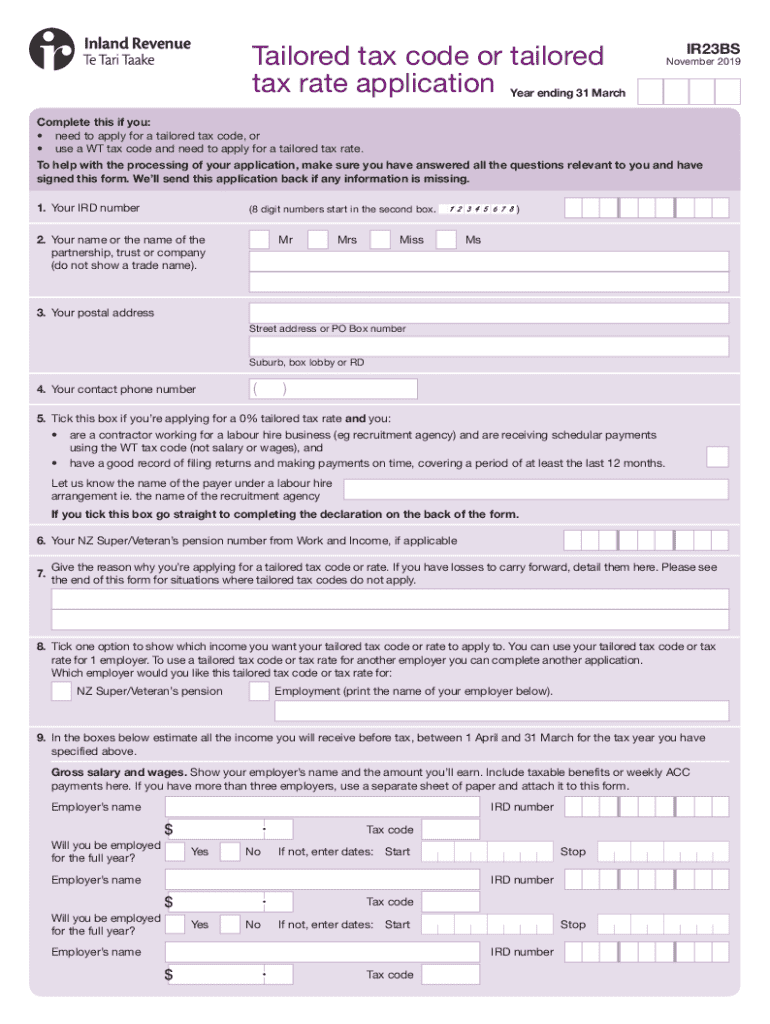

Tailored Tax Code or Tailored Tax Rate Application 2019-2026

Understanding the Tailored Tax Code Application

The tailored tax code application, known as the ir23bs form, is essential for taxpayers in the United States who need to apply for a specific tax rate that aligns with their unique financial circumstances. This form allows individuals to request a tailored tax code that may reduce their tax burden based on their income level and other personal factors. It is particularly relevant for those who may not fit into standard tax brackets due to varying income sources or deductions.

Steps to Complete the Tailored Tax Code Application

Completing the ir23bs form involves several important steps to ensure accuracy and compliance. Begin by gathering all necessary financial documents, including income statements and any relevant tax records. Next, fill out the form with your personal information, ensuring that all details are accurate. Pay close attention to the sections that require you to specify your income sources and deductions, as this information is crucial for determining your tailored tax rate. Once completed, review the form for any errors before submitting it.

Eligibility Criteria for the Tailored Tax Code Application

To qualify for the tailored tax code application, applicants must meet specific eligibility criteria. Generally, individuals must demonstrate that their income level or financial situation does not align with the standard tax rates. This may include self-employed individuals, retirees, or those with multiple income streams. Additionally, applicants should be prepared to provide documentation that supports their request for a tailored tax code, as this will be necessary for approval.

Required Documents for Submission

When submitting the ir23bs form, certain documents are required to support your application. These typically include proof of income, such as W-2 forms or 1099 statements, and any additional documentation that outlines deductions or credits you are claiming. It is advisable to include a cover letter that explains your circumstances and why a tailored tax code is appropriate for your situation. Ensuring that all documents are complete and accurate will facilitate a smoother review process.

Form Submission Methods

The ir23bs form can be submitted through various methods, including online, by mail, or in person. For those who prefer a digital approach, many tax software programs allow for electronic submission, which can expedite the review process. If opting to submit by mail, ensure that you send the form to the correct address as specified by the tax authority. In-person submissions may be available at designated tax offices, providing an opportunity to ask questions or clarify any uncertainties during the application process.

Legal Use of the Tailored Tax Code Application

The ir23bs form is legally recognized and serves as an official request for a tailored tax code. It is important to understand that submitting this form does not guarantee approval; however, it provides a legitimate avenue for taxpayers seeking a more favorable tax rate. Compliance with all legal requirements and accurate reporting of financial information is crucial, as any discrepancies may lead to penalties or denial of the application.

