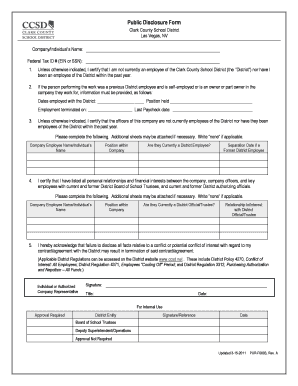

Federal Tax ID # EIN or SSN Form

Understanding the Federal Tax ID: EIN vs. SSN

The Federal Tax Identification Number, commonly known as the Employer Identification Number (EIN), is essential for businesses operating in the United States. Unlike the Social Security Number (SSN), which is primarily for individual identification, the EIN is used for various business purposes, including tax reporting and compliance. Organizations, partnerships, and corporations typically require an EIN to open bank accounts, apply for business licenses, and file tax returns. Understanding the distinction between these identifiers is crucial for anyone involved in business operations.

Steps to Obtain an EIN

Obtaining an EIN is a straightforward process. Here are the steps to follow:

- Determine your eligibility: Ensure that your business is located in the United States or its territories.

- Complete the application: You can apply for an EIN online through the IRS website, or you can submit Form SS-4 by mail or fax.

- Provide necessary information: Include details about your business structure, ownership, and the reason for applying.

- Submit your application: If applying online, you will receive your EIN immediately upon completion. If submitted by mail or fax, it may take several weeks to process.

Legal Uses of the EIN

The EIN serves multiple legal purposes for businesses. It is required for:

- Filing federal and state tax returns.

- Opening business bank accounts.

- Applying for business licenses and permits.

- Establishing a business credit profile.

Using the EIN correctly is essential for maintaining compliance with tax laws and regulations.

Required Documents for EIN Application

When applying for an EIN, certain documents and information are necessary. You should have:

- Your legal business name.

- The structure of your business (e.g., sole proprietorship, partnership, corporation).

- The reason for applying for an EIN.

- Your personal information, including your SSN or ITIN if applicable.

Having these documents ready will streamline the application process.

Form Submission Methods

There are several ways to submit your EIN application, each with its own advantages:

- Online: The fastest method, providing immediate issuance of your EIN.

- By Mail: Send Form SS-4 to the appropriate IRS address, which may take several weeks for processing.

- By Fax: If you provide a fax number, you may receive your EIN within four business days.

Eligibility Criteria for EIN Application

To apply for an EIN, you must meet specific eligibility criteria. These include:

- Your business must be based in the United States or its territories.

- You must have a valid SSN or ITIN.

- The application must be completed by an individual authorized to act on behalf of the business.

Understanding these criteria ensures a successful application process.

Quick guide on how to complete federal tax id ein or ssn

Complete Federal Tax ID # EIN Or SSN effortlessly on any device

Online document management has gained popularity among both organizations and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides all the tools needed to create, modify, and eSign your documents swiftly without any delays. Handle Federal Tax ID # EIN Or SSN on any device using the airSlate SignNow Android or iOS applications and enhance any document-focused process today.

How to modify and eSign Federal Tax ID # EIN Or SSN with ease

- Find Federal Tax ID # EIN Or SSN and click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Mark important sections of the documents or conceal sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign feature, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Select your preferred method of delivering your form, whether by email, text message (SMS), or invite link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form navigation, or mistakes that necessitate printing new copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you choose. Edit and eSign Federal Tax ID # EIN Or SSN to ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the airSlate SignNow solution for Clark County School District forms?

The airSlate SignNow solution streamlines the process of handling Clark County School District forms by allowing users to create, send, and eSign documents efficiently. With an intuitive interface, it simplifies form management and enhances collaboration among staff and students. This digital solution reduces paperwork and speeds up processing times.

-

How does airSlate SignNow improve the eSigning process for Clark County School District forms?

AirSlate SignNow enhances the eSigning process for Clark County School District forms by providing a secure and legally binding eSignature solution. Users can sign documents from anywhere, on any device, which expedites approvals and reduces delays. The platform also offers tracking features to monitor the status of the forms.

-

Is airSlate SignNow cost-effective for managing Clark County School District forms?

Yes, airSlate SignNow is a cost-effective solution for managing Clark County School District forms. Its pricing plans are flexible, catering to different needs and budgets, ensuring that educational institutions can implement the software without a hefty investment. This affordability allows schools to redirect their resources toward other critical areas.

-

What features does airSlate SignNow offer for Clark County School District forms?

AirSlate SignNow offers a range of features tailored for Clark County School District forms, including customizable templates, automated workflows, and real-time document tracking. These features ensure that the form-filling process is efficient, transparent, and simple for all users involved. Additionally, the platform supports multiple file formats for versatility.

-

Can airSlate SignNow integrate with existing systems used by Clark County School District?

Yes, airSlate SignNow provides seamless integrations with various systems that Clark County School District may already be using, such as file storage services and student information systems. These integrations allow for a smooth transition and streamlined operations, ensuring that data flows between platforms without disruption. This connectivity improves the overall efficiency of managing forms.

-

What are the benefits of using airSlate SignNow for Clark County School District forms?

Using airSlate SignNow for Clark County School District forms offers numerous benefits, including increased efficiency, reduced paper usage, and enhanced compliance with regulations. The straightforward eSigning process saves time for both staff and students while maintaining the integrity and security of the documents. Overall, it contributes to a more environmentally friendly and effective administrative process.

-

How secure is airSlate SignNow for handling Clark County School District forms?

AirSlate SignNow prioritizes security, employing advanced encryption methods and secure data storage to protect Clark County School District forms. With features like audit trails and authentication processes, it ensures that every document is handled with the utmost care. Users can feel confident that their sensitive information is well-protected.

Get more for Federal Tax ID # EIN Or SSN

- Florida general power of attorney form

- Free florida limited power of attorney form pdfword

- Guardianship forms sixth judicial circuit

- Georgia general power of attorney form

- Georgia minor child power of attorney form

- Free georgia revocation power of attorney form pdf

- Free hawaii limited power of attorney form pdfword

- Hawaii durable power of attorney form

Find out other Federal Tax ID # EIN Or SSN

- eSignature South Dakota Education Confidentiality Agreement Later

- eSignature South Carolina Education Executive Summary Template Easy

- eSignature Michigan Doctors Living Will Simple

- How Do I eSignature Michigan Doctors LLC Operating Agreement

- How To eSignature Vermont Education Residential Lease Agreement

- eSignature Alabama Finance & Tax Accounting Quitclaim Deed Easy

- eSignature West Virginia Education Quitclaim Deed Fast

- eSignature Washington Education Lease Agreement Form Later

- eSignature Missouri Doctors Residential Lease Agreement Fast

- eSignature Wyoming Education Quitclaim Deed Easy

- eSignature Alaska Government Agreement Fast

- How Can I eSignature Arizona Government POA

- How Do I eSignature Nevada Doctors Lease Agreement Template

- Help Me With eSignature Nevada Doctors Lease Agreement Template

- How Can I eSignature Nevada Doctors Lease Agreement Template

- eSignature Finance & Tax Accounting Presentation Arkansas Secure

- eSignature Arkansas Government Affidavit Of Heirship Online

- eSignature New Jersey Doctors Permission Slip Mobile

- eSignature Colorado Government Residential Lease Agreement Free

- Help Me With eSignature Colorado Government Medical History