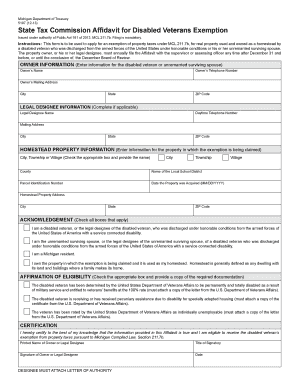

Disabled Veterans Exemption State of Michigan Form

What is the Disabled Veterans Exemption in the State of Michigan

The Disabled Veterans Exemption in Michigan provides property tax relief for eligible veterans who have a service-connected disability. This exemption is designed to assist those who have sacrificed for their country by reducing the financial burden of property taxes. To qualify, veterans must demonstrate a disability rating from the U.S. Department of Veterans Affairs. The exemption applies to the primary residence of the veteran, ensuring that they can maintain stable housing while managing their health and financial responsibilities.

Eligibility Criteria for the Disabled Veterans Exemption in Michigan

To qualify for the Disabled Veterans Exemption in Michigan, applicants must meet specific criteria. These include:

- Being a veteran of the U.S. Armed Forces.

- Having a service-connected disability rating of at least 100 percent or being permanently and totally disabled.

- Owning and occupying the property for which the exemption is being claimed as their primary residence.

Additionally, the exemption is available to the surviving spouse of a qualified veteran, provided they have not remarried and continue to occupy the property.

Steps to Complete the Disabled Veterans Exemption Application in Michigan

Completing the application for the Disabled Veterans Exemption involves several key steps:

- Gather necessary documentation, including proof of military service and disability rating.

- Obtain the Disabled Veterans Exemption application form from your local assessor's office or the Michigan Department of Treasury website.

- Fill out the application form accurately, ensuring all required information is provided.

- Submit the completed application to your local assessor's office by the deadline, which is typically before the tax day of December 31.

It is important to ensure that all information is accurate and complete to avoid delays in processing.

Required Documents for the Disabled Veterans Exemption in Michigan

When applying for the Disabled Veterans Exemption, applicants must provide specific documents to support their claim. These documents typically include:

- A copy of the veteran's discharge papers (DD-214).

- Documentation of the service-connected disability rating from the U.S. Department of Veterans Affairs.

- Proof of property ownership, such as a deed or tax statement.

Having these documents ready can streamline the application process and ensure compliance with local regulations.

Legal Use of the Disabled Veterans Exemption in Michigan

The Disabled Veterans Exemption is legally recognized under Michigan law, providing qualified veterans with a means to reduce their property tax obligations. This exemption is consistent with federal and state policies aimed at supporting veterans. The legal framework ensures that the exemption is applied fairly and consistently, protecting the rights of eligible veterans. It is essential for applicants to understand their rights and responsibilities under this exemption to ensure compliance and maximize their benefits.

Form Submission Methods for the Disabled Veterans Exemption in Michigan

Applicants can submit the Disabled Veterans Exemption application through various methods, including:

- In-person submission at the local assessor's office.

- Mailing the completed application to the local assessor's office.

- Some jurisdictions may offer online submission options through their official websites.

Choosing the appropriate submission method can depend on personal preferences and local regulations, so it is advisable to check with the local assessor for specific guidance.

Quick guide on how to complete disabled veterans exemption state of michigan

Complete Disabled Veterans Exemption State Of Michigan easily on any gadget

Web-based document management has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides you with all the resources needed to create, amend, and eSign your documents promptly without any hold-ups. Handle Disabled Veterans Exemption State Of Michigan on any device with airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

How to modify and eSign Disabled Veterans Exemption State Of Michigan effortlessly

- Obtain Disabled Veterans Exemption State Of Michigan and then click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of the documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review the details and then click on the Done button to save your modifications.

