Charitable Donation of Securities in Kind Form TD Bank

What is the Charitable Donation of Securities in Kind Form TD Bank

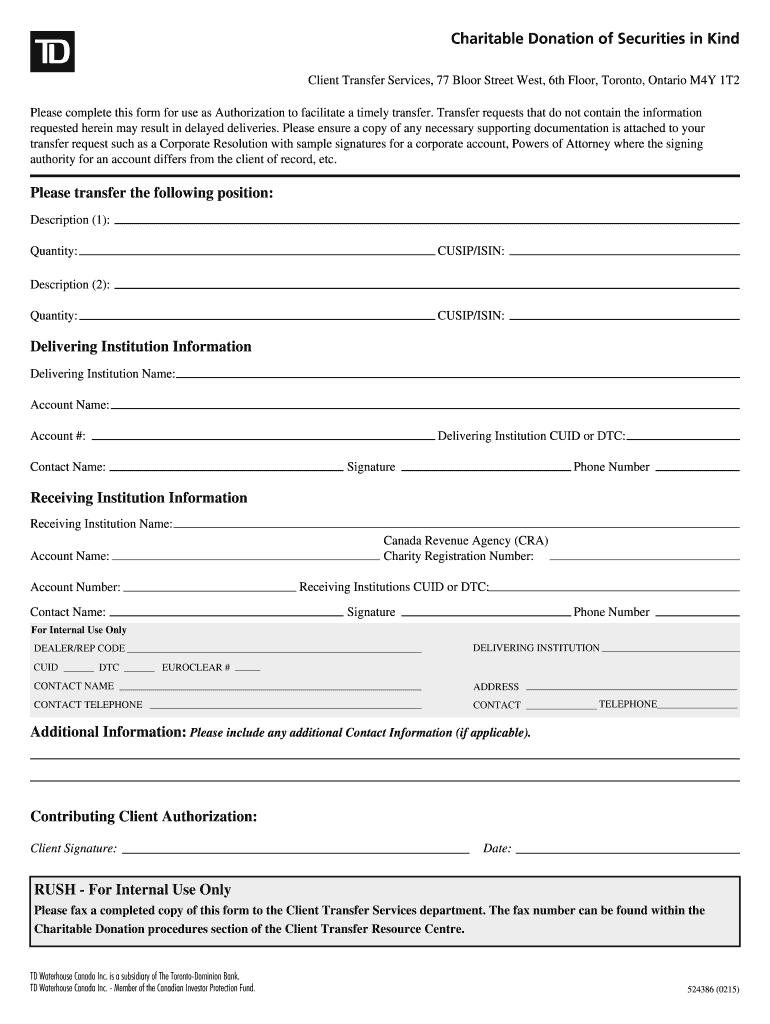

The Charitable Donation of Securities in Kind Form TD Bank is a specialized document used to facilitate the donation of securities directly to charitable organizations. This form allows donors to transfer ownership of stocks, bonds, or other financial instruments, which can provide significant tax benefits. By using this form, donors can ensure that their contributions are properly documented and compliant with IRS regulations, making it easier for both the donor and the receiving charity to manage the donation process.

Steps to Complete the Charitable Donation of Securities in Kind Form TD Bank

Completing the Charitable Donation of Securities in Kind Form involves several key steps to ensure accuracy and compliance. First, gather all necessary information, including the donor's details, the charity's information, and specifics about the securities being donated. Next, accurately fill out each section of the form, ensuring that all required fields are completed. After filling out the form, review it for any errors or omissions. Finally, submit the form according to the specified submission methods, which may include online, mail, or in-person delivery.

Legal Use of the Charitable Donation of Securities in Kind Form TD Bank

The legal use of the Charitable Donation of Securities in Kind Form is governed by IRS guidelines and federal regulations. To be considered valid, the form must be completed accurately and submitted in a timely manner. The donation must also meet specific criteria to qualify for tax deductions, including the requirement that the securities be held for more than one year. By adhering to these legal requirements, donors can ensure that their contributions are recognized and that they receive the appropriate tax benefits.

Key Elements of the Charitable Donation of Securities in Kind Form TD Bank

Key elements of the Charitable Donation of Securities in Kind Form include the donor's name and contact information, the charity's name and tax identification number, a detailed description of the securities being donated, and the donor's signature. Additionally, the form typically requires a declaration of the fair market value of the securities at the time of donation. These elements are crucial for ensuring that the donation is processed correctly and that both the donor and the charity have a clear record of the transaction.

IRS Guidelines

IRS guidelines regarding charitable donations of securities emphasize the importance of documentation and compliance. Donors must ensure that the value of the donated securities is accurately reported, and they may need to provide additional documentation, such as a qualified appraisal, for donations exceeding a certain value. Understanding these guidelines helps donors maximize their tax benefits while ensuring compliance with federal regulations.

Form Submission Methods

The Charitable Donation of Securities in Kind Form can typically be submitted through various methods, including online submission, mailing the completed form to the charity, or delivering it in person. Each method may have specific requirements or timelines, so it is essential to choose the one that best fits the donor's circumstances and to ensure that the charity receives the form promptly to facilitate the donation process.

