Ckyc Form Axisbank

What is the KYC Form for Axis Bank?

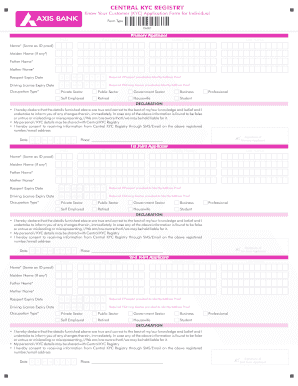

The KYC (Know Your Customer) form for Axis Bank is a crucial document used to verify the identity and address of customers. This form is part of the regulatory requirements set by financial institutions to prevent fraud, money laundering, and other illegal activities. By completing the KYC form, customers provide essential information such as their name, address, date of birth, and identification details. This information helps Axis Bank maintain accurate records and comply with legal obligations.

Steps to Complete the KYC Form for Axis Bank

Completing the KYC form for Axis Bank involves several straightforward steps. First, gather the necessary documents, which typically include proof of identity, proof of address, and a recent photograph. Next, access the KYC form, which can often be found on the bank's official website or obtained at a local branch. Fill out the form with accurate information, ensuring that all details match your supporting documents. Finally, submit the completed form along with the required documents either online or in person at the bank branch.

Required Documents for the KYC Form

To successfully complete the KYC form for Axis Bank, customers need to provide specific documents. These usually include:

- Government-issued photo ID (such as a passport, driver's license, or state ID)

- Proof of address (such as a utility bill, bank statement, or lease agreement)

- Recent passport-sized photographs

It is essential to ensure that all documents are current and clearly legible to avoid any processing delays.

Legal Use of the KYC Form for Axis Bank

The KYC form for Axis Bank is legally binding and must be filled out accurately to comply with regulations set by financial authorities. This form serves as a protective measure for both the bank and the customer. By providing truthful information, customers help the bank mitigate risks associated with identity theft and financial fraud. Additionally, Axis Bank must retain these records for a specified period to comply with regulatory audits and inspections.

Form Submission Methods for the KYC Form

Customers can submit the KYC form for Axis Bank through various methods. The most common options include:

- Online submission via the bank's website, where customers can upload scanned copies of their documents.

- In-person submission at a local Axis Bank branch, where customers can hand over their completed forms and documents directly to a bank representative.

- Mail submission, although this method may take longer for processing.

Choosing the right submission method depends on individual preferences and convenience.

Examples of Using the KYC Form for Axis Bank

The KYC form for Axis Bank is used in various scenarios, including:

- Opening a new bank account, where verification of identity is required.

- Updating personal information, such as a change of address or name.

- Applying for loans or credit facilities, as lenders need to verify the borrower's identity and financial background.

These examples illustrate the importance of the KYC form in maintaining secure banking practices.

Quick guide on how to complete ckyc form axisbank

Effortlessly Prepare Ckyc Form Axisbank on Any Device

Digital document management has gained traction among businesses and individuals alike. It offers an excellent environmentally-friendly substitute for conventional printed and signed paperwork, enabling you to obtain the right format and securely archive it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents quickly without interruptions. Manage Ckyc Form Axisbank on any device using airSlate SignNow's Android or iOS applications and enhance your document-related processes today.

How to Modify and eSign Ckyc Form Axisbank Effortlessly

- Obtain Ckyc Form Axisbank and select Get Form to initiate the process.

- Utilize the tools we provide to complete your document.

- Emphasize critical sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for this purpose.

- Create your electronic signature using the Sign feature, which takes seconds and holds the same legal validity as a traditional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Select your preferred method of sending your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searching, or mistakes that necessitate printing additional copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device of your preference. Alter and eSign Ckyc Form Axisbank while ensuring effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the india bank kyc registry?

The India bank KYC registry is a centralized database designed to streamline the Know Your Customer (KYC) process for banks in India. It helps financial institutions verify the identity and address of their customers efficiently, enhancing compliance and security. By utilizing this registry, banks can signNowly reduce the time and resources spent on KYC verification.

