Private Education Loan Applicant Self Certification Form

What is the Private Education Loan Applicant Self Certification

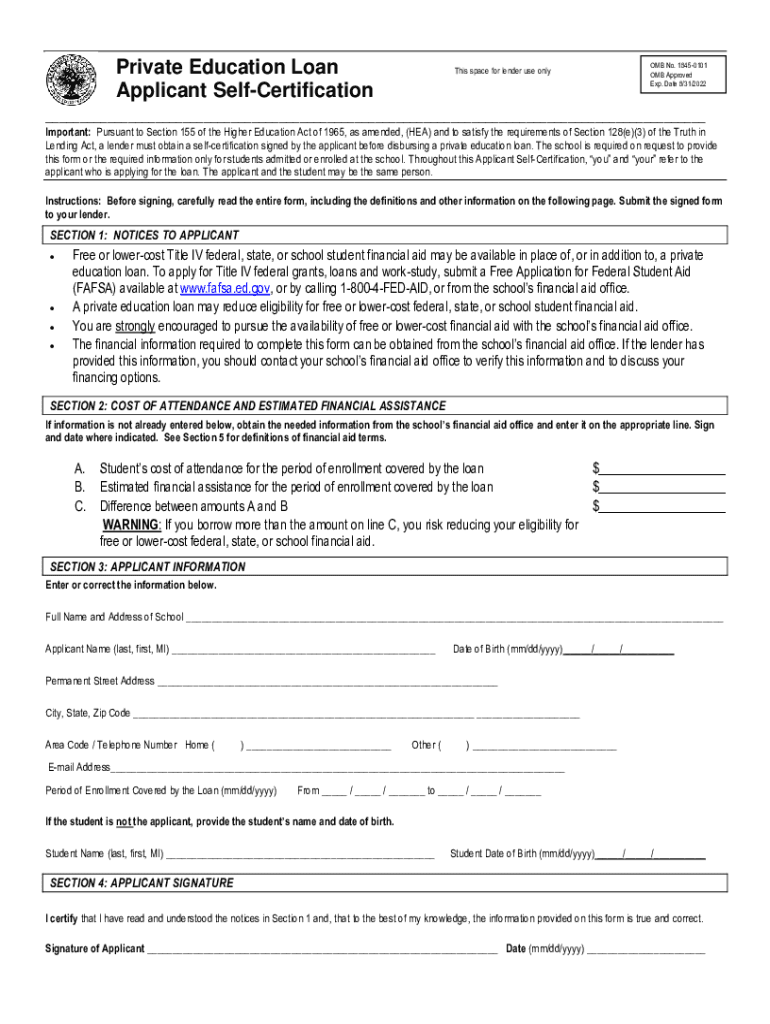

The Private Education Loan Applicant Self Certification is a crucial document that helps lenders assess a borrower's eligibility for a private education loan. This form is designed to provide essential information about the applicant's financial situation, including income, expenses, and school enrollment status. By completing this certification, borrowers can demonstrate their need for financial assistance while ensuring compliance with federal regulations. This form is typically required by lenders to process loan applications efficiently and accurately.

Steps to complete the Private Education Loan Applicant Self Certification

Completing the Private Education Loan Applicant Self Certification involves several key steps:

- Gather necessary information: Collect details about your income, expenses, and the educational institution you plan to attend.

- Access the form: Download the Private Education Loan Applicant Self Certification form, usually available in PDF format from your lender's website.

- Fill out the form: Provide accurate information in all required fields, ensuring that you double-check for any errors.

- Sign and date the form: Your signature confirms the accuracy of the information provided and your understanding of the loan terms.

- Submit the form: Send the completed form to your lender through the preferred submission method, whether online, by mail, or in person.

Legal use of the Private Education Loan Applicant Self Certification

The Private Education Loan Applicant Self Certification is legally binding once signed. It must comply with federal regulations, including the Truth in Lending Act and the Higher Education Act. This ensures that lenders and borrowers adhere to established guidelines, protecting both parties during the loan process. Proper completion of the form is essential to avoid potential legal issues and ensure that the loan application is processed smoothly.

Key elements of the Private Education Loan Applicant Self Certification

Several key elements are essential to the Private Education Loan Applicant Self Certification:

- Applicant information: Full name, Social Security number, and contact details.

- Financial details: Information on income, monthly expenses, and other financial obligations.

- School information: Name of the educational institution, program of study, and expected graduation date.

- Loan amount requested: The specific amount of the private education loan being sought.

- Certification statement: A declaration affirming the accuracy of the information provided and understanding of the loan terms.