Quick guide on how to complete tailored tax code or tailored tax rate application

Prepare Tailored Tax Code Or Tailored Tax Rate Application easily on any device

Digital document handling has become increasingly favored by companies and individuals alike. It offers an ideal environmentally friendly substitute to conventional printed and signed documents, as you can access the right form and securely keep it online. airSlate SignNow equips you with all the tools necessary to generate, modify, and eSign your files promptly without wait times. Manage Tailored Tax Code Or Tailored Tax Rate Application on any platform with airSlate SignNow's Android or iOS applications and enhance any document-focused process today.

How to edit and eSign Tailored Tax Code Or Tailored Tax Rate Application effortlessly

- Find Tailored Tax Code Or Tailored Tax Rate Application and click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Highlight pertinent sections of the documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review the details and click the Done button to save your changes.

- Select how you want to send your form, via email, text message (SMS), or invite link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, or errors that require reprinting new document copies. airSlate SignNow fulfills your document management needs with just a few clicks from any device of your choice. Modify and eSign Tailored Tax Code Or Tailored Tax Rate Application and guarantee outstanding communication at every stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct tailored tax code or tailored tax rate application

Create this form in 5 minutes!

How to create an eSignature for the tailored tax code or tailored tax rate application

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the ir23bs form and why is it important?

The ir23bs form is a crucial document used for reporting income and tax information. It helps businesses ensure compliance with tax regulations and provides a clear record for both employers and employees. Understanding the ir23bs form is essential for accurate financial reporting.

-

How can airSlate SignNow help with the ir23bs form?

airSlate SignNow simplifies the process of sending and eSigning the ir23bs form. Our platform allows you to securely manage and store your documents, ensuring that your ir23bs form is easily accessible and compliant with legal standards. This streamlines your workflow and saves time.

-

What features does airSlate SignNow offer for managing the ir23bs form?

With airSlate SignNow, you can create, edit, and send the ir23bs form with ease. Our platform includes features like customizable templates, real-time tracking, and secure cloud storage. These tools enhance your document management process and ensure your ir23bs form is handled efficiently.

-

Is airSlate SignNow cost-effective for handling the ir23bs form?

Yes, airSlate SignNow offers a cost-effective solution for managing the ir23bs form. Our pricing plans are designed to fit various business needs, allowing you to choose the best option for your budget. Investing in our platform can lead to signNow savings in time and resources.

-

Can I integrate airSlate SignNow with other tools for the ir23bs form?

Absolutely! airSlate SignNow integrates seamlessly with various applications, enhancing your ability to manage the ir23bs form. Whether you use CRM systems, cloud storage, or accounting software, our integrations ensure a smooth workflow and improved efficiency.

-

What are the benefits of using airSlate SignNow for the ir23bs form?

Using airSlate SignNow for the ir23bs form offers numerous benefits, including increased efficiency, enhanced security, and improved compliance. Our platform allows for quick eSigning and document management, which can signNowly reduce turnaround times. This leads to a more streamlined process for your business.

-

How secure is the ir23bs form when using airSlate SignNow?

Security is a top priority at airSlate SignNow. When handling the ir23bs form, your documents are protected with advanced encryption and secure access controls. This ensures that sensitive information remains confidential and compliant with industry standards.

Get more for Tailored Tax Code Or Tailored Tax Rate Application

- Texas release lien sample form

- How to file a restraining order form

- Deed trust form

- Land trust form

- Postnuptial agreement form 481367150

- South carolina general durable power of attorney for property and finances or financial effective immediately 481367151 form

- Pennsylvania summary administration package not more than 50000 small estates form

- Lease renewal form

Find out other Tailored Tax Code Or Tailored Tax Rate Application

- eSignature Arkansas Courts LLC Operating Agreement Now

- How Do I eSignature Arizona Courts Moving Checklist

- eSignature Wyoming Real Estate Quitclaim Deed Myself

- eSignature Wyoming Real Estate Lease Agreement Template Online

- How Can I eSignature Delaware Courts Stock Certificate

- How Can I eSignature Georgia Courts Quitclaim Deed

- Help Me With eSignature Florida Courts Affidavit Of Heirship

- Electronic signature Alabama Banking RFP Online

- eSignature Iowa Courts Quitclaim Deed Now

- eSignature Kentucky Courts Moving Checklist Online

- eSignature Louisiana Courts Cease And Desist Letter Online

- How Can I Electronic signature Arkansas Banking Lease Termination Letter

- eSignature Maryland Courts Rental Application Now

- eSignature Michigan Courts Affidavit Of Heirship Simple

- eSignature Courts Word Mississippi Later

- eSignature Tennessee Sports Last Will And Testament Mobile

- How Can I eSignature Nevada Courts Medical History

- eSignature Nebraska Courts Lease Agreement Online

- eSignature Nebraska Courts LLC Operating Agreement Easy

- Can I eSignature New Mexico Courts Business Letter Template