-

How does airSlate SignNow integrate with the india bank kyc registry?

AirSlate SignNow seamlessly integrates with the India bank KYC registry, allowing businesses to automate their KYC documentation processes. This integration ensures that documents requiring signatures are compliant and secure while referencing up-to-date customer verification data. By connecting with this registry, SignNow enhances the overall efficiency of document transactions.

-

What are the benefits of using airSlate SignNow for the india bank kyc registry?

Using airSlate SignNow in conjunction with the India bank KYC registry provides numerous benefits, including increased speed and efficiency in document signing. It reduces the manual effort needed for KYC compliance and provides a secure environment for sensitive information. Moreover, businesses and banks can streamline their operations while ensuring regulatory adherence.

-

Is airSlate SignNow cost-effective for handling the india bank kyc registry?

Yes, airSlate SignNow offers a cost-effective solution for managing KYC-related documents as part of the India bank KYC registry process. With flexible pricing plans and no hidden fees, businesses can choose the option that best suits their needs. This ensures reliable document handling without breaking the bank.

-

Can airSlate SignNow improve my KYC compliance related to the india bank kyc registry?

Absolutely! AirSlate SignNow enhances KYC compliance related to the India bank KYC registry by providing tools to automate document management and signature procedures. This reduces the likelihood of human errors while ensuring that all necessary documentation aligns with regulatory requirements. Improved compliance means fewer legal issues and penalties for businesses.

-

What features does airSlate SignNow offer for the india bank kyc registry?

AirSlate SignNow offers features such as document templates, custom workflows, and secure electronic signatures tailored for the India bank KYC registry. These tools ensure that businesses can manage their KYC processes efficiently while maintaining high levels of security and compliance. Additionally, users can track document status in real-time, enhancing overall operational effectiveness.

-

How does airSlate SignNow ensure data security when using the india bank kyc registry?

AirSlate SignNow prioritizes data security when utilizing the India bank KYC registry by implementing advanced encryption protocols and secure data storage solutions. It ensures that all customer data and KYC-related documents are protected from unauthorized access and bsignNowes. Regular security audits and compliance checks further bolster the security framework.

Get more for Ckyc Form Axisbank

- Wwwdlipagovindividualslabor managementboilers and unfired pressure vessels department of labor form

- Healthmogovdatavitalrecordsbureau of vital records missouri department of health and form

- Aoc 846 instructions fill online printable fillable blank form

- Handypdfcompdfform mv 521 1 personal historyform mv 5211 personal history new york edit fill

- Id rec agency disclosure brochure 2020 2021 fill and form

- Hereinafter called seller and hereinafter form

- Wwwsignnowcomfill and sign pdf form79640make sure you are aware of possible nancial consequences

- Temporary hearing aid dispenser license initial application form

Find out other Ckyc Form Axisbank

- Sign South Dakota Working Time Control Form Now

- Sign Hawaii IT Project Proposal Template Online

- Sign Nebraska Operating Agreement Now

- Can I Sign Montana IT Project Proposal Template

- Sign Delaware Software Development Agreement Template Now

- How To Sign Delaware Software Development Agreement Template

- How Can I Sign Illinois Software Development Agreement Template

- Sign Arkansas IT Consulting Agreement Computer

- Can I Sign Arkansas IT Consulting Agreement

- Sign Iowa Agile Software Development Contract Template Free

- How To Sign Oregon IT Consulting Agreement

- Sign Arizona Web Hosting Agreement Easy

- How Can I Sign Arizona Web Hosting Agreement

- Help Me With Sign Alaska Web Hosting Agreement

- Sign Alaska Web Hosting Agreement Easy

- Sign Arkansas Web Hosting Agreement Simple

- Sign Indiana Web Hosting Agreement Online

- Sign Indiana Web Hosting Agreement Easy

- How To Sign Louisiana Web Hosting Agreement

- Sign Maryland Web Hosting Agreement Now