How to use the Private Education Loan Applicant Self Certification

Using the Private Education Loan Applicant Self Certification effectively involves understanding its purpose and ensuring all information is accurate. Once you have completed the form, it serves as a supporting document for your loan application. Lenders rely on this certification to evaluate your financial need and eligibility for a private education loan. Be sure to keep a copy for your records, as you may need to reference it during the loan process or for future financial planning.

Required Documents

To complete the Private Education Loan Applicant Self Certification, you may need to provide additional documentation. Commonly required documents include:

- Proof of income: Recent pay stubs, tax returns, or bank statements.

- Enrollment verification: A letter or document from your educational institution confirming your enrollment status.

- Identification: A government-issued ID, such as a driver's license or passport.

Quick guide on how to complete private education loan applicant self certification

Complete Private Education Loan Applicant Self Certification with ease on any device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal environmentally friendly alternative to traditional printed and signed paperwork, allowing you to access the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents swiftly and without hindrance. Handle Private Education Loan Applicant Self Certification on any platform using airSlate SignNow's Android or iOS applications and simplify any document-driven process today.

The easiest way to modify and electronically sign Private Education Loan Applicant Self Certification effortlessly

- Locate Private Education Loan Applicant Self Certification and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your documents or redact sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Create your electronic signature with the Sign feature, which takes mere seconds and holds the same legal validity as a conventional handwritten signature.

- Review all information carefully and click the Done button to save your modifications.

- Choose your preferred method for sharing your form, whether by email, SMS, or invitation link, or download it to your computer.

Disregard the concerns of lost or misplaced documents, monotonous form navigation, or mistakes that necessitate printing new copies. airSlate SignNow meets all your document management needs with just a few clicks from any device of your preference. Edit and electronically sign Private Education Loan Applicant Self Certification to ensure outstanding communication throughout every phase of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the private education loan applicant self certification

The best way to create an eSignature for your PDF online

The best way to create an eSignature for your PDF in Google Chrome

The best way to generate an electronic signature for signing PDFs in Gmail

How to make an eSignature right from your smartphone

The way to generate an electronic signature for a PDF on iOS

How to make an eSignature for a PDF on Android

People also ask

-

What is airSlate SignNow and how does it benefit a loan applicant online?

airSlate SignNow is an electronic signature platform that simplifies the way businesses and individuals sign documents. For a loan applicant online, this means a fast and secure way to complete applications and agreements without the hassle of printing or faxing.

-

How much does it cost to use airSlate SignNow for a loan applicant online?

airSlate SignNow offers various pricing plans to accommodate different needs, including a free trial for new users. Loan applicants online can benefit from affordable subscription options that provide access to essential features without breaking the bank.

-

What features does airSlate SignNow offer for a loan applicant online?

airSlate SignNow provides features such as customizable templates, electronic signatures, and real-time tracking of document status. These tools empower a loan applicant online to complete and manage their applications more efficiently.

-

Is airSlate SignNow secure for loan applicants online?

Yes, airSlate SignNow prioritizes security with industry-standard encryption and compliance with legal regulations. This ensures that loan applicants online can submit sensitive information confidently and securely.

-

Can I integrate airSlate SignNow with other platforms for my online loan application?

Absolutely! airSlate SignNow integrates seamlessly with various CRM and financial software, allowing loan applicants online to streamline their processes. This connectivity enhances the overall experience by reducing the time spent switching between platforms.

-

How can airSlate SignNow improve the application process for loan applicants online?

By enabling electronic signatures and automated workflows, airSlate SignNow signNowly accelerates the application process for loan applicants online. This not only saves time but also enhances the overall user experience by minimizing paperwork.

-

Is it easy to use airSlate SignNow for a loan applicant online?

Yes, airSlate SignNow is designed to be user-friendly, even for those who are not tech-savvy. A loan applicant online can easily navigate through the platform, making signing documents a seamless experience.

Get more for Private Education Loan Applicant Self Certification

Find out other Private Education Loan Applicant Self Certification

- How To eSign Illinois Sports Form

- Can I eSign Illinois Sports Form

- How To eSign North Carolina Real Estate PDF

- How Can I eSign Texas Real Estate Form

- How To eSign Tennessee Real Estate Document

- How Can I eSign Wyoming Real Estate Form

- How Can I eSign Hawaii Police PDF

- Can I eSign Hawaii Police Form

- How To eSign Hawaii Police PPT

- Can I eSign Hawaii Police PPT

- How To eSign Delaware Courts Form

- Can I eSign Hawaii Courts Document

- Can I eSign Nebraska Police Form

- Can I eSign Nebraska Courts PDF

- How Can I eSign North Carolina Courts Presentation

- How Can I eSign Washington Police Form

- Help Me With eSignature Tennessee Banking PDF

- How Can I eSignature Virginia Banking PPT

- How Can I eSignature Virginia Banking PPT

- Can I eSignature Washington Banking Word