- Choose how you wish to share your form, via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, the hassle of searching for forms, or mistakes that necessitate printing new copies of documents. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Edit and eSign Disabled Veterans Exemption State Of Michigan and ensure effective communication throughout the form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the disabled veterans exemption state of michigan

How to create an electronic signature for a PDF file online

How to create an electronic signature for a PDF file in Google Chrome

How to create an electronic signature for signing PDFs in Gmail

How to create an eSignature right from your mobile device

How to create an eSignature for a PDF file on iOS

How to create an eSignature for a PDF on Android devices

People also ask

-

How can airSlate SignNow benefit veterans in their businesses?

airSlate SignNow provides veterans with an easy-to-use, cost-effective solution for managing and eSigning documents. By streamlining the document workflow, veterans can focus on their core business activities without getting bogged down by paperwork. This efficiency is crucial for veterans looking to grow and sustain their enterprises.

-

What features does airSlate SignNow offer that are particularly helpful for veterans?

airSlate SignNow offers features like document templates, advanced security measures, and integration capabilities that are especially beneficial for veterans. These tools can help veterans quickly prepare and sign important documents, ensuring compliance and protecting sensitive information. Such features enhance productivity and promote a smoother operational flow.

-

Are there special pricing options available for veterans using airSlate SignNow?

Yes, airSlate SignNow often provides special pricing options and discounts for veterans. This ensures that veterans can access essential eSigning tools without straining their budgets. It's advisable for veterans to check the website or signNow out to customer service to learn about applicable discounts and offers.

-

Can veterans integrate airSlate SignNow with other tools they are using?

Absolutely! airSlate SignNow supports integration with a wide range of tools that veterans might already be using in their businesses. These integrations can help facilitate a more seamless process in document management and enhance overall operational efficiency, making it easier for veterans to use the solution effectively.

-

Is airSlate SignNow suitable for various industries that veterans operate in?

Yes, airSlate SignNow is versatile and can be effectively used across various industries where veterans may operate. Whether in healthcare, real estate, or government services, veterans can benefit from eSigning solutions tailored to their specific industry needs. This adaptability ensures that veterans have the right tools regardless of their sector.

-

How does airSlate SignNow ensure the security of documents for veterans?

airSlate SignNow prioritizes security by implementing advanced encryption protocols and compliance with electronic signature regulations. For veterans, protecting sensitive information is crucial, and SignNow’s robust security features provide peace of mind. Veterans can rest assured that their documents are safe during the signing process.

-

What support options are available for veterans using airSlate SignNow?

Veterans can take advantage of various support options when using airSlate SignNow, including online resources, tutorials, and customer service. This ensures that veterans can get assistance whenever needed, making it easier for them to navigate and utilize the platform effectively. The dedicated support for veterans is part of airSlate SignNow's commitment to customer satisfaction.

Get more for Disabled Veterans Exemption State Of Michigan

Find out other Disabled Veterans Exemption State Of Michigan

- eSign Colorado Education Promissory Note Template Easy

- eSign North Dakota Doctors Affidavit Of Heirship Now

- eSign Oklahoma Doctors Arbitration Agreement Online

- eSign Oklahoma Doctors Forbearance Agreement Online

- eSign Oregon Doctors LLC Operating Agreement Mobile

- eSign Hawaii Education Claim Myself

- eSign Hawaii Education Claim Simple

- eSign Hawaii Education Contract Simple

- eSign Hawaii Education NDA Later

- How To eSign Hawaii Education NDA

- How Do I eSign Hawaii Education NDA

- eSign Hawaii Education Arbitration Agreement Fast

- eSign Minnesota Construction Purchase Order Template Safe

- Can I eSign South Dakota Doctors Contract

- eSign Mississippi Construction Rental Application Mobile

- How To eSign Missouri Construction Contract

- eSign Missouri Construction Rental Lease Agreement Easy

- How To eSign Washington Doctors Confidentiality Agreement

- Help Me With eSign Kansas Education LLC Operating Agreement

- Help Me With eSign West Virginia Doctors Lease Agreement Template