Quick guide on how to complete charitable donation of securities in kind form td bank

Complete Charitable Donation Of Securities In Kind Form TD Bank effortlessly on any device

Managing online documents has gained traction among businesses and individuals alike. It offers an ideal environmentally friendly substitute to traditional printed and signed documents, as you can easily locate the required form and securely save it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly and without delays. Handle Charitable Donation Of Securities In Kind Form TD Bank on any platform with airSlate SignNow’s Android or iOS applications and enhance any document-driven process today.

The simplest method to modify and eSign Charitable Donation Of Securities In Kind Form TD Bank with ease

- Obtain Charitable Donation Of Securities In Kind Form TD Bank and click on Get Form to begin.

- Utilize the tools we offer to populate your form.

- Emphasize important sections of the documents or redact sensitive information using tools that airSlate SignNow provides specifically for this purpose.

- Create your signature using the Sign tool, which takes only seconds and has the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, text message (SMS), an invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your preference. Modify and eSign Charitable Donation Of Securities In Kind Form TD Bank and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is airSlate SignNow and how does it relate to 524386?

airSlate SignNow is a comprehensive e-signature solution that empowers businesses to send and eSign documents efficiently. The term '524386' represents a specific feature set that enhances the signing process, ensuring legal compliance and security. With airSlate SignNow, users can streamline their document workflows while benefiting from the features highlighted in 524386.

-

How does airSlate SignNow's pricing compare for the features in 524386?

airSlate SignNow offers competitive pricing tiers that include all the essential features outlined in 524386. Depending on the chosen plan, businesses can access various tools that simplify document management while remaining cost-effective. This flexibility allows organizations of all sizes to find a suitable solution within their budget.

-

What specific features does airSlate SignNow include in 524386?

The 524386 identifier encompasses key features such as customizable templates, secure cloud storage, and real-time collaboration tools. airSlate SignNow is designed to make the signing experience seamless, while also focusing on user privacy and document security. By leveraging these features, businesses can greatly improve their operational efficiency.

-

Can airSlate SignNow integrate with other software in the context of 524386?

Yes, airSlate SignNow supports various integrations with popular applications to enhance the functionality detailed in 524386. These integrations include CRM systems, project management tools, and cloud storage services. By connecting with these platforms, users can streamline their workflows and improve overall productivity.

-

What are the main benefits of using airSlate SignNow highlighted in 524386?

The main benefits of using airSlate SignNow, as detailed in 524386, include increased productivity, reduced errors, and improved customer satisfaction. By digitizing the signing process, businesses can expedite transactions and enhance communication with their clients. This ensures that document management is both efficient and user-friendly.

-

Is airSlate SignNow suitable for small businesses looking to address 524386 needs?

Absolutely! airSlate SignNow caters to small businesses seeking to manage document workflows effectively, as described in 524386. Its intuitive platform offers essential features at a price point that fits smaller budgets, making it accessible to all types of organizations. This empowers small businesses to adopt professional e-signature solutions without breaking the bank.

-

How does airSlate SignNow ensure compliance with legal standards mentioned in 524386?

airSlate SignNow follows strict compliance protocols that align with the legal standards referred to in 524386. The platform utilizes advanced encryption and authentication methods to ensure that all e-signatures are legally binding and secure. This commitment to compliance allows businesses to use airSlate SignNow confidently, knowing their documentation meets legal requirements.

Get more for Charitable Donation Of Securities In Kind Form TD Bank

- Wwwirsgovpubirs soiinternal revenue service instructions for form 990 pf

- Get the free about form 8949internal revenue service irsgov

- Form 1099 int rev january 2022 interest income

- 1120 pol u s income tax return for certain political form

- Form 7200 rev april 2021 internal revenue service

- Wwwirsgovadvocatereports to congressreports to congressinternal revenue service irs tax forms

- Instructions for form 7200 rev april 2021 instructions for form 7200 advance payment of employer credits due to covid 19

- Wwwadobecomacrobatadobe acrobat dc pdf softwareadobe acrobat form

Find out other Charitable Donation Of Securities In Kind Form TD Bank

- How To Electronic signature New York Courts Stock Certificate

- Electronic signature South Carolina Sports Separation Agreement Easy

- Electronic signature Virginia Courts Business Plan Template Fast

- How To Electronic signature Utah Courts Operating Agreement

- Electronic signature West Virginia Courts Quitclaim Deed Computer

- Electronic signature West Virginia Courts Quitclaim Deed Free

- Electronic signature Virginia Courts Limited Power Of Attorney Computer

- Can I Sign Alabama Banking PPT

- Electronic signature Washington Sports POA Simple

- How To Electronic signature West Virginia Sports Arbitration Agreement

- Electronic signature Wisconsin Sports Residential Lease Agreement Myself

- Help Me With Sign Arizona Banking Document

- How Do I Sign Arizona Banking Form

- How Can I Sign Arizona Banking Form

- How Can I Sign Arizona Banking Form

- Can I Sign Colorado Banking PPT

- How Do I Sign Idaho Banking Presentation

- Can I Sign Indiana Banking Document

- How Can I Sign Indiana Banking PPT

- How To Sign Maine Banking PPT