enhancing your ability to manage the TC 40CB, Renter Refund Application Forms & Publications Tax Utah. This integration simplifies the workflow, allowing you to have your documents organized and accessible within the platforms you already use.

-

What features does airSlate SignNow offer to simplify the TC 40CB application process?

airSlate SignNow includes features such as document templates, automated workflows, and e-signature capabilities that signNowly simplify the TC 40CB, Renter Refund Application Forms & Publications Tax Utah process. These tools ensure that your forms are filled out accurately and submitted on time, minimizing stress and maximizing your chances of receiving your refund.

-

How secure is airSlate SignNow for handling sensitive tax documents?

airSlate SignNow prioritizes security and compliance, implementing robust encryption and authentication measures to safeguard all sensitive documents, including the TC 40CB, Renter Refund Application Forms & Publications Tax Utah. We ensure that your information remains protected throughout the document lifecycle, giving you peace of mind while managing your tax-related paperwork.

Get more for TC 40CB, Renter Refund Application Forms & Publications Tax Utah

Find out other TC 40CB, Renter Refund Application Forms & Publications Tax Utah

- How Do I Sign Washington Healthcare / Medical Word

- How Can I Sign Indiana High Tech PDF

- How To Sign Oregon High Tech Document

- How Do I Sign California Insurance PDF

- Help Me With Sign Wyoming High Tech Presentation

- How Do I Sign Florida Insurance PPT

- How To Sign Indiana Insurance Document

- Can I Sign Illinois Lawers Form

- How To Sign Indiana Lawers Document

- How To Sign Michigan Lawers Document

- How To Sign New Jersey Lawers PPT

- How Do I Sign Arkansas Legal Document

- How Can I Sign Connecticut Legal Document

- How Can I Sign Indiana Legal Form

- Can I Sign Iowa Legal Document

- How Can I Sign Nebraska Legal Document

- How To Sign Nevada Legal Document

- Can I Sign Nevada Legal Form

- How Do I Sign New Jersey Legal Word

- Help Me With Sign New York Legal Document